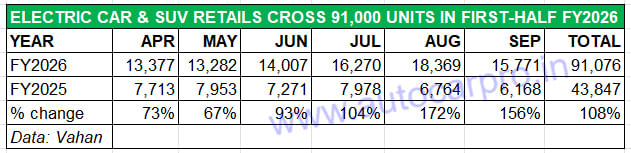

The electric passenger vehicle industry is clocking strong growth in the current fiscal year. Retail sales in the first six months, from April to September 2025, at 91,076 units are a strong 108% YoY increase (H1 FY2025: 43,847 units). This robust growth, as the Vahan data (as of October 11, 2025) also means that India e-PV Inc has already achieved 84% of last year’s record sales and is just 17,533 units shy of the 108,609 e-PVs sold in FY2025, a gap which will be bridged either in the Diwali month of October or by mid-November.

Monthly sales right from April have been strong with handsome double-digit YoY growth (see first-half sales data table below) and August 2025 (18,369 units) turned out to be this segment’s best-ever month to date. However, EV deliveries in September 2025 (15,771 units) fell 14% month on month, which can be attributed to the rationalisation of GST on fossil—fuelled vehicles from 28% to 18% as also the withdrawal of the compensation cess.

At 91,076 units sold between April-September 2025, India e-PV Inc has already achieved 84% of CY2024’s record sales (108,609 units) and needs to sell another 17,534 units to surpass that total.

With the 5% GST on electric cars, SUVs and MPVs remaining untouched, along with the sustained demand for new models and another six months left In this fiscal, e-PV manufacturers could be looking at a near-doubling of H1 FY2026 retails and a record 175,000 units by end-March March 2026.

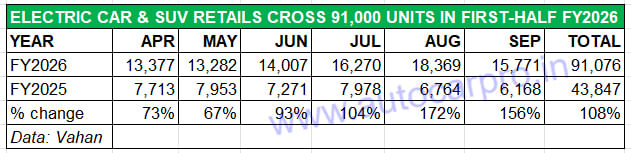

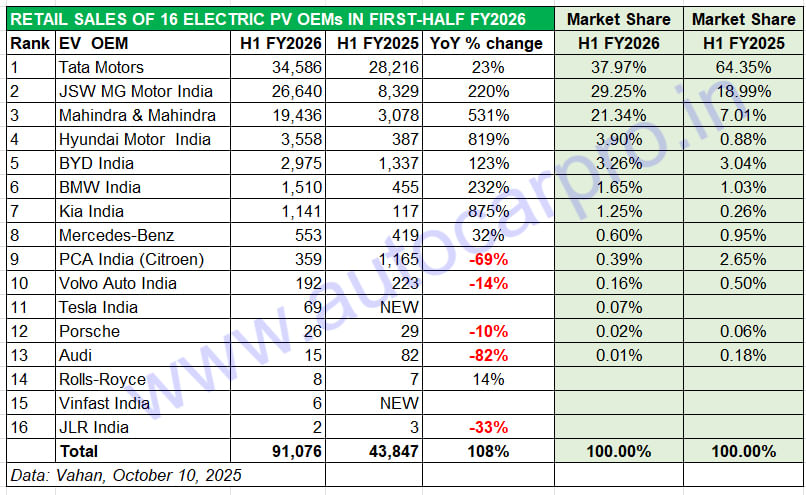

Let’s take a quick look at 14 electric PV manufacturers’ performance in the past six months and their market share standing year on year.

Market leader Tata Motors remains on top with cumulative April-September 2025 sales of 34,586 units, up 23% YoY (H1 FY2025: 28,216 units). The company, which sells the Punch, Nexon, Currv, Harrier, Tiago and Tigor in their electric avatars has seen its monthly sales improve since July when the Harrier EV was launched. Nevertheless, it has a lot of catching up to do in terms of market share– at 40% right now, it is down 14% on the 64% e-PV market share it commanded in first-half FY2025. Tata Motors’ biggest challenge comes from JSW MG Motor India and Mahindra & Mahindra, whose combined e-PV market share has doubled to 50% from 26% a year ago.

JSW MG Motor India has delivered 26,640 EVs to customers in the past six months, up 220% YoY (H1 FY2025: 8,329 units). This translates into a difference of 18,311 units, most of which comprise the pathbreaking Windsor EV and its innovative BaaS option. This stellar performance has resulted in JSW MG Motor’s market share rising smartly from 19% a year ago to 29% in H1 FY2026. The company has also expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster priced at Rs 72.49 lakh. These two new models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

For Mahindra & Mahindra, whose e-SUV portfolio also includes the XUV400, the rollout of the BE 6 and XEV 9e in January this year has dynamically improved its EV retail market performance. Between April and September 2025, the company has delivered 19,436 e-SUVs — the bulk of this total comprising the BE 6 and XEV 9e — to its customers. The 531% growth translates into an additional 16,358 e-SUVs units over the 3,078 XUV400s M&M sold in H1 FY2025. As a result, its market share has grown three-fold to 21% from 7% a year ago.

Hyundai Motor India is ranked fourth amongst the 16 e-PV OEMs in India. The 3,558 units sold in H1 FY2026 are an 819% YoY increase on a low year-ago base of 387 Ioniq 5s. The launch of the Creta Electric in mid-January 2025 has helped Hyundai Motor India move ahead of BYD India in the e-PV numbers game. While the Creta remains Hyundai’s best-selling model and is also India’s No. 1 midsize SUV, the market response to the Creta Electric is tepid. Nevertheless, with the Creta Electric’s entry, Hyundai’s e-PV share has risen to 4% from 1% a year ago.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, has registered cumulative sales of 2,935 units, up 123% YoY. This, however, sees it maintain its 3% share in a market where retails have doubled over the past year.

Kia India has risen three ranks to No. 7 amongst the 16 OEMs in H1 FY2026 with retail sales of 1,141 units. This marks 875% YoY growth on a very low year-ago base of just 117 units. The zero-emission vehicle of growth is the recently launched, made-in-India Carens Clavis EV which is the most affordable seven-seat, all- electric MPV in the country. Thanks to the Clavis EV, Kia India has registered record EV sales for two months in a row. In August 2025, Kia India sold 463 units and followed it up with 563 units in September. This gives a new charge to Kia which entered the domestic EV market three years ago with the EV6 and then introduced the EV9, both as CBU imports which are far more expensive than the Clavis EV.

LUXURY EV MAKERS SELL 2,375 EVs, BMW COMMANDS 64% SHARE

On the luxury EV front, combined retail sales of the eight OEMs, of which Tesla is the latest to enter the market, at 2,375 units are up 139% on year-ago sales of 1,218 units in April-September 2024. BMW India, the luxury EV market leader in CY2024 with 1,227 units and a 47% market share, has sold 1,510 EVs in the past six months, which marks stellar 232% YoY growth and gives it a 64% share of the luxury e-PV market in first-half of FY2026.

Mercedes-Benz India, which has clocked retail sales of 553 units in the past six months, has seen its sales rise by 32% YoY, a performance which gives it a 23% share of the luxury e-PV market.

Volvo Auto India, the No. 3 luxury e-PV manufacturer, sold 192 units in the period under review, down 14% on year-ago sales of 223 units.

Tesla Auto India, as per Vahan, which has received over 600 bookings for the Model Y, delivered 60 units of the e-SUV to customers in Mumbai, Delhi, Pune, and Gurugram. This gives the American EV maker fourth rank in the luxury e-PV segment in its first month (September). The Model Y, which is imported as a CBU from China, is priced at Rs 59.89 lakh (Standard variant), while the Long Range variant is priced at Rs 67.89 lakh (ex-showroom).

While Porsche, with 26 units, is down 10% on year-ago retails of 29 percent, Audi with 15 units has seen its deliveries fall sharply by 82% YoY (H1 FY2024: 82 units), and Rolls-Royce sold 8 units of the uber-luxurious Spectre.

Meanwhile, Vinfast India, which has begun sales of the locally assembled VF6 and VF7 e-SUVs, has delivered 6 units to customers last month, as per Vahan statistics.

ELECTRIC PV INDUSTRY GROWTH OUTLOOK

The e-PV retail market scenario in H1 FY2026 is similar to the calendar year growth where

cumulative sales in the first nine months of CY2025 at 125,052 units have raced past entire CY2024 sales of 99,625 units.

With the festive season underway in full swing and Diwali on October 20, this month will be a key month to keep a watch on. The 5% GST on EVs remains untouched, which essentially means that the once-substantial price gap between ICE PVs and EVs, particularly entry level models, has reduced sharply. This market dynamic was reflected in the slower sales of e-PVs in September. Will the robust buying of ICE cars and SUVs continue? Was the month-on-month sales decline in September, due to the GST cut on fossil-fuelled vehicles, an aberration?

Nevertheless, with a much wider choice of EVs now available to customers and a growing charging infrastructure, expect demand for zero-emission cars, SUVs and MPVs to remain robust. EV aficionados are awaiting the India market launch of the Maruti e-Vitara midsize e-SUV, the first BEV from Maruti Suzuki which is slated for launch this December and will take on the Tata Curvv EV, Hyundai Creta EV and MG ZS EV. Keep watching this space for the latest updates on the EV industry . . . in India and also globally.

ALSO READ: Mahindra BE 6, XEV 9e clock best-ever monthly production, sales and exports in September 2025