Passenger car sales exceed pre-pandemic records for the second consecutive month, accumulating an increase of 15% until October

With 21,687 sales of plug-in hybrid and electric passenger cars, the electrified market accounts for 22% of the total in October

Registrations of light commercial vehicles increase by 8.5%, with 16,668 sales

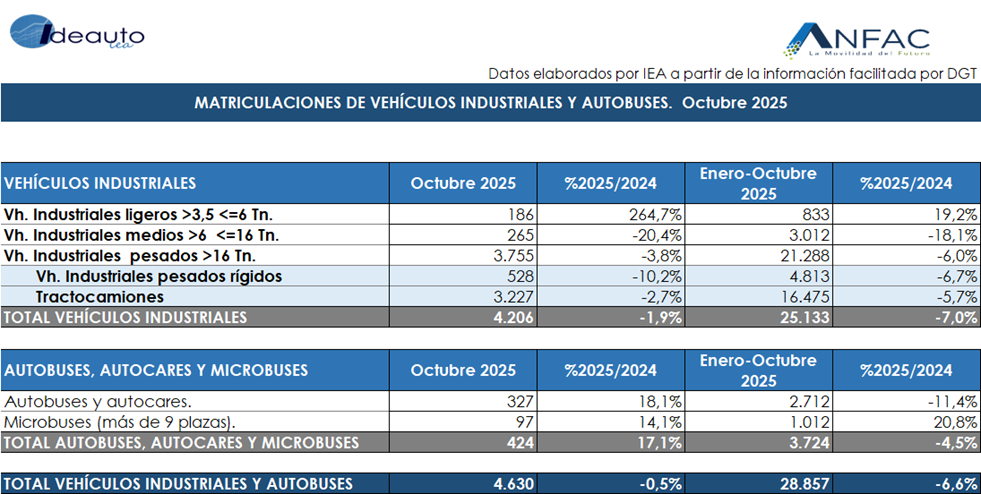

Sales of commercial vehicles, buses, coaches and minibuses registered a slight decrease, with a decline of 0.5% and 4,630 units

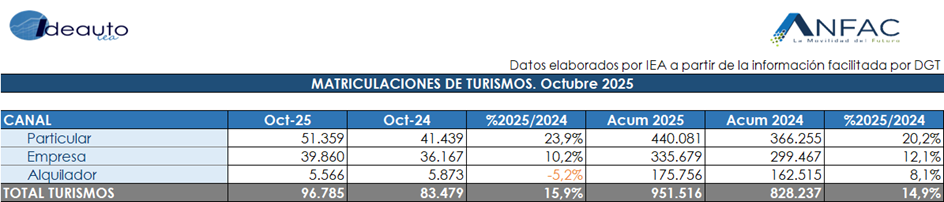

Madrid, November 3, 2025. The passenger car market maintains its good evolution and achieved a 16% increase in sales in October, with 96,785 new registrations. With one in four sales of electrified passenger cars, electrification continues to drive an important part of the market, allowing us to once again record a month with figures higher than the same period in 2019, prior to the pandemic.

In the total for the year, the market accumulates 951,516 units sold, which represents 14.9% more than in the same period of the previous year, but still 10% below the same records in 2019. In any case, the good rhythm accumulated until October allows us to place the year-end forecast above 1.1 million passenger car sales by 2025.

Regarding sales of electrified passenger cars (BEV+PHEV), 21,687 units were registered, with a growth of 119% in October, representing 22.4% of the market in the month. In total for the year, 180,429 units were sold, doubling the sales from a year ago. In 2025 they will already represent 19% of the market, 8 percentage points more than in 2024.

The average CO2 emissions of passenger cars sold in October drop to 100.2 grams of CO2 per kilometer traveled, 13.6% lower than the average emissions of new passenger cars sold in the same month of 2024. In the accumulated period of 2025, the average emissions are 104.6 grams of CO2 per kilometer traveled, 10.7% less than in the same period of 2024.

Regarding the markets in the different channels, sales aimed at individuals and companies once again registered an increase, with the rental channel once again recording a decrease. Specifically, individuals totaled 51,359 units (+23.9%) and companies achieved 39,860 sales (+10.2%) in October. For its part, the market aimed at rent-a-car fell 5.2% in the month, with 5,566 passenger cars.

LIGHT COMMERCIAL VEHICLES

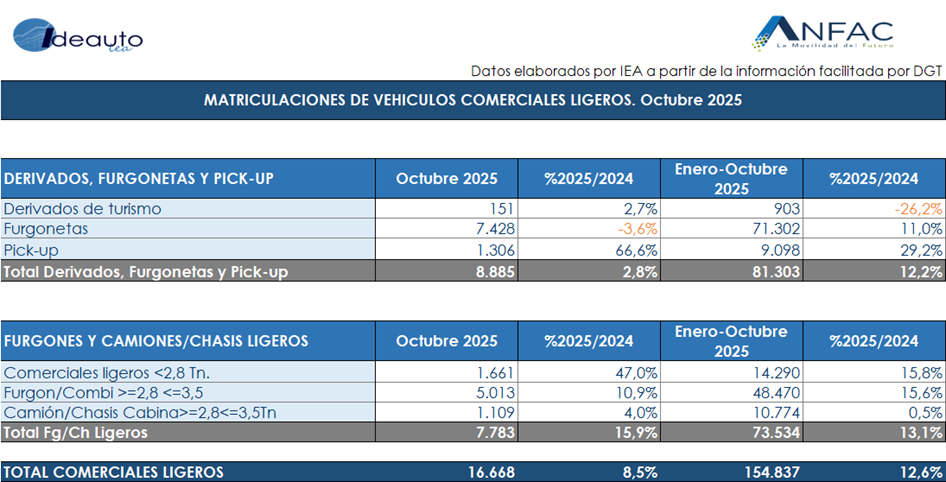

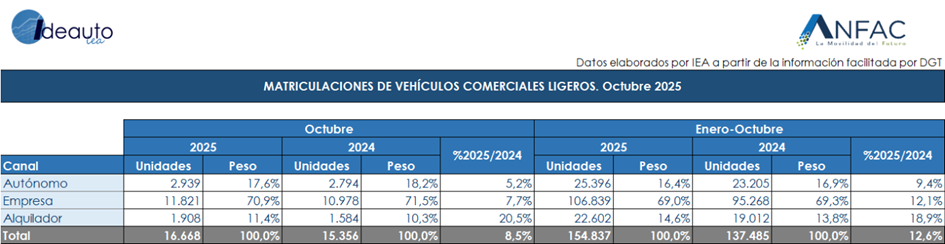

Registrations of light commercial vehicles increased by 8.5% in October, with 16,668 units. In the accumulated year, a total of 154,837 sales were recorded, an increase of 12.6%. Regarding sales by channels, the rental market achieved the greatest growth, with 1,908 vehicles, 20.5% more. For its part, sales to self-employed workers and companies grew by 5.2% and 7.7%, respectively.

INDUSTRIAL AND BUSES

In October, after two months of growth, registrations of commercial vehicles, buses, coaches and minibuses decreased again, with a decline of 0.5% and 4,630 units. Until the tenth month, 28,857 sales have accumulated, which represents a decrease of 6.6% compared to the previous year. By type of vehicle in the month, industrial companies reduced their sales by 1.9%, with 4,206 new registrations and the bus and coach market achieved 424 sales, 17.1% more than October 2024.

Félix García, director of communication and marketing of ANFAC, explained that “October maintains the positive trend of the market and is the second month in which sales grow more than the same month in 2019, prior to the pandemic. The behavior of recent months makes us predict an end of the year in which we would be around 1.12 or 1.13 million passenger cars for all of 2025. In terms of technologies, the market continues to increasingly leave aside diesel, whose sales are residual. Citizens and companies are betting every “This is not the case with light commercial vehicles, where electrification is at a minimum and where diesel accounts for more than 90% of sales. At this rate, light commercial vehicles will not be able to achieve the decarbonization objectives set for 2030. And much less will industrial vehicles, since neither electric trucks nor buses have received aid since last April 2024.”

Raúl Morales, communication director of FACONAUTO, pointed out that “the automotive market in our country has once again shown signs of robustness in the month of October, and this strength has been due, above all, to the good performance of registrations of electrified vehicles.

In this regard, we are concerned about the little visibility we have regarding the continuity of aid in those regions or autonomous communities where the budget has been exhausted.

What is clear, in any case, is that the sector is being able to mobilize demand, especially that of those citizens who have become interested in electrified vehicles.

If this trend and the contribution to the market of the autonomous communities where there are plans to renew the fleet are maintained, we consider that we can reach, in the current year, 1.2 million registered vehicles.”

Tania Puche, communications director of GANVAM, pointed out that “the market continues its upward trend in October and has accumulated 14 consecutive positive months. Individual purchases continue to show significant increases compared to 2024 and, for the second consecutive month, we exceed pre-pandemic levels, with good performance in registrations of electrified vehicles. Now, it is necessary to apply immediate measures and additional provisions to respond until the end of the year to buyers, especially in those communities where Waiting lists have been set up due to the end of funds from the Moves plan. Any uncertainty surrounding the purchase decision must be dispelled because we cannot allow the market to lose momentum, just at the moment when it was beginning to recover.