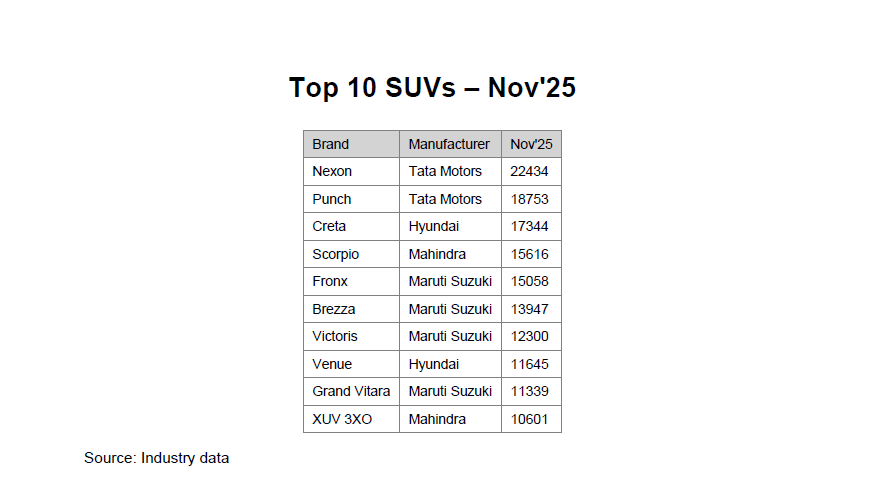

Tata Motors Passenger Vehicles Ltd, the newly renamed passenger vehicle arm of Tata Motors following the October 2025 demerger, strengthened its position in the Indian market in November by securing the top two spots in the SUV segment. The Nexon and Punch finished as the best selling SUVs of the month. The Nexon posted 22,434 units and the Punch followed with 18,753 units. This result further consolidates TMPV’s influence in the fast growing compact SUV category.

The Nexon continued to be TMPV’s strongest volume driver across its internal combustion and electric versions. Its appeal among urban buyers and young families remained steady in November. The Punch, which has become a cornerstone in the micro SUV segment, maintained consistent traction through both its ICE and EV variants.

The performance of these two models shows how TMPV has built depth in compact SUV sub segments. These sub segments currently account for a large share of incremental growth in the domestic market.

Strong Rankings in the Overall Passenger Vehicle Market

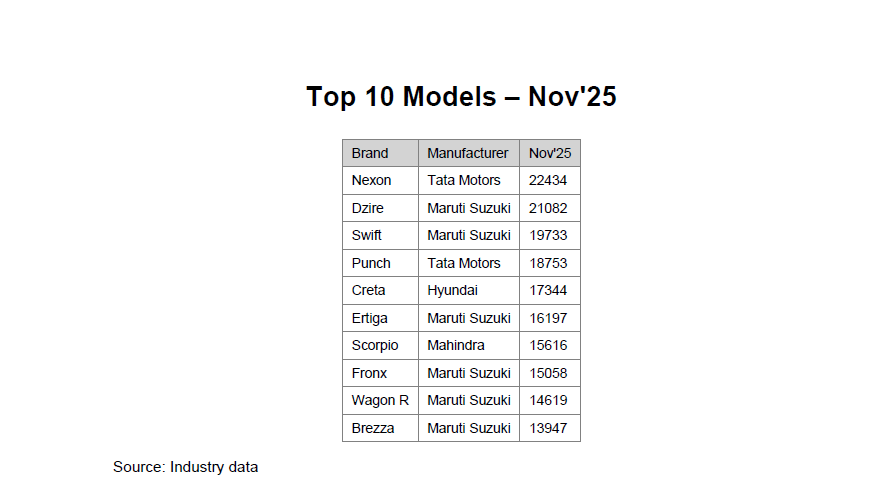

TMPV’s strength in the SUV category was clearly reflected in the overall passenger vehicle rankings. The Nexon finished as India’s best selling passenger vehicle in November. Maruti Suzuki’s Dzire with 21,082 units and the Swift with 19,733 units followed. The Punch finished fourth in the all India passenger vehicle chart.

This strong performance has helped TMPV remain competitive in the overall ranking where it has been engaged in a close contest with Hyundai Motor India and Mahindra and Mahindra for the second and third positions.

Lead Over Hyundai and Mahindra in SUV Standings

Despite strong numbers from competitors, TMPV retained a clear lead in the SUV ranking for November.

This table indicates the continued strength of TMPV’s compact SUV portfolio in a segment where competition is intense and where each model cycle has a significant effect on monthly market share.

Aligned With TMPV Guidance for Stronger Second Half

The performance in November is in line with TMPV’s earlier guidance that the second half of FY26 will be stronger. The company has highlighted that better supply chain visibility, improved availability of key trims, higher contribution from EVs, and planned model interventions will support outperformance during the latter part of the fiscal.

Executives have also indicated that refreshed and upcoming models will play an important role in maintaining volume momentum.

TMPV is preparing to introduce the all new Sierra and the Punch facelift in the second half of the year. These launches are expected to bring incremental volumes in the mid size and compact SUV categories. The Sierra will help expand the company’s presence in a higher value segment. The Punch facelift will refresh demand for one of the company’s most popular products.

Analysts expect both models to be important in sustaining TMPV’s competitive position in 2026, especially as the number of new SUV launches from rival manufacturers increases.

Closest Contest Among the Top Three OEMs

The Indian passenger vehicle market continues to see one of its tightest phases of competition. TMPV, Hyundai Motor India and Mahindra and Mahindra are very closely placed in the monthly wholesale and retail charts. Gains from new launches, facelifts and variant additions have become increasingly important in determining the short term ranking.

November’s data again confirms the continued shift in customer preference toward SUVs and crossover body styles. While compact cars like the Dzire and Swift remain strong contributors for the industry, SUVs continue to form the core of demand creation. TMPV has benefited significantly from this transition through its strong presence in the compact and micro SUV categories.