Demand for electric vehicles remains on the upswing in Europe with EVs accounting for more than a quarter of all new car registrations even as governments continue to invest heavily in charging networks and zero-emission mandates. EV sales have accelerated across both large and emerging markets in the first nine months of CY2025.

While battery electric vehicle (BEV) registrations in Europe rose 25.4% year-on-year to nearly 1.8 million units (1,796,688), plug-in hybrids (PHEVs) grew even faster, surging 32% to 918,527 units. As such, fully electric vehicles accounted for 27.3% of the total European new car market of 9.92 million units in the first 9 months of CY2025. However, hybrid electric vehicles (HEVs) lead the pack, with 3.45 million (3,454,676) sales, almost exceeding the combined total of petrol (2.7 million) and diesel (0.8 million) vehicles. HEVs now hold the largest share of the European market at 34.8% of all new car registrations, compared with a combined 35.2% for petrol and diesel vehicles. Diesel continues its long-term retreat, representing just 8% of sales, while alternative fuels remain niche at 2.6% percent.

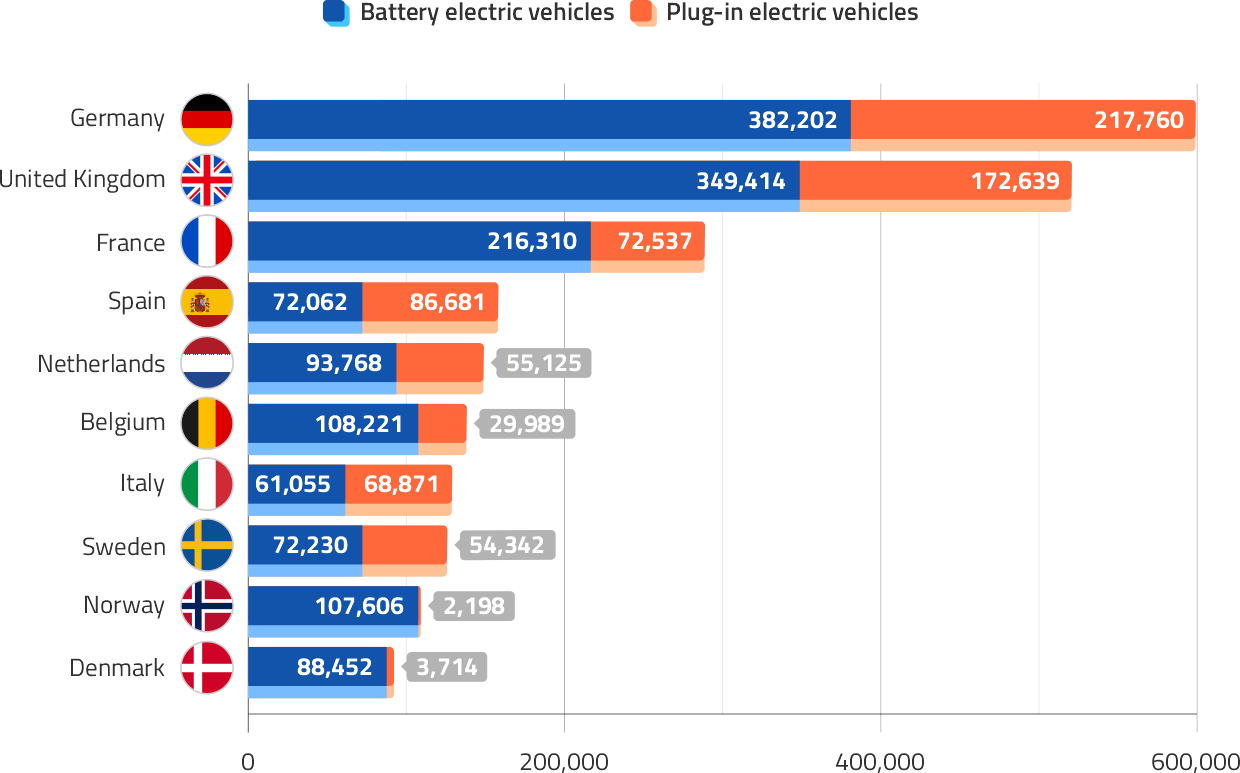

Germany and the United Kingdom are leading Europe in total EV sales, with 599,962 and 522,053 units sold, respectively, across battery electric (BEV) and plug-in hybrid (PHEV) models. This information and retail sales data of the European new car market is derived from a recent report by TradingPedia, a financial media platform, which analysed EV sales using new car registration data from the European Automobile Manufacturers’ Association (ACEA).

As the report states, these figures highlight a profound transformation in European motoring. Consumers are increasingly gravitating toward electrified options, with hybrids offering a pragmatic bridge between traditional engines and full electrification. Meanwhile, battery-electric and plug-in electric vehicles are rapidly encroaching on petrol’s territory, signalling that the continent is accelerating toward a future dominated by clean, sustainable mobility.

According to Tradingpedia’s Michael Fisher, “Europe’s EV market is showing striking contrasts: while mature markets like Germany and the UK continue to post high volumes, rapid adoption in Central and Eastern Europe, from Latvia to Poland, is reshaping the continent’s electrification landscape. The surge in PHEVs and HEVs highlights that many consumers are still relying on transitional technologies, reflecting persistent gaps in charging infrastructure that could constrain BEV growth.

Looking forward, sustaining momentum will depend less on incentives alone and more on expanding fast-charging networks, improving battery range, and scaling infrastructure in emerging markets, where policy-driven acceleration has proven that even modest starting points can deliver outsized growth.”

Interestingly, Norway, which boasts the highest EV market share in Europe at over 96%, ranks only eighth in absolute sales, just behind Sweden, showing that dominance in market share does not necessarily equate to the highest absolute volumes.

Germany, with 382,202 BEVs (up 38%) and 217,760 PHEVs (up 64%) in the first nine months of 2025, is witnessing growing demand for hybrid options alongside full electrics. Graphic: Tradingpedia

GERMANY LEADS THE CHARGE IN EUROPE

Germany is leading the charge for EV sales in Europe and saw deliveries of 382,202 BEVs (up 38%) and 217,760 PHEVs (up 64%) in the first nine months of 2025, highlighting the growing popularity of hybrid options alongside full electrics. However, as the report states, “the overall EV share stagnated at 28.4% of all new car registrations. The end of certain subsidies and price cuts from Chinese automakers reshaped demand: PHEVs rose sharply (up 63.9%), suggesting consumers are hedging between affordability and range anxiety.”

The UK followed closely, registering 349,414 BEVs and 172,639 PHEVs, with growth of 29.5% for BEVs and 38.2% for PHEVs, demonstrating strong market demand even as incentives evolve.

Southern Europe is starting to catch up in the EV transition. Spain nearly doubled BEV sales to 72,062 and more than doubled PHEVs to 86,681 units, while Italy also posted strong growth (up 26.6% year-over-year to 61,055 BEVs (up 72.6% to 68,871 PHEVs), driven by rising consumer interest and improving infrastructure. In contrast, France saw an 8.6% drop in total EV registrations, driven by a collapse in plug-in hybrid sales to 72,537 units (down 26.8%), as its new ‘green bonus’ rules excluded many imported EVs. Meanwhile, Belgium also experienced a decline (down 9.8%) despite still-high EV penetration (nearly 43%) – PHEVs fell 47.3% to 29,989 units, highlighting a fragmented market where hybrid adoption is highly sensitive to incentives and policy changes.

Poland though stands out as a potential turning point in Central Europe. BEV registrations more than doubled (up 106.7%), with plug-in hybrids following closely (up 97%), pushing the country’s EV share to 11%, nearly twice last year’s level. Similarly, the Czech Republic saw its EV market grow 55% overall, with plug-in hybrids in the lead (+78.6%).

IMPRESSIVE GROWTH IN SMALLER, EMERGING MARKETS

Meanwhile, smaller and emerging markets are outpacing their larger counterparts in EV sales, registering the most pronounced relative gains. Latvia (up 141.5%), Lithuania (up 114.1%), and Poland (up 102.1%) more than doubled their EV fleets compared with 2024, illustrating how electrification is surging from a low baseline in Central and Eastern Europe. Across southern Europe and the Nordic fringes, Spain (up 97.8%) and Iceland (up 91.8%) witnessed near-doubling of EV sales, signalling a swift embrace of electric mobility beyond the traditional early-adopter strongholds.

Among the Nordic countries, Norway continued to post strong absolute growth (up 31.5%), although certain segments lagged: plug-in hybrid (down 14.3%) and hybrid (down 66%) registrations fell, even as battery-electric vehicles surged. Sweden (up 15%) and Finland (up 13.9%) showed steady, incremental gains, though hybrids in Finland declined sharply (down 17.5%), reflecting a shift in consumer preference toward full electrics.

Meanwhile, the Netherlands, once a rapidly expanding EV market, is beginning to plateau. Total EV registrations rose 15%, but growth was uneven: battery-electric vehicles increased only slightly (up 3.9%), hybrids fell (down 6%), while plug-in hybrids gained more strongly (up 40.5%), highlighting a maturing market with evolving segment dynamics.

Overall, as the report states, Europe’s largest markets are transitioning from explosive early growth toward a more mature phase, where absolute volumes remain high, but year-on-year percentage increases are more moderate compared with the smaller, emerging markets leading the electrification surge.

LEGACY OEMs TAKE CHARGE WITH VOLKSWAGEN AT THE FOREFRONT

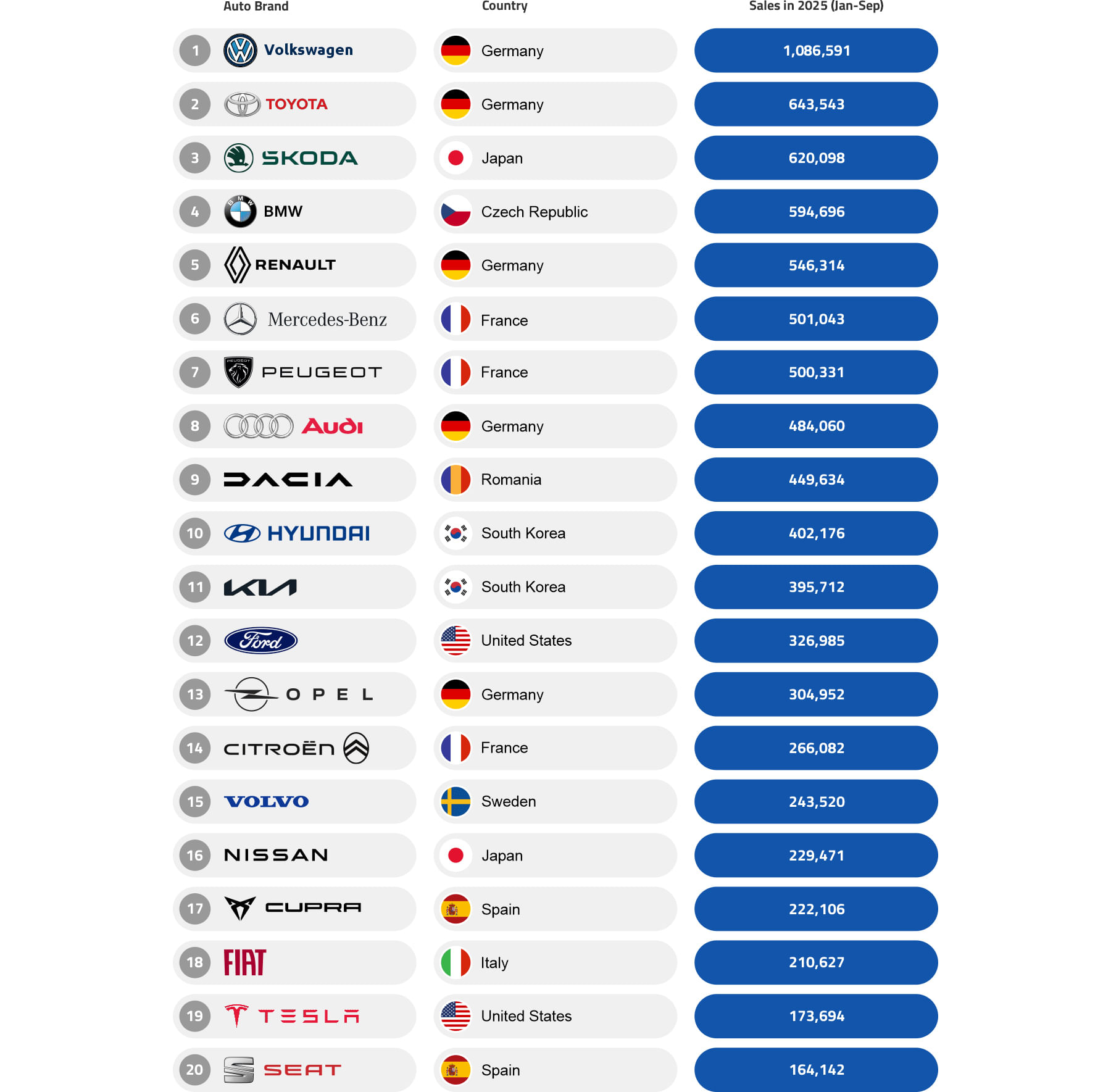

In 2025, Germany is asserting its dominance over Europe’s EV market: Volkswagen is at the forefront with more than 1.08 million units sold between January and September. BMW, Mercedes-Benz, and Audi reinforce the country’s supremacy, all comfortably occupying the Top 10 positions. Skoda’s 620,000 units further highlight the breadth and cohesion of the Volkswagen Group’s portfolio, while French stalwarts Renault, Peugeot, and Citroën collectively contribute over 1.3 million EVs, demonstrating that Western Europe’s legacy automakers remain formidable players in the transition to electrification.

Meanwhile, Asian manufacturers continue to hold significant ground, with Toyota, Hyundai, Kia, and Nissan securing influential positions in the rankings. Yet, perhaps, the most striking narrative is Tesla’s relative underperformance: the brand long synonymous with the EV revolution lands only in 19th place, with 173,694 units. The contrast underscores a fundamental shift in the European market: scale, production networks, and established consumer trust are proving decisive, positioning legacy automakers, rather than EV newcomers, as the true architects of the continent’s electric future.

Lead image: ACEA/X

ALSO READ: Electric car and SUV sales in India cross 144,000 units in first 10 months of CY2025

Indian EV makers sell record 234,000 units in October, charge towards 2 million in CY2025