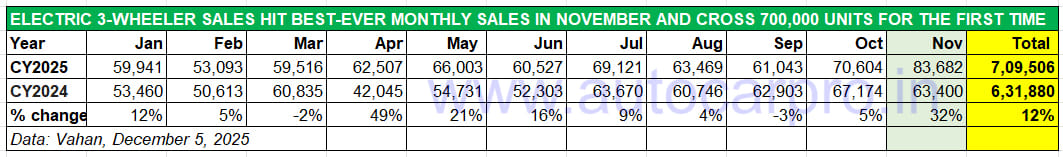

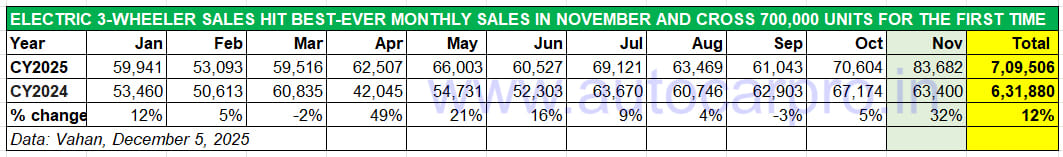

India’s electric three-wheeler industry, which is the segment witnessing the fastest transition to electric mobility, continues to register robust growth mainly driven by legacy ICE OEMs which have diversified into zero-emission vehicles. In November 2025, the e-3W industry registered record retail sales of 83,682 units, which marks handsome 32% YoY growth (November 2024: 63,400 units).

November sales translate into 2,784 units sold every day and take cumulative January-November 2025 sales to 709,506 units, up 12% YoY. Autocar Professional had accurately forecast the crossing of the 700,000 milestone in November itself. This stellar performance also ensures that India remains the world’s largest e-3W market for the third year in a row, having beaten China in CY2023 for the first time.

Deliveries of e-3Ws crossed the 80,000 mark for the first time in November 2025 and enabled total sales to surpass the 700,000 milestone for the first time.

India e-3W Inc’s robust performance, which is driven by four legacy OEMs – Mahindra & Mahindra, Bajaj Auto, TVS Motor Co and Piaggio Vehicles – has ensured that the India e-3W has raced past the 700,000 retail sales milestone for the first time in a calendar year, surpassing CY2024’s 691,296 units.

Compared to its e-2W and e-passenger vehicle siblings, the e-3W segment is far more resilient. Proof of this is the November sales. While e-2Ws (116,849 units, down 19% MoM) and e-passenger vehicles (14,739 units, down 22% MoM) registered a month-on-month decline versus their record October 2025 sales, the e-3W industry has bucked the trend with an 18.52% month-on-month increase (October 2025: 70,604 -e3Ws).

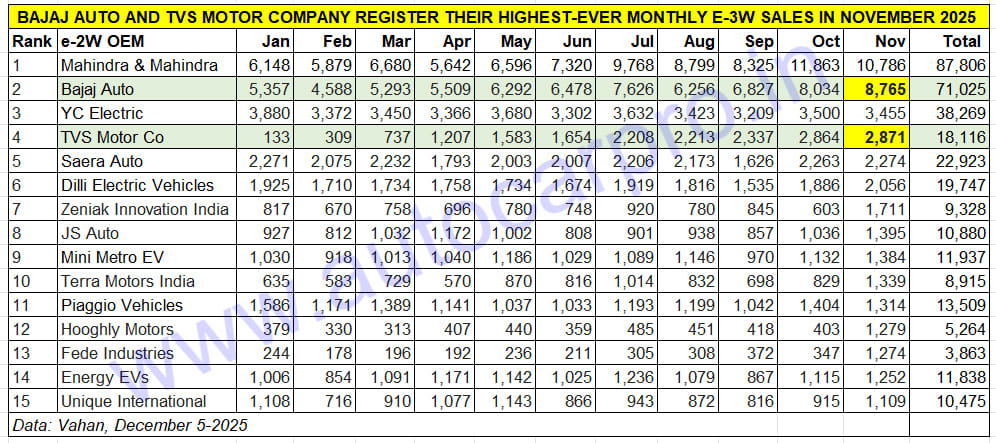

November sees two of the top three legacy OEMs improve upon their October sales. While market leader Mahindra & Mahindra (10,786 e-3Ws) witnessed a 9% MoM decline, Bajaj Auto registered a 9% MoM increase with best-ever monthly retails of 8,765 units and TVS Motor Co sold seven more units in November (2,871 units), which nevertheless makes for its highest monthly sales for the company which is a recent entrant in the 600-player-strong e-3W market.

Mahindra, TVS and Bajaj Auto Command 27% of November Sales

The electric 3W segment has the largest number of players – over 600 – compared to the two-wheeler, passenger vehicle or commercial vehicle segments. In November 2025, the Top 10 companies sold 36,036 units and accounted for 43% of the record 83,682 units sold last month. Combined e-3W sales of M&M, TVS and Bajaj Auto, which are the top three ICE legacy OEMs, at 22,422 units constitute 27% of November sales. For the first 11 months, these three OEMs’ sales at 176,947 units make for one-fourth or 25% of the total 709,506 units, establishing their grip on the growing market.

Mahindra Last Mile Mobility (MLMM) delivered 10,786 e-3Ws to customers last month, up 51% YoY (November 2024: 7,134 units). This is the market leader’s second-best monthly sales in the year to date after a new high in October (11,863 units) and gives MLMM a 13% market share.

As the first legacy OEM to plug into e-mobility nearly a decade ago, Mahindra & Mahindra and MLMM now offer the largest e-3W portfolio, including the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus, and e-Alfa Cargo. From January to November 2025, MLMM has clocked sales of 87,806 units, up 40% YoY (January-November 2024: 62,567 units), which gives it a 12% market share for the current year.

Bajaj Auto, which had sold 41,905 units in CY2024 and had a 6% e-3W market share last year, is likely to double its sales in CY2025. January-November 2025 sales (71,025 units) translate into an additional 29,120 units and have risen 88% YoY ((January-November 2024: 37,668 unit), giving the company a current market share of 10 percent.

Monthly sales crossed the 8,000-unit sales mark for the first time in October and have scaled a new high of 8,765 units in November. The company, which has the GoGo brand of passenger and cargo e-3Ws, has recently expanded its portfolio with the Riki e-rickshaw. With December numbers still to be factored, as also the market entry of the Riki e-rickshaw, in both passenger and cargo variants, expect Bajaj Auto to clock total sales of around 82,000-85,000 units in CY2025.

Despite the advance of M&M and Bajaj Auto, third-ranked and longstanding player YC Electric remains a formidable competitor. In November, the company delivered 3,455 units for a 4% market share. The company offers five models: Yatri Super, Yatri Deluxe, and Yatri for passenger transport, and E-Loader and Yatri Cart for cargo operations. YC Electric’s cumulative 11-month sales are 38,269 units which gives it a 5% share of total CY2025 YTD sales.

The No. 4 OEM is TVS Motor Co with 2,871 units — its highest monthly e-3W sales to date — capturing a 3% share of the 83,682 e-3Ws sold in India last month. TVS’ cumulative sales of 18,116 e-3Ws over the past 11 months of CY2025 give it a 2.55% market share of the total 709,506 units. It’s a very creditable performance given that the company has recently entered the market.

Rajasthan-based Saera Electric Auto, which manufactures the nine-model Mayuri brand of electric rickshaws, ranks fifth in the Top 10 list with November sales of 2,274 units but is No. 4 in cumulative 11-month sales (22,923 units) and ahead of TVS (18,116 units). Like several other e-rickshaw makers, Saera Auto has been impacted by the growing presence of legacy OEMs in the e-3W industry.

Sixth-ranked Dilli Electric Auto delivered 2,056 e-3Ws in November, its highest sales this year. The Haryana-based company manufactures electric rickshaws under the CityLife brand — a segment now under pressure as legacy players like MLMM, Bajaj Auto, TI Mobility, and now TVS target it with better-built, safer products.

Ranks 7-10 are comprised of Zeniak Innovation India (1,711 units), JS Auto (1,395 units), Mini Metro Electric Vehicles (1,384 units) and Terra Motors India (1,339 units) respectively.

Legacy OEM Piaggio Vehicles comes in at 11th position with 1,314 units, which is the fourth highest sales this year after January (1,586 units), October (1,404 units) and March (1,389 units). The company, which has launched two new models under its Apé Electrik range – the Apé E-City Ultra and Apé E-City FX Maxx – in July, has sold 13,509 units between January and November this year for a 2% market share.

Mahindra & Mahindra, TVS and Bajaj Auto, with combined sales of 22,422 units, account for 27% of November’s record sales. TVS and Bajaj have clocked their highest monthly numbers.