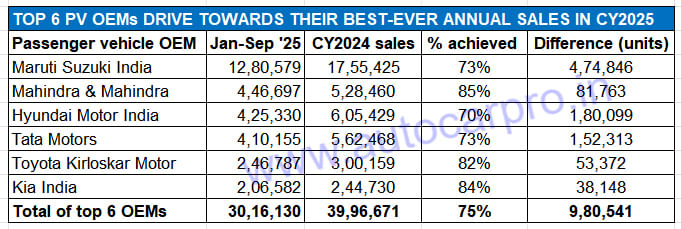

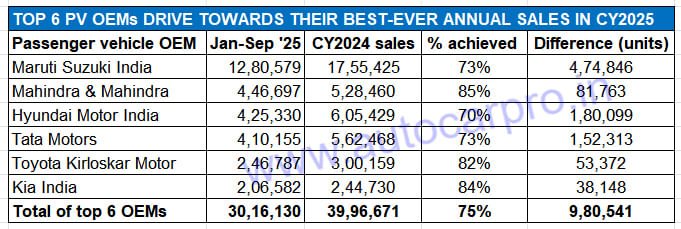

In CY2024, a total of 4.27 million (42,74,793 units) passenger vehicles were sold, up 4% YoY. Of this, the top six PV OEMs last year – Maruti Suzuki, Hyundai, Tata Motors, Mahindra, Toyota and Kia – accounted for 3.99 million (39,96,671 units) or a 93% share, leaving the balance 7% to be fought over by the 10 other car and SUV manufacturers.

Nine months into the year, each of these six PV manufacturers has achieved nearly three-fourths or more of their CY2024 wholesales, as the data table below indicates. What has added strong tailwinds to their growth is the reduced GST, which has helped slash prices of most cars, SUVs and even MPVs and brought pent-up consumer demand to the fore.

Furthermore, it is understood that new vehicle sales in Navratri 2025 (September 22-October 1) have turned out to the best in a decade. In fact, the demand was so strong that some of the leading PV makers could have achieved higher numbers if it weren’t for the paucity of trucks to transport vehicles from their manufacturing plants to town and country.

That’s not all – new vehicle bookings for the top six OEMs are also on a high and it can be surmised that October 2025 should turn out to be the best-ever month for PV wholesales yet.

Mahindra, Toyota and Kia, which have already achieved over 80% of their CY2024 wholesales, will be the earliest of the Top 6 PV makers to register their best-ever annual sales in CY2025.

Maruti Suzuki had sold 1.75 million units in CY2024, up 3% (FY2023: 1.70 million units). Now, with 1.28 million units sold in the first nine months of CY2025, which is 73% of last year’s total, the company has to sell an additional 474,847 PVs to surpass that. This calls for average sales of 158,282 units for each of the next three months.

Though the PV market leader has seen its UV sales decline for four months in a row, the surge in consumer enquiries and bookings it has witnessed during Navratri is likely to continue in October and November. It is learnt that it has over 250,000 bookings in hand and counting.

The company, not surprisingly, has ramped up production and September’s 198,316 units was a 26% YoY jump (September 2024: 156,709 units). To cater to the surge in bookings for its cars, production of the six-pack (Baleno, Celerio, Dzire, Ignis, Swift, Wagon R, and Toyota Glanza) rose by 36% to 93,301 units.

And, with over 25,000 bookings for the recently launched Victoris midsize SUV, overall production of the UV portfolio (Brezza, Ertiga, Fronx, Jimny, XL6, Victoris, and rebadged UVs for Toyota) rose by 27% to 79,496 units in September.

CY2024’s No. 2 PV OEM Hyundai Motor India, with 425,330 units, has achieved 70% of its record CY2024 wholesales of 605,429 units, which was the second time that the company has crossed the 600,000 milestone.

This means it needs to sell an additional 180,100 units between October and December 31 this year to cross last year’s wholesales. In CY2025 YTD, Hyundai’s best monthly sales came in January (54,003 units), which were down 5% on its best-ever monthly sales a year ago (January 2024: 57,115 units) when the new Creta was launched.

Mahindra & Mahindra, which sold over half-a-million SUVs (528,460 units) for the first time in a calendar year in CY2024 (551,487 units) is well set to register record annual sales this year.

In the current calendar year’s first nine months, M&M has sold 446,697 SUVs, up 16% YoY (January-September 2024: 386,310 SUVs). This is already 85% of its CY2024 wholesales, which means it needs to sell another 81,763 units to surpass that total.

Given the current strong sales momentum, particularly after the GST 2.0-driven price reductions and three months left to go this year, expect M&M to register record wholesales of around 610,000 SUVs (up 15% YoY) in CY2025.

Tata Motors, which had surpassed 500,000 units annually for the third time last year and also registered its best-ever annual score in CY2024 (562,468 units), has clocked wholesales of an estimated 410,155 PVs in the January-September 2025 period, down 3% YoY.

This is 73% of the CY2024 sales and leaves the car and SUV maker 152,313 units shy of last year’s total. Along with the surge in demand for its ICE models following the GST cut, Tata Motors is also witnessing growing demand for its EVs.

The robust EV sales in Q3 CY2025 have helped drive cumulative first 9-month sales to 57,022 units, up 8% YoY (January-September 2024: 52,861 units). This strong performance means Tata Motors is poised to surpass its best-ever annual EV sales of 69,153 units in CY2023.

Toyota Kirloskar Motor, which achieved the 300,000 annual sales milestone for the first time in CY2024 (300,159 units), has clocked wholesales of 246,787 units in the past nine months. This is 82% of its last year’s wholesales – TKM needs to sell another 53,372 units to exceed last year’s total.

With sustained strong demand for most of its products particularly the Innova Hycross MPV and the Hyryder midsize SUV, TKM along with M&M and Kia will be the earliest of the six OEM achieve its best-ever annual sales this year.

Kia , with wholesales of 206,582 units and 7% YoY growth, is 38,149 units away from registering its best-ever annual sales. In CY2024, the company had clocked sales of an estimated 244,730 units. Of its current model portfolio, the Sonet compact SUV is the best-seller, followed by the Carens MPV, Seltos midsize SUV and then the new Syros compact SUV.

OCTOBER 2025 SET TO BE A MONTH OF MEGA SALES

In this year to date, January 2025 (399,386 units, up 2%) has been the best month for PV wholesales. September 2025, whose final numbers will be released in mid-October, should easily beat that with an estimated 400,000-425,000 units. But October just might scale a new monthly high for India PV Inc.

With the festive season underway and all the Top 6 PV manufacturers reporting a surge of new vehicle bookings as well as customer enquiries, it looks like October with Diwali in the third week will turn out to be a month of sales fireworks. In fact, it could even become the best-ever month for PV wholesales yet.

October’s momentum should continue into November before tapering off in December, which typically sees vehicle buyers in India defer their purchase to the new year. Nevertheless, with the reduced GST and mouther-watering offers by OEMs, this clearly is the best time to buy a new car or SUV.

ALSO READ: Mahindra drives ahead of Hyundai and Tata Motors in January-September