Kia India announced it will transfer the complete benefit of the recent Goods and Services Tax (GST) reduction to customers across its entire Internal Combustion Engine (ICE) portfolio, with the price reductions taking effect from September 22, 2025.

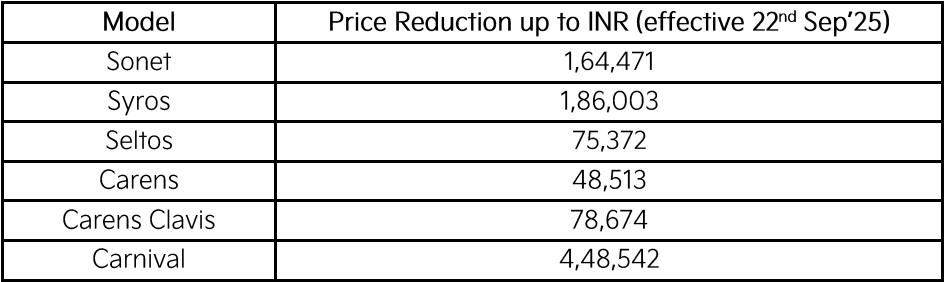

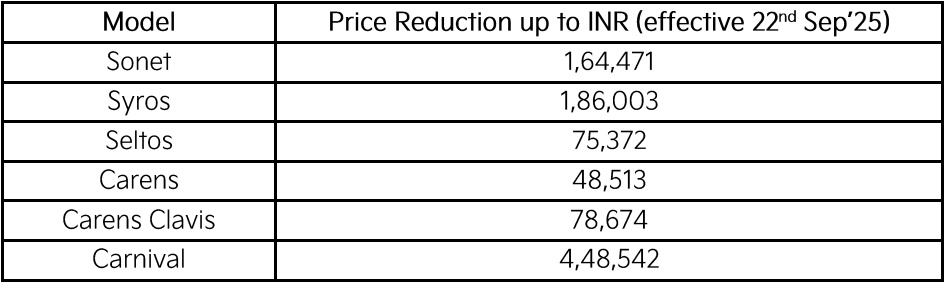

The mass-premium automobile manufacturer revealed price cuts ranging from INR 48,513 to INR 4.48 lakh across six models in response to the government’s GST reform on passenger vehicles.

Price Reduction Details

The benefit distribution varies significantly across Kia’s model range:

The luxury MPV Carnival receives the highest benefit at nearly INR 4.5 lakh, while the Carens sees the smallest reduction at under INR 50,000.

Gwanggu Lee, Managing Director and CEO of Kia India, welcomed the government’s initiative, stating: “We welcome the Government of India’s visionary citizen-centric reforms to reduce the GST on passenger vehicles. This transformative measure represents a progressive and timely decision towards making vehicle purchase more affordable for consumers and bringing a boost to the automotive sector’s growth”.

Lee emphasized the company’s commitment to customer affordability: “In line with this vision, we are proud to pass on the full benefit of the GST rate reductions to our customers, ensuring more affordability and greater accessibility”.

The CEO also highlighted the reform’s broader impact, noting: “This significant reform simplifies the taxation framework and reinforces the government’s commitment to sustainable economic growth and innovative mobility solutions. We are confident this move will energize consumer sentiment and drive demand during the upcoming festive season”.

The manufacturer’s Indian portfolio includes nine vehicles: Seltos, Syros, Sonet, Carens, Carens Clavis, Carens Clavis EV, Carnival, EV6, and EV9.

The GST benefit transfer positions Kia India among automotive manufacturers responding to the government’s tax policy changes aimed at stimulating the passenger vehicle market ahead of the festive season.