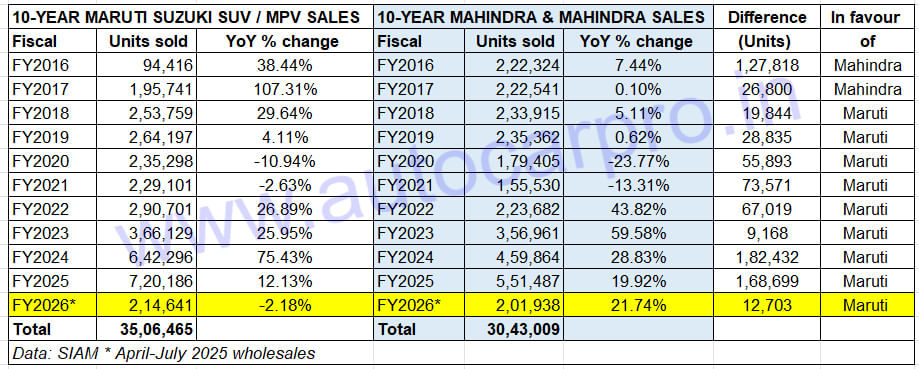

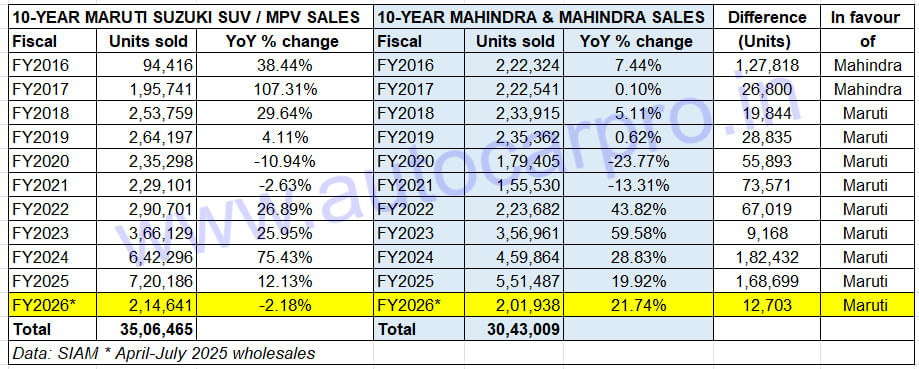

There’s an exciting battle underway in the most exciting segment in the Indian passenger vehicle industry. Maruti Suzuki India, which had wrested the utility vehicle (UV) market leader title from Mahindra & Mahindra eight years ago in FY2018, is facing a renewed charge from the SUV market leader. As per the latest UV wholesales statistics released by SIAM, the two auto majors are separated by 12,703 units in the April-July 2025 period.

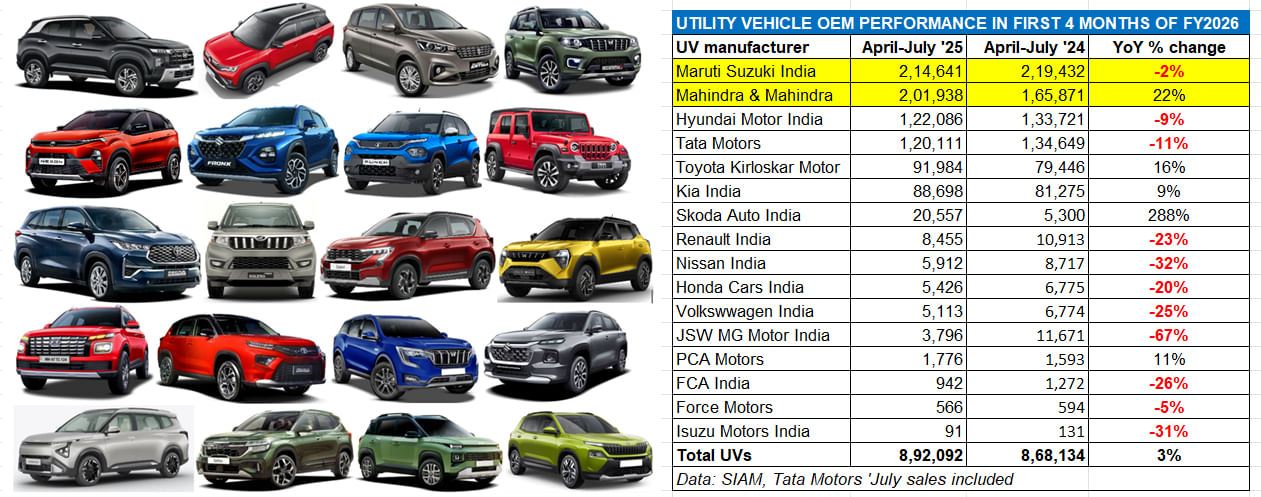

While Maruti Suzuki has clocked factory dispatches of 214,641 UVs in the past four months, M&M has registered wholesales of 201,938 units. The key difference other than the 12,703 units in the UV market leader’s favour is that Maruti Suzuki has witnessed a 2% YoY decline (April-July 2024: 219,432 UVs) and Mahindra has clocked 22% YoY growth (April-July 2024: 165,871 units). While UV market leader Maruti Suzuki has a 24% share with 214,641 units (down 2%), Mahindra & Mahindra with 201,938 units (up 22%) has a 23% market share in the first four months of FY2026.

While UV market leader Maruti Suzuki has a 24% share with 214,641 units (down 2%), Mahindra & Mahindra with 201,938 units (up 22%) has a 23% market share in the first four months of FY2026.

Both companies exited FY2025 on a stellar note, each having achieved their best-ever UV wholesales. Maruti Suzuki had sold 720,186 units and registered 12% YoY growth (FY2024: 642,296 units) and Mahindra had sold 551,487 units which marked a 20% YoY increase (FY2024: 459,864 units). This meant Maruti Suzuki had a market-leading 26% share of the record 2.79 million UVs sold in India last fiscal. In comparison, M&M – the No. 2 UV OEM – had a 20% share, separated by 168,699 units from Maruti Suzuki.

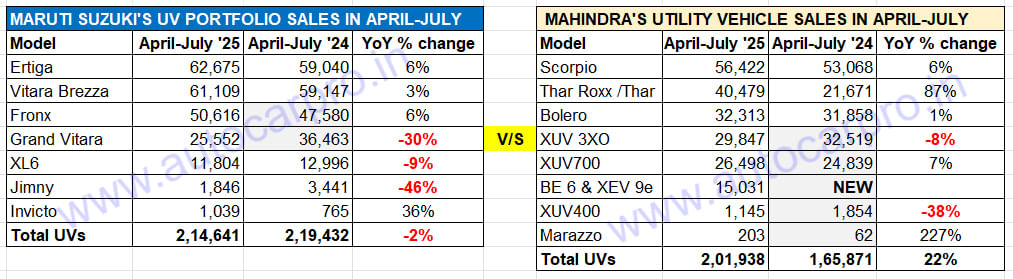

Now, after the first four months in the current fiscal’s first four months, where the UV wholesale difference is just 12,703 units, the difference in the two OEMs’ market share has also narrowed down. While Maruti Suzuki has a 24% share of the estimated 892,092 UVs sold between April-July 2025, M&M is close behind with 23 percent. Left: Combined sales of the Ertiga, Vitara Brezza and Fronx at 174,400 units are 81% of Maruti Suzuki’s 214,641 UVs in April-July 2025. Right: For Mahindra, along with No. 1 model Scorpio, the Thar Roxx has been the star performer and (with the Thar) contributed 20% to M&M’s 201,938 UVs.

Left: Combined sales of the Ertiga, Vitara Brezza and Fronx at 174,400 units are 81% of Maruti Suzuki’s 214,641 UVs in April-July 2025. Right: For Mahindra, along with No. 1 model Scorpio, the Thar Roxx has been the star performer and (with the Thar) contributed 20% to M&M’s 201,938 UVs.

THE MOVERS AND SHAKERS FOR MARUTI AND MAHINDRA

A deep dive into the model-wise wholesales for both rivals reveals some interesting takeaways. Of Maruti Suzuki’s seven-model stable of UVs, three (Grand Vitara, XL6 and Jimny) have registered a YoY sales decline (see data table above). The top three models (Ertiga, Vitara Brezza and Fronx), each with single-digit growth, have together sold 174,400 units or 81% of the company’s 214,641 UV wholesales in April-July 2025, which constitutes 30% of its FY2025 total.

Sales of the Grand Vitara midsize SUV (25,552 units), are down 30% and the XL6 (11,604 units) by 9 percent. Jimny sales are down 46% (1,846 units). The sole Nexa model of the five premium UVs to register growth is the Invicto MPV: up 36% at 1,039 units. As previously reported, in the first four months of FY2026, sales of the overall eight-model Nexa portfolio of 146,356 units are down 11%, their contribution to Maruti Suzuki’s passenger vehicle sales (531,348 units, down 4.53% YoY) reducing to 28% from 29% in April-July 2024.

However, expect Maruti Suzuki to be cognisant of the looming threat from M&M and make strategic moves to protect its UV turf. The company is set to make a splash in September, which is the beginning of the festive season, with the launch of its first EV – the e-Vitara – and also the new Escudo SUV, which will bridge the gap between the Vitara Brezza and the Grand Vitara. Expected to be priced between Rs 850,000 and Rs 15 lakh (ex-showroom), the Escudo will be retailed from the mass-market Maruti Arena channel. And, Maruti Suzuki is expected to introduce a seven-seater, three-row Grand Vitara by end-CY2025.

Mahindra & Mahindra, which achieved the 500,000 annual sales milestone for the first time in CY2024, and went on to improve upon that score in FY2025 with 551,487 SUVs, is driving towards another record calendar year and fiscal.

The SUV maker’s cumulative wholesales of 351,065 units, up 20% YoY (January-July 2024: 291,971 units) are already 66% of its CY2024 sales of 528,460 units. And the 201,938 units in the first four months of FY2026 s 201,938 units, up 21% YoY (April-July 2024: 165,871 units) are 37% of its record sales of 551,487 SUVs in FY2025 with eight months still to go in the current fiscal year.

Furthermore, of its eight model lines, only two – XUV 3X0 and XUV400 – have witnessed a YoY sales decline. While the Scorpio N and Classic top the M&M model sales table with 56,422 units and a 28% share, the star performer is the Thar brand, mainly due to the robust demand for the five-door Thar Roxx. Total Thar wholesales at 40,479 units are up 87% YoY and account for a 20% share compared to a 13% share a year ago. The indefatigable Bolero soldiers on with 32,313 units sold. While the XUV 3XO with 26,498 units is down 8% YoY, the flagship XUV700, which has surpassed the 300,000 sales milestone, clocked 26,498 units, up 7% YoY. The two electric-origin SUVs, BE 6 and XEV 9e have contributed 7% (15,031 units) to M&M’s SUV sales in April-July 2025.

Meanwhile for the UV industry per se, total wholesales in the April-July 2025 period at 892,092 units are up marginally by 3% YoY (April-July 2024: 868,134 units) – an addition of just 23,958 units over four months. As the SIAM-sourced 16-OEM sales data table below depicts, only five UV manufacturers – Mahindra & Mahindra, Toyota Kirloskar Motor, Kia India, Skoda Auto India and PCA Motors – have increased their sales year on year.

What will come as a shot in the arm for India Auto Inc is the recent news that the existing Goods & Services Tax (GST) rate will be reduced at festive Diwali time. While this move will essentially provide a boost to sales of small passenger cars, which have borne the brunt of the consumer shift towards SUVs over the past four years, expect the UV sales numbers to continue in growth mode.

What will come as a shot in the arm for India Auto Inc is the recent news that the existing Goods & Services Tax (GST) rate will be reduced at festive Diwali time. While this move will essentially provide a boost to sales of small passenger cars, which have borne the brunt of the consumer shift towards SUVs over the past four years, expect the UV sales numbers to continue in growth mode.