October 2025 will stand out as a red-letter month for India Auto Inc when wholesales (factory dispatches) of passenger vehicles as well as two- and three-wheelers hit their highest-ever levels.Driven by the festive season as well as pent-up demand and, importantly, by the GST 2.0 transition which has made most vehicles more affordable, the record PV numbers have been powered by the highest-ever monthly wholesales of utility vehicles (UVs).

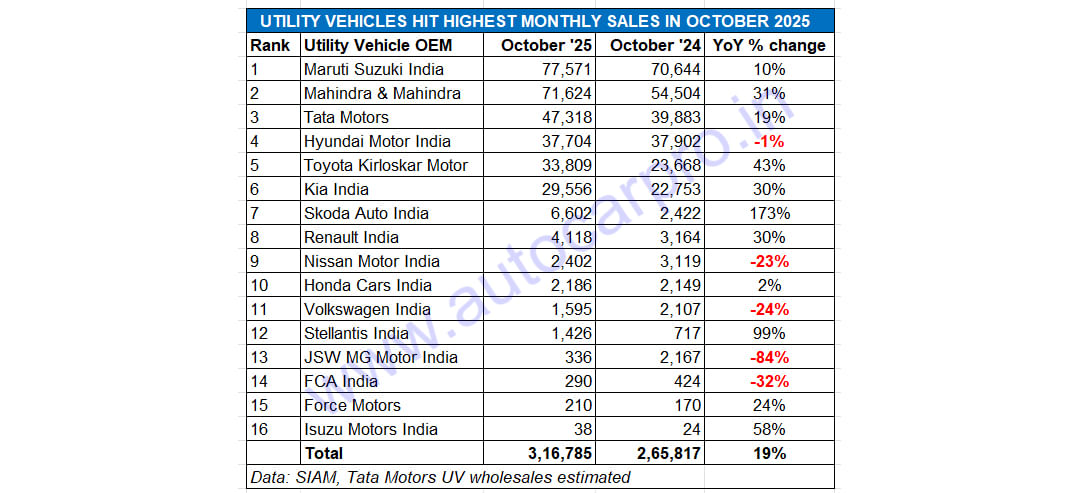

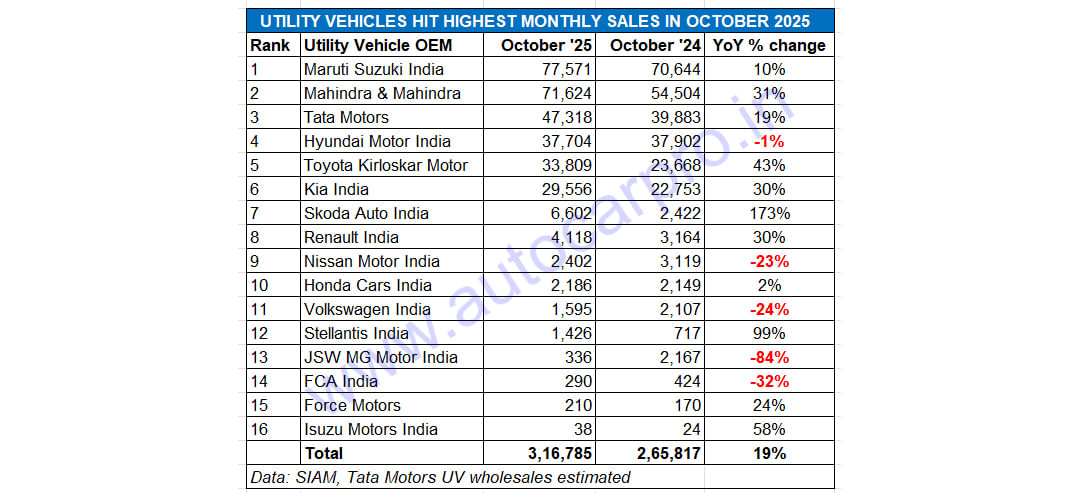

As per the data released by apex industry body SIAM yesterday, 16 passenger vehicle (PV) manufacturers dispatched a total of 460,739 cars and UVs in October 2025, up 17% YoY (October 2024: 393,238 units). This mega-total includes 316,785 utility vehicles, up 19% YoY (October 2024: 265,817 units), which translates into the UV share of PV sales rising to 69% last month as compared to 67% in October 2024.

October 2025’s record sales of 316,785 units constitute 10,218 SUVs and MPVs sold on each of the 31 days. Month-on-month growth was also robust – 26% (September 2025: 250,603 UVs).

Six of the top seven utility vehicle OEMs registered their highest-ever monthly wholesales in October 2025. The 316,785 UVs accounted for 69% of the record 460,739 passenger vehicles sold last month.

Six of the top seven utility vehicle OEMs registered their highest-ever monthly wholesales in October 2025. The 316,785 UVs accounted for 69% of the record 460,739 passenger vehicles sold last month.

MARUTI SUZUKI LEADS BUT MAHINDRA DISPLAYS STRONGER GROWTH

If the overall PV segment clocked its best-ever monthly score in October 2025, it’s also because Maruti Suzuki – the bellwether of India PV Inc – registered its highest monthly dispatches: 176,318 units, up 10% YoY. While utility vehicles (77,571 units, up 10%) accounted for a 44% share, hatchbacks and sedans (85,210 units) had a 48% share and vans (13,537 units) an 8% share.

The Ertiga, India’s No.1 MPV, topped the charts for Maruti with 20,087 units, followed by the Fronx (17,003 units), the new Victoris (13,496 units), Vitara Brezza (12,072 units) and the Grand Vitara (10,409). The other three UVs comprise the XL6 (3,611 units), Jimny (592 units) and the Invicto (301 units). Maruti Suzuki had a 24% share of the UV sales last month.

An aggressive Mahindra & Mahindra, which is hard on Maruti’s heels, sold a record 71,624 SUVs last month, a 31% YoY increase (October 2024: 54,504 units) which gave it a near-23% UV share. The Scorpio N and Classic maintained their No. 1 model ranking for M&M with 17,880 units and a 25% share of October sales. The Bolero brand (14,343 units) went ahead of the XUV 3XO compact SUV (12,237 units) as well as the Thar and Thar Roxx (12,029 units), which can be attributed to the company dispatching the new Bolero and Bolero Neo to its showrooms across India. While flagship XUV700 (10,139 units) takes fifth position and the BE 6 and XEV 9e, which clocked their best-ever monthly wholesales yet (4,842 units) sixth rank. Cumulative 10-month dispatches of the two Born Electric SUVs have crossed 36,000 units and helped M&M drive past the half-a-million SUV sales milestone in the calendar year to date.

Like Maruti Suzuki and Mahindra, Tata Motors too hit its highest monthly sales of both PVs and UVs. While PV dispatches at 61,134 units rose 27% YoY, the company registered its best-ever UV wholesales of 47,318 SUVs, a 19% YoY increase (October 2024: 39,883 SUVs) and gave it a 15% share of India UV sales. This translates into a UV share of 77% in monthly PV sales – the highest yet for Tata Motors – and also facilitated by a growing demand for the electric SUVs Nexon, Punch, Curvv and Harrier.

With 22,083 units, the Nexon, which is sold with diesel, petrol, CNG and electric powertrains, was India’s No. 1 SUV last month and accounted for 47% of Tata UV sales last month. While the Punch sold 16,810 units, its highest in the first seven months of FY2026, the Harrier and its EV sibling sold 4,483 units. The Safari is ranked fourth with 2,510 units and the Curvv fifth with 1,432 units.

No. 4 UV OEM Hyundai Motor India sold 37,704 SUVs, down 1% YoY (October 2024: 37,902 units) for a 12% overall UV share. The Creta remains the company’s best-seller (18,381 units) while the Venue compact SUV is second with 11,738 units last month.

Toyota Kirloskar Motor, which is riding a wave of demand for its UVs, registered its highest monthly UV sales of 33,809 units, up strongly by 43% YoY (October 2024: 23,668 UVs). This gives it an 11% UV market share for October 2025, up from 9% a year ago. The key models that drove TKM’s growth last month are the Hyryder midsize SUV (11,555 units) and the Innova twins (11,089 units) which together comprised 67% of TKM UV sales last month. And the Rumion MPV hit its highest monthly sales: 3,075 units.

Kia India, whose portfolio comprises only SUVs and MPVs, also registered its highest monthly sales since market entry in August 2019. The 29,556 units sold are a 30% YoY increase and give it a 9% share of the India UV market in October 2025. Kia’s best-selling model last month was the Sonet compact SUV (12,745 units), followed by the Carens MPV (8,779 units) which has received a sales boost with the rollout of the new Carens Clavis and the Carens Clavis EV. The Carens Clavis EV also enabled Kia India to achieve its highest monthly retail sales of 658 EVs in October.

Skoda Auto India is also on a roll. The company, which sells the Kushaq, Kodiaq and Kylaq SUVs, along with the Slavia and Superb sedans, clocked highest-ever PV sales of 8,252 units. This includes a best-ever monthly UV score of 6,602 units comprising 5,078 Kylaqs, 1,219 Kushaqs and 305 Kodiaqs for a 2% UV market share last month.

As the 16-UV OEM wholesales data table above reveals, the Top 6 companies – Maruti Suzuki, Mahindra & Mahindra, Tata Motors, Hyundai, Toyota and Kia – with 297,582 UVs sold last month accounted for 94% of October’s record sales of 316,785 units, leaving the remaining 8% to be fought over by the other 10 OEMs.

ALSO READ: Mahindra sells half-a-million SUVs in Jan-Oct, set to surpass 600,000 in CY2025