StraCon Business Advisory & Consultancy Firm released a report analyzing India’s electric vehicle sector from 2019 to 2024, during which annual sales increased from 434,000 units to 2.08 million units. The study, titled “India’s Electric Mobility Landscape: Five-Year Market Trends and the Path to 2030,” examines market evolution and proposes seven measures to address structural challenges.

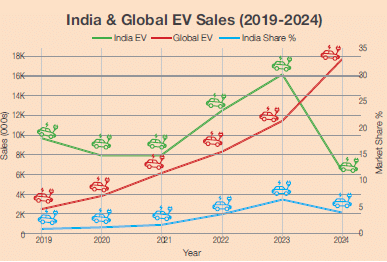

India became the world’s second-largest electric vehicle market by volume during the study period. The market expanded at a compound annual growth rate of 47.9 percent, exceeding the global rate of 34.3 percent. Electric vehicle penetration rose from 1.2 percent of total vehicle sales in 2019 to 7.66 percent in 2024. Public charging infrastructure expanded from 500 stations in 2019 to over 29,000 stations by mid-2025.

The report notes India’s 2030 target of 30 percent electric vehicle penetration remains distant. Electric vehicles accounted for 7.66 percent of overall vehicle sales in 2024, compared to the global average of 16.48 percent.

Anamika Singh, Partner & Editor at StraCon, said, “The momentum is real, but sustaining it will require more than enthusiasm. Policy consistency, stronger domestic manufacturing, and smarter financing will determine whether India can convert this early headway into a long-term competitive advantage.”

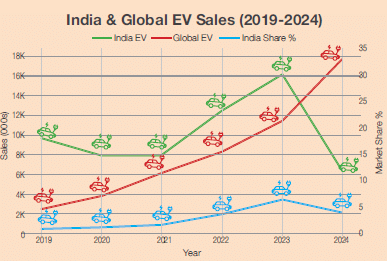

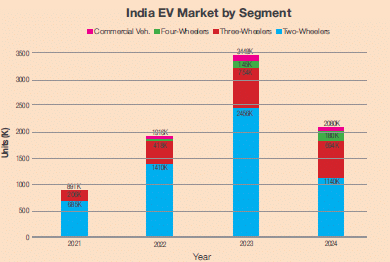

Market data shows segment-specific patterns. Two-wheelers expanded from 685,000 units in 2021 to a peak of 2.456 million units in 2023 before declining 54 percent to 1.14 million units in 2024, representing 54.8 percent of the market. Three-wheelers grew from 206,000 units in 2021 to 694,000 units in 2024, accounting for 33.4 percent of sales. Four-wheelers demonstrated sustained growth from 43,000 units in 2022 to 180,000 units in 2024, achieving a compound annual growth rate of 64.7 percent.

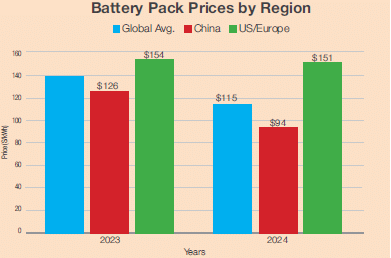

Lithium-ion battery pack prices declined from USD 156 per kilowatt-hour in 2019 to USD 115 per kilowatt-hour in 2024. The report identifies this as a factor enabling affordability improvements, particularly for two-wheelers and three-wheelers. Indian battery pack costs dropped 85 percent between 2014 and 2024.

The study identifies challenges including subsidy disbursal delays of six to twelve months, fragmented state-level policies, complete import dependence for lithium and cobalt, and geographic concentration of charging infrastructure. Karnataka, Maharashtra, and Uttar Pradesh account for 40 percent of charging stations despite representing approximately 25 percent of vehicle registrations. The electric vehicle to charger ratio improved from 868:1 in 2019 to 71:1 by August 2025, though this remains above international benchmarks of 10 to 15 vehicles per charger.

Suketu Thanawala, Partner for Business Development at StraCon, said, “India has the depth of market and engineering talent to lead globally in affordable electric mobility. But the ecosystem must mature in a coordinated way — from recycling and diagnostics to financing and charging accessibility.”

The report proposes seven interventions. A National Battery Passport would create blockchain-based digital records of battery health, charge cycles, and remaining useful life to address used electric vehicle valuation uncertainty. Public-Private Recycling Zones would co-locate battery recycling facilities in designated industrial corridors with government-funded shared utilities. Flexible leasing models would decouple vehicle ownership from battery ownership through subscription arrangements.

Additional measures include Urban Mobility Credits requiring developers of projects exceeding 50,000 square meters to install charging infrastructure at minimum ratios of one charger per 20 parking spaces. A carbon trading platform would enable commercial fleet operators to monetize emission reductions through tradeable credits. Government support for artificial intelligence-based battery diagnostics would strengthen resale valuation and predictive maintenance capabilities. A National Electric Vehicle Financing Facility would provide concessional-rate loans through development financial institutions.

The report projects these measures could reduce India’s oil import bill by USD 20 to 30 billion annually and generate 500,000 to 750,000 jobs by 2030. Market valuation expanded from USD 3.2 billion in 2019 to USD 23.38 billion in 2024, with projections indicating USD 113.99 billion by 2029.

India’s global market share declined from 17.9 percent in 2019 to 11.7 percent in 2024, reflecting faster growth in other markets, particularly China, which accounted for 49.9 percent of global sales in 2024 with 8.88 million units. Europe’s share decreased from 24 percent to 17 percent, while the United States maintained 7.6 percent with 1.36 million units.

StraCon Business Advisory & Consultancy Firm is a research and consulting organization operating across risk advisory, industry research, human capital solutions, and business development.