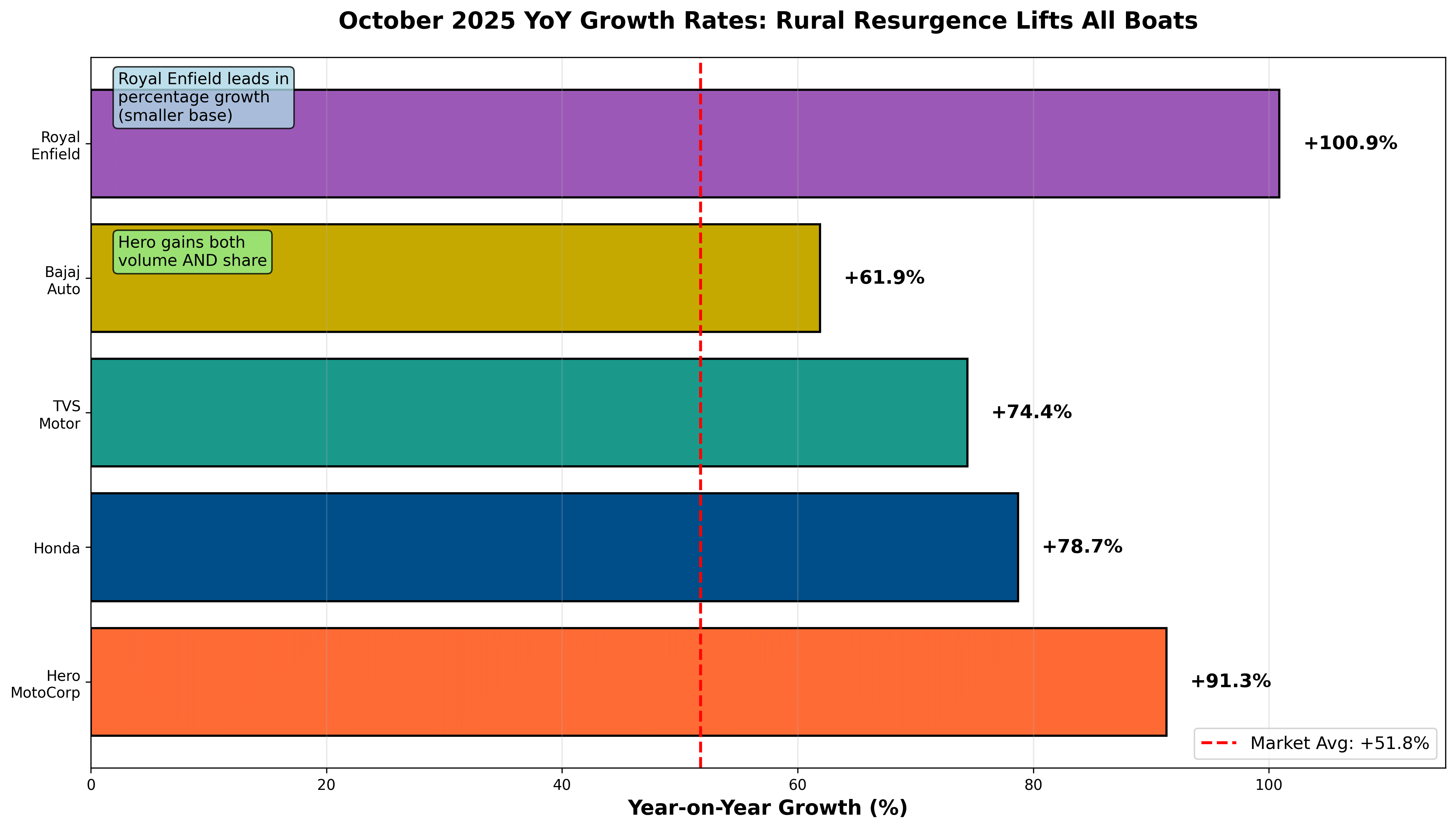

October 2025 will be remembered as a watershed moment for India’s two-wheeler industry. The sector delivered its strongest-ever monthly performance, with retail sales surging 51.76% year-on-year to reach 31.5 lakh units—an all-time high that underscores the transformative power of policy reform, festive sentiment, and rural economic revival.

The Perfect Storm: GST 2.0, Festivities, and Rural Resurgence

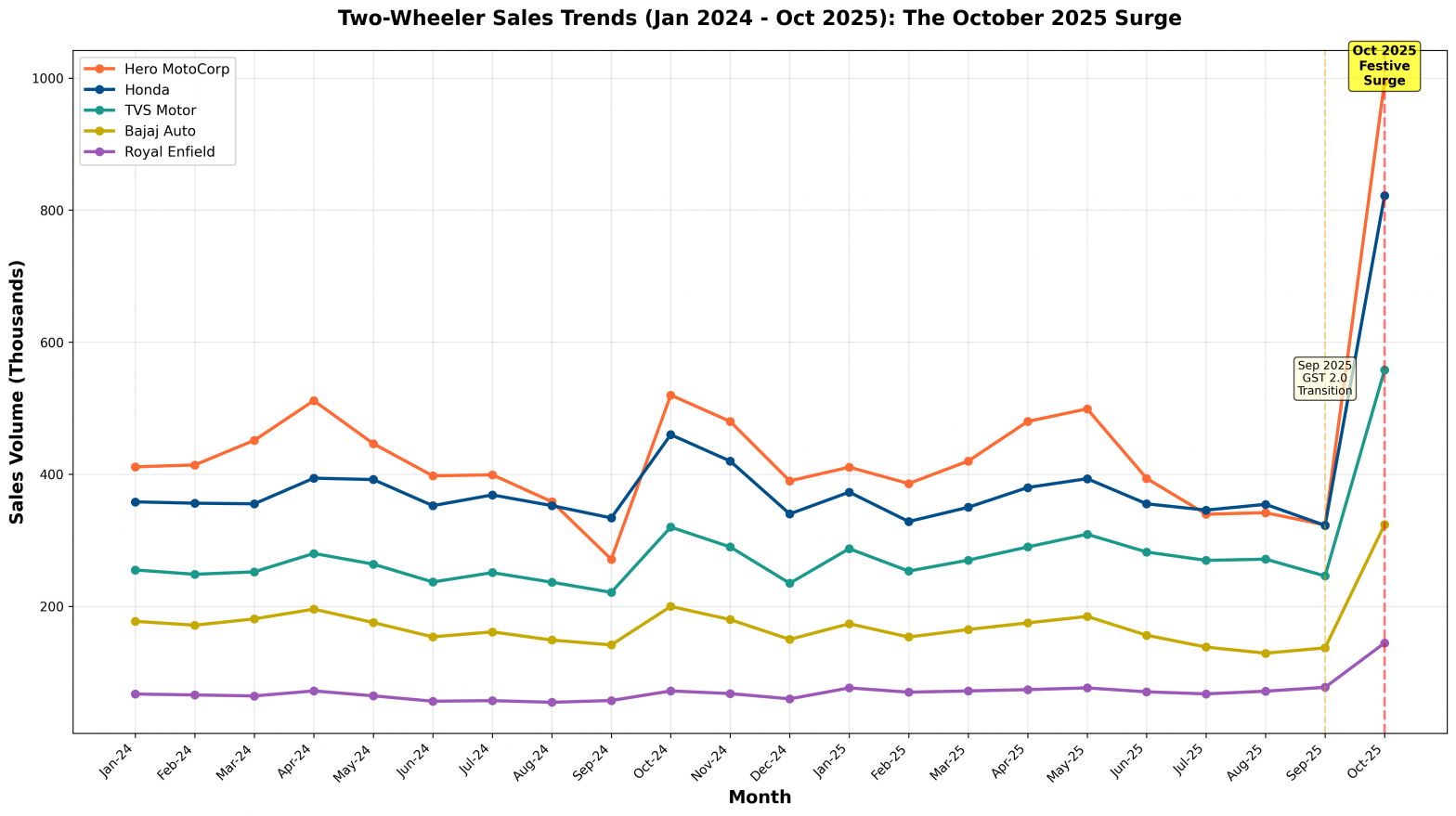

After a subdued first three weeks of September, when the industry held its breath during the GST 2.0 transition, October witnessed what the Federation of Automobile Dealers Associations (FADA) described as a “hurdle-race-style rebound.” The convergence of three powerful forces—the government’s GST rate cuts for entry-level two-wheelers, the twin festivals of Dussehra and Diwali falling in the same month, and unprecedented rural demand—created conditions for explosive growth.

The GST 2.0 reforms proved transformational, particularly for the mass-market segment. By lowering tax rates on entry-level motorcycles and scooters, the government effectively expanded the addressable market, making two-wheeler ownership accessible to millions of first-time buyers in cost-sensitive rural markets. This affordability boost, arriving precisely during the festive buying season, converted aspiration into action across India’s heartland.

Perhaps the most significant development was the emergence of rural India as the industry’s primary growth engine. Favorable monsoons, higher farm incomes, and sustained government infrastructure spending pumped purchasing power into rural households. According to FADA data, rural two-wheeler growth nearly doubled urban rates, with rural markets accounting for 61% of total two-wheeler registrations in October—up from 58% in the previous year.

Hero MotoCorp: The Rural Champion Reclaims Dominance

Hero MotoCorp’s October performance vindicated its strategic focus on rural markets and entry-level motorcycles. The company sold an astounding 9.95 lakh units—nearly doubling its October 2024 volume of 5.2 lakh units, representing a spectacular 91% year-on-year surge. Including Telangana, the number is higher than 1 million.

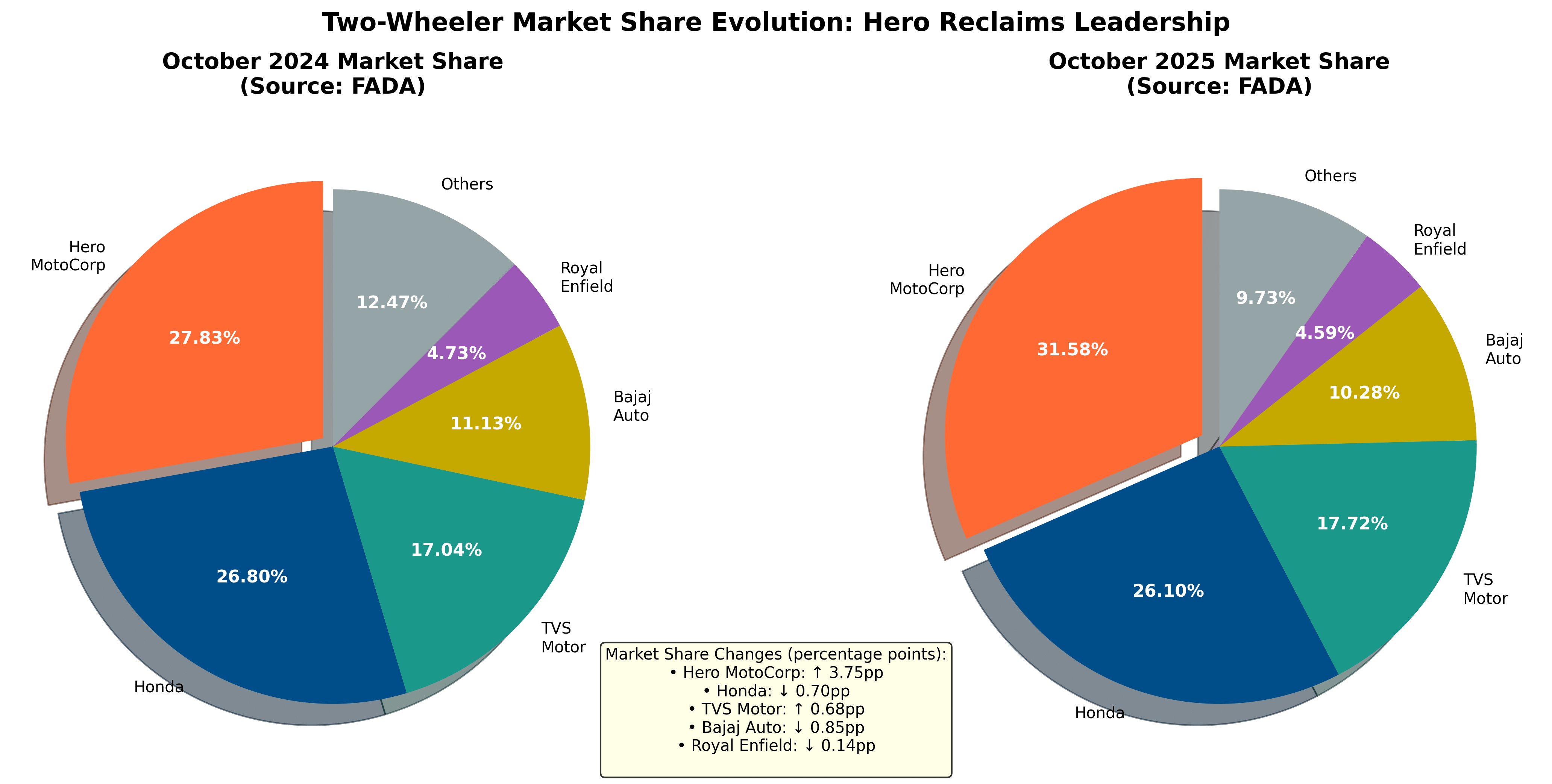

More importantly, Hero’s market share expanded to 31.58%, up from 27.83% the previous year, marking a decisive reclamation of leadership in a competitive marketplace, thanks to the rural resurgence.

Hero’s success can be attributed to several factors. First, its extensive distribution network in rural India—with penetration into remote tier-3 and tier-4 towns—positioned it perfectly to capture the rural boom. Second, its product portfolio, heavily weighted toward affordable commuter motorcycles like the Splendor and HF Deluxe, aligned perfectly with the demand pattern triggered by GST rate cuts. These entry-level models saw significant price reductions, making them even more attractive to rural first-time buyers and replacement purchasers.

The company’s September struggles—when it sold just 3.23 lakh units—made October’s rebound even more dramatic, suggesting that Hero successfully captured pent-up demand that had accumulated during the GST transition period. Dealers reported record footfalls and improved conversion rates, indicating strong brand pull in target segments.

Honda: Strong Growth, Slight Market Share Erosion

Honda Motorcycle and Scooter India posted impressive absolute numbers, selling 8.22 lakh units in October 2025 compared to 4.6 lakh units in October 2024—a robust 79% year-on-year increase. However, the Japanese manufacturer’s market share slipped marginally to 26.10% from 26.80%, suggesting it didn’t fully capitalize on the rural resurgence despite strong overall growth.

Honda’s portfolio, which includes popular models like the Activa scooter and Shine motorcycle, appeals strongly to urban and semi-urban buyers. While these segments grew, the disproportionate acceleration in rural markets—where Hero and TVS have stronger presence—meant Honda grew below the market rate. The company’s premium positioning, while advantageous in normal times, may have been a relative disadvantage during a month when affordability-driven entry-level demand dominated.

That said, Honda’s performance remains commendable in absolute terms. The company’s scooter segment, which includes the best-selling Activa, likely benefited from strong festive demand from women buyers and urban families. Honda’s challenge moving forward will be to enhance its rural reach and strengthen its entry-level portfolio to participate more fully in the rural growth story.

TVS Motor: Balanced Portfolio Delivers Gains

TVS Motor Company emerged as another significant winner, selling 5.58 lakh units in October 2025 versus 3.2 lakh units in October 2024—a 74% year-on-year increase. More notably, TVS expanded its market share to 17.72% from 17.04%, demonstrating the effectiveness of its diversified product strategy.

TVS’s strength lies in its balanced portfolio spanning entry-level commuters (Sport, Radeon), premium motorcycles (Apache series), scooters (Jupiter, Ntorq), and electric vehicles (iQube). This diversification allowed the company to participate across multiple demand segments. The company’s strong presence in both rural markets (through distributors and affordable models) and urban markets (through premium offerings) enabled it to capture growth across geographies.

The GST rate cuts particularly benefited TVS’s entry-level and commuter segment, while its electric scooter iQube gained traction in urban markets where environmental consciousness and government incentives drive adoption. TVS’s gain in market share, while modest, is significant given the competitive intensity and suggests effective execution across channels.

Bajaj Auto: Premium Play Limits Market Share

Bajaj Auto’s October performance tells a different story. While the company posted healthy absolute growth—selling 3.24 lakh units compared to 2 lakh units in October 2024 (62% increase)—it lost market share, dropping from 11.13% to 10.28%. This underperformance relative to the market reflects Bajaj’s strategic positioning in the premium motorcycle and export-oriented segments.

Bajaj’s domestic portfolio is heavily skewed toward premium motorcycles (Pulsar, Dominar) and three-wheelers rather than entry-level commuter motorcycles. During a month when affordability-driven demand dominated—catalyzed by GST rate cuts on entry-level models—Bajaj’s premium positioning became a relative disadvantage. The company’s traditional strength in urban and semi-urban markets also meant it missed out on the disproportionate rural surge.

However, Bajaj’s Pulsar range continues to hold strong brand equity, and the company remains a formidable player in the 125cc-plus segment. The market share loss should be viewed in context: in a month of exceptional rural and entry-level growth, Bajaj’s premium-focused strategy naturally yielded different results.

Royal Enfield: Doubling Down on Niche Appeal

Royal Enfield, the premium motorcycle specialist, delivered spectacular percentage growth—selling 1.45 lakh units compared to 72,000 units in October 2024, representing a stunning 101% year-on-year increase. This doubling of volumes suggests strong demand for the company’s lifestyle-oriented motorcycles during the festive season.

However, Royal Enfield’s market share dipped slightly from 4.73% to 4.59%, indicating that while the company grew robustly, it expanded below the market rate. This is unsurprising given that Royal Enfield operates in the premium segment (350cc-plus motorcycles) with price points ranging from ₹1.5 lakh to ₹4 lakh—well above the entry-level commuter segment that drove October’s growth.

Royal Enfield’s strength lies in its brand cult and aspiration value. The festive season saw strong demand from urban professionals, enthusiasts, and upgraders making lifestyle purchases. The company’s recent product launches, including the Himalayan 450 and updated Classic 350, likely contributed to the strong uptake.

The Road Ahead: Sustaining Momentum

Looking forward, the industry faces the challenge of sustaining October’s extraordinary momentum. FADA’s dealer sentiment survey reveals measured optimism: 64% of dealers expect growth in November, though with natural moderation after an all-time-high October. For the next three months, 70% anticipate expansion, supported by marriage season demand, post-harvest cash flows, and new model launches.

The GST 2.0 reforms continue to anchor affordability under the government’s “Simpler Tax, Stronger Growth” vision. Strong rural liquidity, improved financing conditions, and stable fuel prices create a supportive ecosystem for sustained growth through year-end and into 2026.

For two-wheeler manufacturers, October 2025’s results carry clear strategic lessons. Rural market penetration, entry-level portfolio strength, and affordability remain critical success factors. Hero’s dominant performance and TVS’s market share gains underscore the importance of these elements. Conversely, Honda’s slight erosion and Bajaj’s larger loss highlight the challenges of premium positioning during affordability-driven growth phases.

As India’s two-wheeler industry enters 2026, it does so with renewed confidence, backed by progressive policy reforms, grassroots economic revival, and an expanding addressable market. October 2025 will stand as the month when rural India reasserted itself as the beating heart of Indian automotive retail—a truly Viksit Bharat moment for the nation’s mobility sector.