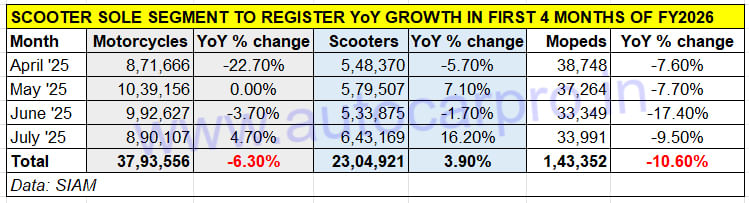

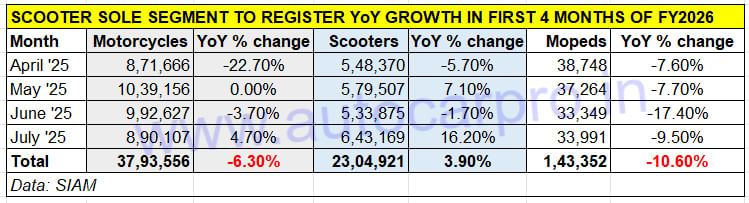

After achieving strong 9% growth with sales of 19.60 million units in in FY2025, the Indian two-wheeler industry is witnessing slow going in the current fiscal year. Total two-wheeler (motorcycles, scooters, mopeds) dispatches at 62,41,829 units are down 2.9% YoY in the first four months of FY2026 (see four-month sales data table below).

At 643,169 units in July, the scooter segment posted strong 16% growth. For the April-July 2025 period, it is the only 2W category to register growth (3.90%) with motorcycles (-6%) and mopeds (-10%) both down.

At 643,169 units in July, the scooter segment posted strong 16% growth. For the April-July 2025 period, it is the only 2W category to register growth (3.90%) with motorcycles (-6%) and mopeds (-10%) both down.

Wholesales of motorcycles – the two-wheeler industry’s main volume driver – at 37,93,556 units in April-July 2025 are lower by 6.3% YoY and that of mopeds down 10.6% at 143,352 units. The only sub-segment to register growth is scooters – the 23,04,921 units are up 3.9% year on year.

While the scooter share of the two-wheeler market has increased to 00% in the first four months of FY2026 compared to 00% a year ago, the share of motorcycles stands reduced to 00% from 00% in April-July 2024.

In July 2025, with 643,169 units and robust 16% YoY growth, scooter manufacturers have clocked their best monthly figures in the current fiscal accounting for 00% of the two-wheeler industry’s 15,67,267 wholesales.

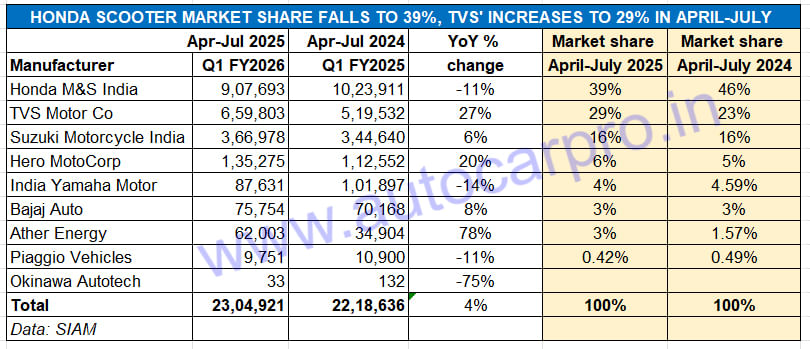

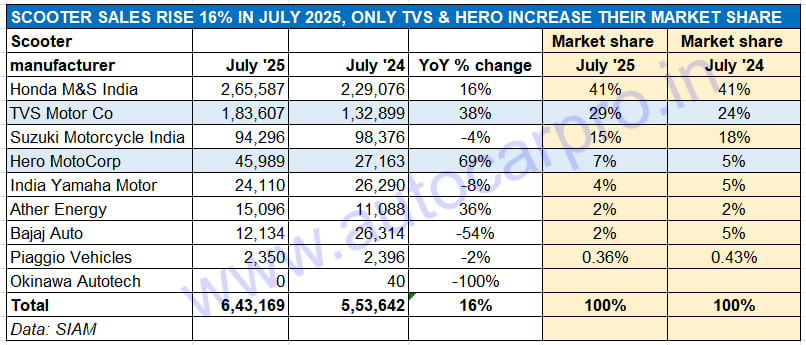

Of the nine scooter makers, four (Honda, TVS, Hero MotoCorp and Ather Energy) registered growth in July 2025. Of these four OEMs, only TVS Motor Co and Hero MotoCorp saw their market shares increase year on year.

Of the nine scooter makers, four (Honda, TVS, Hero MotoCorp and Ather Energy) registered growth in July 2025. Of these four OEMs, only TVS Motor Co and Hero MotoCorp saw their market shares increase year on year.

A deep dive into the OEM-wise sales splits for July reveals that of the nine scooter makers, only four – Honda, TVS, Hero MotoCorp and Ather Energy – have registered YoY growth. While longstanding scooter market leader Honda Motorcycle & Scooter India (HMSI) factory dispatches of 265,587 units and 16% growth (July 2024: 229,076 units), the additional 36,511 units are less than what TVS clocked in terms of additional scooters. Market share for Honda, which sells the Activa 110/125, Dio 110/125 and the electric Activa E and QC 1, remains unchanged YoY at 41 percent.

TVS Motor Co, which has the Jupiter, NTorq, Zest and electric iQube in its scooter stable registered wholesales of 183,607 units, up 38% YoY (July 2024: 132,899 units) last month. This translates into an additional 50,708 units, which is reflected in the company’s scooter market share rising to 29% from 24% in July 2024.

At No. 3 in the India scooter world is Suzuki Motorcycle India with 94,296 units, down 4% (July 2024: 98,376 units). This performance sees its market share decline to 15% from 18% a year ago. The Access 125 remains its best-selling product, whose engine also powers the Avenis and Burgman Street scooters. Suzuki has announced its foray into the electric scooter market with its e-Access. While it has produced 488 units in Q1 FY2026, wholesales have yet to commence.

Hero MotoCorp, with factory dispatches of 45,989 units in July, has recorded handsome 69% YoY growth (July 2024: 27,163 units). Hero’s scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. What has given the company a new sales verve is the growing demand for its electric scooters – the Vida 2 and the recently launched V2X. The 11,225 Vida EVs dispatched in July 2025 are a 00% increase YoY (July 2024: 4,600 Vida 1s). This performance sees the world’s largest two-wheeler maker’s scooter market share increase to 7% from 5% in July 2024.

India Yamaha Motor, whose stable contains the 125cc-engined Alpha, Fascino and Ray ZR along with the 155cc Aerox, dispatched 24,110 units, down 8% YoY (July 2024: 26,290 units). This sees its market share drop marginally to 4% from 5% a year ago.

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter, dispatched 15,096 units of its electric scooters which include the 450 and 450 Apex in July 2025, up 36% YoY. However, this does not impact its market share which remains unchanged at 2 percent.

Bajaj Auto, which has had a tough July due to a paucity of heavy rare earth magnets, has dropped two ranks to seventh position. The company’s EV dispatches at 12,134 units in July, comprising 11,584 Chetaks and 550 Yulu e-scooters, were down by 54% YoY (July 2024: 26,314 units). The fewer 14,180 units YoY translate have resultantly impacted Bajaj Auto’s scooter market share, which at 2% is down from the 5% it had in July 2024.

Four months into FY2026, the Indian scooter industry has achieved 34% of its record 68,53,214 wholesales in FY2025. It will have to perform better over the next eight months of the current fiscal if it is both improve upon that total and also go on breach the seven-million-units milestone.