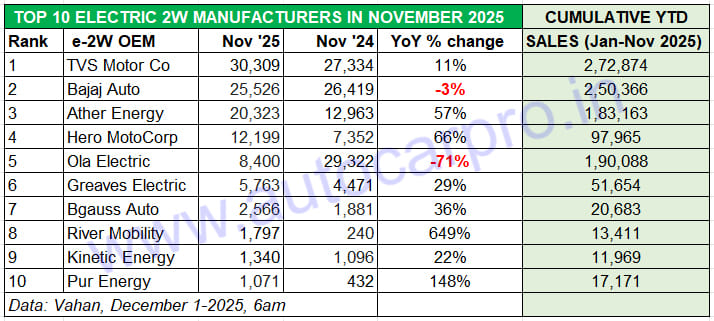

Maintaining the lead over arch rival it displayed in the first half of November 2025, TVS Motor Co has regained the electric two-wheeler crown it had lost to Bajaj Auto in October. As per Vahan retail sales statistics, TVS sold 30,309 units in November, which constitutes 4,783 additional e-scooters than Bajaj Auto (25,526 Chetaks). TVS’ lead in the first fortnight of November was 1,627 units, which means its sales momentum was stronger in the second half of last month.

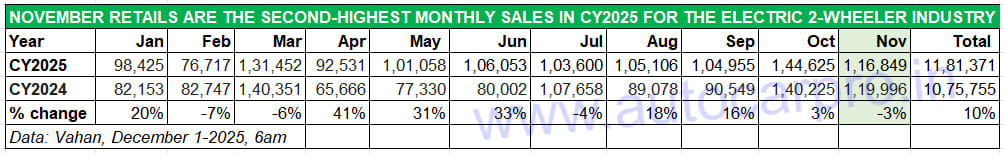

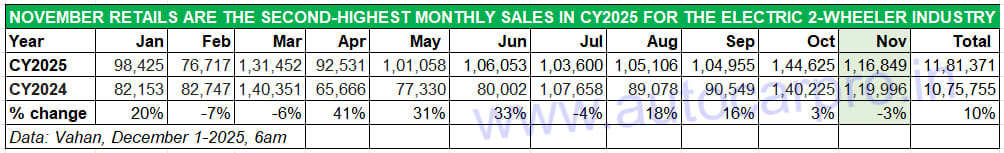

The Indian e-2W industry delivered a total of 116,849 zero-emission scooters, motorcycles and mopeds last month, down 3% YoY (November 2024: 119,996 units), which is 27,776 fewer units than the record 144,625 electric 2Ws sold in the festive month of October. Nevertheless, November 2025 retails are still the second highest monthly sales in the calendar year to date, and take cumulative 11-month calendar year sales to 1.18 million units, up 10% YoY (January-November 2024: 1.07 million units).

November 2025 retail sales of 116,849 e-2Ws are the second highest monthly sales in the year to date.

TVS Motor Co’s 30,309 e-scooter sales in November, up 11% YoY, are its second-best monthly sales this year after March (30,772 units) and the third time that its monthly sales have crossed the 30,000-units mark since it entered the market with the iQube in January 2020. October 2024 (30,240 units) is the second highest monthly score. November sales give TVS a 26% e-2W market share for November 2025. With this performance, TVS has topped e-2W sales for the seventh time this year – it had a straight run at the top right from April to September, lost the crown in October and has now regained it in November.

What would have given a fillip to sales last month is the phased rollout of the new Orbiter e-scooter. Priced at Rs 99,900 (ex-showroom Bengaluru), inclusive of PM E-Drive Scheme subsidies, Orbiter sales have commenced in Karnataka and the company is now expanding into Maharashtra. This pricing places the Orbiter — which has a 3.1 kWh battery pack — on par with the base iQube variant that features a smaller 2.2 kWh battery pack. The Orbiter, which has a top speed of 68kph, is designed for urban commuting and has an IDC range of 158 km per charge.

TVS is also aiming for a first-mover advantage for e-2Ws in rural India. Speaking in an earnings call after the Q2 FY2026 results, KN Radhakrishnan, CEO, TVS Motor Co said: “I’m very sure GST reform is going to help rural (India) and (road) connectivity. I believe that for mobility needs in India, which has a lot of self-employed people, the two-wheeler is the best mobility solution. And rural is the most important driver. I’m very confident that rural will start growing in line with urban.”

Bajaj Auto, whose monthly retail sales crossed the 30,000-units mark for the first time in October 2025 (31,392 units) and helped it top the market, has registered retail sales of 25,526 units in November, down 3% YoY (November 2024: 26,419 units). This gives the Chetak manufacturer a share of 22% and helps it surpass the 250,000 units cumulative sales milestone for the first time in a calendar year. The company, which currently sells the Chetak and Yulu e-scooters is readying the launch of a brand-new model early in CY2026, which could mean potential Chetak buyers would be awaiting that model. Bajaj Auto continues to expand its Chetak network which now stands at 390 exclusive stores and 4,000 points of sale in 800 cities.

Ather Energy, which has made the No. 3 position its very own and clocked its highest monthly sales of 28,405 units in October, has sold 20,323 e-scooters in November, a robust 57% YoY growth (November 2024: 12,963 units). This puts it 9,986 e-2Ws behind TVS and 5,203 units behind Bajaj Auto. The e-2W start-up, which is fast reducing the sales gap with the two legacy OEMs, continues to witness surging demand for its Rizta family scooter, far more than that for the 450X or 450S models. The company has reported strong sales traction for the high-range (160km) options on the 450S and Rizta S, which has helped expand sales and market share. What’s more, the Battery as a Service (BaaS) option has enabled a reduction of the upfront price of the Rizta S to Rs 76,000, making the premium family scooter far more affordable.

The standout news of November has been Hero MotoCorp’s Vida brand rising to No. 4 position, ahead of Ola Electric. As per Vahan data, the company has delivered a total of 12,199 Vida e-scooters last month, up 66% YoY (November 2024: 7,352 units). This is 3,799 units more than Ola Electric (8,400 units), which gives Hero Vida a 10% market share – 3% more than Ola’s 7% in November 2025. The world’s largest two-wheeler manufacturer continues to be an EV newsmaker as a result of the robust demand for its new Vida VX2 model. Though October 2025 (16,014 units) remains its highest monthly sales yet, November marks five consecutive months of 10,000-plus e-scooter sales for Hero MotoCorp and its Vida e-2W brand.

Ola Electric, with retail sales of 8,400 units in November, down sharply by 71% YoY (November 2024: 29,322 units), slips to No. 5 in the e-2W OEM market and gives it a market share of 7% for last month. As per Vahan statistics, this is the lowest monthly retail sales for Ola in the current year to date after February 2025 (8,673 units).

The company, which manufactures and sells both e-scooters and e-motorcycles, had opened CY2025 with 24,411 units in January, which remains its highest monthly sales in the year to date. Ola’s cumulative 11-month retail sales (190,088 units) from January to end-November 2025 at 190,088 units are far fewer than TVS (272,874 units) or Bajaj Auto (250,366 units) and just 6,925 e-2Ws more than Ather Energy (183,163 units) in the same period. Clearly, Ola Electric will have to come up with an aggressive sales and product strategy if it is to regain the vigour and shine it had displayed not very long ago as the e-2W market leader.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, remains the firm No. 6 on the OEM ranking list with retails of 5,763 units and a 5% market share. This is GEM’s second highest monthly score this year after October (7,632 units). GEM and Ampere Vehicles, which are witnessing a revival of demand driven by new products like the Nexus, Magnus Neo and the Grand, recently surpassed cumulative retail sales of 250,000 units.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is ranked seventh amongst the Top 10 e-2W OEMs. Bgauss sold 2,566 units of its e-2Ws comprising the RUV 350 and Max C12 in November.

Bengaluru-based River Mobility, now rebranded River EV, which has a single product – the River Indie – is now a regular fixture in the Top 10 e-2W listing. The company sold a record 1,797 units in November, which gives it No. 8 position. This is the fifth straight month that sales have surpassed the 1,500-units mark. The company, which recently bagged the Red Dot Product Design Award 2025, rolled out the Indie Gen 3 in September and is fast expanding its sales network. Plans are to grow its dealer footprint from the existing 35-odd showrooms to 80 across India by March with a focus on Punjab, Rajasthan, Madhya Pradesh, Uttar Pradesh, and Gujarat.

Kinetic Green, which sells the E-Zulu, Zing, and the E-Luna, is ranked ninth in the Top 10 listing with 1,340 units, up 22% YoY. The company had hit its highest monthly sales in August (1,514 units). Kinetic plans to up the ante with the launch of a new premium family scooter in CY2026, the first of three models to be launched over the next 18 months. Given that it has a strong manufacturing infrastructure and a 400-strong network of exclusive e-2W dealers across the country, the company is looking to aggressively expand this business operation.

Pur Energy or Pure EV, with 1,071 units, wraps up the Top 10 e-2W OEM listing, narrowly edging out electric bikemaker Revolt Motors (1,046 units).

ALSO READ:

EV sales in India cross 2 million units in first 11 months of CY202