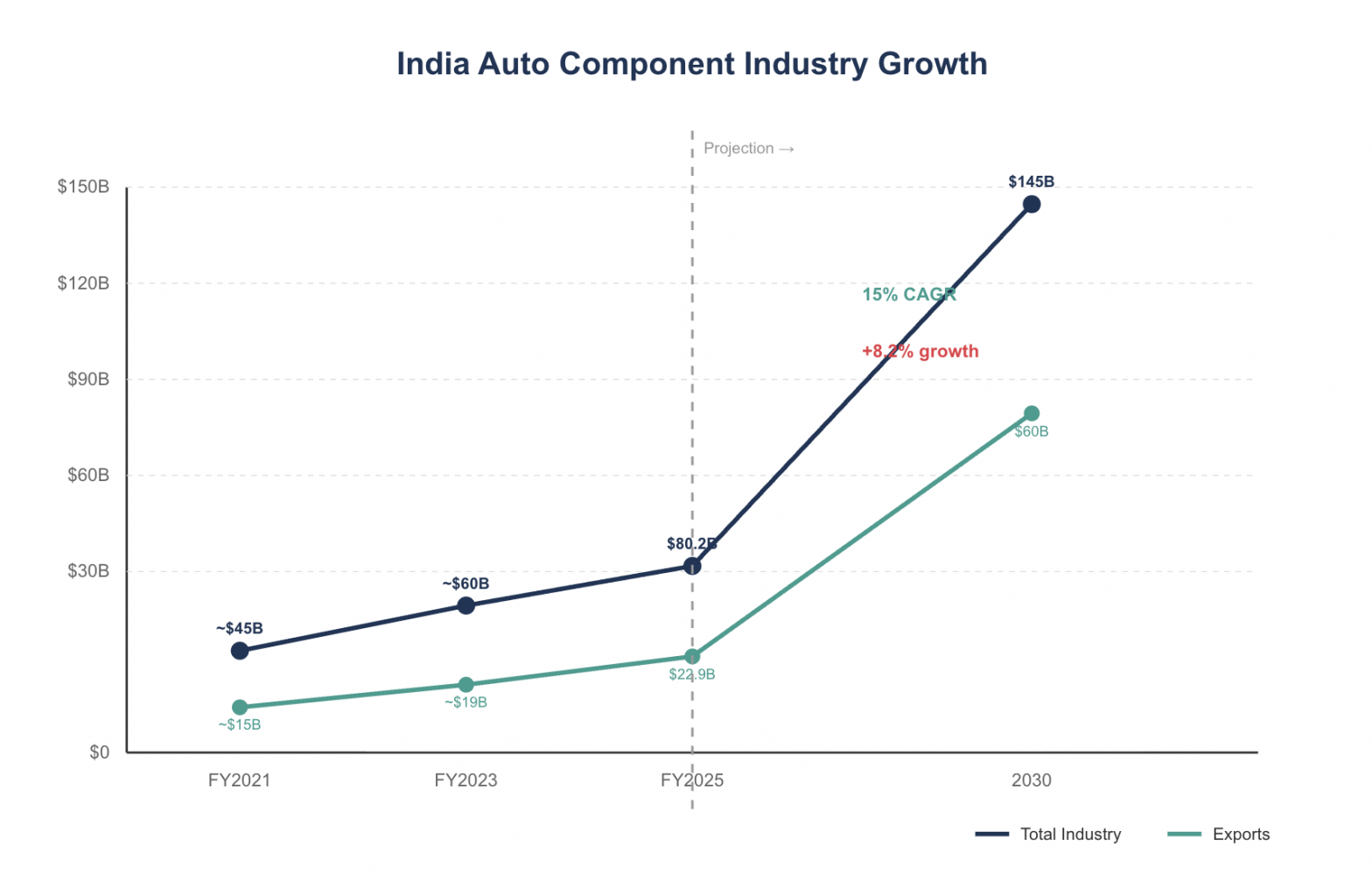

India’s automotive component industry recorded a turnover of $80.2 billion in FY2025, marking an 8.2% year-on-year growth, according to Rubix Data Sciences’ latest Industry Insights report released in November 2025. The analysis, citing data from the Automotive Component Manufacturers Association (ACMA), indicates the growth was driven by robust domestic vehicle production, which reached nearly 31 million units during the fiscal year.

The industry has achieved a significant milestone in trade dynamics, posting a trade surplus of $0.5 billion in FY2025. Exports stood at $22.9 billion while imports totaled $22.4 billion, reversing the trade deficit of $0.5 billion recorded in FY2021. From FY2021 to FY2025, exports and imports grew at compound annual growth rates of 15% and 13% respectively.

Despite this progress, India’s share in the global automotive components trade remains at just 3%. The country faces particular challenges in high-precision segments such as engines, drive transmission, and steering systems, where it holds only 2-4% of global trade despite these categories representing 60% of worldwide commerce.

NITI Aayog projects the Indian auto-component industry will reach $145 billion in production by 2030, with exports potentially tripling to $60 billion and creating a trade surplus of $25 billion. This expansion would increase India’s global market share from 3% to 8%.

The industry faces emerging challenges, particularly concerning rare earth magnets critical for electric vehicle motors. India imported $221 million worth of rare earth magnets in FY2025, with over 80% sourced from China. Recent Chinese export controls have raised concerns about supply chain disruptions, as these magnets account for nearly 30% of an EV motor’s cost.

In response, the Indian government plans to nearly triple its incentive program for rare earth magnet manufacturing to over $788 million, pending cabinet approval. The country is also diversifying sourcing from Australia, Vietnam, and South Africa while promoting recycling initiatives.

US tariff policies present another concern for the sector. With the United States accounting for 27% of India’s auto component exports, analysts warn that 15-20% of exports to the US market could be affected in the short term. Auto component exports to the US declined by nearly 12% between May and September 2025.

Major industry players are making substantial investments to strengthen capabilities. Exide Industries committed over $119 million across lithium-ion and lead acid battery businesses, while Samvardhana Motherson International Limited announced plans for $714 million in capital expenditure through 14 greenfield facilities, with 70% allocated to non-automotive diversification.

The industry is also adapting to India’s Draft Digital Personal Data Protection Rules 2025, which will significantly impact manufacturers involved in Software-Defined Vehicles. The Indian SDV market is projected to expand from $18.2 billion in 2025 to $69.5 billion by 2031, requiring enhanced data governance and security measures.Industry experts indicate that India’s auto component ecosystem is transitioning from a cost-competitive supplier base to a high-value, innovation-driven manufacturing hub aligned with global sustainability goals and technological advancements.