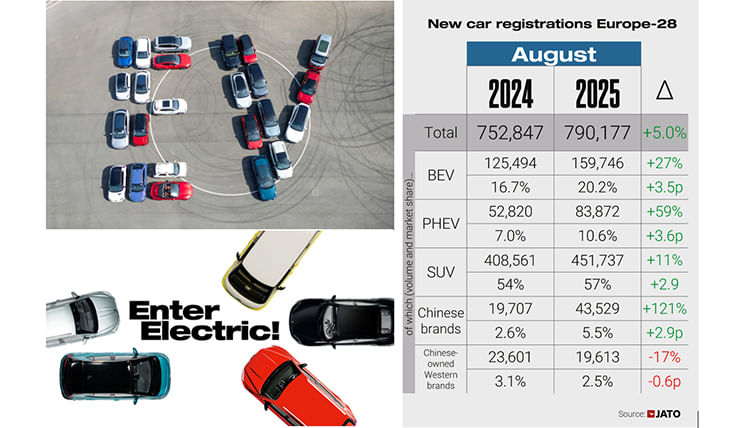

August 2025 turned out to be a month of growth of Europe’s new passenger car market, helped in some manner by the growing demand for Battery Electric Vehicles (BEVs) as well as Plug-in Hybrid Vehicles (PHEVs).

According to JATO Dynamics’ retail sales data for 28 European markets, a total of 790,177 units were registered in August 2025, up by 5.0% year on year. Last month’s growth was mostly driven by Germany (+5.0%), Poland (+15%), Spain (+18%) and Austria (+25%).

The growth witnessed Europe’s new car market last month can be partly attributed to strong growth in registrations of BEVs. At 159,746 units, BEV retail sales were up by 27% YoY (August 2024: 125,494 units). This has resulted in a new record market share for the BEV segment of 20.2%, up by 3.6 percentage points from the 16.7%. So far in 2025, 1.54 million BEVs have been registered in Europe.

BEV sales at 159,746 units in August rose 27% YoY and took the BEV share of the overall new car market in Europe to a record 20.2 percent.

According to Felipe Munoz, Global Analyst at JATO Dynamics. “The data shows that there was strong demand for BEVs in August, however a 27% increase is less significant than it looks when you consider how widely they are being promoted across Europe. The new record market share for BEVs achieved last month has been partly distorted by the fact that Italy – typically a less enthusiastic adopter of BEVs – is usually quiet during August.”

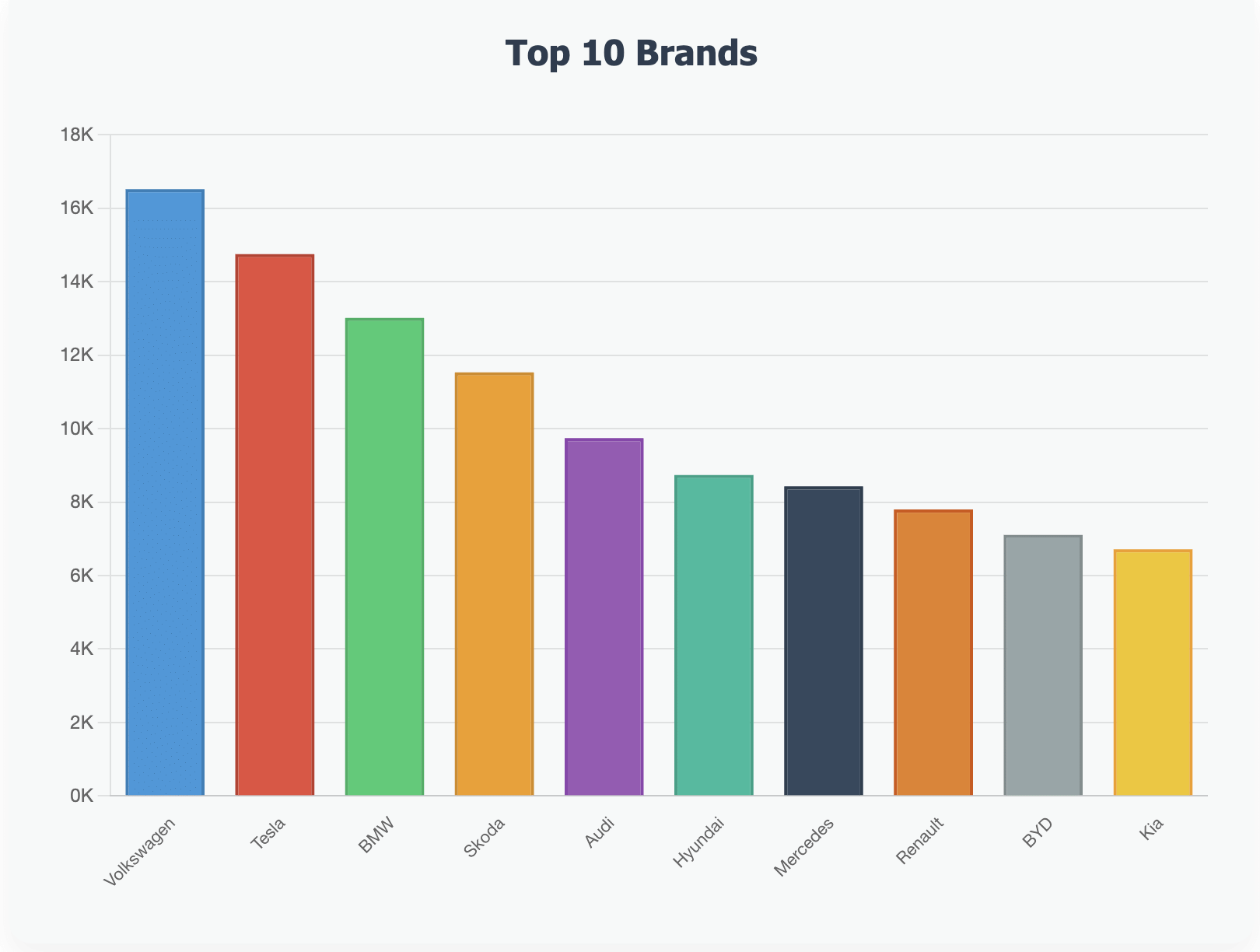

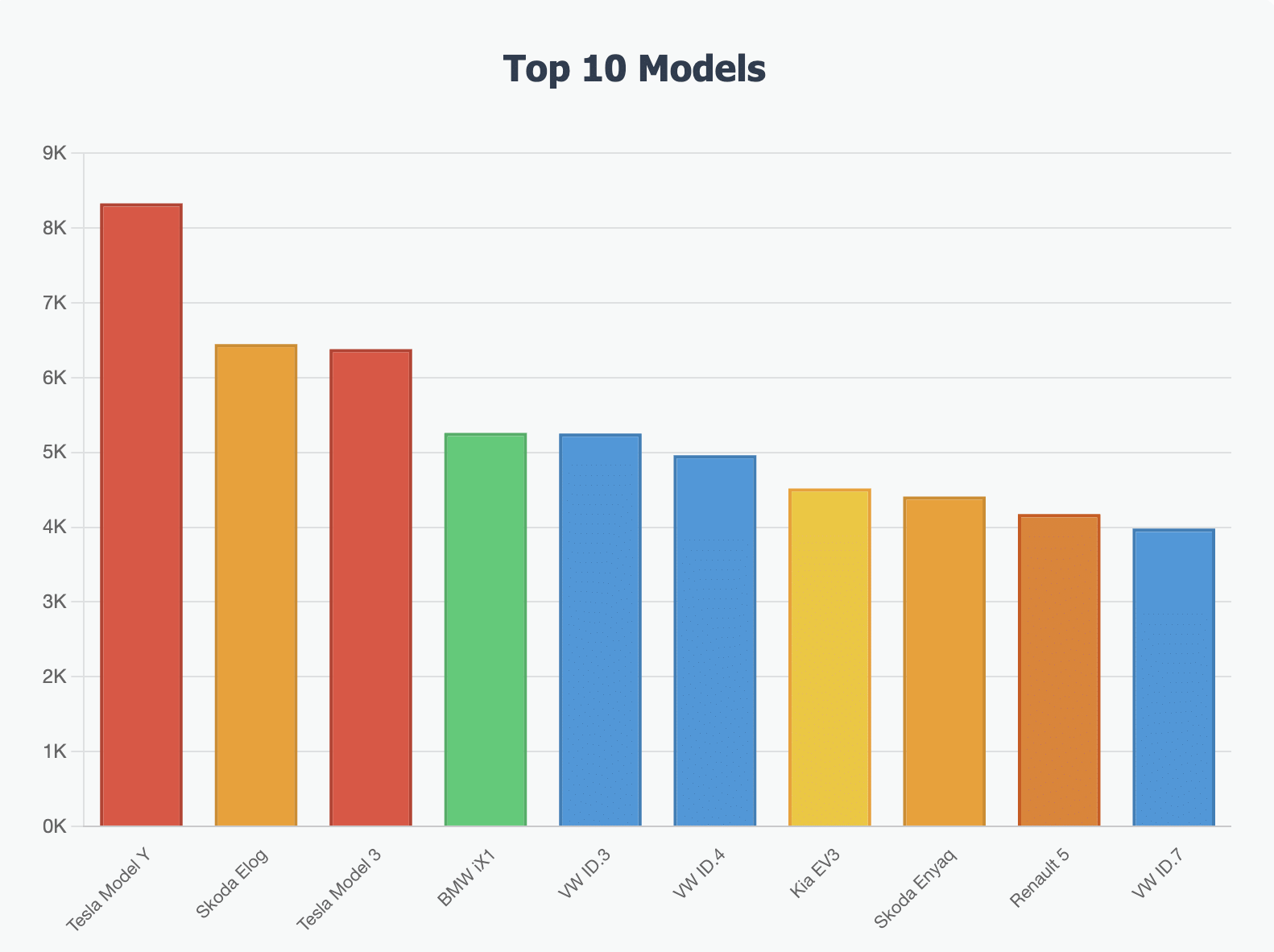

While VW was the No. 1 BEV OEM in August with 16,523 units and 10% of total BEV sales of 159,746 units, Tesla’s Model Y was the best-selling model with 8,330 units.

While VW was the No. 1 BEV OEM in August with 16,523 units and 10% of total BEV sales of 159,746 units, Tesla’s Model Y was the best-selling model with 8,330 units.

ID.3, ID.4 and ID.7 command 86% of VW BEV sales in August

The Volkswagen Group, the BEV market leader in Europe, maintained its No. 1 position in August. Volkswagen itself was the No. 1 BEV OEM with deliveries of 16,523 units, up 45% YoY and accounted for 10% of the total BEV sales of 159,746 units. The ID. 3, ID.4 and ID.7, with combined sales of 14,197 units, accounted for 86% of VW’s BEV sales last month.

Of the VW Group models in the Top 25 BEV list, the Skoda Elroq (ranked No. 2) was the best-seller with 6,450 units, followed by the VW ID.3 (5,253 units, up 52% and ranked No. 5), VW ID.4 (4,963 units, up 22% and ranked No. 6. While the Skoda Enyaq’s sales were down 18% at 4,410 units, the VW ID.7 (3,981 units, up 42%) was ranked 10th in the Top 25 models. While the Audi Q6 e-tron (2,952 units) saw 209% YoY growth, sibling Q4 e-tron sales were down 26% at 2,406 units.

However, despite the strong showing of both VW and the VW Group, Tesla continues to lead the BEV model sales chart. Despite YoY sales of the Tesla Model Y dropping by 38% to 8,330 units last month, it confirmed its position as Europe’s preferred electric vehicle between January and August this year.

PHEV demand also growing rapidly

Meanwhile, plug-in hybrid vehicles (PHEVs) had an even more impressive month. According to JATO Dynamics, 83,900 units were registered in August, with volumes increasing by 59% YoY and the powertrain’s market share rising to 10.6 percent. Facing higher tariffs on BEV imports to Europe, Chinese car brands are now boosting their presence in the PHEV segment. Registrations increased from just 779 units in August 2024 to 11,064 units last month, with BYD now the eighth best-selling brand for PHEVs. The top 10 PHEV ranking included three Chinese models: the BYD Seal U, the Jaecoo J7 and the MG HS.

ALSO READ: Volkswagen Group sells 465,500 BEVs worldwide in first-half 2025, up 47%

India’s electric car and SUV market scales a new high In August 2025

Tata Motors hits best-ever monthly EV sales in August: 8,540 units