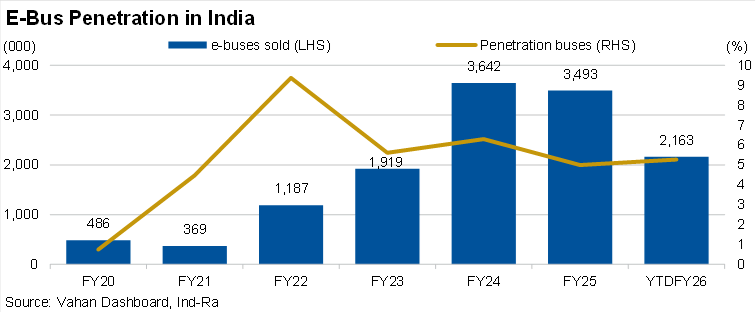

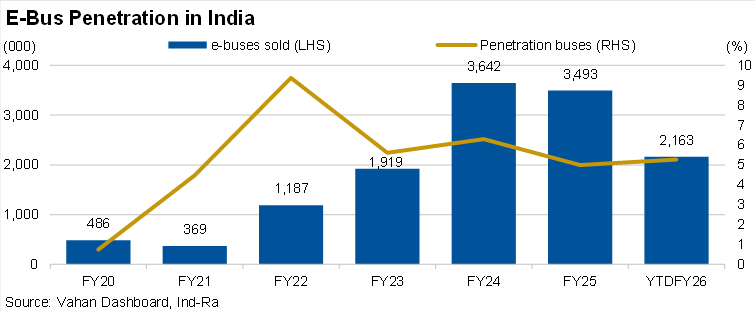

Electric buses are projected to account for 10-12% of overall new bus sales in India by FY27, doubling from current levels of 5% in FY25, driven by government policy support and favorable total ownership costs compared to internal combustion engine vehicles, according to India Ratings and Research.

The projection comes as India pursues its commitment to reduce carbon intensity by 45% by 2030 and achieve net zero emissions by 2070, targets announced by Prime Minister Narendra Modi at COP26 in 2021. Road transportation accounts for 12% of India’s energy-related carbon dioxide emissions and is a key contributor to urban pollution. Trucks and buses, while comprising only 4% of India’s vehicle fleet, account for nearly 50% of total emissions, making them prime candidates for accelerated electrification, according to a Niti Aayog report.

However, gaps in charging infrastructure, supply chain issues and the exclusion of private operators from subsidy schemes continue to pose challenges to the e-bus industry in the near term, India Ratings noted. Despite these constraints, e-bus adoption is expected to grow rapidly in the medium-to-long term, backed by strong order books, supportive policies and the low penetration of buses in India.

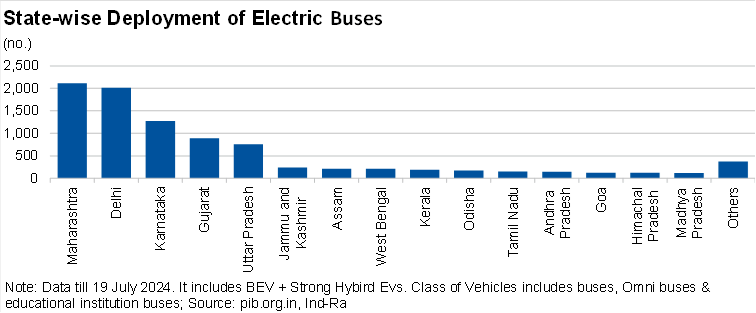

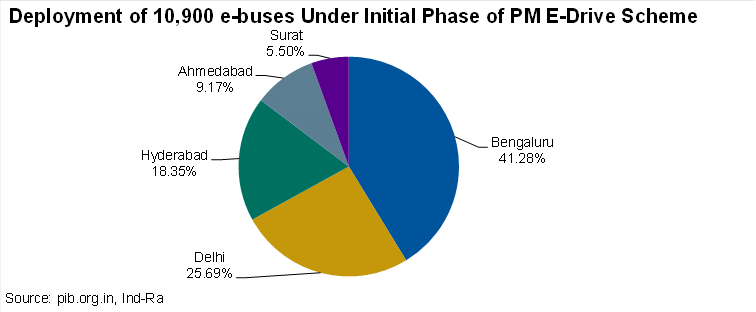

Bus penetration in India remains low compared to other South Asian markets. The e-bus industry is at a nascent stage, with only 5% penetration compared to over 60% in China, offering significant scope for expansion, according to the International Energy Agency Global EV Outlook 2025. E-bus deployment is largely confined to cities including Delhi, Mumbai, Bengaluru, Ahmedabad and Lucknow. Under the initial phase of the PM E-DRIVE scheme, buses have mainly been deployed in these five cities due to high vehicular traffic and severe pollution levels.

The government introduced the PM E-DRIVE scheme in October 2024 with an outlay of ₹10,900 crore for deployment of electric vehicles and establishment of charging infrastructure over two years through March 2026. The scheme replaced the FAME-II programme that expired in March 2024. PM E-DRIVE subsidizes up to ₹10,000 per kWh, capped at ₹3.5 million, on the purchase of electric buses for state transport undertakings. The scheme targets deployment of 14,028 e-buses across nine major cities.

Additionally, the PM e-Bus Sewa scheme targets e-bus adoption under the public-private partnership model and grants assistance for development of behind-the-meter power infrastructure and civil depot infrastructure, including battery charging stations. The payment security mechanism under the scheme ensures timely payments to e-bus operators.

In October 2024, the government notified the PM e-Bus Sewa-Payment Security Mechanism scheme with an allocated budget of ₹3,435.33 crore to support deployment of more than 38,000 electric buses from FY25 to FY29. The scheme provides payment security in case of default by public transport authorities for making timely payment to operators, addressing concerns that have deterred manufacturers from participating in such partnerships.

E-buses entail higher upfront purchase costs compared to diesel and compressed natural gas buses. However, given their lower cost of operation, the total cost of ownership of e-buses is lower than that of diesel and CNG buses. Developing charging infrastructure for e-buses is easier compared to setting up CNG stations, which are largely restricted to major cities in India.

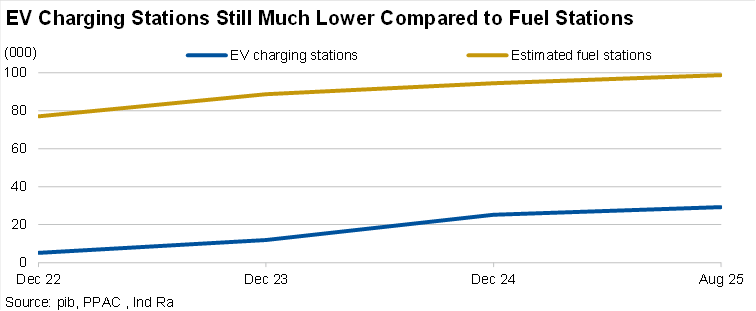

Prevailing challenges include inadequate charging infrastructure, exclusion of private electric bus operators from major schemes and delayed deliveries of e-buses by manufacturers. India has less than one-third of EV charging stations compared to total fuel refilling stations, according to industry estimates. The scheme proposes installation of 22,100 fast chargers for four-wheelers, 1,800 fast chargers for e-buses and 48,400 fast chargers for two and three-wheelers.

Government policies have been focused on state transport undertakings, which operate only 5-7% of the total buses registered in India and have been witnessing significant losses, declining fleet size and low fleet utilization. This poses the risk of delayed payments, restricting the enhancement of electric fleet size. While the risk is mitigated by the gross cost contract model along with the payment security mechanism, the inclusion of private bus operators is imperative for the segment to grow rapidly, India Ratings noted.

E-bus deliveries have been slower than expected, primarily due to supply chain bottlenecks. The top five manufacturers together hold an order book of more than 25,000 e-buses to be delivered over the next one to two years. However, the industry has noted delays in servicing these orders due to supply chain issues, including dependence on imports for critical components and essential minerals. Major manufacturers have reported shortages of key components such as batteries, chassis and powertrains, many of which are imported. The lack of alternate indigenous suppliers of crucial parts further constrains the ability to fulfill large orders quickly.

India is developing local manufacturing capacities for batteries, with significant investments coming in, but the same could take some time, the ratings agency said. The Ministry of Power has approved ₹5,400 crore in Viability Gap Funding for 30 GWh of Battery Energy Storage Systems, in addition to 13.2 GWh already underway, expected to attract ₹33,000 crore in investments by 2028.

India Ratings noted that the adoption of e-buses marks a promising shift towards cleaner and more cost-efficient public transport. While the journey has been shaped by notable benefits such as reduced emissions and lower operating costs supported by government subsidies, it has also faced challenges such as infrastructure gaps, supply chain delays and financing hurdles. Addressing these issues through targeted policy support and industry collaboration will be crucial to sustain momentum in e-bus adoption.