Like the passenger vehicle and utility vehicle segments which registered their highest monthly wholesales in festive October 2025, the two-wheeler segment which comprises motorcycles, scooters and mopeds, too hit a new high . . . mainly due to manufacturers pumping up the volumes to fed a scooter-hungry market.

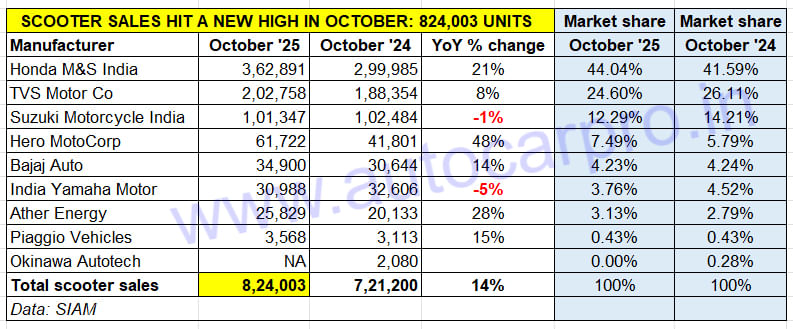

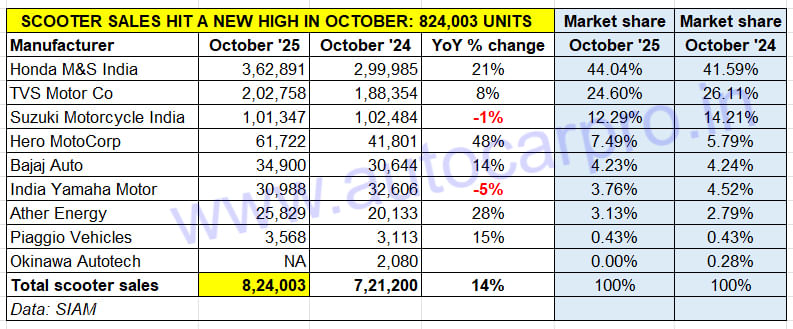

October saw a total of 2.21 million two-wheelers dispatched from 12 OEM factories to showrooms across India. While motorcycle wholesales (13,35,468 units) were down 4% YoY, scooter dispatches at a record 824,003 units rose 14% YoY to scale a new monthly high. Mopeds, with 51,256 units, were down 2% YoY. October sales come on the back of September 2025’s 733,391 units, up 9% YoY, which means the Indian scooter industry has registered two months in a row of record wholesales.

What has accelerated demand for scooters, as well as for motorcycles and passenger vehicles, is the two-month-old transition to GST 2.0 which has helped slash new vehicle prices and enabled a higher level of affordability, both for urban and rural India. Dealer body FADA has pointed out that rural India has become “the true growth engine — with favourable monsoons, higher farm incomes, and government infrastructure push driving purchasing power.”

Overall two-wheeler demand is rising due to improved rural India sentiment, better liquidity, and the affordability impact of GST rationalisation. Scooter sales are also benefiting from the rapidly growing demand for electric models. Going ahead, dealers foresee steady demand backed by rural liquidity, wedding-related purchases, and spillover from festive bookings, aided by GST benefits and improved sentiment.

Honda, with 362,891 Activas and Dios, accounted for 44% of the record 824,003 scooters sold in October. However, HMSI’s highest monthly scooter sales were in September 2017 (386,456 units) when it had a 56% market share.

SCOOTERS CONTRIBUTE 37% TO RECORD DISPATCHES OF 2.21 MILLION 2Ws IN OCTOBER

In terms of segment share, motorcycles accounted for 60% (down from 64% YoY), scooters for 37% (up from 33% YoY) and mopeds for a little less than 3 percent.

Last month’s factory dispatches to dealers across India were powered by market leader Honda Motorcycle & Scooter India (HMSI) which clocked wholesales of 362,891 units, up 21% YoY with an additional 62,906 units, which gives it a market share of 44 percent. These are entirely comprised of the Honda Activa twins and the Dio scooters, both available in 110cc and 125cc. It is estimated that the two Activa siblings account for nearly 90% of HMSI sales, with the Dio siblings making up the balance 10 percent.

While HMSI’s sales last month (362,891 units) are the highest in the current calendar and fiscal year, they are not the highest monthly sales for the Japanese scooter maker. In September 2017, Honda had clocked wholesales of 386,456 units, when it had a 56% market share of the total 686,478 scooters sold.

TVS Motor Co, with 202,758 scooters sold, registered 8% YoY growth which gives it a 24% share versus 26% a year ago. The company sold 170,769 units of its three ICE scooters – Jupiter, NTorq and Zest – and 31,989 units of its e-scooter, the i-Qube.

Suzuki Motorcycle India, which also sells scooters in the form of the 124cc Access, Avenis and Burgman and has revealed the electric avatar of the Access, is the only other OEM to sell over 100,000 scooters in October. The 101,347 units are down 1% on year-ago sales and gives the company a 12% share versus 14% a year ago.

Hero MotoCorp has increased its scooter market share to 7.49% from 5.79% a year ago as a result of dispatching 61,722 units – an additional 19,921 units. This total comprises 47,250 units of the Destini, Maestro and Pleasure, 453 Xooms and 14,019 Vida e-scooters. While the ICE scooters have posted a 43% YoY increase, the Vida V2 and V2X have clocked 60% YoY growth.

Bajaj Auto, which is in the scooter market because of its Chetak and Yulu electric scooters, dispatched 30,988 units in October 2025, up 14% YoY, albeit with its 4% scooter market share remaining unchanged.

India Yamaha Motor, ranked sixth on the OEM scale with 30,988 units, is down 5% YoY and a resultant drop in its share to 3.76% from 4.52% a year ago.

Ather Energy continues to ride a wave of demand for its Rizta family scooter. The company, which also sells the 450S and 450X e-scooters, registered wholesales of 25,829 units, up 28% YoY for a 3% market share.

Italian scooter maker Piaggio Vehicles, with 3,568 units in October 2025, posted 15% YoY growth.

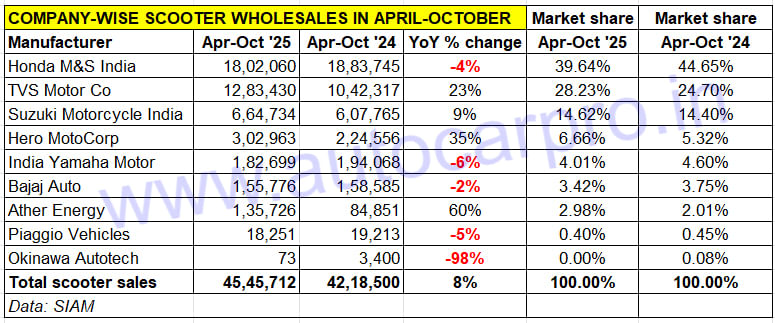

HMSI remains No. 1 but YoY its market share has fallen to 40% from 45 percent. No. 2 scooter OEM TVS Motor Co, with 23% growth in April-October 2025, sees its share rise to 28% from 24 percent.

HONDA SCOOTER SHARE AT 40% in APRIL-OCTOBER, TVS’ INCREASES TO 28%

Honda’s strong sales of nearly 363,000 scooters in October have helped it both cross the 1.8 million-unit mark for the first seven months of the current fiscal and also increased its April-October 2025 market share to 39.64% from 38.66% in the first-half of FY2026. However, on a YoY basis, with sales down 4%, HMSI remains well below its H1 FY2025 share of 44.65 percent. In FY2025, Honda had sold 28.4 lakh units (up 12%) albeit its scooter market share had slipped to 41.50% from 43.33% in FY2024.

TVS Motor Co, which has the Jupiter, NTorq and Zest in its ICE scooter stable and the iQube and recently launched Orbiter electric scooters, with cumulative sales of 1.28 million units, up 23%, sees its share rise to 28% from 25% a year ago. As compared to HMSI, TVS benefits from its electric scooters. The 179,762 iQubes sold between April-October account for 14% of its scooter sales.

Suzuki Motorcycle India has done well to sell 664,734 scooters in the past seven months, up 9% YoY. This performance helps the two-wheeler arm of the Japanese major increase its scooter market share marginally to 15% from 14% a year ago. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Hero MotoCorp, the motorcycle market leader, is ranked fourth with 302,963 units, up 35% YoY. This sees its market share increase to 6.48% from 5% a year ago. Hero’s ICE scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. These together have sold 226,349 units, up 20% YoY. The company has received a growth accelerator through its e-2W sales, particularly the new V2X. Hero Vida sales of 75,501 units are up 114% YoY

India Yamaha Motor, with 182,699 units, has registered a 6% sales decline which results in its scooter market share reducing marginally to 4.01% from 4.60% a year ago. The 125cc-engined Alpha, Fascino and Ray ZR have together sold 167,259 units, down 7% YoY. The 155cc Aerox scooter, with 12,551 units, has registered 13% growth (April-October 2024: 13,680 Aerox).

Bajaj Auto has sold a total of 155,776 Chetak and Yulu e-scooters in the first seven months of FY2026, down 2% YoY. While its No. 6 OEM ranking remains unchanged, its market share has fallen a tad to 3.42% from 3.75% a year ago. This sales decline can be attributed to the hampered production the company experienced in July and early August, due to reduced supplies of rare earth magnet supplies. However, Bajaj Auto has bounced back since then.

Ather Energy with total wholesales of 135,726 units in April-October, has witnessed a 60% YoY growth. This strong performance sees the EV start-up’s overall scooter market share rise to 3% from 2% a year ago.

ALSO READ: TVS regains e-2W lead in first-half November, Hero Vida outsells Ola Electric

Ather Energy clocks best-ever monthly sales in October: 28,000 unit