India’s automobile industry witnessed a remarkable convergence of policy reform and festive sentiment during September-October 2025, creating what industry veterans are calling a “once-in-a-decade” opportunity. The implementation of GST 2.0 on September 22, followed immediately by the Navratri festivities, triggered an unprecedented surge in retail car sales that reshaped the competitive landscape, and the numbers show that two players–Maruti Suzuki and Tata Motors–walked away with most of the incremental volumes from the GST cut and festive season.

The GST Game-Changer

The timing couldn’t have been more fortuitous. When the government slashed GST rates on sub-4-meter cars from 28% to 18% and removed the compensation cess, it created a seismic shift in pricing dynamics. The impact was immediate and dramatic—the Maruti S-Presso saw the steepest cut in percentage terms, with GST price drops ranging from ₹70,600 to ₹1.30 lakh, translating to reductions of 12.59% to 23.94%.

The first three weeks of September saw buyers in a holding pattern, anticipating the new rates. But when September 22 arrived, dealerships across India witnessed unprecedented scenes. Tata Motors recorded sales of nearly 10,000 passenger vehicles on that single day, supported by over 25,000 customer inquiries at its dealerships nationwide, while Maruti Suzuki achieved its best single-day performance in 35 years, delivering close to 30,000 vehicles after receiving more than 80,000 inquiries.

Maruti’s Dual-Pronged Strategy

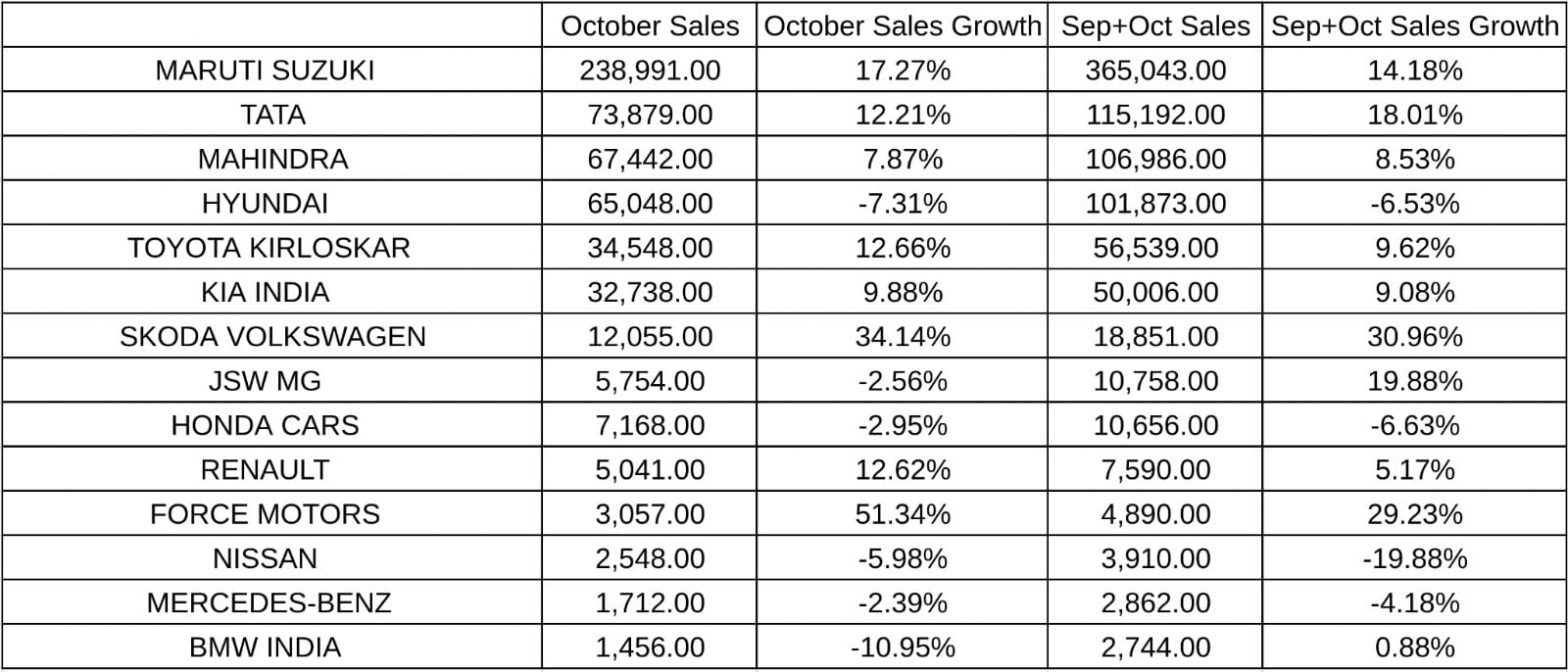

Maruti Suzuki, showing a 14.18% growth in combined September-October sales at 365,043 units, demonstrated masterful market timing. The company’s October sales alone hit 238,991 units, marking a robust 17.27% year-on-year growth.

What made Maruti’s approach particularly effective was the combination of GST benefits with festive offers. The S-Presso, which had already benefited from the massive GST reduction of up to 27%, received additional festive season discounts. The WagonR saw GST price drops ranging from ₹60,600 to ₹79,600 (8.6% to 13.76%), and on top of this, Maruti offered festive benefits including a cash discount of ₹30,000 and an exchange bonus of ₹15,000, totaling up to ₹57,500 in additional savings.

The cumulative impact was staggering—customers could effectively get an S-Presso at prices never seen before, with some variants dropping below ₹3.50 lakh ex-showroom. This pricing revolution particularly resonated in tier-2 and tier-3 cities, where the affordability threshold for four-wheeler ownership was suddenly breached.

Tata’s Strategic Triumph

If there was a clear winner in percentage terms, it was Tata Motors. The company’s 18.01% growth in combined September-October sales (115,192 units) tells only part of the story. September 2025 marked Tata’s best-ever monthly sales performance, with the company capitalizing perfectly on its SUV-heavy portfolio.

The Nexon saw GST price drops ranging from ₹68,100 to ₹1.55 lakh, translating to rate cuts of 5.77% to 10.11%. This was the second-highest reduction in percentage terms after the S-Presso. On top of these GST benefits, Tata offered festive discounts of up to ₹45,000 on all Nexon variants, creating a compelling value proposition.

The Punch, another volume driver, saw GST price drops between ₹64,000 and ₹1.08 lakh (8.51% to 12.02%), with additional festive benefits of up to ₹40,000. Almost 87% of Tata Motors’ ICE portfolio attracted the lower GST slab, and the impact was strongly visible.

Mahindra’s Premium Play Pays Off

Mahindra’s performance (106,986 units sold in September-October with 8.53% growth) becomes more impressive when viewed through the lens of its product positioning. Unlike competitors who benefited massively from sub-4-meter GST cuts, Mahindra’s portfolio of larger SUVs still saw significant GST benefits. The entire Mahindra lineup, including the Thar Roxx, Scorpio N, Bolero, XUV700, and XUV 3XO, received GST benefits of over ₹1 lakh each.

The XUV 3XO diesel saw the largest price reduction of up to ₹1.56 lakh, while even the Scorpio Classic and Thar diesel 4WD saw drops of up to ₹1.01 lakh. This meant that Mahindra could maintain its premium positioning while offering substantial value, helping drive the company’s 7.87% growth in October to 67,442 units.

The Korean Conundrum

Hyundai’s performance presents an interesting contrast. Despite significant GST benefits—the Venue saw price drops of over ₹1 lakh and the flagship Tucson became cheaper by up to ₹2.4 lakh—the company saw a 6.53% decline in combined September-October sales (101,873 units). The Creta, Hyundai’s volume driver, saw price reductions of up to ₹72,145, yet this wasn’t enough to prevent the decline.

Kia fared better with a 9.08% growth in the two-month period (50,006 units). The Sonet saw maximum GST benefits of up to ₹1.86 lakh, while the new Syros received reductions of up to ₹1.64 lakh. The Seltos’ ₹75,372 price cut marginally exceeded the Creta’s, helping Kia maintain positive momentum.

The European Surge

The standout performer was Skoda Volkswagen Group, posting an impressive 30.96% growth in September-October sales (18,851 units). Skoda’s Kylaq, though launched before the GST cuts, saw price reductions of up to ₹1.19 lakh, while the Kushaq and Slavia received benefits of up to ₹65,828 and ₹63,207 respectively. The flagship Kodiaq saw massive reductions of up to ₹3.28 lakh.

This combination of new product introduction (Kylaq) with aggressive GST-driven pricing created a perfect storm for Skoda. The company reported that it had sold 3,000 units of the Kylaq even before deliveries began in January 2025, with plans to deliver 33,333 units by May 2025.

JSW MG, despite a slight October dip (-2.56%), managed 19.88% growth for the two-month period (10,758 units). The company’s focus on value-oriented products, combined with GST benefits across its range, continued to find takers in a price-sensitive market.

Force Motors emerged as the surprise package with a stunning 51.34% growth in October and 29.23% for the combined period, albeit from a small base of 4,890 units.

The Luxury Segment Benefits Too

Even premium brands saw substantial GST benefits. Mercedes-Benz and BMW, despite posting mixed growth figures, saw significant price reductions. Jeep’s Grand Cherokee and Wrangler became cheaper by up to ₹4.5 lakh and ₹4.84 lakh respectively, while the Meridian and Compass saw reductions of up to ₹2.47 lakh and ₹2.16 lakh.

Toyota’s portfolio saw varied benefits—the Fortuner, its flagship SUV, received the biggest price cut of up to ₹3.49 lakh, while the Innova Hycross and Crysta saw drops of up to ₹1.16 lakh and ₹1.81 lakh respectively.

The Federation of Automobile Dealers Associations (FADA) reported that dealerships across the nation witnessed record-breaking footfalls and deliveries, with overall retails surging by 34% year-on-year during Navratri—a historic high during any festive season. This wasn’t just about lower prices; it was about perfect timing and execution.

The convergence of GST cuts with Navratri, followed by Dussehra and the build-up to Diwali, created unprecedented buying momentum. Industry-wide logistics constraints emerged as a consequence, with carmakers struggling to move vehicles fast enough from factories to dealerships, and trucks taking nearly 20 days for a round trip.

Strategic Insights: Price vs Product

The September-October performance reveals crucial strategic insights. Maruti’s ability to combine maximum GST benefits (with the S-Presso seeing up to 27% price reduction) with aggressive festive offers created an unbeatable value proposition. The company’s focus on the sub-4-meter segment, which benefited most from GST reforms, proved prescient.

Tata’s success stemmed from having the right products at the right time. With models like the Nexon (receiving up to 17.5% GST reduction) and Punch positioned perfectly in the sub-4-meter SUV segment, the company could offer SUV aspirations at hatchback prices.

Mahindra’s resilience, despite its larger SUVs benefiting less proportionally from GST cuts, demonstrates the power of brand equity and product differentiation. Even with smaller percentage reductions, the absolute savings of over ₹1 lakh on popular models kept demand robust.

The October sales figures, heavily weighted towards the post-GST period, suggest fundamental market shifts are underway. With entry-level cars like the S-Presso now available at unprecedented prices and compact SUVs becoming more accessible, the traditional segmentation of the Indian car market is being rewritten.

Industry leaders believe this isn’t just a festive spike. Shailesh Chandra of SIAM noted that many two-wheeler owners are now confident about upgrading to a “reasonably sized car” due to lower tax rates and better financing options. The “real GST 2.0 customer”—those who weren’t in the market before but are now considering purchases due to improved affordability—is expected to sustain demand beyond the festive season.

Winners and Lessons

The clear winners of the festive season were those who:

- Maximized GST benefits: Maruti with its small car portfolio and aggressive pass-through of benefits

- Leveraged product positioning: Tata with its sub-4-meter SUV range perfectly aligned with GST benefits

- Maintained premium appeal: Mahindra proving that absolute savings matter as much as percentages

- Timed product launches: Skoda’s Kylaq launch coinciding with the GST reforms

The companies that struggled were those heavily dependent on segments that saw limited benefits or those unable to quickly adapt their communication and pricing strategies to the new reality.

The Road Ahead

What’s clear is that September-October 2025 will be remembered as a watershed moment in India’s automotive history. The combination of the most significant tax reform in recent years with perfect festive timing created opportunities that smart manufacturers seized with both hands.

For Maruti and Tata, their ability to quickly leverage GST benefits through clear communication and additional festive offers has strengthened their market positions. The real test will come in the subsequent quarters when the initial euphoria settles and the market finds its new equilibrium.

Has the GST cut permanently expanded the addressable market for cars in India? Early indicators suggest yes—with entry barriers significantly lowered and monthly EMIs reduced by 10-15% across segments, a new generation of car buyers is entering the market.

The companies that recognized and capitalized on this shift—particularly Tata with its 18% growth and Maruti with its volume leadership—have emerged as the clear winners of India’s great festive auto boom of 2025.