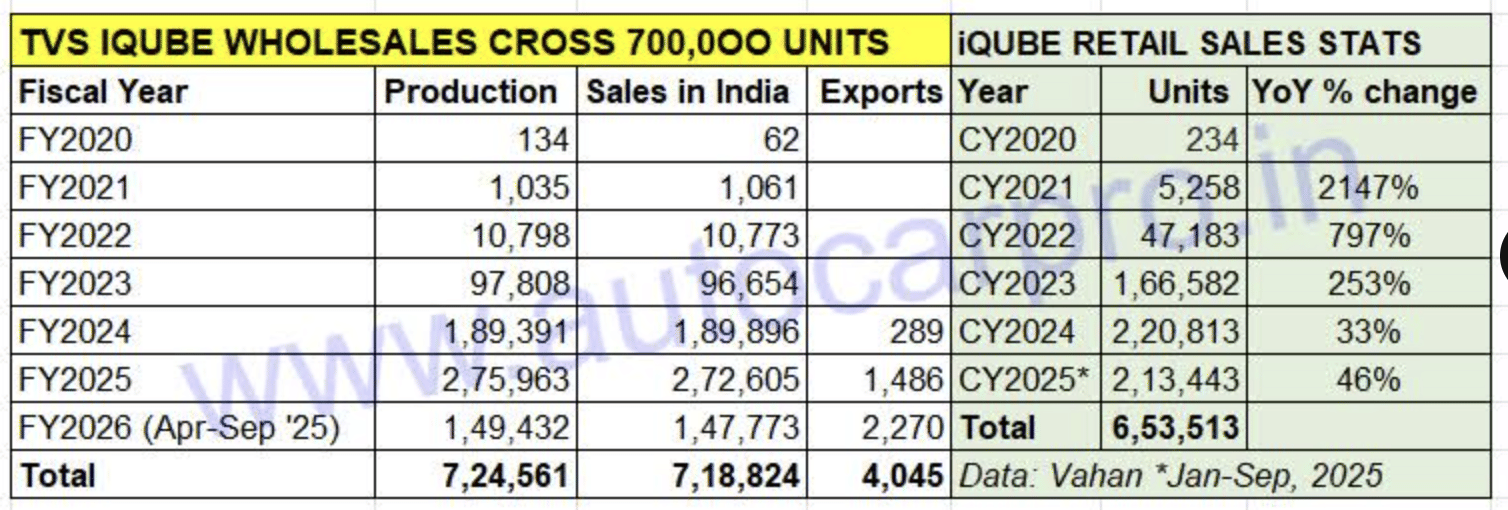

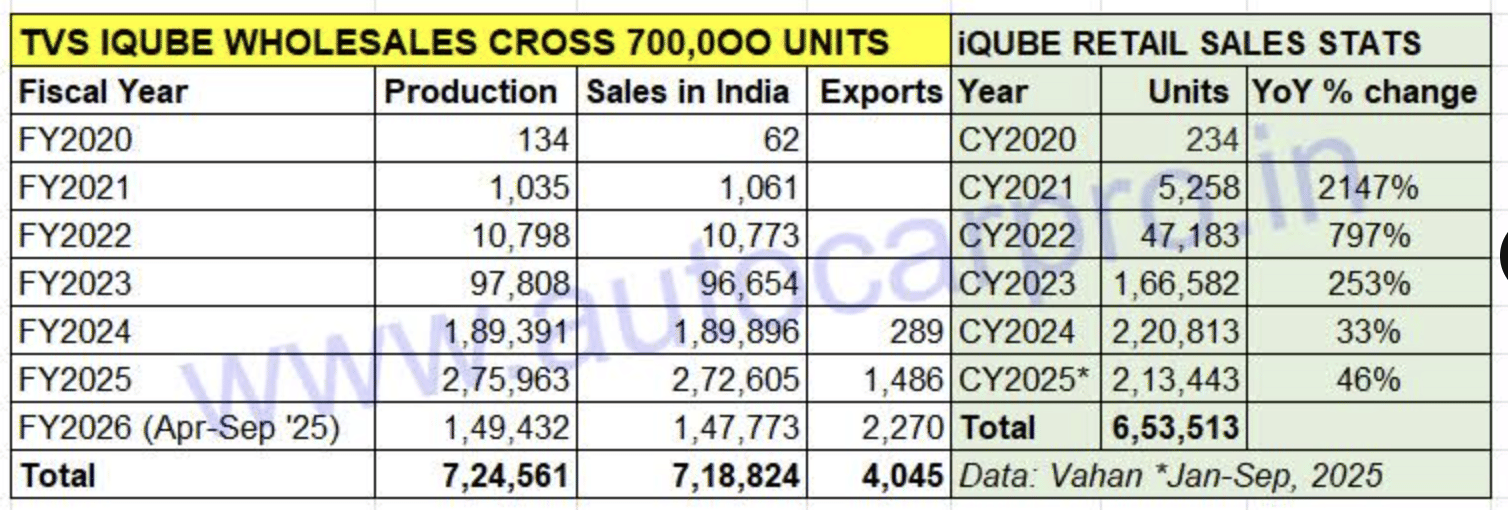

The TVS iQube, TVS Motor Co’s first-ever and flagship electric scooter, has surpassed the 700,000 wholesales milestone in the domestic market. At the end of September 2025, as per SIAM industry data statistics, total factory dispatches (wholesales) from market launch in January 2020 were 718,824 units. TVS has also exported 4,045 iQubes to overseas markets. Total iQube production from FY2020 till September 2025 is 724,561 units.

While the first 100,000 iQube domestic market sales took a little over three years, the run from 100,000 to 200,000 iQubes was achieved in far less time – just 10 months. The 300,000-unit wholesales milestone was surpassed in early April 2024, 52 months or four years and four months after launch. But the real and rapid growth has come after that. The sales run from 300,001 to 700,000 units has taken just 17 months, clearly reflecting the surging demand for the e-scooter.

TVS iQube has taken 69 months from launch in January 2020 to cross the 700,000 milestone. While the first 300,000 units were sold in 52 months, the last 400,000 units sold in just under 18 months.

The iQube was launched in January 2020 as a fine blend between practicality and performance, equipped with full LED lights, connected tech and positioned as a family e-scooter with a wide seat and decent storage space. The zero-emission scooter has taken 69 months or a little less than six years to achieve the 700,000 sales milestone. As the data depicts, demand has grown by leaps and bounds in the past three fiscal years, accelerating rapidly in FY2025 and thereon.

TVS had a cracker of a fiscal in FY2025, which saw the Chennai-based two-wheeler major register record sales of 1.81 million scooters (18,13,103 units, up 25% YoY) comprising the petrol-engined Jupiter, NTorq and Zest and the electric iQube. While this stellar performance gave TVS a 26% market share and helped it contribute strongly to the record 68,53,214 sales for the domestic scooter industry in India in FY2025, the TVS iQube with 272,605 units contributed 15% to TVS scooter sales last fiscal.

In the current fiscal’s first six months, TVS has registered wholesales of 147,773 iQubes, which marks 20% YoY growth (April-September 2024: 122,927 iQubes) and accounts for 14% of TVS’ scooter sales of 10,80,672 units in April-September 2025, up 27% YoY. The strong performance of the iQube has helped TVS achieve a scooter market share of 29% in H1 FY2026, a marked increase over the 24% in H1 FY2025 and its highest to date. TVS’ scooter portfolio also includes the petrol-engined Jupiter, NTorq and Zest, which sold 932,899 units, up 28% YoY, in the first half of the current fiscal.

While the iQube has a strong fan following, monthly retails for both the Bajaj Chetak and Ather Rizta are on the upswing.

iQUBE RETAIL SALES CROSS 650,000. . . BAJAJ AUTO AND ATHER ALSO SEE STRONG DEMAND

While wholesales statistics are essentially factory dispatches to company dealerships across the country, retail sales constitute the real-world story. As per Vahan retail sales data (which does not include Telangana stats), a total of 653,513 iQubes have been sold in India since January 2020 till end-September 2025. Ola Electric with over 960,000 e-2Ws sold is the only other OEM ahead of TVS. In comparison, Bajaj Auto, which launched its Chetak in the same month (January 2020) as the TVS iQube, has sold over 500,000 units till end-September 2025.

CY2025 will turn out to be the TVS iQube’s best calendar year for retail sales. Nine months into this year, TVS Motor Co had delivered 213,443 units (up 46% YoY) to customers, just 7,340 units shy of CY2024’s 220,813 units which have been surpassed in October.

What has given iQube sales a boost is TVS Motor Co slashing prices by up to Rs 26,000 and also increasing the battery capacity of some variants. The battery capacity of the base variant of the MY2025 iQube, iQube S and iQube ST has been increased by 0.1 kWh and the TVS flagship e-scooter now has a claimed riding range of 145km per charge.

The iQube S and iQube ST come with a fast 950W charger, which means a 0-80% top-up takes just three hours. While the S variant (Rs 140,000) receives a 0.1 kWh bump up to 3.5 kWh, the lower version of the higher-spec ST iQube also gets the same 3.5 kWh battery pack upgrade. The higher ST variant now houses a 5.3 kWh battery, up 0.2kWh, and is priced at Rs 159,000.

TVS has topped the monthly sales charts for six months in a row this year from April to September, losing the crown in October to Bajaj Auto, which is back in action following a couple of tepid months caused by impacted production as a result of inadequate supplies of rare earth magnets. Ather Energy, riding on strong demand for its Rizta family scooter, is also hitting new highs for the past three months.

ALSO READ: TVS eyes new markets for iQube e-scooter in rural India