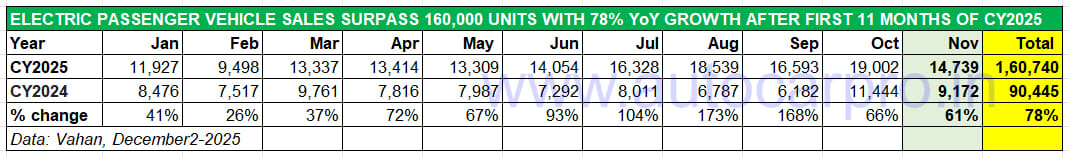

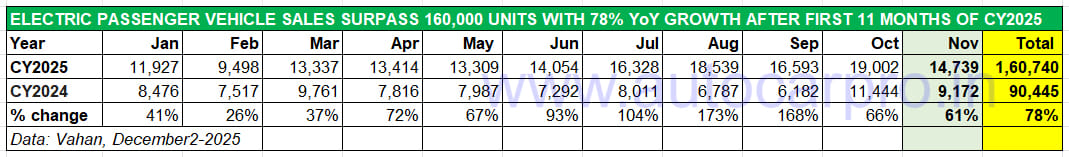

After the heady month of October 2025, which registered the highest-ever passenger vehicle retail sales of 550,000-plus units including a record 19,000 electric SUVs, MPVs, cars and sedans, November retail sales numbers are a lot more sedate. As per new electric vehicle registration and delivery data on the Vahan portal (December 2, 7am), a total of 14,739 units were sold last month, up 61% YoY (November 2024: 9,172 e-PVs).

November sales of 14,739 e-PVs are the fifth highest monthly sales in the current calendar year.

November was the second full month of sales after GST 2.0 kicked in on September 22, 2025, facilitating intensive price cuts enabled by the rationalisation of GST from 28% to 18% as also the withdrawal of the compensation cess. The 5% GST on EVs remains untouched, which essentially means that the once-substantial price gap between ICE PVs and EVs, particularly entry level models, has reduced sharply. November was also the third month of sales for the two new EV makers – Vinfast India and Tesla – who have joined the existing 14 players in the e-PV market, as has Maruti Suzuki India which is set to announce the prices of its first EV – the e-Vitara – today (December 2). While the Vietnamese EV maker has already hit the headlines, Tesla is yet to see strong sales traction. Let’s take a closer look the OEM-wise performance in November and their month-on-month growth or decline, along with their current market share.

TATA MOTORS SELLS OVER 6,000 UNITS FOR FIFTH MONTH IN A ROW

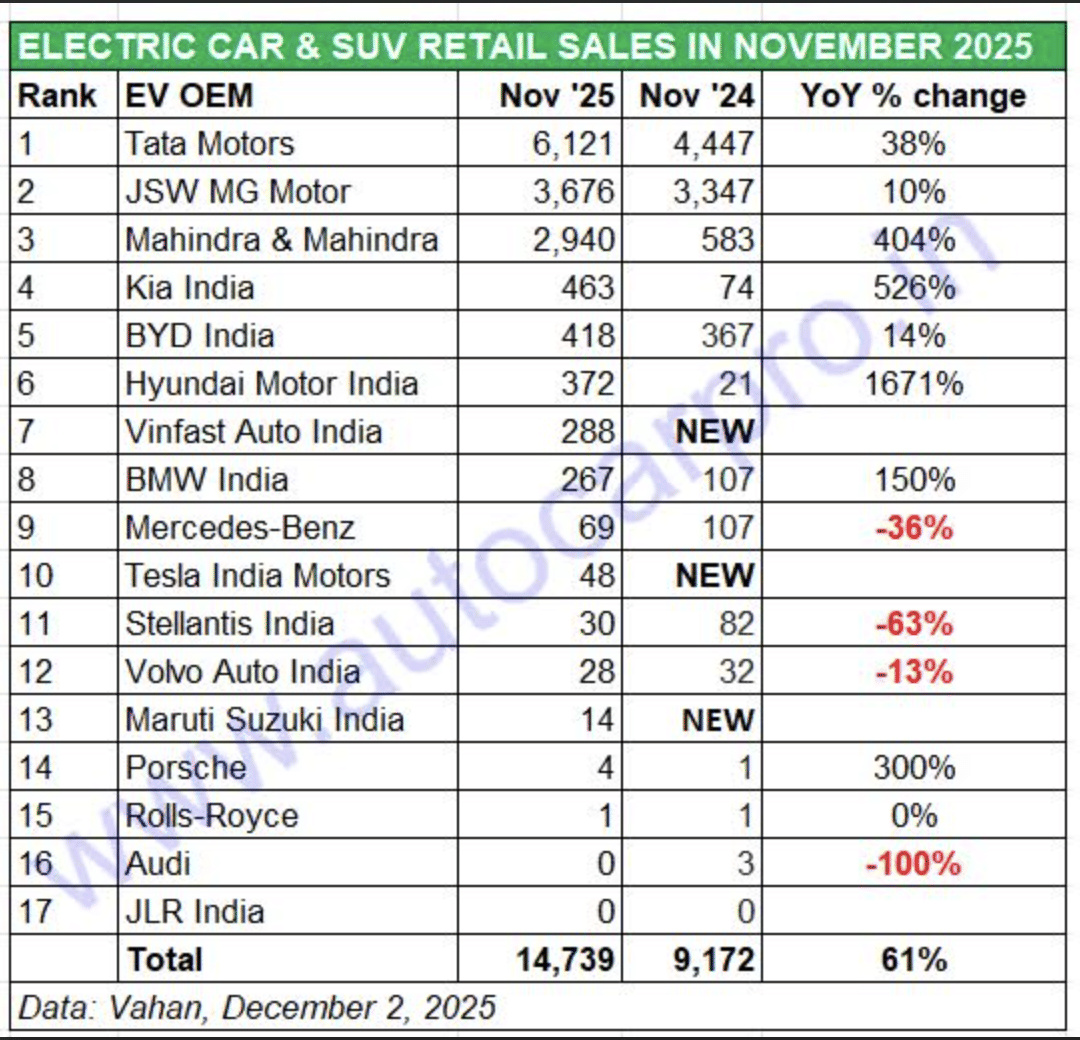

While six OEMs commanded 93% of November’s 388,624 passenger vehicle sales comprising both ICE and EVs, the e-PV market is led by three players – Tata Motors, JSW MG Motor India and Mahindra & Mahindra. These three OEMs, with combined retail sales of 12,737 units, accounted for 86% of the total e-PV sales of 14,739 units last month. On the cumulative 11-month scale, they have 88% of the market with 140,850 units from the total 160,628 e-PVs bought between January and November.

Electric PV market leader Tata Motors delivered 6,121 cars and SUVs last month, up 38% YoY (November 2024: 4,447 units), which sees its monthly share increase to 42% from the 40% it had in October and September 2025. While the recently launched Harrier EV has helped revive demand for the company, the Punch, Nexon and Curvv EVs continue to have their fair share of buyers. Tata Motors, whose EV portfolio also includes the Tiago and Tigor, has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of whom have launched new EVs in the past year.

JSW MG Motor India sold 3,676 e-PVs, which marks a 10% YoY increase (November 2024: 3,347 units) and a 25% e-PV market share. November makes for the company’s second lowest monthly sales after February 2025 (3,489 units) while the highest was July (5,350 units). Last month also saw the company register cumulative EV sales of 100,000 units, with the game-changing Windsor EV being the growth accelerator. The company, which has made inroads into Tata Motors’ market share with the Windsor EV and its BaaS option, has expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster priced at Rs 72.49 lakh. Both models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

Mahindra & Mahindra, which reclaimed its No. 2 PV OEM status in November after being upstaged by Tata Motors in September and October, registered retail sales of 2,940 e-SUVs last month. This constitutes 404% YoY growth on a low year-ago base (November 2024: 583 XUV400s). The company, which is seeing strong demand for the two new electric origin SUVs – BE 6 and XEV 9e – launched the XEV 9S on November 27 at Rs 19.95 lakh up to Rs 29.45 lakh (ex-showroom) for the top-end variant. The XEV 9S is Mahindra’s first three-row, born-electric SUV based on the modular INGLO skateboard platform and slots above the stylish XEV 9e and the radical BE 6 SUVs, both of which are two-row EVs. With battery options spanning 59 kWh, 70 kWh, and 79 kWh, the XEV 9S introduces technology and comfort features that the company typically associates with vehicles positioned much higher in the market. In November, M&M had a 20% e-PV market share and takes its 11-month total to 31,191 e-SUVs.

Kia India, which was ranked eighth a year ago, has risen four ranks to become the No. 4 e-PV OEM in November 2025 with 463 units, a 526 % YoY increase on a low base (November 2024: 74 EVs). This gives Kia a 3% e-PV market share, which puts it ahead of both BYD India and Hyundai Motor India. This rise can be attributed to growing demand for the mass-market Carens Clavis EV MPV. Kia’s EV portfolio also contains the EV6 and EV9, which are imported as CBUs into the country and, as a result, are far more expensive than the mass-market Carens Clavis EV-MPV.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer has slipped to fifth rank on the e-PV OEM sales table, with retail sales of 418 units last month, up 14% YoY (November 2024: 367 units). BYD’s Indian arm, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, is set to increase the price of the Sealion 7 from January. However, it has announced that bookings made before December 31 will get the current ex-showroom pricing of Rs 48.90 lakh for the Premium variant and Rs 54.90 lakh for the Performance variant. Following its launch at the Bharat Mobility Global Expo 2025 in January, the Sealion 7 has sold over 2,000 units in India, indicating strong market acceptance in the premium EV segment.

Hyundai Motor India sold 372 e-SUVs last month, up 1671% YoY (November 2024: 21 Ioniq 5s) which gives it a 2.52% share of the e-PV market. Following the launch of the Creta Electric in January 2025, monthly sales had risen from 775 units in February to 905 units in March but since then demand has tapered for the zero-emission avatar of India’s best-selling midsize SUV.

November’s e-PV market newsmaker is Vinfast India, which is now the new No. 7 e-PV OEM. The Indian arm of the Vietnamese EV manufacturer, which markets the locally assembled VF6 and VF7 e-SUVs, delivered 288 units to customers last month, as per Vahan statistics and up 113% MoM (October 2025: 135 units). This sees the Vietnamese EV maker move up to seventh place from eighth in October amongst the 17 e-PV OEMs in India. What’s more, Vinfast India has outsold the luxury EV market leader BMW India (267 units) in November. The company, which has partnered with the State Bank of India and ICICI Bank for EV customer financing, has opened 24 dealerships in major Indian cities with plans to add another 11 by the end of this year. Recognising the potential of the growing market for electric MPVs and the demand for the Kia Carens Clavis EV and the BYD eMax 7, Vinfast India has confirmed plans to launch its third premium EV – the seven-seater Limo Green electric MPV – in February 2026.

Interestingly, Maruti Suzuki India makes its appearance for the first time in the EV section of the Vahan statistics. The portal has listed 14 units to the company, which could mean that the company has sold 14 units of the soon-to-be-launched e-Vitara midsize SUV to its dealers.

LUXURY CARMAKERS SELL 417 EVs IN NOVEMBER

Combined sales of the eight luxury EV manufacturers at 417 units in November 2025 are up 66% YoY (November 2024: 251 units). This gives them a 3% share of the overall e-PV market for last month.

BMW India, the luxury EV market leader, sold 267 units in November which gives it a 64% share of luxury e-PV sales. However, rank-wise, BMW India is now the No. 8 with Vinfast India moving up the ladder. In the first 11 months of CY2025, BMW India has sold 2,837 e-PVs.

Mercedes-Benz India, the No. 2 luxury e-PV OEM, has registered retails of 69 zero-emission vehicles in November 2025 for a 17% luxury e-PV market share but down 36% YoY (November 2024: 107 units). For the January-November 2025 period, the German carmaker has sold a total of 1,087 e-PVs, up 28% YoY (January-November 2024: 851 units).

Tesla India, which has received over 600 bookings for the Model Y, delivered 48 units of the e-SUV to customers in Mumbai, Delhi, Pune, and Gurugram last month and is currently ranked No. 3 amongst the luxury OEMs. Over the past three months, the American EV maker has sold 157 units of the Model Y which is imported into India as a CBU product.

Meanwhile, Volvo Auto India delivered 28 EVs last month, down 13% YoY (November 2024: 32 units).

Cumulative e-PV industry sales in the first 11 months of CY2025 at 160,628 units have raced past entire CY2024 sales of 99,694 units. Given the current sales momentum and the launch of the much-awaited Maruti e-Vitara in December 2025, expect this zero-emission vehicle segment to register record retail sales of around 175,000-180,000 units this calendar year, setting a new benchmark for the e-PV industry in India.

ALSO READ: Annual EV sales in India surpass 2 million units for the first time