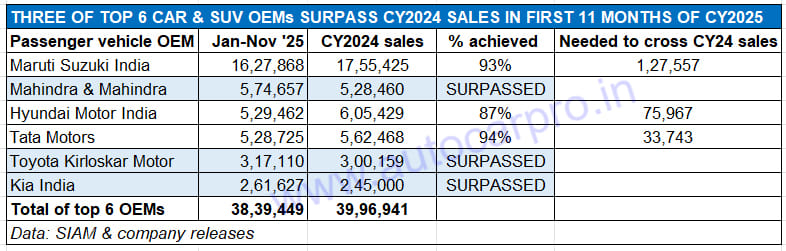

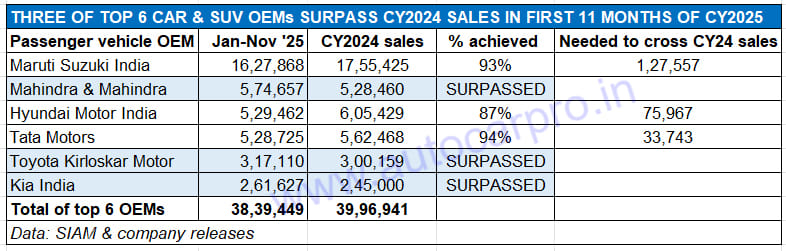

As accurately forecast in its future growth outlook for the Top 6 passenger vehicle manufacturers, published on October 6, three OEMs – Mahindra & Mahindra, Toyota Kirloskar Motor and Kia India – have become the first of the Top 6 PV OEMs to surpass their record sales of CY2024. Each of this trio has gone past their respective annual sales for last year this November.

The other half comprising Maruti Suzuki India, Hyundai Motor India and Tata Motors have this month (December 2025) to be counted before they surpass their CY2024 total. However, while Maruti Suzuki and Tata Motors, which have already clocked 93% and 94% respectively of their last year’s sales in the first 11 months of CY2025, Hyundai with 87% achieved needs to dispatch another 75,968 PVs this month if it is to exceed its CY2024 total of 605,429 units. And that seems daunting, which means it could be the only one of these six PV OEMs to see a calendar year-on-year sales decline in CY2025.

In CY2024, as per SIAM wholesales data, a total of 4.27 million (42,74,793 units) passenger vehicles were sold, up 4% YoY. Of this, the top six PV OEMs last year – Maruti Suzuki, Hyundai, Tata Motors, Mahindra, Toyota and Kia – accounted for 3.99 million (39,96,671 units) or a 93% share, leaving the balance 7% to be fought over by the 10 other car and SUV manufacturers.

Eleven months into CY2025, the 16 SIAM-member PV OEMs’ estimated wholesales of 4.07 million units are 95% of the CY2024 total, which means India PV Inc needs to sell another 202,000-odd vehicles in December to exceed last year’s record wholesales.

What has helped the segment very close range of the CY2024 total is the highest-ever monthly factory dispatches of 460,739 PVs in festive October which was also the first full month of GST 2.0 which reduced prices of most cars, SUVs and even MPVs and brought pent-up consumer demand to the fore.

The Top 6 OEMs’ combined sales of 38,39,449 hatchbacks, sedans, SUVs, MPVs and vans are a 3.6% YoY increase (January-November 2024: 37,05,002 PVs) and give them a 94% share of the PV market for the past 11 months. Of the six OEMs, five barring Hyundai achieved their highest-ever monthly sales. Let’s take a quick look at this six-pack’s performance.

While Mahindra, Toyota and Kia have already registered record annual sales in the first 11 months of CY2025 itself, Maruti Suzuki, Hyundai and Tata Motors still need their December sales to reach there.

While Mahindra, Toyota and Kia have already registered record annual sales in the first 11 months of CY2025 itself, Maruti Suzuki, Hyundai and Tata Motors still need their December sales to reach there.

Maruti Suzuki had sold 1.75 million units in CY2024, up 3% (FY2023: 1.70 million units). Now, with 1.62 million units sold in the first 11 months of CY2025 (flat sales of 0%: January-November: 16,25,308 units), which is 93% of last year’s total, the company has to sell an additional 127,558 PVs to surpass that score. This calls for average sales of 158,282 units for each of the next three months. December 2025 should see the PV market leader sell more than the 130,117 units it sold last December. That’s because the GST 2.0-driven rate cuts have helped revive demand in the entry level hatchback market, particularly from town and country. This, along with the sustained demand for most of its eight utility vehicles, should see Maruti Suzuki sell over 150,000 PV in the last month of this calendar year.

The outlier OEM in CY2025 is Mahindra & Mahindra which has risen two ranks from No. 4 in CY2024 to being the current No. 2 PV OEM in CY2025 YTD. The SUV maker, which sold over half-a-million SUVs (528,460 units) for the first time in a calendar year in CY2024 has already gone past that total. Its January-November 2025 wholesales at 574,657 units are a robust 18% YoY increase (January-November 2024: 487,036 units). This translates into an additional 46,197 SUVs sold YoY. This stellar market performance is the result of surging demand for the Scorpio N and Classic, Thar Roxx, 3X0 aas well as fresh contribution from the two Born Electric SUVs, BE 6 and XEV 9e. With strong sales momentum continuing, M&M is well set to drive past the 600,000 annual sales milestone for the first time and register record wholesales of around 610,000 SUVs (up 15% YoY) in CY2025.

Hyundai Motor India, which was the longstanding No. 2 PV OEM till CY2024, is currently ranked No. 3 amongst the Top 6 players. The 529,462 cars and SUVs sold in January-November 2025 are down 6% YoY (January-November 2024: 563,221 units). The company, whose best-seller is also India’s No. 1 midsize SUV (Creta) needs to sell 75,967 PVs in December to be level with its record CY2024 wholesales of 605,429 units. That seems difficult considering its best month this year was October (53,792 units, down 3% YoY) and that the company saw a YoY decline in nine of the past 11 months, barring September and November. This would also mean that Tata Motors, currently No. 4 and just 737 units behind Hyundai, would go ahead to take the No. 3 podium position in CY2025.

Tata Motors has, in the past 11 months, dispatched 528,725 cars and SUVs, up 2% YoY (January-November 2024: 518,238 units). This is 94% of its best-ever annual score in CY2024 (562,468 units) and needs to sell another 33,744 units to achieve that. The company’s EV portfolio (74,219 units, up 8% YoY) has contributed 14% to PV sales and is set to end this calendar year with record sales of over 80,000 units. Expect Tata to sell around 52,000 PVs including EVs this month which would take its CY2025 total to 580,000 units, making it the fourth year in a row that the company has surpassed half-a-million wholesales. And also make it the new No. 3 for CY2025.

Toyota Kirloskar Motor, which has witnessed sustained strong demand for most of its products particularly the Innova Hycross MPV and the Hyryder midsize SUV, has already hit its highest-ever annual sales in the January-November period: 317,110 units. This includes its best-ever monthly sales of 40,247 units, up 43% YoY, in October.

Kia India, with wholesales of 261,627 units and 11% YoY growth (January-November 2024: 236,043 units), is the third OEM to have already registered its highest annual sales, with December numbers yet to be counted. Of its current model portfolio, the Sonet compact SUV is the best-seller, followed by the Carens MPV and Seltos midsize SUV, whose second-generation model is to be globally unveiled tomorrow (December 4).

DECEMBER BIDS FAIR TO BE A HIGH-SELLING YEAR-ENDER

December usually is a month which sees temporary moderation of new vehicle registrations as buyers tend to defer their purchase decision to the new model year. However, plenty of model availability, growing demand for compact SUVs as well as wallet-friendly year-end deals could see the PV industry scale a new high in December 2025.

December 2024 (314,934 PVs) was a 10% YoY increase over December 2023 (286,390 units) and 14% over December 2022 (275,352 units). Will this December surprise with over 330,000 units? Watch this space for the latest sales updates and analyses.

ALSO READ: Utility Vehicle Industry Poised for Record Sales of 2.8 Million Units in CY2025