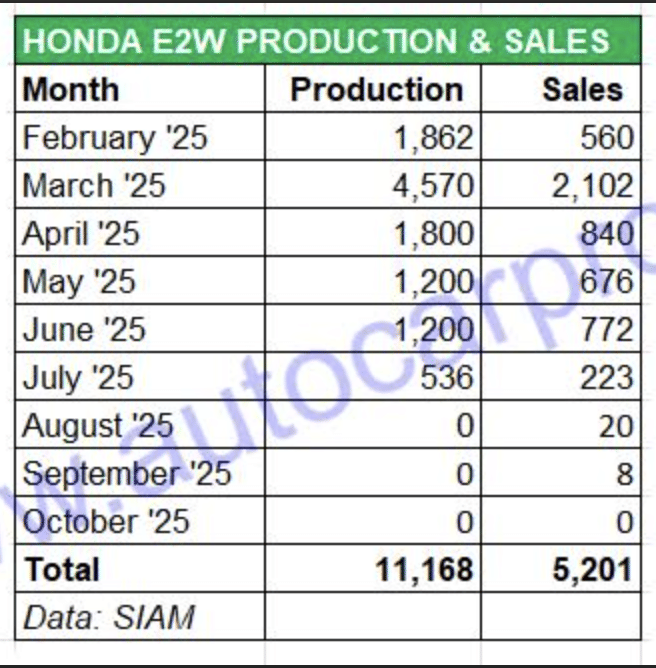

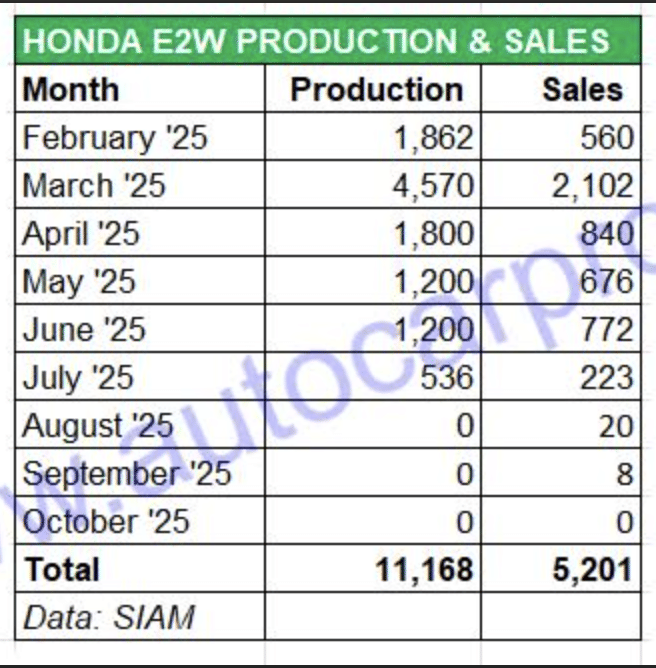

Honda Motorcycle & Scooter India (HMSI), which entered the electric two-wheeler market in February this year, has not produced any electric two-wheelers between August and October 2025. This revelation comes through a perusal of the industry production numbers provided by apex body SIAM in its monthly updates of the Indian automobile industry (see nine-month production and wholesales data table below).

Between February and October, HMSI’s Narasapura plant in Karnataka has rolled out 11,168 units of the Activa e and QC1. Dispatches to dealers are 5,201 units with the QC1 accounting for the bulk of the wholesales.

Deliveries of HMSI’s two electric scooters – the Activa e and QC1 – had commenced in March 2025. As the cumulative nine-month data reveals, the highest monthly production of the two electric scooters which roll out of the company’s Narasapura plant in Karnataka was in March 2025 (4,570 units). The highest monthly wholesales (vehicle dispatches to dealers) were also in the same month: 2,102 units. Since then, production dropped to 1,800 units in April, a similar 1,200 units in May and June, and to 536 units in July. This takes total production of the Honda e-2Ws to 11,168 units. While cumulative domestic market sales are 5,201 units, two units were exported in February 2025.

Compared to its ICE rivals TVS Motor Co, Bajaj Auto or Hero MotoCorp, which are all having a stellar run of the e-2W market, Honda has found the going tough for its two electric commuter scooters.

First revealed in November 2024, the Activa e and QC1 are the 12th and 13th models respectively in Honda’s target to launch 30 electric models globally by 2030. While the Honda Activa e, which is equivalent to a 110cc internal combustion engine mode, comes with two Honda Mobile Power Pack swappable batteries as its power source and is meant primarily for personal commuting, the Honda QC1 (equipped with a fixed battery) is targeted at gig-worker operations and is more of an affordable urban runabout.

The Activa e, which looks far more stylish than its ICE sibling which is India’s longstanding best-selling scooter, has two variants: standard (Rs 117,428, ex-showroom Delhi) and RoadSync Duo (Rs 152,000). It has a 102km claimed IDC range, does the 0-60kph sprint in 7.3 seconds and goes on to hit a top speed of 80kph.

The Activa e: is sold through Honda Red Wing dealers, with a ‘shop-in-shop’ concept as part of a phased rollout with Concept Stores opening in some cities. There are over 80 Honda Power Pack e: battery-swapping stations in Bengaluru, which was the first market where the Activa e: was launched, and they are being introduced in Delhi and Mumbai as well.

The QC1, Honda’s more budget-friendly EV and essentially an eco-friendly urban runabout, is priced at Rs 90,000 which is lower than the market-leading TVS iQube or the Bajaj Chetak. The QC1 is the most affordable Japanese electric scooter in India, has a claimed top speed of 50kph, does the 0-40kph in 9.7 seconds and delivers a claimed IDC range of 80km.

While the Activa e: is powered by two swappable 1.5 kWh batteries and has to be ‘juiced up’ at a Honda swapping station, the Honda QC1 with a single 1.5 kWh fixed battery can be charged at home.

QC1 accounts for 86% of Honda e-2W sales

Cumulative nine-month wholesales numbers reveal that the QC1, thanks to its user-friendliness when it comes to charging at home, is outselling the Activa e which has to bank on Honda swapping stations to be ‘juiced up’. Furthermore, while the Activa e is currently available in only a couple of cities including Bengaluru, which has the Honda swapping network, the QC1’s availability is more widespread.

Between February and October 2025, HMSI sold a total of 5,201 electric 2Ws. This total comprises 740 units of the Activa e and 4,461 units of the QC1 indicating a strong preference for the QC1, which accounted for 86% of the wholesales.

While swapping the depleted battery packs with two new fresh ones at a Honda swapping station is a smooth affair and takes less than two minutes, there is no provision to charge them at home which is an EV-specific convenience factor e-2W users are now comfortable with. This, probably, reflects in the slow customer demand for the Activa e. Ease of use will, therefore, be reliant on the number of Honda battery swapping stations in each city where the product is on sale.

On the retail sales front, as per Vahan data (as of November 20), a total of 3,045 Honda e-scooters have been delivered to customers. July 2025 (411 units) has been the month with the highest sales.

It is likely that the zero production of the two Honda e-scooters over the past three months is the result of high inventory levels at company dealers. Total production has been 11,168 units compared to dealer dispatches of 5,201 units in India and retail sales of 3,045 units (and two units exported) over the past nine months and 20 days.

What’s clear is that the customer response for Honda’s first e-2Ws in India has been very tepid, and at a time when most of the leading players are having a good run of the market. While the stylish Activa e seems to be a product ahead of its time with sales dependent on how fast Honda expands its swappable battery network, the no-frills QC1 is a rather affordable Japanese EV but it comes with some obvious compromises.

Meanwhile, Suzuki, the other Japanese OEM to have announced its entry into India’s booming e-2W market with the e-Access , the zero-emission avatar of the popular 125cc petrol-engined Access, has manufactured a total of 488 units since May 2025 when production began but is yet to commence sales. Watch this space for the latest sales updates and analyses.

With inputs from Rishaad Mody, Autocar India

ALSO READ: Indian e-2W OEMs sell 143,000 units in record-breaking October

Honda Activa e review: promising EV, just not today