Hyundai Motor India has revealed ambitious advancements in battery technology that could fundamentally reshape the economics and consumer appeal of electric vehicles, with next-generation cells promising 30% lower costs, 15% higher energy density, and 15% faster charging by 2027—all while maintaining over 90% battery life retention even after 250,000 miles of use.

At the company’s investor day presentation today, Hyundai showcased a comprehensive battery technology roadmap built on three pillars: superior durability performance, strengthened competitiveness through cost and efficiency improvements, and diverse battery solutions spanning multiple chemistries and form factors to address different vehicle segments and use cases.

Battery Durability: The 250,000-Mile Promise

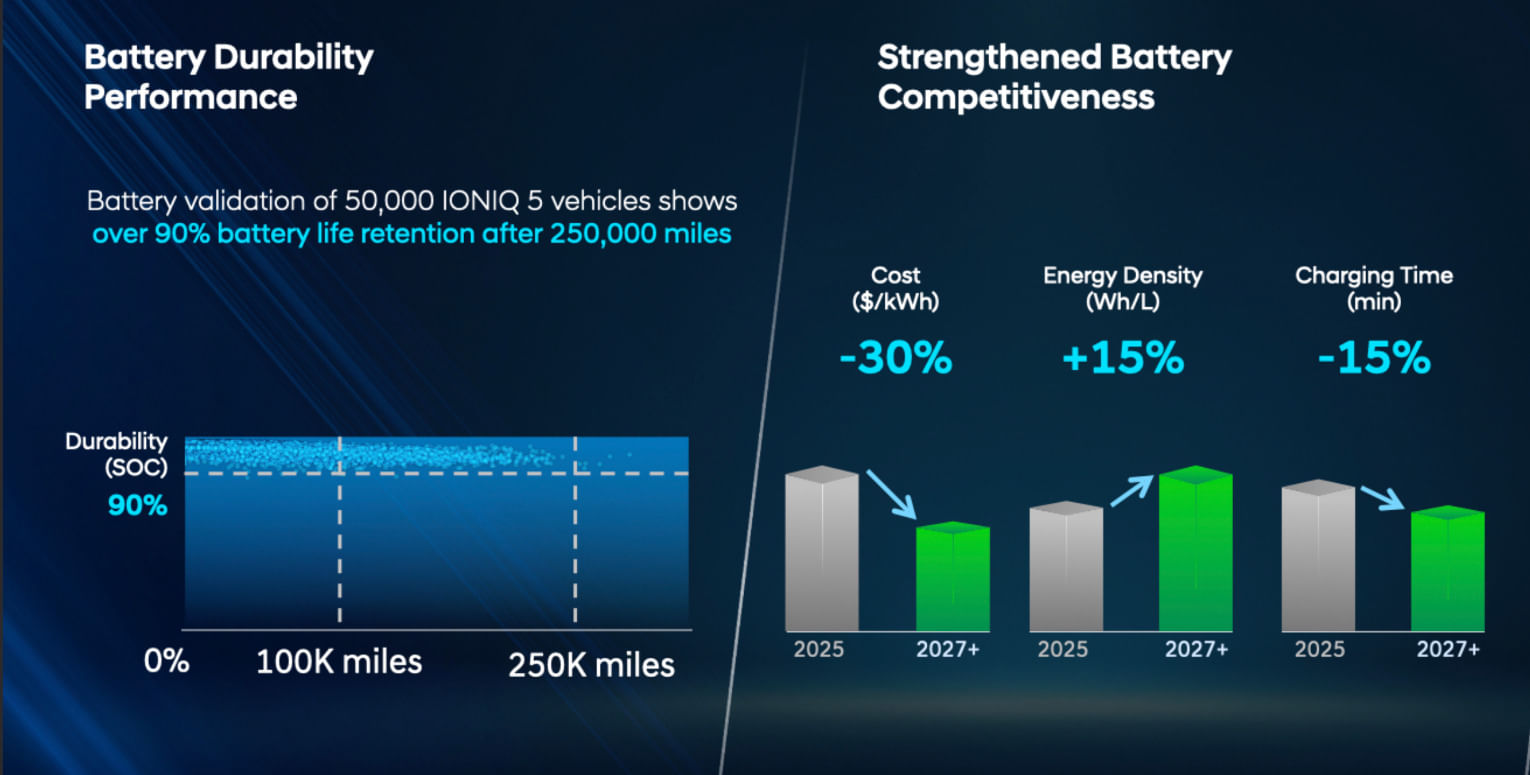

Perhaps most significant for consumer confidence is Hyundai’s battery durability data, derived from validation testing of 50,000 IONIQ 5 vehicles globally. The results show batteries retaining over 90% of their capacity after 250,000 miles—a threshold that exceeds the typical lifetime of most vehicles in India, where the average car is driven approximately 12,000-15,000 km (7,500-9,300 miles) annually.

This exceptional durability directly addresses one of the primary consumer concerns about EVs: battery degradation and the associated loss of range over time. In practical terms, a Hyundai EV with an initial range of 500 km would still deliver 450+ km even after a decade of use—more than sufficient for daily driving needs.

The durability milestone also has profound implications for total cost of ownership and residual values. High battery life retention means Hyundai EVs will command stronger resale prices, as second-hand buyers won’t face the prospect of expensive battery replacements. Additionally, sustained battery performance lowers warranty costs for Hyundai, potentially enabling the company to offer more competitive pricing or longer warranty coverage to build consumer trust.

2027 Breakthrough: The Cost-Density-Speed Triple Win

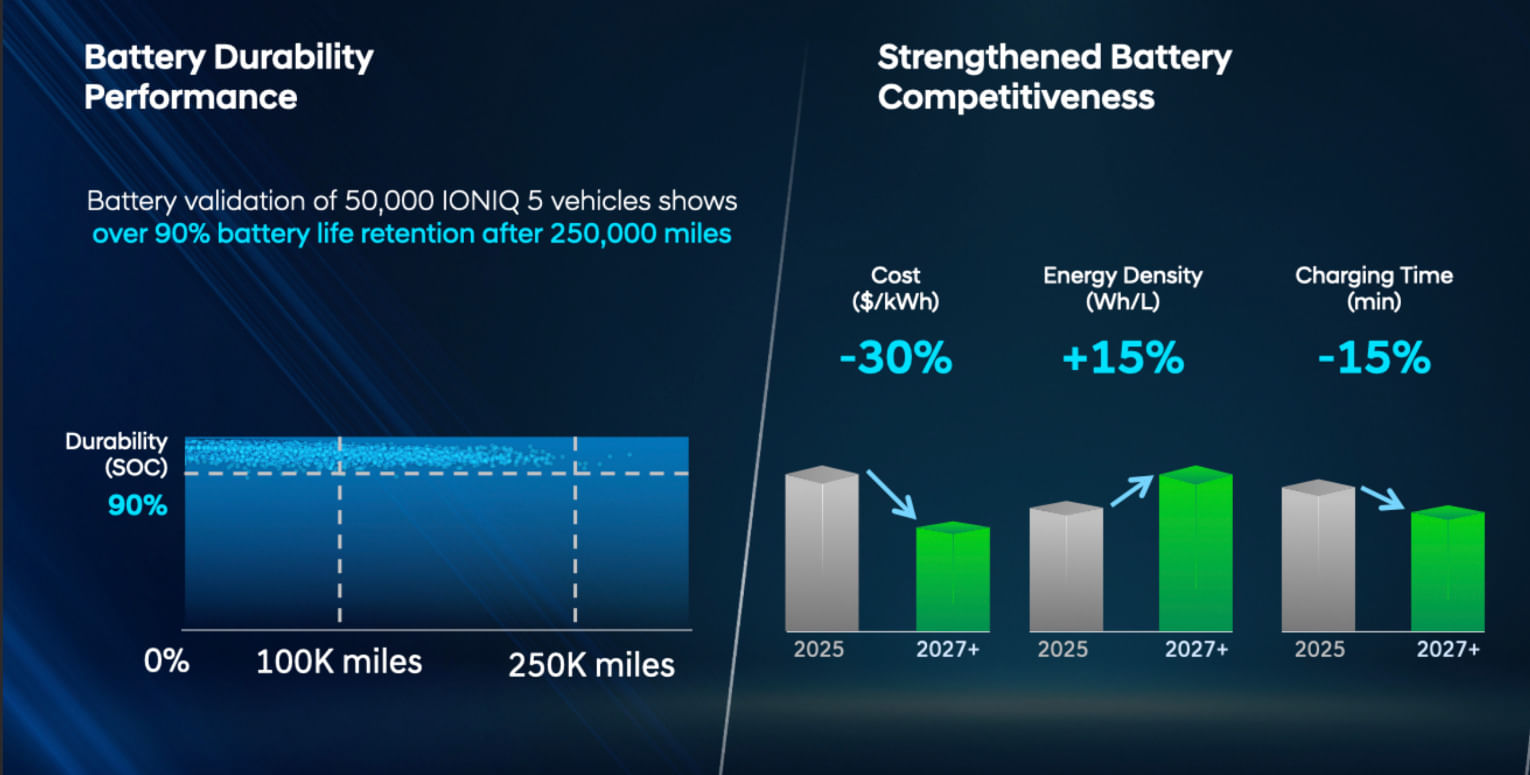

Hyundai’s next-generation battery technology, slated for introduction in 2027 or beyond, promises simultaneous improvements across three critical parameters—a rare achievement in battery development where gains in one area often come at the expense of others.

The projected 30% reduction in cost per kilowatt-hour could be transformative. If current battery costs hover around $120-130/kWh at the pack level, a 30% reduction would bring them below $90/kWh—approaching the long-sought threshold where EVs achieve price parity with equivalent ICE vehicles without subsidies. For a vehicle with a 60 kWh battery, this translates to roughly $1,800-2,400 (₹1.5-2 lakh) in savings, which could be passed to consumers or invested in additional features and content.

The 15% improvement in energy density (Wh/L) means more energy storage in the same physical space, enabling either longer range without increasing battery size, or maintaining current range with smaller, lighter battery packs. This is crucial for vehicle packaging—allowing designers to optimize interior space while improving efficiency through weight reduction.

Equally important is the 15% reduction in charging time. While the slide doesn’t specify absolute numbers, if a current 60 kWh battery requires 40 minutes to charge from 10-80% at a fast charger, the improved chemistry could reduce this to 34 minutes—edging closer to the refueling experience of conventional vehicles and addressing a key barrier to EV adoption for long-distance travelers.

Diverse Battery Solutions: Chemistry and Form Factor Flexibility

Hyundai is pursuing a multi-chemistry strategy rather than betting exclusively on a single battery technology. The company highlighted both NCM (Nickel Cobalt Manganese) and LFP (Lithium Iron Phosphate) chemistries, each with distinct advantages.

NCM batteries offer higher energy density, making them ideal for premium, long-range EVs where performance and range are paramount. LFP batteries, while slightly less energy-dense, offer superior thermal stability, longer cycle life, and lower costs due to the absence of expensive cobalt—making them perfect for affordable, mass-market EVs where cost competitiveness is critical.

This chemistry flexibility allows Hyundai to optimize battery selection based on vehicle positioning. Entry-level EVs targeting price-sensitive buyers could use LFP, while flagship models and SUVs requiring maximum range could deploy NCM technology.

Beyond chemistry, Hyundai is also developing three distinct form factors: prismatic cells (rectangular, widely used and manufacturing-efficient), pouch cells (lightweight and flexible in packaging), and cylindrical cells (the format used by Tesla, offering excellent thermal management and manufacturing scalability).

This form factor diversity provides engineering flexibility across different vehicle platforms and allows Hyundai to work with multiple suppliers globally, reducing supply chain risks and fostering competitive sourcing.

Safety-First Design: Active Diagnostics and Layered Protection

Recognizing that battery safety remains a concern following high-profile EV fire incidents globally, Hyundai has implemented what it calls a “Safety-First Battery Design” with two complementary approaches: active diagnostics and layered physical protection.

The active battery diagnostic system provides real-time health assessment and rapid anomaly detection through a cloud-based battery management system (BMS). This system continuously monitors battery behavior during both charging and driving, analyzing cell voltages, temperatures, and current flows to identify potential issues before they become critical.

Critically, the system includes “Early Dendrite Detection via Advanced Diagnostics”—addressing one of the primary causes of battery failures. Dendrites are crystalline structures that can form inside lithium-ion cells during charging, potentially causing internal short circuits. By detecting dendrite formation early through sophisticated diagnostics, Hyundai can alert drivers and service centers before safety is compromised.

Complementing the active diagnostics is a layered physical safety design incorporating multiple redundant protections: safety vents to release pressure buildup, ultra-safety relays to disconnect power in emergencies, refractory shields to contain thermal events, and separation barriers between cell modules to prevent thermal runaway from propagating across the entire battery pack.

This multi-layered approach reflects lessons learned from the broader EV industry, where relying solely on active monitoring or passive protection has proven insufficient. The combination creates defense-in-depth, ensuring that even if one safety system fails, others provide backup protection.

Strategic Implications for India

For Hyundai’s Indian operations, these battery advancements carry particular significance. The company has already announced plans to manufacture battery cells locally and collaborate with IITs on battery technology development. The 30% cost reduction and improved durability directly support Hyundai’s goal of making EVs accessible to mainstream Indian buyers, not just early adopters.

The 250,000-mile durability data provides powerful marketing ammunition in a market where long-term reliability concerns often override initial purchase price considerations. Indian consumers, accustomed to diesel vehicles that deliver 15-20+ years of service, need assurance that EVs won’t require expensive battery replacements after 5-6 years.

As Hyundai prepares to launch multiple EV models by 2030 and install 600+ DC fast chargers by 2032, these battery technology improvements—spanning cost, performance, charging speed, durability, and safety—create the foundation for credible mass-market EV adoption in India, transforming electric vehicles from niche products into mainstream transportation solutions.