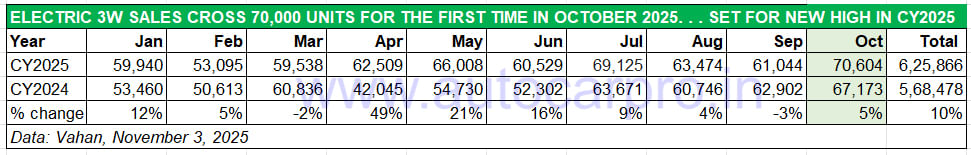

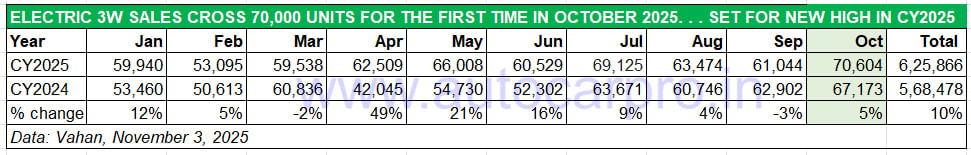

In tandem with the electric 2-wheeler industry, which notched its best-ever monthly sales of 143,713 units in October 2025, the second largest contributor to India EV Inc too had a good outing last month. The electric 3-wheeler industry hit a new monthly retail sales high of 70,604 units, up 5% YoY (October 2024: 67,173 units) and crossed the 70,000-unit mark for the first time, beating the previous best of 69,125 units in July 2025.

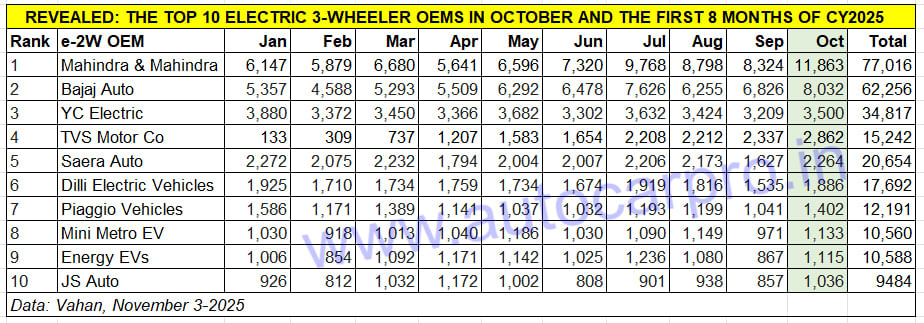

Interestingly, October 2025 saw the top three legacy ICE OEMs – Mahindra & Mahindra, Bajaj Auto and TVS Motor Co – which have expanded into electric mobility achieve their best-ever monthly sales yet. While market leader M&M sold a record 11,863 units, No. 2 e-3W OEM Bajaj sold 8,032 units and fourth-ranked TVS 2,862 units. The combined sales of these three OEMs at 22,557 units gives them a 32% share of the record 70,604 units sold last month in India, leaving the balance 68% to the other 620 players in this segment of the EV industry. What is also clear is that these legacy ICE players are capturing market share from smaller players and startups, drawing buyers with their better-built and safer products, extensive sales and service network and better technology and engineering.

The e-3W industry hit a new retail sales high of 70,604 units in October, beating the previous best of 69,125 units in July 2025. It needs to sell another 65,437 units to go past CY2024 (691,302 units).

TOP 10 OEMS ACCOUNT FOR 50% OF OCTOBER SALES

The electric 3W segment has the largest number of players – over 600 – compared to the two-wheeler, passenger vehicle or commercial vehicle segments. In October 2025, the Top 10 companies sold 35,093 units and accounted for exactly 50% of the 70,604 units sold last month. For the first 10 months of the year, these 10 OEMs with 270,500 units command a 43% share of the 625,866 e-3Ws sold.

Longstanding market leader Mahindra Last Mile Mobility (MLMM), according to Vahan data, recorded retail sales of 11,863 units in October 2025, a robust 59% increase YoY (October 2024: 7,480 units). This marks the company’s highest monthly sales figure, ahead of July 2025’s 9,768 units, and gives MLMM a 17% market share for last month.

As the first legacy OEM to enter electric mobility nearly a decade ago, Mahindra & Mahindra and MLMM now offer the largest e-3W portfolio, including the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus, and e-Alfa Cargo. From January to October 2025, MLMM has clocked sales of 77,016 units, which gives it a 12% market share for the 10-month period.

Bajaj Auto crossed the 8,000-unit sales mark for the first time last month. The 8,032 units, up 61% YoY (October 2024: 5,001 units) are its best monthly total yet and ahead of July 2025 (7,626 units). This performance gives Bajaj an 11% market share for October 2025. The company entered the e-3W market in June 2023 with two models — the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 — which have since been replaced by the GoGo e-3W brand launched in February 2025. With cumulative 10-month sales of 62,256 units and a 10% market share, Bajaj has long surpassed its CY2024 total of 41,904 units and should end the year with around 75,000-80,000 sales.

Longstanding e-3W OEM and third-ranked YC Electric remains a formidable competitor. In October, YC sold 3,500 units for a 5% market share. The company offers five models: Yatri Super, Yatri Deluxe, and Yatri for passenger transport, and E-Loader and Yatri Cart for cargo operations. YC Electric’s cumulative 10-month sales are 34,817 units which gives it a 6% share of total sales.

In fourth place is TVS Motor Co which, like Mahindra and Bajaj Auto, is also on a roll. Sales have risen month on month for the company, which has recently entered the e-3W market. TVS recorded retail sales of 2,862 units — its highest monthly e-3W sales to date — capturing a 4% share of the 70,604 e-3Ws sold in India last month. TVS’ cumulative sales of 15,242 e-3Ws over the past 10 months of CY2025 give it a 2.43% market share of the total 625,866 units sold.

TVS, which is the current market leader in electric two-wheeler, also has strong ambition for the electric 3W business. Speaking in an industry conference call after the company’s Q2 FY2026 results were announced last month, K N Radhakrishnan, CEO of TVS Motor Co, said: “We have almost doubled our market share. I know we are very small in India, but our focus is going to be in totality coming up with the products. We want to be a very prominent player like the iQube (e-scooter), and our product is very well accepted in the market. And we are focusing on network, including branches, and we are now increasing the network. We have added almost 100 touch-points in 3-wheelers and we very carefully look at the customer service and also the viability of the network.”

Saera Electric Auto, manufacturer of the Mayuri brand of electric rickshaws, ranks fifth in the Top 10 list with October sales of 2,862 units but is No. 4 in cumulative 10-month sales (20,654 units) and ahead of TVS (15,242 units). The company has averaged monthly sales of 2,065 units this year with September (1,627 units) being the lowest. However, it has bounced back in October. Like several other e-rickshaw makers, Saera Auto has been impacted by the growing presence of legacy OEMs in the e-3W industry. Based in Bhiwadi, Rajasthan — an industrial hub — Saera Auto offers nine models and is a leading supplier of e-rickshaw loader variants such as the Mayuri E-Cart Loader. The company also sells its L5 range of electric three-wheelers, developed in collaboration with Telangana-based Keto Motors for passenger and cargo transportation.

Sixth-ranked Dilli Electric Auto delivered 1,886 e-3Ws in October. The Haryana-based company manufactures electric rickshaws under the CityLife brand — a segment now under pressure as legacy players like MLMM, Bajaj Auto, TI Mobility, and now TVS target it with better-built, safer products.

Piaggio Vehicles is ranked seventh in the e-3W segment with 1,402 units, its second-best monthly sales this year after January 2025 (1,586 units). The company, which had launched two new models under its Apé Electrik range – the Apé E-City Ultra and Apé E-City FX Maxx – in July, has sold 12,191 units between January and October this year for a 2% market share.

Mahindra, Bajaj Auto and TVS each clocked their best-ever monthly sales in October. Their combined sales at 22,557 units gives them a 32% share of the record 70,604 units sold last month.

WILL ELECTRIC 3W INDUSTRY HIT THE 750,000 SALES MILESTONE THIS YEAR?

The electric 3W industry, which is the second-largest contributor to EV sales in the country after the two-wheeler segment but the one witnessing the fastest transition from ICE to e-mobility, is well set to register its best-ever annual sales this year.

With two months left to go in CY2025, the e-3W industry is well set to achieve its best-ever calendar-year sales this year. As per retail sales statistics on the Vahan portal, a total of 625,866 units were delivered between January and October, up 10% YoY (January-October 2024: 568,478 units). This translates into 00% of its record full-year CY2024 volume of 691,302 units. E3W makers need to sell 65,437 units more to cross the CY2024 total and if the current growth trajectory is sustained, this segment of the EV industry is likely to surpass the 700,000-unit milestone this month (November 2025). With December to follow, India e-3W Inc could be looking at a new annual retail sales record of 750,000 units and 00% YoY growth.

At 494,300 units sold in the first eight months of CY2025, up 13% YoY (January-August 2024: 438,400 units), it has already achieved 72% of its record 691,302 units sold in CY2024. If it maintains the same growth trajectory in the remaining four months of this year, this segment could go on to hit the 750,000 milestone for the first time in a calendar year and ensure it remains the world’s largest market for electric 3Ws for the third year in a row, ahead of China.

Stay plugged into Autocar Professional as we bring you the latest updates and exclusives in the world of electric mobility.

ALSO READ: India beats China again to be world’s largest electric 3W market