Mahindra & Mahindra, positioning itself as the world’s largest farm tractor manufacturer, has unveiled an aggressive, multifaceted strategy designed to solidify its domestic dominance and seize next-generation growth opportunities abroad.

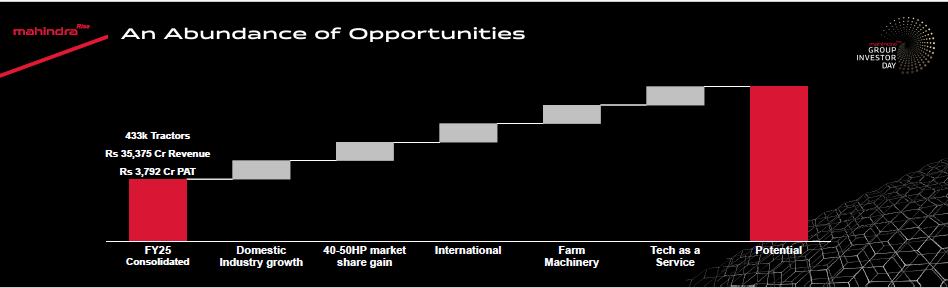

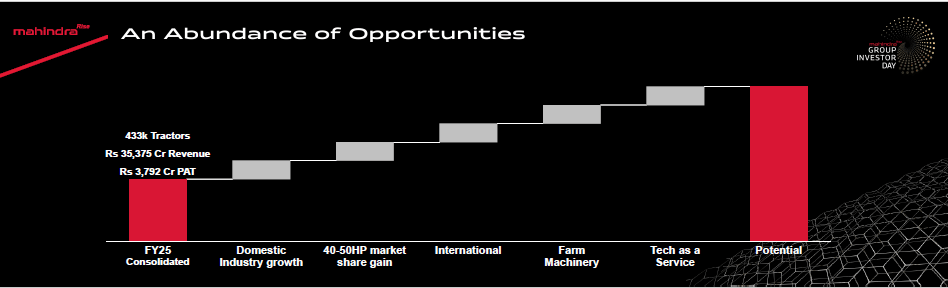

The groundwork for this push is already robust, highlighted by consolidated performance figures spanning Fiscal Years 2020 through 2025. During this period, the farm segment saw its consolidated revenue grow 1.7 times, achieving Rs 35,375 crore, while global tractor volume expanded 1.4 times, hitting 433,000 units. Crucially for investors, Farm Consolidated Profit Before Interest and Tax (PBIT) surged 2.6 times, reaching Rs 4,947 crore. The segment also remained a major contributor, generating 39% of PAT and 32% of Cash Generated Post Capex and Investments between FY21 and FY25.

Mahindra’s future blueprint, revealed in its latest Investor Day presentation, revolves around four core growth vectors: fortifying domestic tractors, building international momentum, embracing technology as the next growth horizon, and scaling farm machinery.

The Domestic Power Shift

Domestically, the company is adjusting its product mix to capitalize on shifting market demand toward larger, more powerful equipment. The strategy, dubbed “Fortify,” addresses the industry trend of increased penetration and a preference for bigger horsepower tractors.

Market data shows a significant shift, with the contribution of 40-50 horsepower (HP) tractors skyrocketing from 49% in FY20 to 64% by FY25. Looking ahead, the segment comprising tractors greater than 50HP is expected to expand its market share contribution to a current estimate of 9% by FY30, up from earlier projections of 7%.

To meet this demand, Mahindra draws on its dual-brand strength, with Mahindra and Swaraj ranked as the number one and two tractor brands in India, respectively. Their NextGen Portfolio is engineered for reliability, toughness, low cost of ownership, and comfort, designed to handle heavy load equipment. New and updated offerings central to this strategy include the Yuvo Tech +, Naya Swaraj, and Swaraj Protek. This domestic push comes amidst favorable economic factors, including a 5.6% increase in profitability for cash and horticulture crops, even as the Tractor Price Index decreased by 7.1%.

Global Momentum: OJA Drives International Ambitions

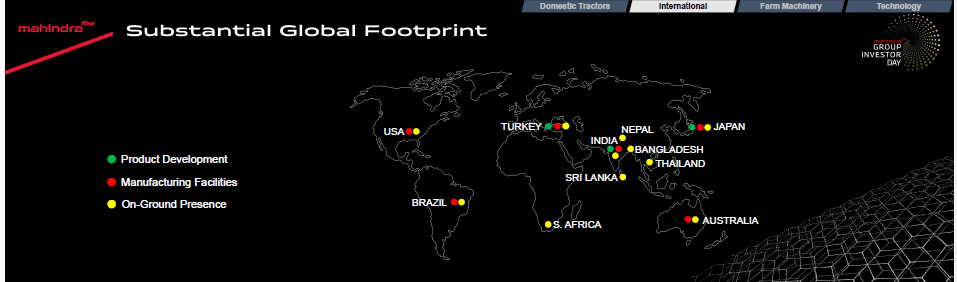

Internationally, Mahindra is focused on “Building Momentum”–leveraging its extensive global footprint across regions including the USA, Brazil, Turkey, and Japan.

A centerpiece of this international strategy is the OJA platform. This platform has already been launched and has captured an 8.5% share of the US market. In North America, where the company targets the sub-110HP market (approximately 200,000 tractors), Mahindra achieved a notable 10.4% market share in the sub-20HP segment during the fourth quarter of FY25. The company plans to scale this presence by leveraging a network exceeding 440 dealers.

In Brazil, targeting the sub-120HP market (around 40,000 tractors), Mahindra currently commands an 8% market share in the <120HP category and approximately 20% share in the <50HP category. Plans there include launching the OJA and NOVO platforms, introducing a new High HP platform, and establishing a new manufacturing facility. Upcoming global launches further emphasize the OJA platform, with planned introductions of OJA Small Utility, OJA Large Utility, and the aforementioned High HP platform.

The Next Horizon: Electrification and Autonomy

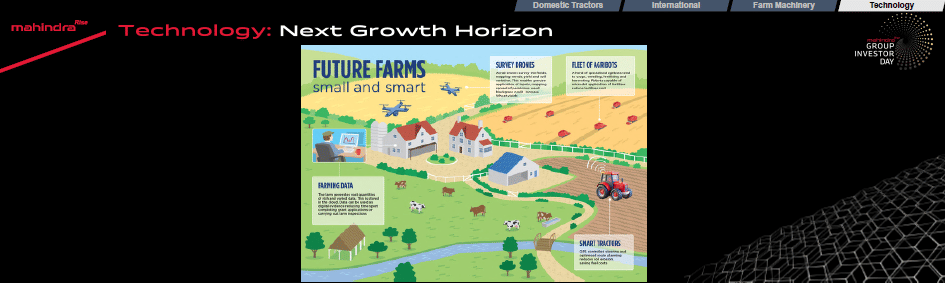

Looking toward future revenue streams, Mahindra identified technology as the “Next Growth Horizon,” aiming to democratize advanced solutions for farmers globally.

The push into high technology is defined by three major pillars:

1. Electrification, highlighted by the development of the Mahindra OJA Electric Tractors.

2. Autonomy, involving the development of Level 2 Autonomy designed to boost precision, productivity, and driver comfort.

3. Alternative Fuels, where the company is exploring options such as Diesel-Biodiesel blends, CNG, and Ethanol (Flex-Fuel).

Beyond the equipment itself, Mahindra is also innovating in service delivery through Precision Ag and Technology as a Service (TaaS), incorporating tools like Telematics, Satellite Imagery, and Drones, often offered through a “Pay as you use” model.

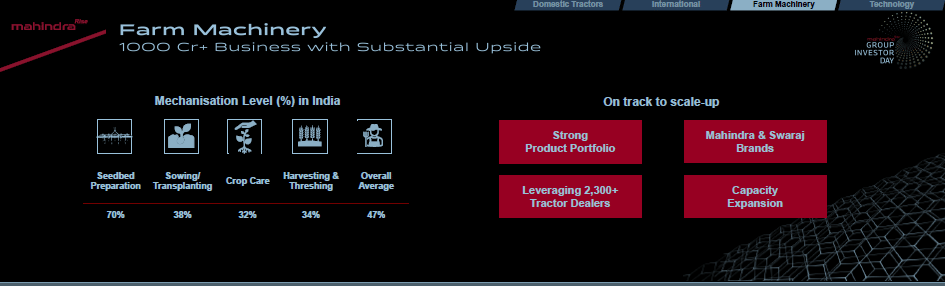

This technological focus ensures that even as Mahindra leverages its massive network of over 2,300 tractor dealers to scale its Farm Machinery business—a sector identified as a ₹1,000 crore business with substantial upside—the core focus remains on evolving the tractor itself. The extensive dealer network provides a crucial channel for distributing both its traditional and next-generation tractor lineup and specialized farm machinery offerings under the Mahindra and Swaraj brands