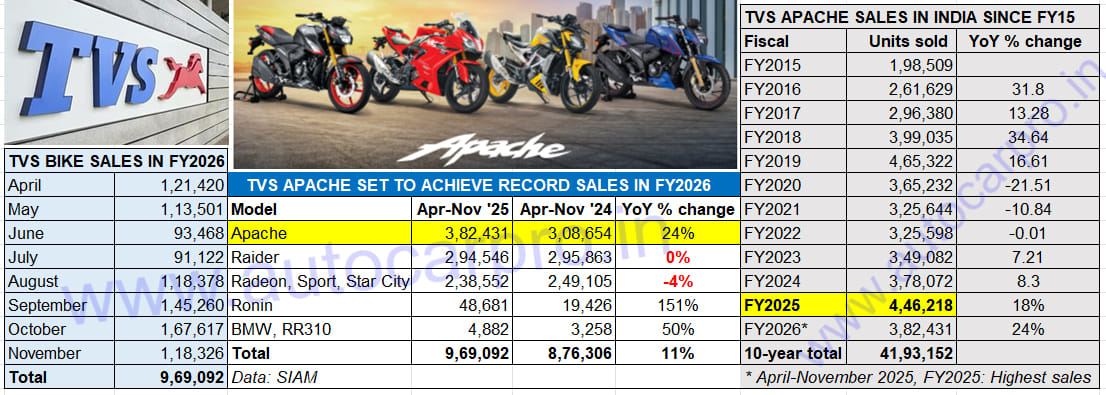

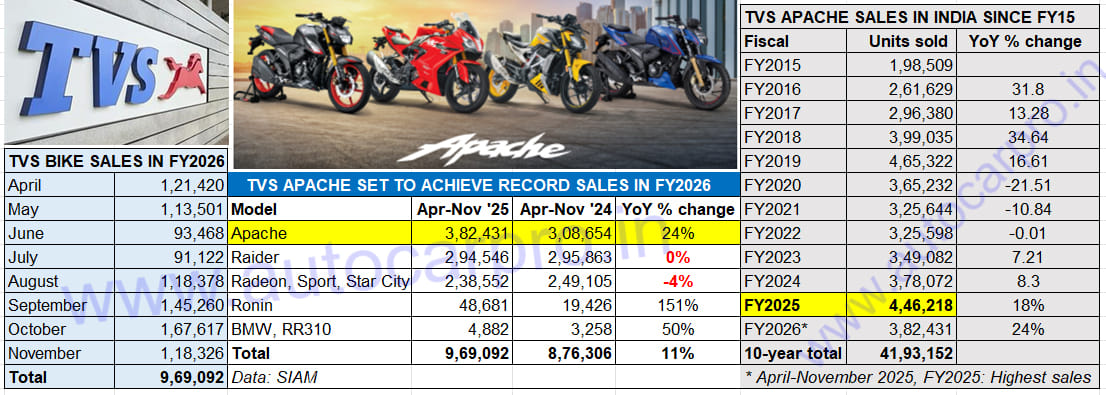

TVS Motor Co is witnessing a strong FY2026 and its cumulative 8-month two-wheeler wholesales comprising scooters, motorcycles and mopeds at 2.79 million units (27,92,046) are up 15% YoY (April-November 2024: 24,36,596 units). While TVS scooter sales (1.48 million units) are up 24% YoY and account for a 53% share, motorcycles (969,092 units) are up 11% YoY and have a 35% share. The humble TVS moped has sold 337,213 units and contributed to a 12% share of TVS’ overall two-wheeler sales.

In FY2025, TVS sold 1.20 million motorcycles, down 1.59% YoY (FY2024: 1.22 million units). In the first 8 months of FY2026, the Chennai-based two-wheeler OEM has dispatched (wholesales) 969,092 motorcycles which marks 11% YoY growth (April-November 2024: 876,306 units) and includes best-ever monthly sales of 167,617 units in festive and GST 2.0-driven October 2025.

The last 8 months’ bike sales translate into average monthly sales of 121,365 units. TVS needs to sell another 254,747 bikes between December 2025 and March 2026 if it is to surpass its best-ever motorcycle sales of 12,23,838 units of FY2024.

Apache brand bike sales of 382,431 units have contributed 39% to TVS Motor Co’s total motorcycle dispatches of 969,092 million units in the first eight months of FY2025.

APACHE SERIES RIDING TOWARDS RECORD 550,000 SALES IN FY2026

TVS Motor’s motorcycle sales growth in the current fiscal is because of the robust customer demand for the Apache series in the 150-200cc segment wherein it continues to lead the market. The TVS Apache brand comprises four models of the Apache RTR Series – RTR 160, RTR 160 4V, RTR 180 and RTR 200. With total wholesales of 382,431 units between April and November 225, this lot of Apache bikes has clocked 24% YoY growth (April-November 2024: 308,654 units). The Apache is also available in the higher RTR 310 and RR 310 avatars along with the recently launched RTX 300 adventure bike which aims to make premium touring and off-road riding more accessible to Indian riders.

December 2025 will see the Apache brand cross the 400,000-units wholesales mark for the third time in its 20-year innings. It had missed the mark in FY2018 (399,035 units) by just 965 units. Launched in 2005, the Apache first rode past 400,000 units in FY2019 (465,322 units, up 16.61% YoY). Sales were impacted in subsequent fiscals, mainly due to the dampened demand due to the Covid-19 pandemic (see 12-fiscal-year data table above).

In the current fiscal’s first eight months, the Apache has averaged monthly sales of 47,803 units, pumped up by the record October 2025’s 61,619 units. The lowest monthly score in April-November 2025 was the 37,566 units in July. While December 2025 sales could be somewhat muted due to buyers delaying purchase to the new year, demand should again be robust in Q4 FY2026 (January-March 2026). If one adds an estimated cumulative 180,000 units for the next four months, the Apache 150-200cc bikes should go on to hit a new fiscal year high of 525,000 to 550,000 units, which translates into 23% YoY growth at the higher end.

The TVS Apache remains the company’s best-selling motorcycle in FY2026. In the first 8 months of this fiscal, it has a 39% share of TVS’ total motorcycle sales and is ahead of its sibling TVS Raider (294,546 units, down 0.44% YoY, 30% share). In FY2024, the Apache (378,072 units) had lost the title of TVS No. 1 bike to the Raider (478,443 units) but wrested it back in FY2025 (446,218 units).

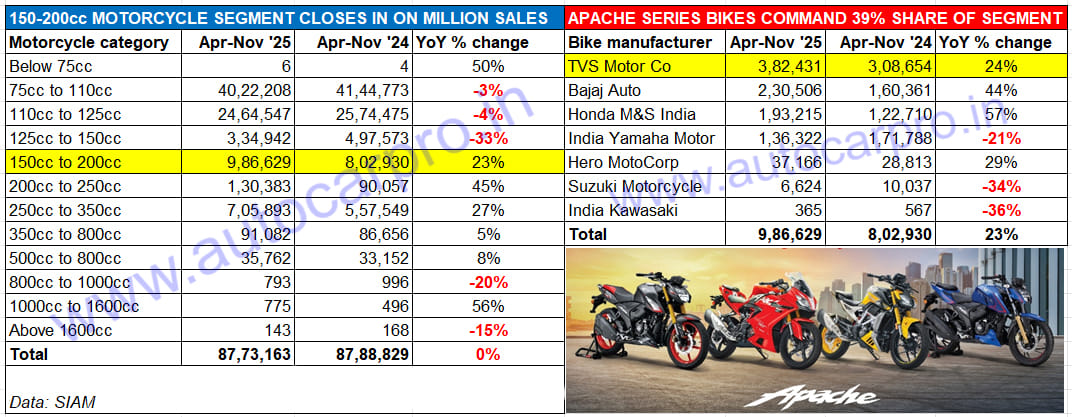

While the 150-200cc segment has posted strong 23% growth in April-November 2025, the TVS Apache commands a 39% segment share with Bajaj Auto in second place with a 23% share.

TVS APACHE REMAINS BEST-SELLING BRAND IN 150-200cc CATEGORY

The TVS Apache’s robust sales have energised the overall 150-200cc segment which comprises seven motorcycle manufacturers, helping it ride into positive territory. In FY2025, this bike category had sold 1.09 million units, down 9% on FY2024’s 1.21 million units.

Now, after the first eight months of FY2026, the 986,629 units constitute a strong 23% YoY increase (April-November 2024: 802,930 units) as a result of strong double-digit growth from bikes made by TVS, Bajaj Auto, Honda and Hero MotoCorp.

FADA’s outlook for the coming months of FY2026 remains firmly positive, supported by sustained momentum from GST 2.0 tax rationalisation, strong enquiry pipelines, and improving rural economic indicators as 74% of dealers expect growth underscoring broad-based confidence across segments. What augurs well for two-wheeler OEMs is good signs of volume recovery across the rural two-wheeler market, driven by GST 2.0 rate cuts, and sustained OEM-dealer offers along with the ongoing marriage season.

Segment leader TVS Motor Co is well positioned to capture demand in this category with its four Apaches – the RTR 160, RTR 165, RTR 180 and RTR 200 – each catering to a different buyer, thereby widening the target audience. The Apache bikes’ pricing (ex-showroom Mumbai) starts at Rs 101,890 for the RTR 160 2V (down from pre-GST 2.0’s Rs 120,400), rises to Rs 125,590 for the RTR 180 and Rs 141,990 for the top-end RTR 200 4V.

The Apache 150-200cc series bikes have also witnessed strong demand in export markets – the 97,767 units shipped overseas in the past eight months make for a strong 32% YoY increase albeit that calls for a new report. Stay tuned in as we bring you the latest number-crunching news and sales analyses.

ALSO READ: Scooter sales cross 5 million in April-November, EVs help TVS, Hero, Ather grow market share

TVS tops electric 2W sales for seventh time this year in November