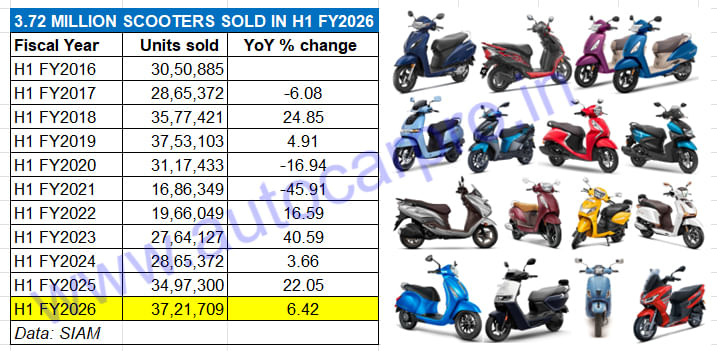

Powered by its best-ever monthly sales of 733,391 units in September 2025, the Indian scooter industry, which hit record wholesales of 6.85 million units in FY2025, seems well set for another mega fiscal in FY2026. Halfway into the current fiscal year, as per SIAM wholesales data, scooter makers have clocked sales of 37,21,709 units, up 6.42% YoY (H1 FY2025: 34,97,300 units). If this segment, which is also benefiting from demand for electric scooters, maintains the same growth trajectory, it will surpass the 7 million sales mark for the first time.

Thanks to the substantial GST 2.0-driven price cuts on IC engine scooters, September 2025 (733,391 units) went past the previous monthly best of October 2024 (721,200 units) by 12,191 units. It is to be noted that last month also had the two-week Shraddh period when vehicle buyers prefer to delay their purchases. October 2025, with Diwali in it and the first full month to see the benefit of reduced GST, just might become the new month for record scooter sales.

H1 FY2026 scooter sales of 3.72 million sales missed the highest first-half FY2019 sales of 3.75 million units by just 31,394 units.

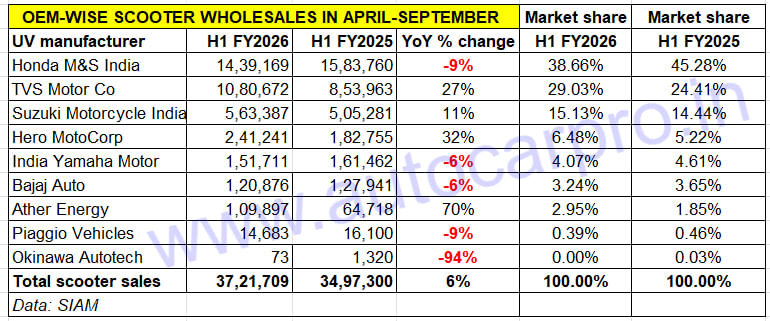

HONDA MARKET SHARE FALLS TO 39%, TVS’ RISES TO 29%

Honda Motorcycle & Scooter India, the longstanding market leader whose portfolio comprises the Activa 110 and 125 and the Dio 110 and 125, sold 1.43 million scooters in the past six months, down 9% YoY (H1 FY2025: 1.58 million units) and 144,591 fewer units YoY. As a result, HMSI’s market share has fallen to 39% from 45% in April-September 2024. In FY2024, Honda had sold 28.4 lakh units (up 12%) albeit its scooter market share had slipped to 41.50% from 43.33% in FY2024.

TVS Motor Co, which has the Jupiter, NTorq and Zest in its ICE scooter stable and the iQube and recently launched Orbiter electric scooters, sold a total of 1.08 million scooters in H1 FY2026, up 27% YoY (H1 FY2025: 853,963 units), which translates into an additional 226,709 units. This gives it a current market share of 29%, a marked increase over the 24% in H1 FY2025.

While the three petrol-engined scooters have sold 932,899 units, up 28% YoY, the TVS iQube electric scooter with 147,773 units has clocked 20% YoY growth (H1 FY2024: 122,793 iQubes). TVS 29% scooter market share is the highest yet for the company. In FY2025, TVS had sold 1.81 million scooters for a 26% market share, up from 25% in FY2024.

Suzuki Motorcycle India has also done well to sell over half-a-million scooters in H1 FY2026 (563,387 units, up 11% YoY). This performance helps the two-wheeler arm of the Japanese major increase its scooter market share to 15% from 14% a year ago. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Suzuki has revealed its e-Access scooter which will rival the TVS iQube, Bajaj Chetak, Hero Vida VX2 and Ather Rizta when is officially launched. Depending on its pricing, this no-nonsense practical EV should find a steady following and boost Suzuki sales.

Hero MotoCorp, the motorcycle market leader, is ranked fourth in the scooter segment with 241,241 units, up 32% YoY. This sees its market share increase to 6.48% from 5% a year ago. Hero’s ICE scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. These together have sold 179,759 units, up 15% YoY (H1 FY2024: 156,220 units). The company has received a growth accelerator through its e-2W sales, particularly the new V2X. Hero Vida sales of 61,482 units are up 132% (H1 FY2025: 26,535 units).

India Yamaha Motor, with 151,711 units, has registered a 6% sales decline which results in its scooter market share reducing marginally to 4.07% from 4.61% a year ago. The 125cc-engined Alpha, Fascino and Ray ZR have together sold 139,160 units, down 7% YoY. The 155cc Aerox scooter, with 12,551 units, has registered 16% growth (H1 FY2024: 10,854 Aerox).

Bajaj Auto, which is in the scooter market because of its Chetak and Yulu electric scooters, sold a total of 120,876 units, down 6% YoY. While its No. 6 OEM ranking remains unchanged, its market share has fallen a tad to 3.24% from 3.65% a year ago. This sales decline can be attributed to the hampered production the company experienced in July and early August, due to reduced supplies of rare earth magnet supplies. However, Bajaj Auto has bounced back since then.

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter, clocked total wholesales of 109,897 units in H1 FY2026, up 70% YoY (H1 FY2025: 64,718 units). This strong performance sees the EV start-up’s overall scooter market share rise to 3% from 2% a year ago.

Of the nine scooter OEMs, only TVS, Suzuki, Hero MotoCorp and Ather Energy, have registered YoY growth and increased their market share.

TVS, Bajaj Auto, Ather Energy and Hero MotoCorp have seen strong e-2W sales in the past six months.

EV SHARE OF SCOOTER SALES GROWS TO 12% WITH 442,640 UNITS

Of SIAM’s scooter-member companies, five – TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Okinawa Autotech – have been manufacturing zero-emission scooters for some time now. While Honda has entered the market with its Activa-e and the QC1 albeit with limited success, Suzuki has revealed the e-Access but is yet to announce its formal launch with product pricing.

Between April and September 2025, these electric 2W manufacturers have sold 442,640 units, a 29% YoY increase (H1 FY2025: 343,487 units). This gives these e-2W OEMs a 12% share of the overall scooter market, up from the 11% in FY2025 when they had sold 773,093 units (up 68% on FY2024’s 460,530 e-2Ws). Importantly, they have helped accelerate overall scooter industry numbers in FY2025.

On the retail sales front, despite the sizeable 10% GST reduction on petrol-engine two-wheelers, there has been little or no impact on customer demand for electric two-wheelers. Unlike the electric passenger vehicle as well as the e-3-wheeler industry, which have felt the heat of the pent-up demand for ICE models, the e-2W segment has been far more resilient. This can be attributed to the long-term, wallet-friendly benefits of e-mobility on two wheels particularly in view of high petrol and CNG prices. And, also the fact that e-2Ws are the most affordable form of e-mobility.

SCOOTER INDUSTRY HEADED FOR RECORD 7 MILLION SALES IN FY2026

Six months into the current fiscal year, wholesales of 37,21,709 scooters mean that this two-wheeler segment is 3.13 million (31,31,505) units away from riding past its record FY2025 sales of 68,53,214 units.

Given the hugely changed market dynamics as a result of the lowered GST rates, which have revived customer sentiment, got vehicle manufacturers ramping up production and accelerating vehicle deliveries to showrooms across India, the second half of FY2026 is bound to reflect far stronger sales. Furthermore, stable interest rates, an above-normal monsoon season along with strong kharif harvest have given a boost to both urban and rural market demand.

While the festival season, which opened with Navratri and will end with Diwali, will turn out to be the best yet for most vehicle segments, expect scooter OEMs to reap strong gains. September 2025, with 733,391 scooters sold, was the best month in this calendar year. October should, most likely, set a new benchmark for the industry, which will put this segment on target to achieve 7 million sales in a fiscal for the first time.

ALSO READ: TVS tops e-2W sales for six months running, Bajaj Auto regains No. 2 rank