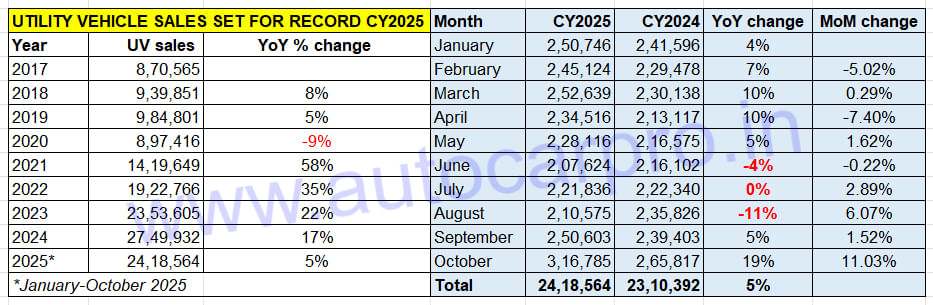

India’s utility vehicle (UV) segment is firing on all cylinders and how. Driven by the festive season as well as pent-up demand and, importantly, by the GST 2.0 transition which has made most vehicles more affordable, UV wholesales hit a new monthly high of 316,785 units in October 2025, surpassing the 300,000 mark for the first time.

What’s more, the UV share of overall passenger vehicle sales rose to 69% last month – up 4% from the 65% they had in FY2025 when the car and sedan share of PV sales had plunged to 31 percent. The robust YoY growth of 19% last month meant that 10,218 SUVs and MPVs were sold on each of October’s 31 days. Month-on-month growth is also energetic – 26% (September 2025: 250,603 UVs).

With the overall market sentiment up since the GST price cut in the last week of September, dealer body FADA has reported stronger vehicle buyer footfalls and an extremely high conversion rate. The association’s dealer survey has revealed that the momentum from the festive surge is expected to extend into November, albeit with a natural moderation after an all-time-high October.

Passenger and utility vehicle dealers have reported a strong pipeline of undelivered festive bookings, better stock availability, and continued traction from the GST price correction. However, it is only to be expected that December numbers will be somewhat muted in comparison as customers await year-end offers and new model launches.

Ten months into CY2025, the UV industry has registered total domestic market dispatches of 2.41 million units (24,18,564), a 5% YoY increase (January-October 2024: 23,10,392 units). This puts the UV segment 331,368 units short of CY2024 wholesales of 27,49,932 units and 381,436 units away from the 2.8-million mark for the current calendar year.

With two months still to be counted, expect India UV Inc to surpass the 2.8 million mark for the first time this year. While November could see UV OEMs dispatch around 275,000 units, December could see a more muted 200,000-odd units in comparison to the previous two months.

With 2.41 million UVs sold between January-October, India UV Inc needs to sell another 331,369 units to beat CY2024 wholesales of 27,49,932 units. At present, it is 381,436 units away from the 2.8-million mark, which it should achieve in CY2025.

With 2.41 million UVs sold between January-October, India UV Inc needs to sell another 331,369 units to beat CY2024 wholesales of 27,49,932 units. At present, it is 381,436 units away from the 2.8-million mark, which it should achieve in CY2025.

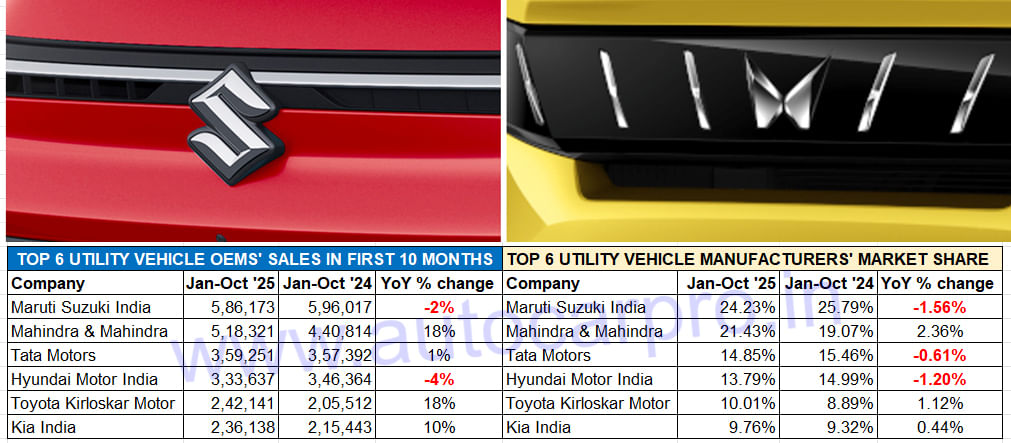

Maruti and Mahindra Command 46% Utility Vehicle Market Share

The Indian UV industry, which has 16 players (barring the luxury OEMs), is dominated by six manufacturers: Maruti Suzuki, Mahindra & Mahindra, Tata Motors, Hyundai Motor India, Toyota Kirloskar Motor and Kia India. Between January and October this year, these six OEMs have dispatched 22,75,661 UVs, up 5% (January-October 2024: 21,61,542 units).

Passenger vehicle market leader Maruti Suzuki also remains the UV market leader. In the first 10 months of CY2025, the company has dispatched 586,173 UVs, down 2% YoY. This gives it a substantial lead of 67,852 units over a hard-charging Mahindra & Mahindra and a current UV market share of 24%, down 2% on the 26% it had a year ago.

The Ertiga, India’s No. 1 MPV, remains Maruti’s best-selling UV with 159,242 units, followed by the Brezza (143,659 units) and Fronx (144,130 units) compact SUVs, Grand Vitara (84,273 units), XL6 (29,944 units), the new Victoris midsize SUV (17,757 units) and the Jimny (4,146 units).

Mahindra & Mahindra has also driven past the half-a-million UV sales mark: 518,321 units, up 18% YoY. M&M, which sold over half-a-million SUVs (528,460 units) for the first time in a calendar year in CY2024 and also in FY2025 (551,487 units), is now headed towards breaking both these records and will surpass the 600,000 milestone for the first time in CY2025. This stellar performance has seen its UV share increase to 21% from 19% a year ago.

While the Scorpio twins remain the largest sellers (145,487 units and a 28% share of M&M UV sales), the Thar and Thar Roxx have become the second best-selling models for M&M (97,092 units, 19% share). The Bolero and Bolero Neo, whose MY2025 models have just been launched, are third (82,915 units, 16% share), followed by the XUV 3XO (estimated 80,007 units, 15% share), flagship XUV700 (74,075 units, 14% share), BE 6 and XEV 9e (36,104 units, 7% share), XUV400 (2,360 units) and the Marazzo MPV (281 units).

Tata Motors, which is set to launch the new Sierra and petrol-engined Harrier, has sold 359,251 UVs in the past 10 months, up 1% YoY. The two compact SUVs – Nexon (158,750 units) and the Punch (138,769 units) – remain its best-sellers and account for 83% of January-October dispatches. The Curvv (25,333 units) is ranked No. 3 and is followed by the Harrier (21,262 units) and Safari (15,137 units). Tata Motors’ market share for the past 10 months is down marginally YoY at 15% but is expected to see an uptick with the new SUV launches. In October 2025, like Maruti Suzuki and Mahindra, Tata Motors also registered its best-ever UV wholesales of 47,318 SUVs, a 19% YoY increase (October 2024: 39,883 SUVs), giving it a 15% share of India UV sales.

Hyundai Motor India, with 333,637 UVs sold between January-October 2025, is ranked fourth in the Top 6 table. This is a 4% sales decline YoY, which sees its UV market share fall to 13.79% from 15% a year ago. The Creta, India’s No. 1 midsize SUV, remains the bulwark of Hyundai sales with 170,624 units and a 51% share of UV sales. The Venue (93,388 units, 28% share) and Exter (56,591 units, 17% share) compact SUVs are No. 2 and No. 3 respectively, followed by the Alcazar (12,217 units), Tucson (676 units) and Ioniq 5 (141 units).

Toyota Kirloskar Motor, which is riding a wave of demand for its UVs, has clocked cumulative 10-month factory dispatches of 242,141 units. This, like M&M, is an 18% YoY increase and gives TKM a market share of 10%, up from the 9% it had a year ago. Topping the model-wise chart are the Innova twins (Hycross and Crysta) with an estimated 92,773 units and a 38% share. The Hyryder midsize SUV, which outsold the two Innovas for the first time in October and clocked its highest monthly sales yet of 11,555 units, has sold 71,295 units in the past 10 months for a 29% share. While the Fortuner SUV has sold an estimated 29,079 units, the Taisor compact SUV has sold 28,634 units and the Rumion MPV 15,728 units in the past 10 months.

Kia India wraps up the Top 6 UV OEM list with 236,138 units, up 10% YoY and a 10% share of UV industry sales in the January-October 2025 period. The Sonet compact SUV is the No. 1 Kia model with an estimated 82,410 units, followed by the Carens MPV (66,962 units) and the Seltos midsize SUV (60,526 units).

ALSO READ: Indian EV Makers Sell Record 234,000 Units in October, Charge Towards 2 Million in CY2025

Tata Motors EV Shipments Hit Record Levels in October: 9,286 Units, up 73%