Mumbai – India’s automobile sector reported strong growth in retail sales during the first nine days of the Navratri festival this year, with vehicle registrations across two-wheeler and passenger vehicle segments recording a 24% and 21% year-on-year surge, respectively, according to VAHAN data.

Source: Nuvama

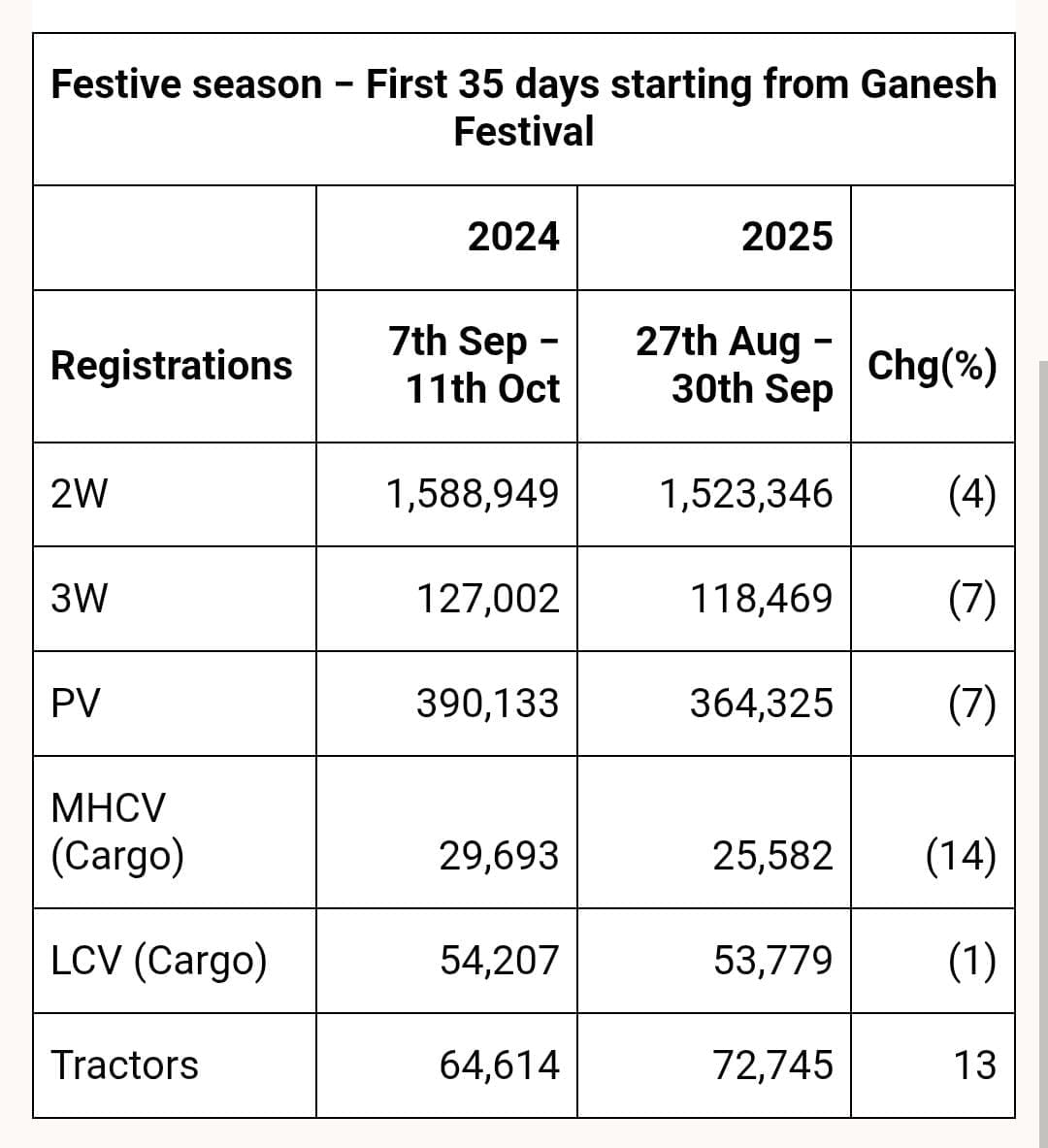

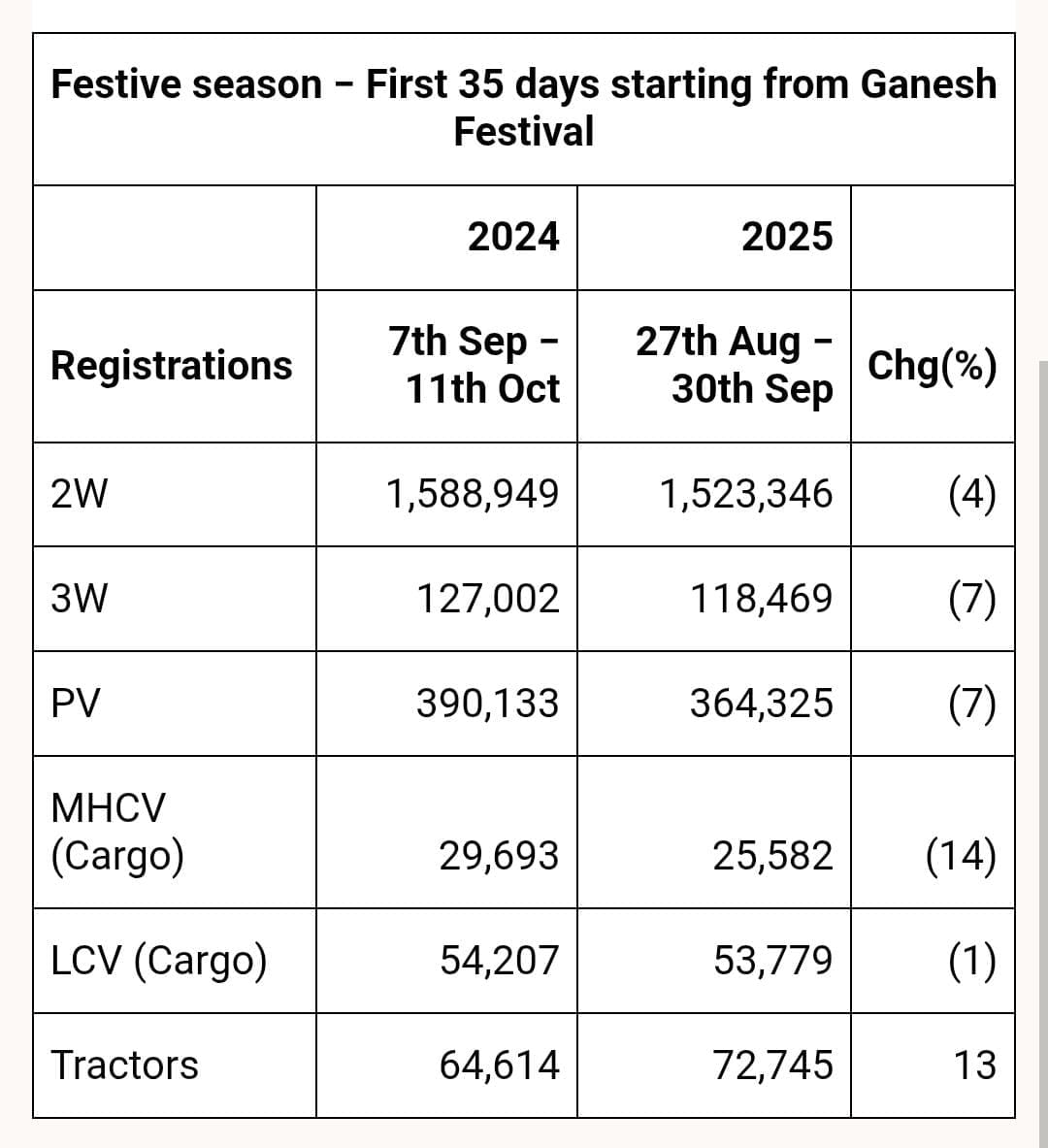

Despite the strong momentum during Navratri, total vehicle registrations during the broader festive window–from Ganesh Chaturthi on August 27 to September 30–remained slightly below last year’s levels.

The resurgence in demand during Navratri comes after months of subdued performance. The rebound has been driven by a confluence of factors, including the much-anticipated GST rate cut–on small cars, two-wheelers and other vehicle categories–which came into effect on September 22, the first day of Navratri.

The rate reduction from 28% to 18% provided a significant boost to consumer sentiment, particularly in the entry and mid-level segments. Automakers responded swiftly, not only passing on the full benefit of the tax cut but also adding further festive discounts across popular models to attract customers.“During the first nine days of the festive period, vehicle registrations have shown strong momentum across both the two-wheeler and passenger vehicle segments. Healthy order bookings at the dealer level are expected to sustain this positive trend through the season,” said Raghunandan NL, Director at Nuvama Institutional Equities. “We believe the festive period should post a growth rate of around 15% for both the two-wheeler and passenger vehicle industries for our full-year estimates to be achieved,” Jay Kale, Equity Analyst for Autos at Elara Securities said, adding that rural demand is likely to recover strongly post-October 15, when farmers receive cash post-harvest.

The first day of Navratri set the tone for the season, as showroom footfalls surged and delivery volumes spiked across the country. Maruti Suzuki alone reported over 80,000 customer enquiries and delivered nearly 30,000 vehicles on the first day. Hyundai registered around 11,000 dealer billings, marking its highest single-day retail performance in five years, while Tata Motors delivered 10,000 vehicles and reported over 25,000 enquiries.

“The response from customers has been phenomenal—something we haven’t seen in the last 35 years,” Partho Banerjee, Senior Executive Officer for Marketing & Sales at Maruti Suzuki had said. The company, along with other leading automakers like Hyundai, Mahindra, and Tata Motors, slashed prices across several models. Maruti’s S-Presso saw price reductions of up to ₹1.29 lakh, while Mahindra’s Bolero and Bolero Neo became cheaper by as much as ₹2.56 lakh. Hyundai’s Tarun Garg called the ongoing festive period a “mayhem of car sales,” driven largely by the structural shift brought on by GST 2.0 reforms.

“Enquiries remain very high, and we may even run out of stock for certain variants. Dealers are staying open late into the night to deliver cars to customers. Compared to last year, the overall response has been exceptionally strong,” said an official.

The festive period is of much significance to automakers owing to high consumer spending due to cultural significance. Volumes generated in this period account for a bulk of automakers’ annual sales. Rural areas, in particular, see a notable increase in vehicle sales during this time, as farmers often have more disposable income after the harvest season.

Despite the strong momentum during Navratri, overall vehicle registrations from Ganesh Chaturthi (August 27) to September 30 remained below last year’s levels. The dip was largely driven by consumers deferring purchases following Prime Minister Narendra Modi’s Independence Day speech, in anticipation of GST rate cuts and the start of more auspicious buying periods.

During this period, two-wheeler registrations declined by 4% year-on-year, while passenger vehicle sales dropped by 7%. The downturn extended across other segments as well, with three-wheelers down 7%, medium and heavy commercial vehicles (MHCVs) falling by 14%, and light commercial vehicles (LCVs) dipping 1%. The tractor segment, however, emerged as the lone bright spot, registering a robust 13% year-on-year growth.

According to VAHAN, during the first 35 days of the festive season in 2024, 1.58 million two-wheelers and 390,133 passenger vehicles were registered. In the same period this year, registrations stood at 1.52 million and 364,325, respectively.

Analysts, however, remain optimistic. Elara Securities’ Kale, believes that the full festive season from Ganesh Chaturthi to Diwali will be critical in meeting FY26 growth targets.

Auto companies are preparing for an extended sales run through October and early November, with Diwali (October 30) expected to bring in the highest volumes. Retailers are reporting sustained order bookings and high enquiry levels, with dealers extending operating hours to meet delivery deadlines. Many popular models are already facing inventory constraints, a sharp contrast to the overstocked showrooms seen earlier this year.

The festive spike is a welcome relief for an industry that has struggled with flat volumes and margin pressures through most of the year. S&P Global Mobility recently raised its 2026 growth forecast for India’s passenger vehicle segment to 8.5%, up from 4.1%, citing improved consumer sentiment and better policy tailwinds.

As automakers enter the most crucial phase of the year, all eyes are on Diwali. A successful festive quarter could not only make up for the lacklustre first half but also lay the foundation for a stronger second half of FY26.