Volvo Eicher Commercial Vehicles (VECV), the joint venture between Eicher Motors Ltd and Volvo Group, expects commercial vehicle demand to remain steady in the second half of FY26, supported by GST rate rationalisation, infrastructure investments, and replacement-led demand.

“Volumes in the first half were slightly below expectations due to the extended monsoon period,” said Vinod Aggarwal, Managing Director and CEO, VECV. “On the positive side, infrastructure investments continue at a strong pace. We’ll also see the lag effect of the recent GST rate rationalization, which has clearly boosted consumption levels… Interest rates remain stable, inflation is easing, and replacement demand is strong. So, there’s every reason to expect volumes to pick up in the coming quarters.”

“As the two-wheeler and passenger car sectors have rebounded, we will naturally see positive spillover for commercial vehicles since higher consumption and goods movement mean more trucks,” he said. “We are in a good position for the second half and look forward to another good year.”

Aggarwal said light and medium-duty trucks, exports, and bus sales are likely to lead growth during the remainder of FY26, while the heavy-duty truck segment will see moderate expansion.

According to Aggarwal, light and medium-duty trucks grew 9% in the first half of the fiscal, while exports rose 40% and bus sales expanded 7-8%. The small commercial vehicle category also improved by about 6-7%.

Heavy-duty trucks grew marginally at 0.2%, weighed down by higher vehicle utilisation levels and migration to higher-tonnage models. “Operators are migrating to higher-tonnage trucks, which means fewer units but more freight capacity. Truck productivity has also risen with many vehicles now running 20,000-25,000 km a month compared to 10,000-12,000 km earlier. This higher utilization will reduce fleet size but also accelerate replacement cycles,” Aggarwal said.

He added that increased use of rail freight corridors, with large companies like Maruti Suzuki shifting a quarter of their car transport to rail, has had some moderating impact on truck volumes. “Despite these shifts, we still achieved 0.2% growth in the first half in heavy-duty trucks. The second half should be better,” he said.

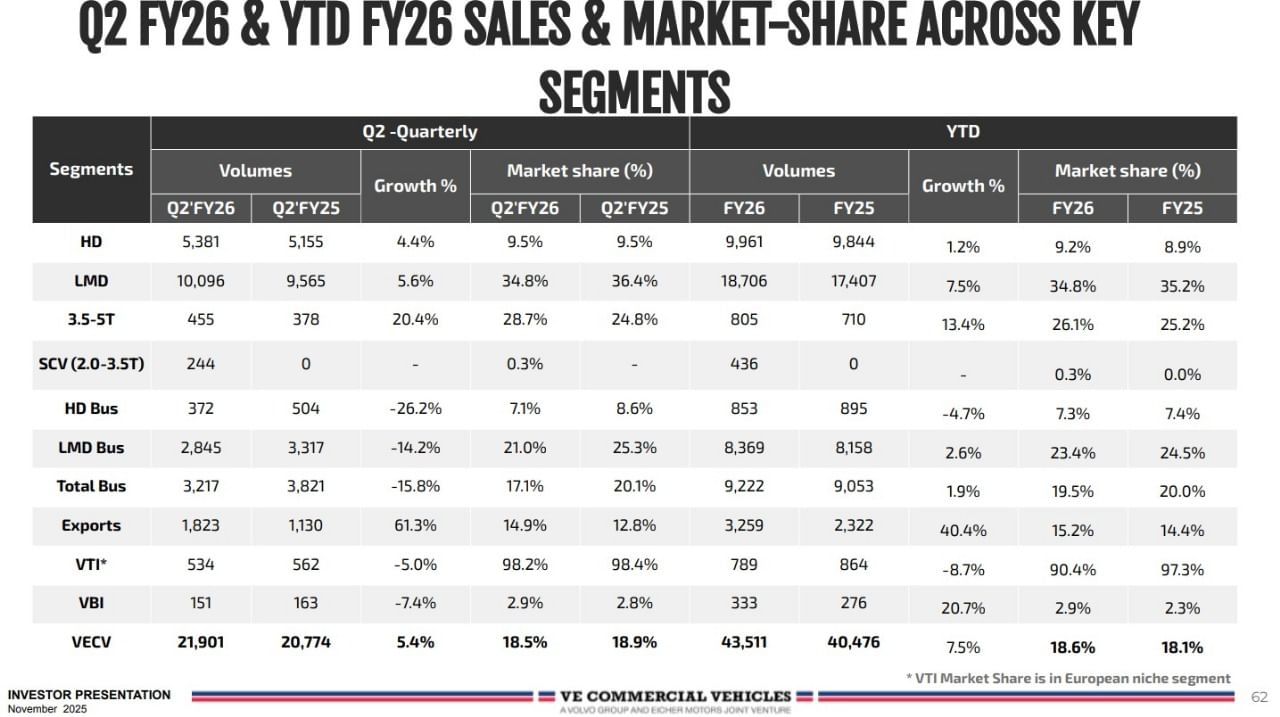

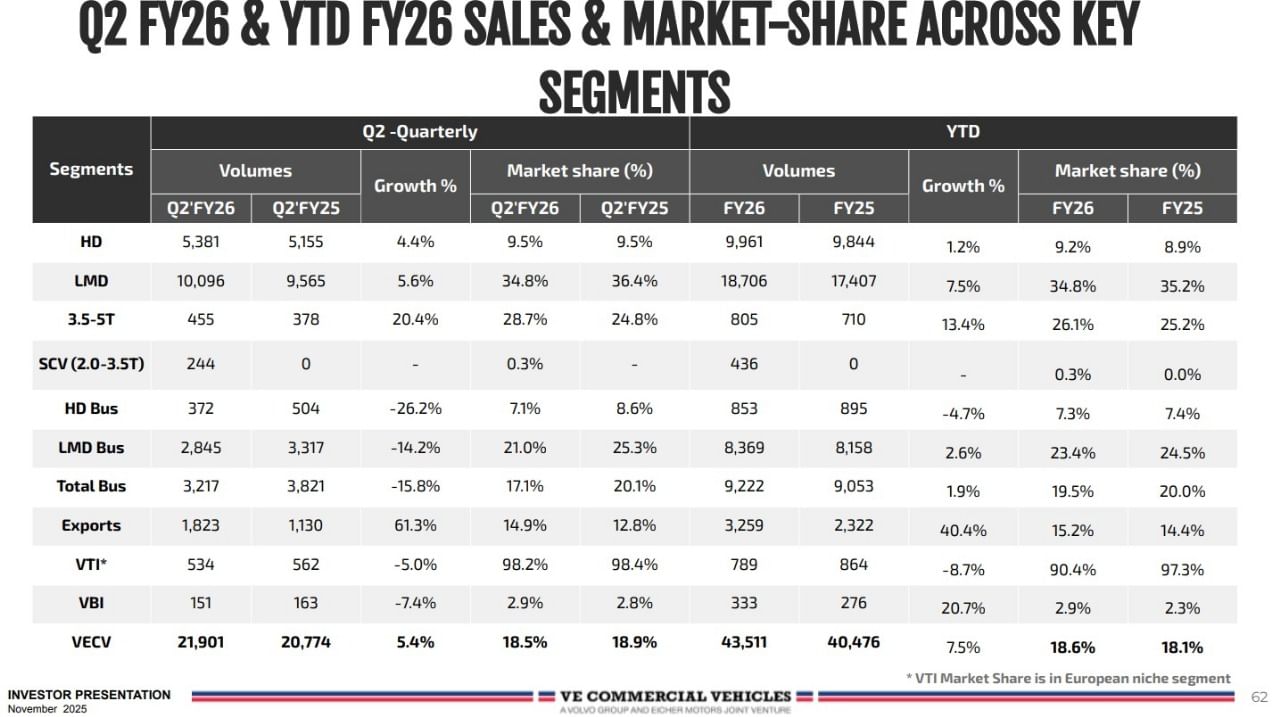

In the September quarter, VECV reported sales of 21,901 units, a 5.1% increase over 20,774 units a year earlier. For the April-September period, sales rose 7.5% to 43,511 units from 40,476 units in the corresponding period last year.

In terms of segmental performance, light and medium-duty truck deliveries stood at 10,096 units in Q2, maintaining a 34.8% market share. Heavy-duty truck volumes grew 3.5%, and overall bus sales reached 3,217 units in the quarter.

Standalone revenue from operations rose 10% year-on-year to ₹6,106 crore in Q2 FY26. Profit after tax increased 19.7% to ₹249 crore, while EBITDA grew 8% to ₹479 crore. For the first half, revenues stood at ₹11,777 crore, up 11% year-on-year.