With 1.94 million scooters, motorcycles and mopeds sold last month, November 2025 turned out to be the best-ever November for the Indian two-wheeler industry. While motorcycles (1.16 million units, up 17% YoY) continue to command the bulk of 2W sales, the share of scooters (735,753 units, up 29% YoY) has risen while that of bikes has fallen. In November 2025, the scooter share of the overall 2W market rose to 38% compared to 35% in November 2025, while that of motorcycles fell to 60% from 62% in November 2025. The humble mopeds accounts for the remaining minuscule share.

Cumulative sales for the first 8 months of FY2026 also paint the same picture. Of the 14.39 two-wheelers sold in April-November 2025, up 3% YoY, the motorcycle share (8.73 million units) is 61% versus 63% in the year-ago period. Meanwhile, the scooter share (5.28 million units) has risen to 37% versus 34% in April-November 2024.

SIAM wholesales data also reveals that 663,850 electric 2Ws were sold in April-November 2025, up 32% YoY (April-November 2024: 502,165 units) translating into the EV share of the overall scooter market increasing to 13% from 10% a year ago. Of the nine SIAM scooter member companies, Piaggio and Yamaha are the only ones without an EV.

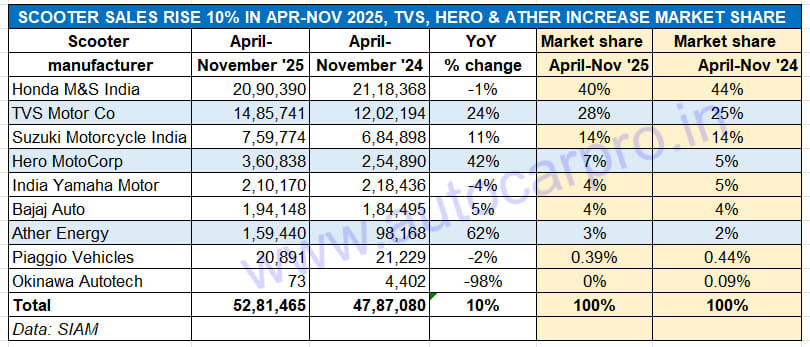

Of the nine scooters OEMs, only TVS Motor Co, Hero MotoCorp and Ather Energy have increased their market share with their electric scooters providing a growth accelerator.

Of the nine scooters OEMs, only TVS Motor Co, Hero MotoCorp and Ather Energy have increased their market share with their electric scooters providing a growth accelerator.

HONDA SHARE REDUCES TO 40%, TVS SHARE INCREASES TO 28%

A deep dive into the wholesales performance of the nine scooter OEMs for the past eight months reveals that five – TVS, Suzuki, Hero MotoCorp, Bajaj Auto and Ather – have registered YoY growth while Honda, Yamaha, Piaggio and Okinawa have seen a YoY decline (see SIAM data table above).

Honda Motorcycle & Scooter India, the longstanding monarch of the scooter market, has sold 2.09 million units, which marks a 1% YoY decline. This comprises 20,87,851 units of the Activa, Dio and Dio 125 (down 1% YoY) and 2,539 units of the Activa-e and QC1 electric scooters. As a result of having dispatched 27,978 fewer scooters YoY, HMSI’s market share has reduced to 40% from 44% a year ago.

No. 2 scooter OEM TVS Motor Co has increased its market share to 28% from 25% a year ago. This is the result of dispatching 1.48 million units, up 24% YoY and 283,547 units more than it did a year ago. This total comprises 12,67,788 units of the Jupiter, NTorq and Zest ICE scooters (up 24% YoY) and 217,953 iQube e-scooters, up 23% YoY. The EV share of TVS’ scooter sales has however fallen to 15% from 17% a year ago, what with the substantially increased ICE scooter volume.

Suzuki Motorcycle India, which sells scooters in the form of the 124cc Access, Avenis and Burgman and has revealed the electric avatar of the Access (whose sales have yet to commence), has sold 759,774 ICE scooters in the past eight months. While this marks good 11% YoY growth, Suzuki’s market share remains unchanged at 14 percent.

Hero MotoCorp has increased its scooter market share to 7% from 5% a year ago as a result of dispatching 360,838 units, a strong 42% YoY increase from an additional 105,948 units. This total comprises 269,437 units of the Destini, Maestro and Pleasure, 1,704Xooms and 89,697 Vida e-scooters. While the ICE scooters have posted a 25% YoY increase, the zero-emission Vida V2 and V2X have clocked handsome 178% YoY growth, thereby contributing to the company’s increased scooter market share.

India Yamaha Motor, ranked fifth on the OEM scale with 210,170 units, is down 4% YoY and witnesses a resultant drop in its scooter share to 4% from 5% a year ago.

Bajaj Auto, which is in the scooter market because of its Chetak and Yulu electricscooters, dispatched 194,148 units, up 5% YoY, albeit its 4% scooter market share remains unchanged.

Ather Energy continues to ride a wave of demand for its Rizta family scooter, which recently surpassed cumulative sales of 200,000 units in a little over 20 months since launch in July 2024. The company, which also sells the 450S and 450X e-scooters, has registered total wholesales of 159,440 units, up 62% YoY. This gives Ather a 3% scooter market share versus 2% a year ago.

Italian scooter maker Piaggio Vehicles, with 20,891 units, posted a 2% YoY decline, which sees its market share reduce to 0.39% from 0.44% a year ago.

SCOOTER INDUSTRY HEADED FOR RECORD 7 MILLION SALES IN FY2026

Powered by best-ever monthly sales of 824,003 units in October 2025, the Indian scooter industry, which hit record wholesales of 6.85 million units in FY2025, seems well set for another mega fiscal in FY2026. Eight months into the current fiscal year, at 5.28 million units, the segment is 1.57 million units away from the record FY2025 total. Given the current strong and sustained growth, and having averaged monthly sales of 660,183 units, this segment is well set to achieve the 7 million sales mark for the first time in FY2026.

ALSO READ:Hero Vida Races Past 100,000 Sales in a Year for the First Time

TVS Tops E-2W Sales for Seventh Time This Year in November, Hero Vida Races Past Ola