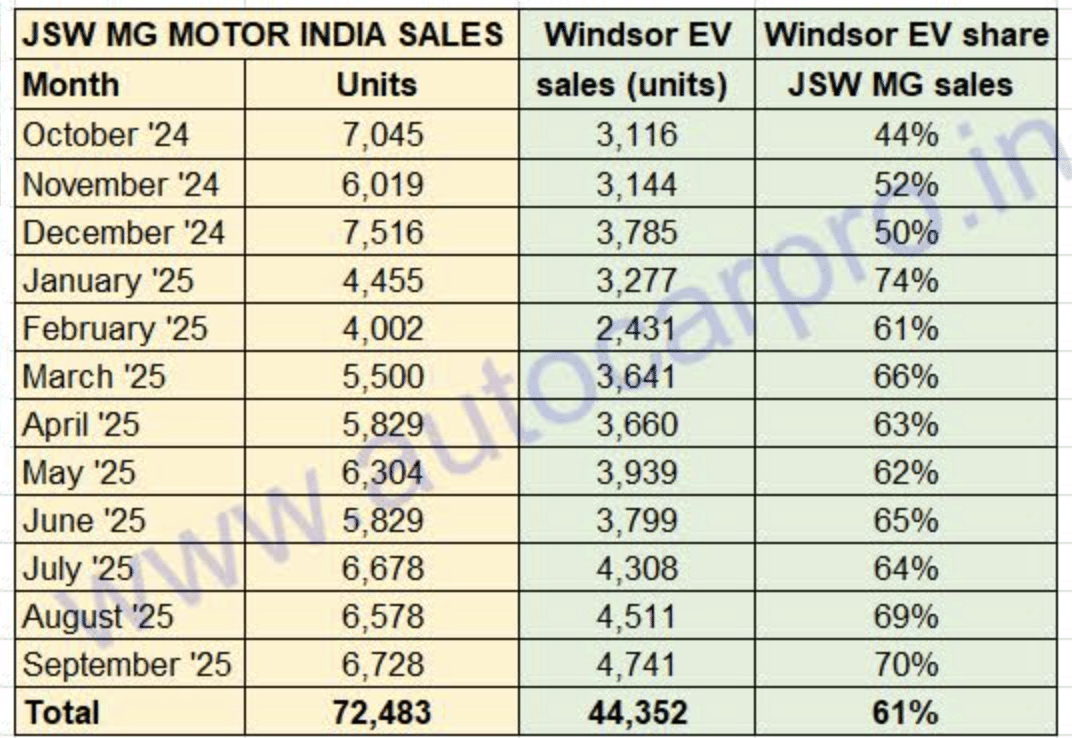

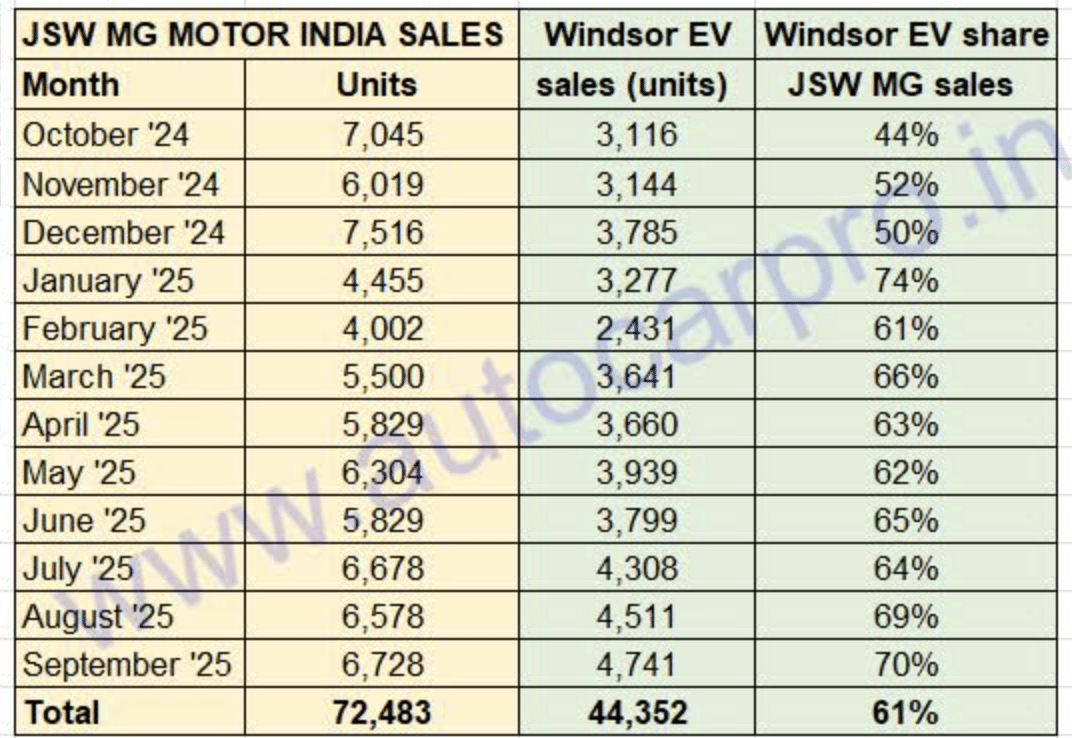

If there was a game-changing EV in the Indian electric passenger vehicle industry in the past year, then that accolade clearly belongs to the MG Windsor EV. Twelve months since its launch, the JSW MG Motor India ZEV has stormed the market and how. Between October 2024 and September 2025, the cool-looking, tech-laden spacious five-seater has clocked estimated wholesales of 44,352 units, accounting for 61% of the company’s total 72,483 passenger vehicles dispatched to its dealers.

The 12-month sales split (see data table below) reveals the growth trajectory. Between October-December 2024, the Windsor EV sold 10,045 units, dropped 7% quarter on quarter to 9,349 in January-March 2025, rose 22% QoQ to 11,398 in April-July 2025, and then jumped 19% QoQ to 13,560 units in July-September 2025.

The Windsor EV, which surpassed the 4,000 units monthly sales mark for the first time in July 2025, has registered record sales for the past three months in a row, culminating in the highest yet last month (September 2025: 4,741 units). What’s more, the Windsor EV’s share of JSW MG Motor’s monthly wholesales has risen from 44% in October 2024 to 70% in September 2025.

JSW MG Motor India currently retails nine models comprising six SUVs (Astor, Hector 5-seater/Hector Plus, Gloster, ZS EV and Windsor EV), one hatchback (Comet EV), the recently launched M9, its first MPV, and the Cybersteer roadster.

The Windsor EV’s share of JSW MG Motor’s monthly wholesales has risen from 44% in October 2024 to 70% in September 2025.

On October 9, to celebrate a year of the Windsor EV’s market entry, JSW MG Motor India launched the Windsor Inspire Edition, with production limited to only 300 units, with prices starting at Rs 16.65 lakh (Rs 99,000 with BaaS). Deliveries of the Windsor Inspire Edition (white side profile photo above) are to commence from October 15.

Over the past year, not only has the Windsor EV become JSW MG Motor’s best-selling product but it has propelled the company to No. 2 position in the e-PV hierarchy, close on the heels of market leader Tata Motors. According to the company, in addition to metros, the Windsor EV is witnessing demand from emerging markets as well, with non-metros constituting close to 50% of its total sales.

The Windsor EV, which comes with a range of segment-first features, lounge-like seating and a lifetime battery warranty along with the innovative Battery-as-a-Service (BaaS) program user plan for its EVs, has given a new charge to JSW MG Motor India’s sales and also helped buffer the decline in sales for some of its other passenger vehicles, particularly the Hector midsize SUV.

Autocar India’s Buyer’s Guide commentary on the Windsor EV states: “The Windsor EV is MG’s best EV yet . . . spacious, has unique and comfy lounge seats, and a long features list. It drives nicely too, being set up for a smooth and easy-going drive. The ride quality, however, is on the firmer side. The innovative battery hire arrangement is worth looking it.”

The standard Windsor EV’s 38kWh battery makes way for a 52.9kWh one on the Pro (pictured above). Consequently, the ARAI-tested range figure jumps to 449km on a single charge from 332km on the standard Windsor EV.

WINDSOR PRO EV UPS THE VALUE QUOTIENT WITH 449KM RANGE

In May this year, the company launched the Windsor Pro EV which is now the new top-end variant with pricing starting at Rs 18.09 lakh (ex-showroom) and to Rs 13.09 lakh under the BaaS program with a usage charge of Rs 4.50 per kilometre.

Where the Windsor Pro EV stands out is the new 52.9 kWh LFP battery, which delivers a claimed 449km range on a single charge compared to the ARAI-certified 332km in the standard Windsor EV with the 38 kWh LFP battery. Power (136hp) and torque (200 Nm) remain unchanged. On the charging front, the Windsor Pro EV comes with a 7.4 kW AC charger that ‘juices’ it up in around nine-and-a-half hours and with 69 kW DC fasting, a 20-80% charge in 50 minutes.

Key products highlights are new 18-inch allow wheels, three new colour options (Celadon Blue, Glaze Red and Aurora Silver), new beige upholstery in the cabin, V2V (Vehicle to Vehicle) and V2L (Vehicle to Load) functionality, where the battery can be used to charge other electric cars and external devices, as well as a Level 2 ADAS safety suite and powered tailgate.

While the standard Windsor EV targets the Tata Nexon EV and Mahindra XUV400, the Windsor Pro EV aims to draw buyers away from the 45 kWh variants of the Nexon EV and entry level variants of the Hyundai Creta Electric and Tata Curvv EV.

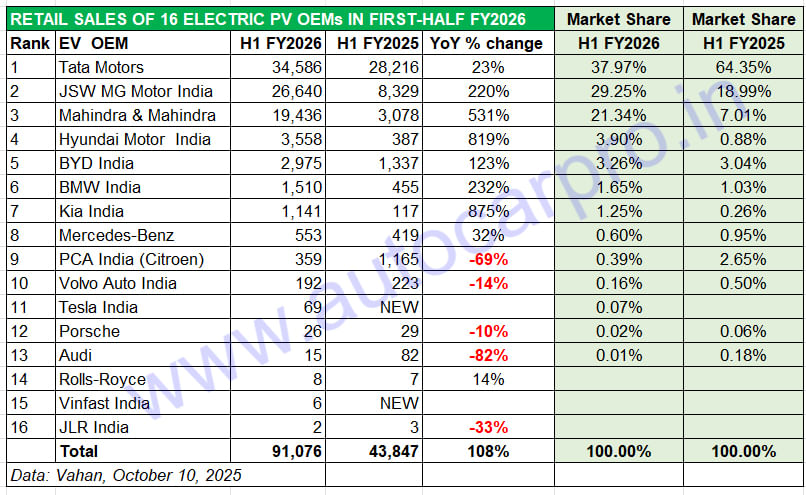

JSW MG MOTOR INDIA EV RETAIL SHARE JUMPS TO 29% IN H1 FY2026

While wholesale numbers are essentially factory dispatches to company dealers, retail sales numbers depict the actual customer deliveries and are the real-world indication of a model’s sales. The latest retail sales data for the 16 e-PV OEMs for the first-half of FY2026, sourced from the Vahan portal (shown below), reveals just how the success of the Windsor EV is reflected in the company’s rapid growth in the past nine months. While the Vahan numbers do not indicate model-wise sales, the strong growth accelerator for JSW MG Motor India clearly is the Windsor EV.

Between April and September 2025, JSW MG Motor India has delivered 26,640 EVs to customers, up 220% YoY (H1 FY2025: 8,329 units). This translates into an additional 18,311 units YoY, most of which comprise the pathbreaking Windsor EV and its innovative BaaS option. This stellar performance has resulted in JSW MG Motor’s market share rising smartly from 19% a year ago to 29% in H1 FY2026. Halfway into FY2026, JSW MG Motor India is 7,946 EVs and 9% in terms of market share behind Tata Motors. Not many would have imagined such a scenario a year ago when the Windsor EV rolled out of the company’s plant in Halol, Gujarat.

Robust demand for Windsor EV has meant that JSW MG Motor India’s e-PV retail market share has jumped to 29% in H1 FY2026 from 19% in H1 FY2025, putting it hard on the heels of Tata Motors.

ALSO READ: Electric PV sales jump 108% to 91,000 units in H1 FY2026, JSW MG and M&M share crosses 50%