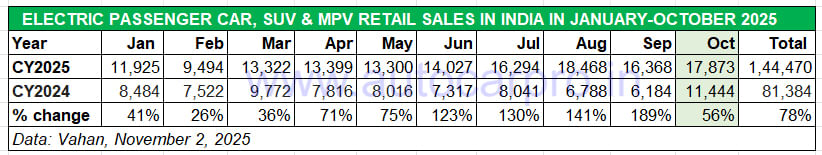

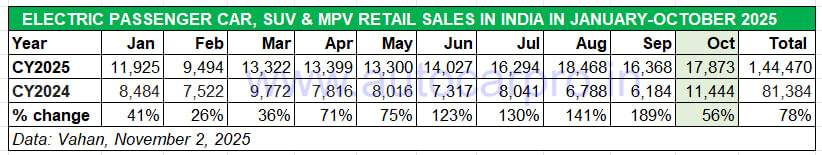

Even as the overall passenger vehicle market saw record wholesales of over 500,000 units in the festive month of October 2025, retail sales of electric passenger vehicles recovered last month after witnessing a month-on-month fall in September (16,354 units). October saw 17,783 zero emission cars, SUVs and MPVs being delivered across India, marking a 56% year-on-year increase (October 2024: 11,444 units) and 9% MoM growth.

A total of 17,873 electric PVs were delivered to customers in October 2025, up 56% YoY, and a 9% increase over September. August 2025 (18,468 units) has been the best-ever sales month though.

October was the first full month of sales after GST 2.0 kicked in on September 22,2025, facilitating intensive price cuts enabled by the rationalisation of GST from 28% to 18% as also the withdrawal of the compensation cess. Not surprisingly, most of the leading PV makers including Maruti Suzuki, Mahindra & Mahindra, Tata Motors and Toyota Kirloskar Motor posted best-ever monthly sales. The 5% GST on EVs remains untouched, which essentially means that the once-substantial price gap between ICE PVs and EVs, particularly entry level models, has reduced sharply.

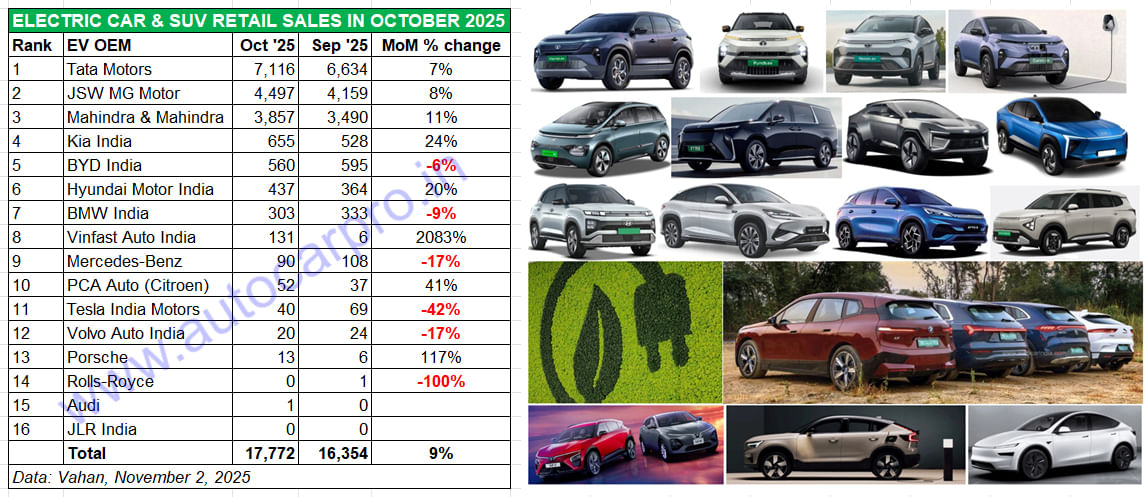

October was the second month of sales for the two new EV makers – Tesla and Vinfast India – who have joined the existing 14 players in the e-PV market. Let’s take a closer look the OEM-wise performance in October and their month-on-month growth or decline, along with their current market share.

Tata Motors, JSW MG and M&M command 87% of e-PV market

Tata Motors clocked retails of 7,118 units last month, up 8% YoY (October 2024: 6,608 units) and 7% up month on month (September 2025: 6,634 units). This is its second highest monthly score after August’s 7,503 units and gives it a market-leading share of 40% for October 2025, the same as in September. While the recently launched Harrier EV has helped revive demand for the company, the Punch, Nexon and Curvv EVs continue to have their fair share of buyers. Tata Motors, whose EV portfolio also includes the Tiago and Tigor, has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of whom have launched new EVs in the past year.

JSW MG Motor India sold 4,497 e-PVs last month, which marks a strong 61% YoY increase (Otober 2024: 2,786 units) and a more understandable 8% MoM growth (September 2025: 4,159 units). This gives it a 25% e-PV market share. The company, which has made inroads into Tata Motors’ market share with Windsor EV and its BaaS option, has expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster priced at Rs 72.49 lakh. Both models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

Mahindra & Mahindra, which registered record monthly retails of 67,442 SUVs and wholesales of 71,624 SUVs in October, also clocked its best-ever EV retail sales last month. The company, which is seeing strong demand come its way for the two new electric origin SUVs – BE 6 and XEV 9e – and also has the XUV400 in its EV portfolio, delivered 3,867 e-PVs to customers last month. This is a 303% YoY increase on a low year-ago base of 957 XUV400s, and up 11% on September 2025’s 3,490 units. This performance gives M&M a 22% market share for October. In an effort to ensure its showrooms were well stocked for the festive season, the SUV manufacturer’s Chakan plant had rolled out 5,959 units of the BE 6 and XEV 9e in September.

Kia India, which was ranked ninth a year ago, has risen five ranks to become the No. 4 e-PV OEM in October 2025 with best-ever monthly retail sales of 655 EVs, up 24% MoM and 1293% YoY (October 2024: 47 EVs), improving upon its No. 5 position in September 2025 (528 units). The company has a 4% e-PV market share in October and is ahead of both BYD India and Hyundai Motor India. This upward movement can be attributed to growing demand for the recently launched mass-market Carens Clavis EV MPV. Kia’s EV portfolio also contains the EV6 and EV9, which are imported as CBUs into the country and, as a result, are far more expensive than the mass-market Carens Clavis EV-MPV.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer has slipped to fifth rank on the e-PV OEM sales table, with retail sales of 560 units last month, down 6% on September 2025’s 595 units. September sales were the best-ever monthly score yet for BYD’s Indian arm which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV.

Hyundai Motor India sold 437 e-SUVs last month, up 20% MoM (September 2025: 364 units) which gives it a 2% share of the e-PV market. Following the launch of the Creta Electric in January 2025, monthly sales had risen from 775 units in February to 905 units in March but since then demand has tapered for the zero-emission avatar of India’s best-selling midsize SUV. Hyundai also sells the Ioniq 5 in India.

Vinfast India, which has begun sales of the locally assembled VF6 and VF7 e-SUVs, delivered 131 units to customers last month, as per Vahan statistics. This sees the Vietnamese EV maker take eighth rang amongst the 16 e-PV OEMs in India.

With combined sales of 15,470 units, Tata Motors, JSW MG Motor and Mahindra & Mahindra had an 87% share of the 17,772 e-PVs sold in October 2025.

LUXURY CARMAKERS SELL 467 EVs IN OCTOBER, UP 33% YoY, DOWN 14% MoM

As compared to the mainstream e-PV market OEMs, luxury passenger vehicle OEMs have fared better YoY but poorer on a month-on-month (MoM) basis. As per Vahan data, cumulative sales of eight OEMs at 467 units are up 33% YoY (October 2024: 353 units) but down 14% MoM (September 2025: 541 units).

BMW India, the luxury EV market leader, sold 303 units in October – 30 fewer EVs than it did in September (333 units). This performance, nevertheless, helps it retain the No. 7 rank in the 16-OEM listing and gives it a 65% share of this sub-segment. In the first 10 months of CY2025, BMW India has sold 2,536 e-PVs, up 162% on year-ago sales of 969 units.

Mercedes-Benz India, the No. 2 luxury e-PV OEM, has registered retails of 90 zero-emission vehicles in October 2025 and gets a 19% luxury e-PV market share. While this total is a 17% decline MoM (September 2025: 108 units), it is down 44% YoY (October 2024: 162 units). For the January-October 2025 period, the German carmaker has sold a total of 1,013 e-PVs, up 37% YoY (January-October 2024: 742 units).

Tesla India, which has received over 600 bookings for the Model Y, delivered 40 units of the e-SUV to customers in Mumbai, Delhi, Pune, and Gurugram last month and is currently ranked No. 3 amongst the luxury OEMs. Over the past two months, the American EV maker has sold 109 units of the Model Y which is imported into India as a CBU product.

Meanwhile, Volvo Auto India delivered 20 EVs last month, down 17% MoM (September 2025: 24 units).

Cumulative e-PV industry sales in the first 10 months of CY2025 at 144,352 units have raced past entire CY2024 sales of 99,688 units. Given the current sales momentum, expect this zero-emission vehicle segment to register record retail sales of around 170,000-180,000 units this calendar year.

ALSO READ:

Bajaj Auto Regains E-2W Crown, Industry Clocks 143,000 Units in Record-Breaking October

Ather Energy Clocks Best-Ever Monthly Sales in October: 28,000 Units

Bajaj Auto Regains E-2W Crown, Industry Clocks 143,000 Units in Record-Breaking October