Led by record exports and cost-control measures, Honda Cars India Ltd (HCIL) posted a net profit of ₹604 crore in FY25, down 9 percent from ₹661 crore in FY24, offsetting a sharp slide in domestic volumes.

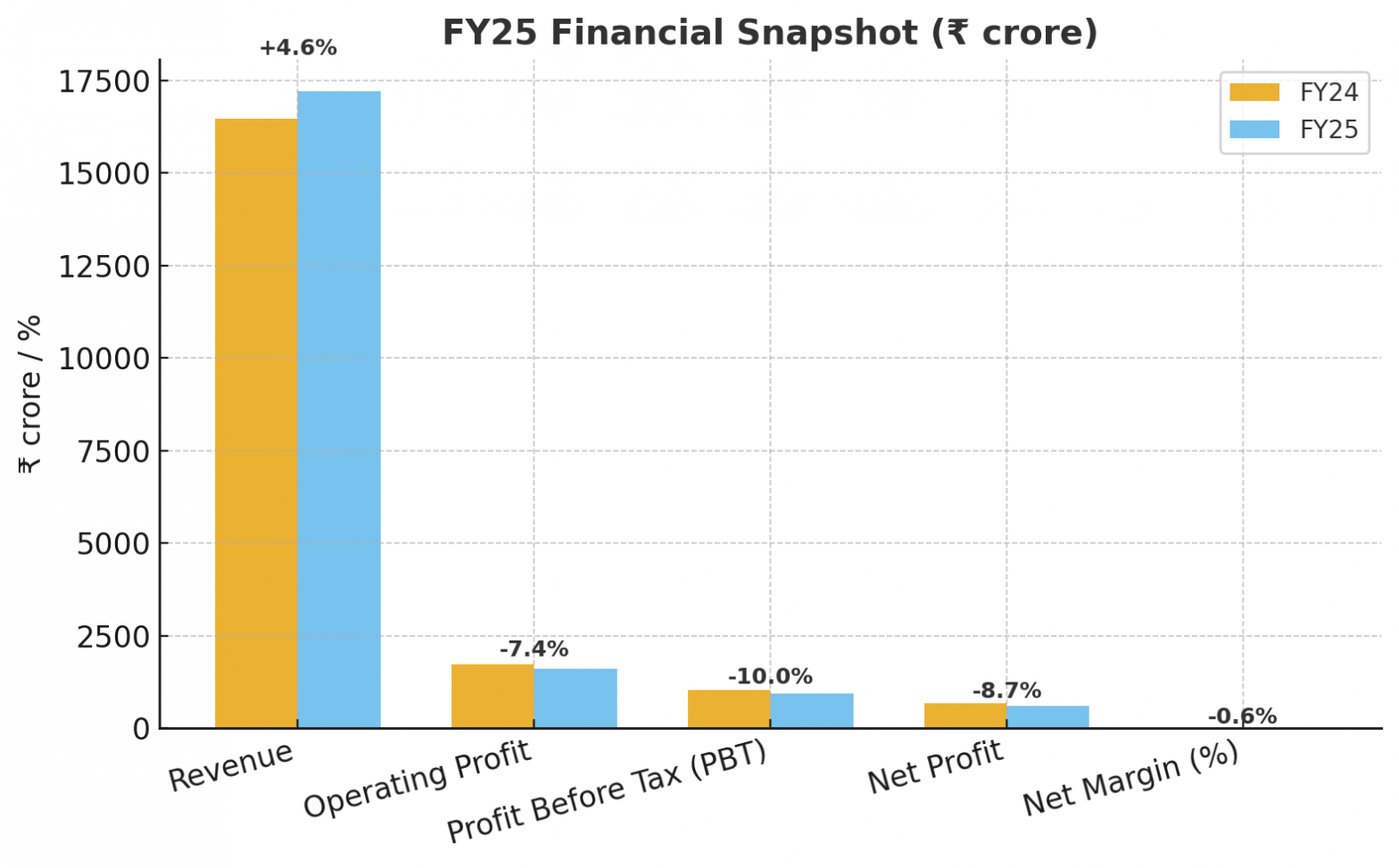

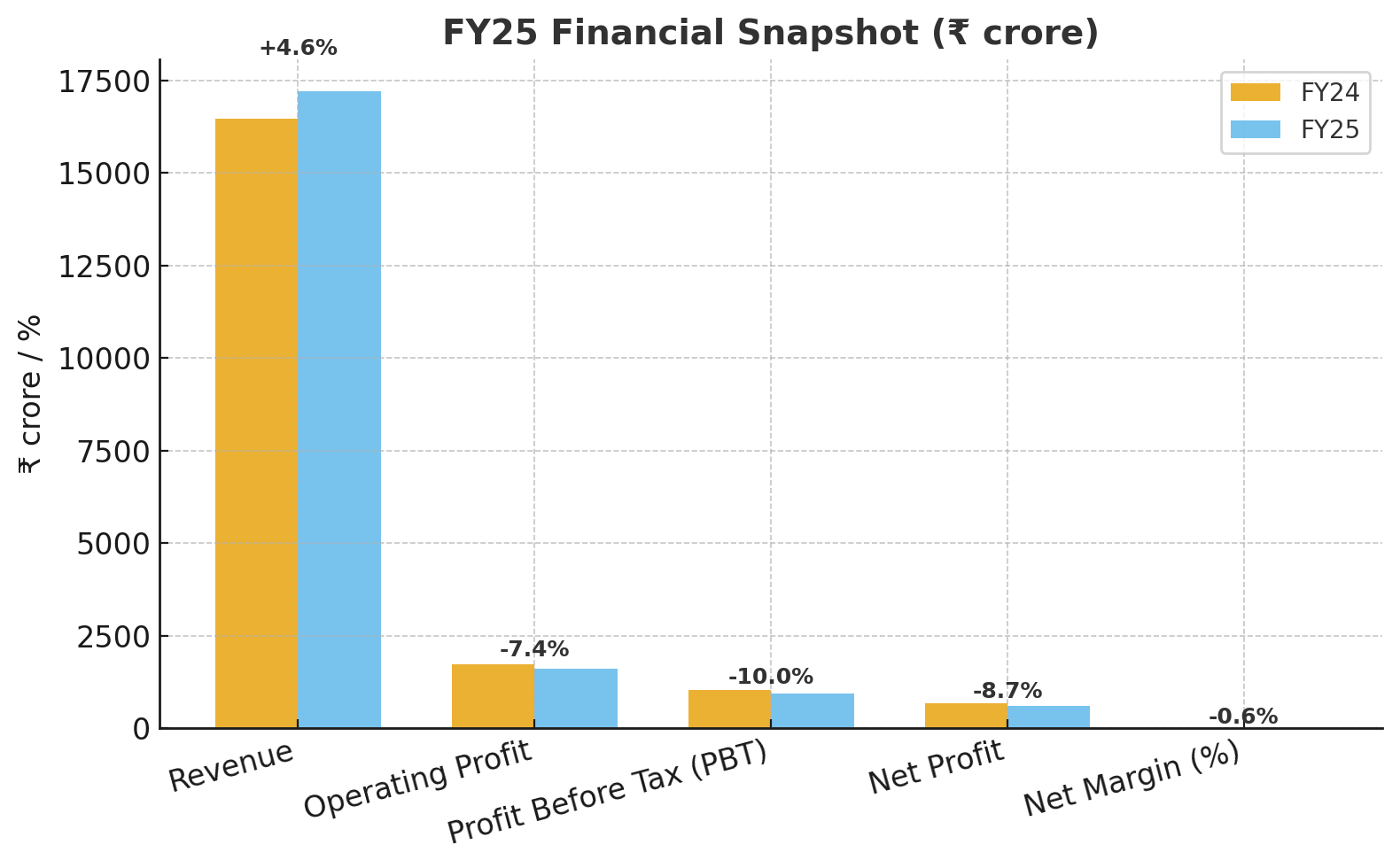

As per the financials sourced from business intelligence platform Tofler, total revenue rose 4.6 percent to ₹17,219 crore, while higher operating expenses and an unfavourable product mix weighed on margins.

Revenue Up, Profit Down

- Operating profit: ₹1,608 crore (−7.4%)

- Profit before tax: ₹926 crore (−10%)

- Net margin: 3.4% vs 4.0% last year

- Total expenses: ₹16,619 crore (+5.8%)

The company noted that the broader passenger vehicle industry had “a steady year with moderate growth of 1.5 percent, reaching highest-ever sales of 4.3 million units.” Yet, Honda’s domestic trajectory diverged sharply — its sales fell to the lowest in two decades.

While domestic performance remained weak, the company expressed confidence about the road ahead, saying it “remains committed to energizing the market through consistent and impactful product interventions that cater to evolving customer preferences.” It added that it is “steadily advancing preparations for the future launch of its new battery-electric vehicle, in alignment with Honda’s long-term global vision of sustainable mobility and carbon neutrality.”

Domestic Sales: A Weak Core

Honda’s domestic sales in FY25 totaled 65,925 units, the lowest since the mid-2000s, underlining its shrinking presence in India’s passenger vehicle market.

The company stated it had “solidified its position in the sedan segment with the launch of the 3rd-gen Amaze in December 2024,” calling it “the most affordable ADAS-equipped passenger car in India.”

While the Amaze drew positive reviews and awards, the sedan-heavy portfolio left Honda underrepresented in the SUV category. The SUV category now accounts for 65 percent of India’s 4.3-million-unit PV market, and the company’s share has slipped below 2 percent.

Exports Cushion Domestic Weakness

Exports were the year’s highlight. The company said, “India continues to be one of the key markets for Honda globally, with a keen eye on making it an export hub. In FY25, HCIL recorded its highest-ever export volume of 60,237 units – a 60 percent growth over last year.”

Parts and components exports stood at ₹848 crore, while shipments of the Japan-spec Elevate (sold as WR-V) reinforced India’s growing role in Honda’s global supply chain. This shift highlights a structural imbalance; Honda now exports nearly as many vehicles as it sells domestically, masking its weakening retail footprint in India.

Dealer Network and Market Presence

HCIL’s dealer network includes 300 facilities in 220 cities, but volumes per outlet remain low compared to market leaders. Despite strong brand recall, the company’s retail footprint has stagnated while competitors aggressively expand into emerging markets.

Lean Investment and Tight Controls

Capital expenditure in FY25 totalled ₹404 crore, primarily for maintenance, plant and software upgrades. Capital work-in-progress: ₹133 crore | Intangibles under development: ₹6 crore. Depreciation rose 4 percent to ₹711 crore, while finance costs declined to ₹296 crore. The spend profile reflects a cautious, maintenance-led investment strategy rather than a capacity or product expansion drive.

People and Process

The company praised its workforce for “commitment, competence and robustness in all business areas,” maintaining harmonious labour relations and a lean organisation.

HCIL continued with its “pay for role” framework, sustaining the 100K break-even manpower structure. It conducted 1,400 training man-days across 70 programmes, emphasising leadership development and the “Honda way of working and Honda philosophy,” the company claimed.

The management said it will “continue to maintain lean manpower and retain high-performing associates in FY26.”

This reflects a company focused on efficiency and stability rather than aggressive expansion.

Autocar Professional Analysis

Honda Cars India ends FY25 with financial stability and operational discipline, even as its domestic business remains under pressure.

Profits were mainly maintained through exports and cost efficiencies rather than a rebound in local demand. The company’s acknowledgment of a “steady year for the industry” contrasts with its weaker domestic trajectory, where volumes have dropped to multi-year lows. However, with exports at record levels and a renewed focus on product interventions, Honda appears intent on rebuilding its India playbook. The upcoming EV launch and future SUV programmes will be critical in determining whether the company can reignite growth and regain strategic relevance in an increasingly competitive market.

The FY25 results underscore a reality: Honda remains a respected and trusted brand in India — but no longer a major player.

Source: Business intelligence platform Tofler / Autocar Professional Research