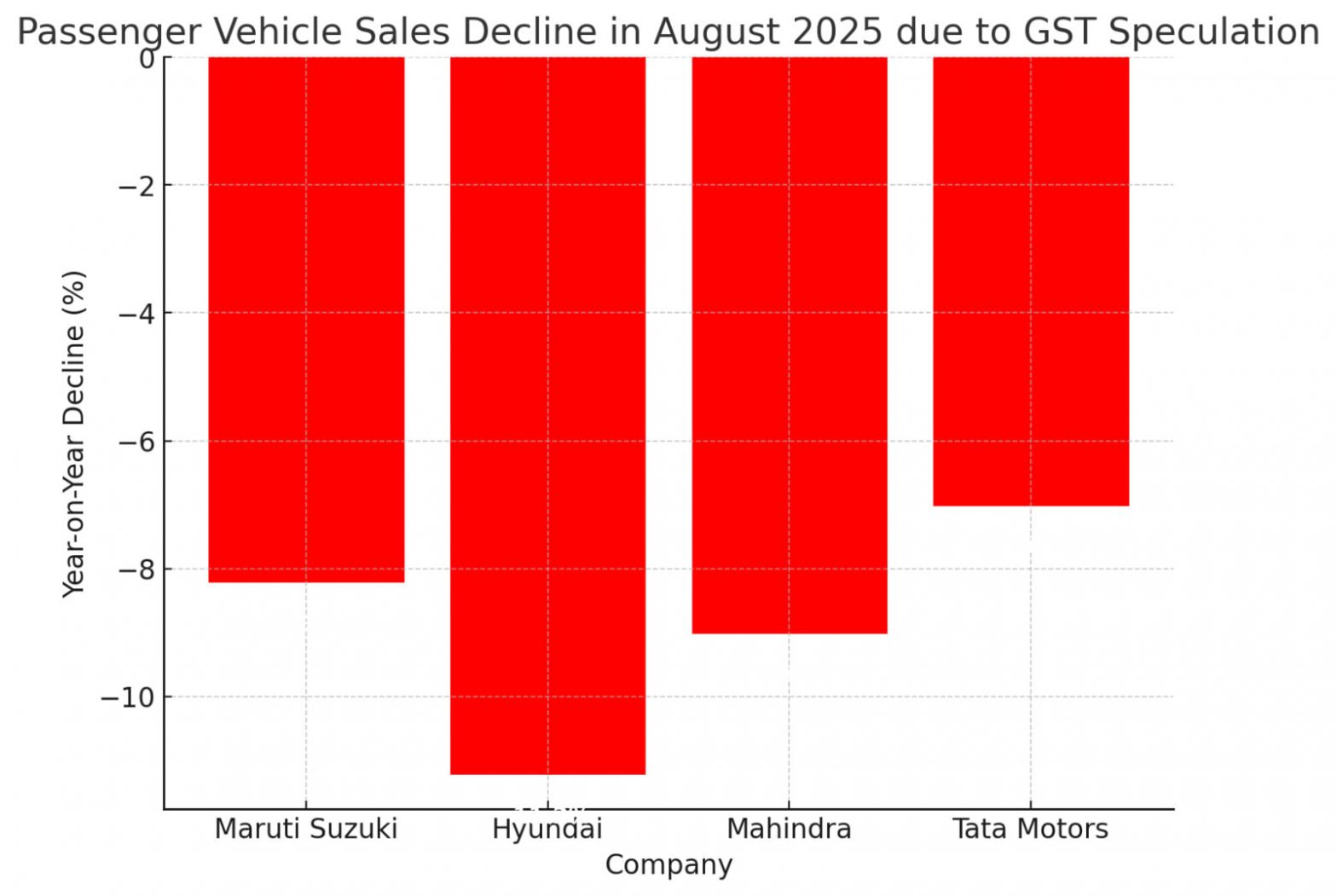

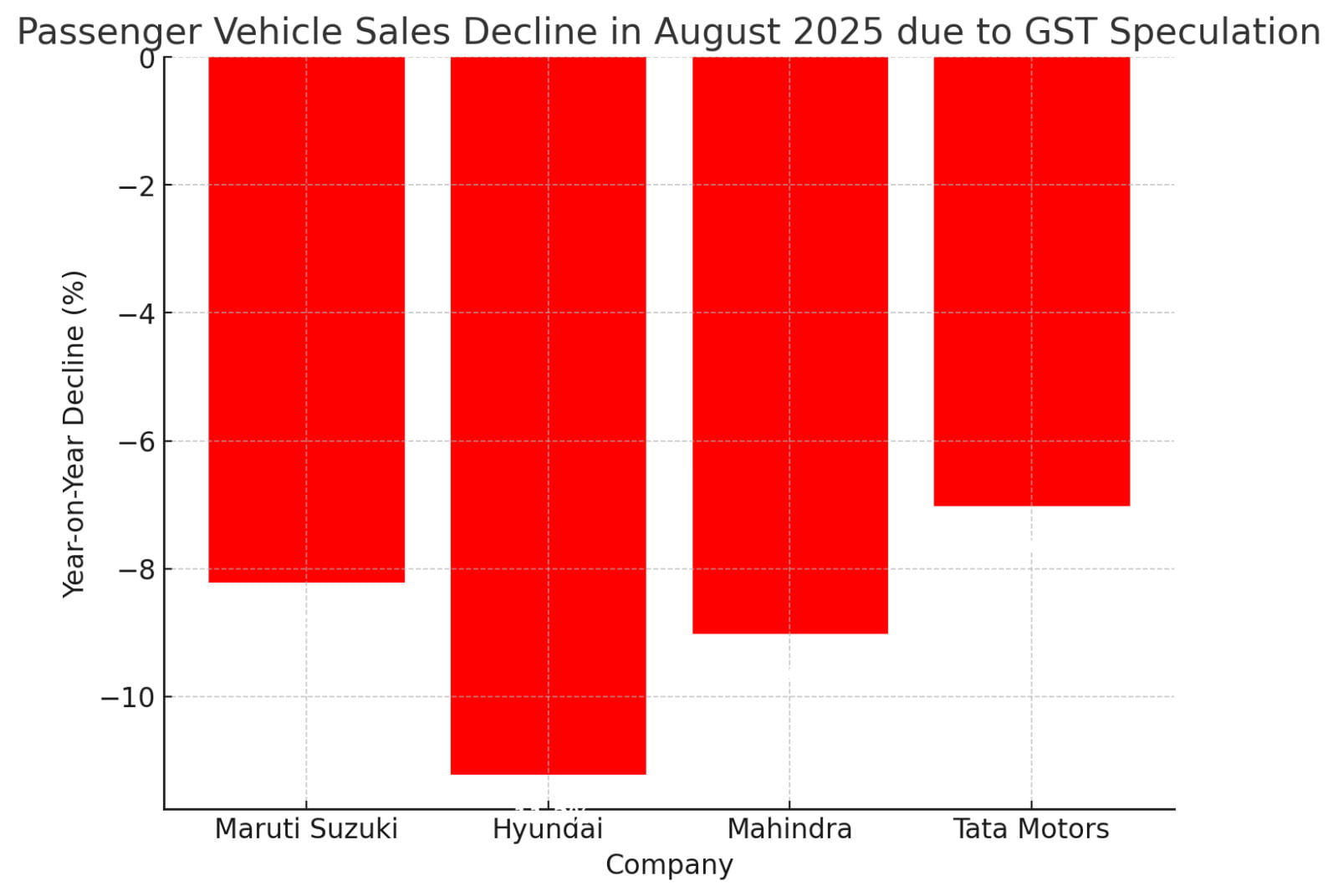

In a rare display of synchronized weakness, all of India’s major car makers, Maruti Suzuki, Hyundai Motor, Mahindra, and Tata Motors, reported significant year-on-year sales declines in August 2025, painting a picture of an industry caught in the grip of policy uncertainty despite what should have been favorable festival timing. Speculation around GST cuts is known to have led dealers to take fewer stocks from manufacturers during August.

The numbers reveal a market in suspended animation: Maruti Suzuki, commanding roughly half of India’s passenger vehicle market, saw domestic PV sales tumble 8.2% to 131,278 units from 143,075 units a year ago. Mahindra’s SUV segment dropped 9% to 39,399 units, while Tata Motors’ passenger vehicles declined 7% to 41,001 units. Hyundai Motor India saw its domestic sales fall by 11.2% to 44,001 compared to a year ago.

The GST Speculation Effect: When Rumors Move Markets

The root cause appears clear: widespread speculation beginning around August 18 that the government was seriously considering slashing GST rates on automobiles from 28% to 18%. For a mid-size SUV priced at ₹15 lakh, this would translate to potential savings of approximately ₹1.5 lakh – enough to make any rational buyer pause their purchase decision.

Mahindra’s CEO, Nalinikanth Gollagunta, said the company “consciously decided to bring down the wholesale billing to minimize the stock being carried by our dealers.” This proactive inventory management, while prudent from a risk perspective, effectively meant accepting lower sales volumes to protect the dealer network from potential losses if GST rates were indeed slashed while they held high-value inventory.

Festival Season Paradox: Early Arrival Fails to Boost Sales

Perhaps the most telling aspect of August’s performance is what didn’t happen. The festival season – traditionally a powerful catalyst for vehicle purchases – arrived approximately 10 days earlier this year, with both Onam and Ganesh Chaturthi beginning in late August rather than around September 6 as in 2024. Under normal circumstances, this calendar shift should have provided a significant boost to August sales as buyers rushed to make auspicious purchases.

Instead, this natural tailwind was completely overwhelmed by the GST speculation headwind. The fact that sales declined despite the early festival season underscores just how powerfully tax uncertainty can influence consumer behavior. Industry watchers note this represents a missed opportunity of significant proportions – the convergence of festivals that typically drives 15-20% higher sales was essentially neutralized.

Maruti’s Particular Pain: Volume Segments Hit Hardest

Maruti Suzuki’s detailed segment breakdown reveals particularly interesting patterns. The compact segment – including volume drivers like Swift, WagonR, and Dzire – managed to hold relatively steady at 59,597 units versus 58,051 units last year. However, the utility vehicle segment, where Maruti has been investing heavily with models like Grand Vitara and Jimny, dropped sharply from 62,684 units to 54,043 units, a decline of nearly 14%.

This suggests that buyers of higher-priced vehicles (where absolute savings from a GST cut would be larger) were more likely to postpone purchases than those shopping in entry segments. The complete disappearance of Ciaz from the mid-size sedan segment (zero sales versus 707 units last year) also points to changing consumer preferences accelerated by the uncertainty.

The situation has placed dealers in an extremely challenging position. With manufacturers like Mahindra explicitly reducing wholesale supplies, dealers face the dual challenge of managing existing inventory while trying to convince increasingly reluctant customers not to wait for potential tax cuts. Reports from dealer networks suggest that while footfalls remained reasonable – helped by the festival season – conversion rates plummeted.

Commercial Vehicles

The stark contrast between passenger and commercial vehicle performance adds another layer of validation to the GST speculation thesis. Tata Motors’ commercial vehicle segment grew a robust 10% year-on-year to 29,863 units. Mahindra reported 16% growth in registrations for its sub-7.5T LCV category, while even Maruti’s Super Carry LCV showed positive momentum with 2,772 units versus 2,495 units last year.

Commercial vehicle purchases are driven by business needs and ROI calculations rather than discretionary timing. A transporter needing vehicles for contracted routes cannot afford to wait for potential tax savings. Moreover, commercial buyers can claim GST input credits, making the absolute rate less critical than for end consumers.

Export Markets

Amid the domestic gloom, export markets provided some relief. Maruti Suzuki’s exports jumped impressively to 36,538 units from 26,003 units a year ago – a 40% increase. This demonstrates that the underlying manufacturing capability and product competitiveness remain intact; the August weakness was purely a domestic demand phenomenon driven by local policy speculation.

Despite manufacturers’ efforts to reduce wholesale dispatches, dealer inventory levels remain elevated. With August retail sales significantly below expectations, dealers are sitting on 45-50 days of inventory versus the normal 30-35 days. If the GST cut doesn’t materialize, this inventory overhang could lead to heavy discounting in September, further pressuring margins across the value chain.

Conversely, if the GST cut is announced, dealers holding pre-GST stock would face immediate losses unless manufacturers provide compensation. This Catch-22 situation explains why companies like Mahindra chose to proactively reduce supplies despite the short-term sales impact.

Historical Context: Learning from 2017

This isn’t the first time GST uncertainty has roiled the auto market. The original GST implementation in July 2017 saw similar purchase postponements, though the current situation differs in being speculation about a rate change rather than a systemic tax reform. Industry veterans recall that the 2017 disruption led to a sharp demand bounce-back once clarity emerged, suggesting potential pent-up demand accumulation.

Looking Ahead: September’s Crucial Test

With the GST Council meeting expected soon, September’s performance will be crucial in determining whether August’s weakness represents a temporary postponement or a more fundamental demand challenge. Both scenarios present challenges:

If GST is cut to 18%:

- Immediate boost to consumer sentiment

- Potential losses on existing dealer inventory

- Margin pressure as competition intensifies

- Question marks over government revenue impact

If GST remains at 28%:

- Pent-up demand could drive strong September/October sales

- Dealers might offer aggressive discounts to clear accumulated inventory

- Consumer disappointment could create negative sentiment

- Government maintains revenue but faces criticism for market disruption

The Broader Economic Implications

The August auto sales debacle extends beyond the industry itself. The automobile sector contributes roughly 7% to India’s GDP and provides employment to millions. The synchronized decline across manufacturers likely impacted component suppliers, logistics providers, and financing companies. The psychological effect of weak auto sales – often seen as a barometer of consumer confidence – could influence broader economic sentiment.

Furthermore, the episode raises questions about policy communication. The fact that mere speculation could cause such market disruption suggests the need for clearer, more proactive government communication on policy intentions. The cost of uncertainty – in terms of lost sales, disrupted planning, and frozen consumer decisions – may exceed any benefits from maintaining policy flexibility.

While all four manufacturers faced similar challenges, their strategic responses varied:

Maruti Suzuki appeared to maintain moderate inventory levels while focusing on export growth to offset domestic weakness. The company’s diverse portfolio helped limit damage, though the UV segment disappointment would be concerning given strategic priorities.

Mahindra took the most proactive approach, explicitly reducing wholesale dispatches to protect dealers. This strategy prioritized ecosystem health over short-term volumes – a calculated bet that maintaining dealer viability matters more than monthly sales figures.

Tata Motors seemed to rely on its commercial vehicle strength to cushion passenger vehicle weakness, highlighting the benefits of portfolio diversification in uncertain times.

The synchronized decline across manufacturers, occurring despite favorable festival timing, demonstrates how powerfully fiscal expectations now influence consumer behavior. As Mahindra’s Gollagunta noted, the industry looks forward to “GST rationalization, which would be a demand driver through the festive season.”