India’s automobile retail sector demonstrated unexpected resilience in November 2025, posting a 2.14% year-on-year growth despite typically experiencing a post-festive slowdown, according to data released by the Federation of Automobile Dealers Associations (FADA).

The performance is particularly noteworthy given the high comparison base from November 2024, when Diwali and Dhanteras fell late in October, pushing many vehicle registrations into November. This year, most festive registrations were completed in October itself.

Passenger vehicles led the growth trajectory with a robust 19.71% year-on-year increase, driven by improved availability of high-demand models, strong compact SUV sales, and marriage season purchases. Commercial vehicles followed closely with 19.94% growth, while three-wheelers surged 23.67%.

The tractor segment recorded the highest growth at 56.55%, reflecting strong rural demand. However, two-wheelers saw a marginal 3.1% decline, attributed to the retail shift to October and supply constraints for preferred models.

FADA President C S Vigneshwar highlighted that GST 2.0 rate reductions coupled with manufacturer-dealer retail offers continued attracting customers to showrooms beyond the festive period. Price reductions across categories, which began in October, sustained conversion momentum through November.

Passenger vehicle inventory improved significantly to 44-46 days from 53-55 days previously, indicating healthier demand-supply dynamics.

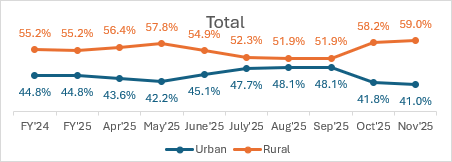

The near-term outlook appears positive with improving rural indicators. Rabi season sowing crossed 39.3 million hectares, significantly ahead of last year, driven by robust soil moisture and better seed availability. Wheat, pulses, and oilseeds recorded sharp acreage expansion, signaling improved farm income prospects.

The India Meteorological Department’s forecast of a colder-than-normal winter across northern and central plains is expected to boost mobility needs and logistics activity.

According to FADA’s dealer survey, 74% of dealers expect growth over the next three months, reflecting broad-based confidence. For December specifically, 63.93% anticipate growth, while 30.36% expect flat performance.

Liquidity conditions remain stable, with 47.14% of dealers reporting neutral conditions and 44.29% reporting good liquidity. Overall sentiment is positive, with 54.29% of dealers expressing optimism.

In terms of market share, Hero MotoCorp led the two-wheeler segment with 34.80%, followed by Honda at 23.81%. Maruti Suzuki dominated passenger vehicles with 39.41% share, while Mahindra & Mahindra held 13.70%.

Electric vehicle adoption continued its gradual climb, with EVs accounting for 4.59% of two-wheeler sales, 62.49% of three-wheeler sales, and 3.77% of passenger vehicle registrations.

The industry enters 2026 with cautious optimism, supported by GST reforms, strong enquiry pipelines, and improving rural fundamentals. Expected January price increases, new model launches, and marriage season demand are anticipated to drive conversions in the coming months.

However, some moderation is expected due to model-year change dynamics and the absence of festive triggers in January-February. FADA characterizes the overall sentiment as consolidating gains while remaining watchful of supply alignment and calendar-year dynamics.

The data was collated from 1,401 out of 1,459 Regional Transport Offices across India, in collaboration with the Ministry of Road Transport & Highways.