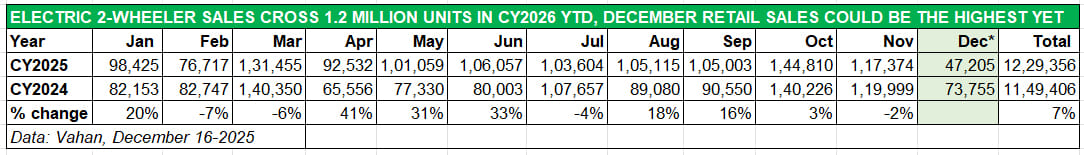

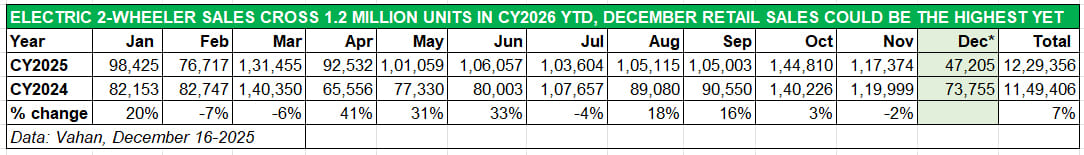

The first fortnight of the last month of CY2025 has seen the Indian electric 2-wheeler industry cross the 1.2 million units mark for the first time. At 47,205 e-scooters, e-motorcycles and e-mopeds delivered, the retail sales in the past 15 days are somewhat slow though compared to the past couple of months, which can be attributed to new e-2W buyers delaying their purchase to the new year 2026.

Nevertheless, with 16 days still left to go before CY2025 turns into CY2026, this December could yet turn out to be the best year-ending month for the e-2W industry, beating the previous best (December 2023: 75,950 units). The gap at present is 28,745 units, which should be surpassed in the last week of the month.

Meanwhile, cumulative sales from January 1 to December 15 at 12,29,356 units are up 7% YoY, pointing the industry towards total CY2025 sales of a record 1.25 million units.

The Indian e-2W industry is headed for record annual retail sales of over 1.25 million units in CY2025.

The Indian e-2W industry is headed for record annual retail sales of over 1.25 million units in CY2025.

TVS Motor Co, which wrested back the No. 1 e-2W OEM title from Bajaj Auto in November, maintains its numero uno position with 13,297 units. It is the only e-2W manufacturer to have sold in excess of 10,000 units and is ahead of Bajaj Auto by 3,773 units. While the iQube remains its main sales force, the company has begun the phased rollout of the new Orbiter e-scooter. Priced at Rs 99,900 (ex-showroom Bengaluru), inclusive of PM E-Drive Scheme subsidies, Orbiter sales have commenced in Karnataka and the company is now expanding into Maharashtra. This pricing places the Orbiter — which has a 3.1 kWh battery pack — on par with the base iQube variant that features a smaller 2.2 kWh battery pack. The Orbiter, which has a top speed of 68kph, is designed for urban commuting and has an IDC range of 158 km per charge.

Bajaj Auto has delivered 9,524 Chetaks to new buyers in the December 1-15 period. The company, which currently sells the Chetak and Yulu e-scooters is readying the launch of a brand-new model early in CY2026, which could mean potential Chetak buyers would be awaiting that model. Bajaj Auto continues to expand its Chetak network, which now stands at 390 exclusive stores and 4,000 points of sale in 800 cities.

Ather Energy, which has made the No. 3 position its very own has retailed 8,376 e-scooters in the past fortnight. This puts it 1,148 units behind Bajaj Auto. The e-2W start-up, which is fast reducing the sales gap with the Puune-based legacy OEMs, continues to witness surging demand for its Rizta family scooter, which recently surpassed cumulative sales of 200,000 units and accounts for 70% of monthly volumes which include the 450X or 450S models. The company has reported strong sales traction for the high-range (160km) options on the 450S and Rizta S, which has helped expand sales and market share. What’s more, the Battery as a Service (BaaS) option has enabled a reduction of the upfront price of the Rizta S to Rs 76,000, making the premium family scooter far more affordable.

Hero MotoCorp, which outsold Ola Electric for the first time in November to take the No. 4 position, has delivered 5,418 units. The world’s largest two-wheeler manufacturer continues to be an EV newsmaker as a result of the robust demand for its new Vida VX2 model. The company looks set to exceed the 10,000-units mark in December, which will make for six straight months of 10,000-plus e-scooter sales for Hero MotoCorp and its Vida e-2W brand including the highest in October 2025 (16,014 units).

Ola Electric, as in November. is currently ranked No. 5 with retail sales of 3,079 units in the December 1-15 period. Clearly, Ola Electric will have to come up with an aggressive sales and product strategy if it is to regain the vigour and shine it had displayed not very long ago as the e-2W market leader. Earlier this month, the company began deliveries of vehicles equipped with its indigenously manufactured 4680 Bharat Cell battery packs. The S1 Pro+ scooter with a 5.2kWh battery is the first product to use these domestically produced cells, making Ola Electric the first Indian company to control both cell and battery pack manufacturing internally.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, remains the firm No. 6 on the OEM ranking list with retails of 1,939 units. GEM and Ampere Vehicles, which are witnessing a revival of demand driven by new products like the Nexus, Magnus Neo and the Grand, recently surpassed cumulative retail sales of 250,000 units.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is ranked seventh amongst the Top 10 e-2W OEMs with 894 units of the RUV 350 and Max C12. Bengaluru-based River Mobility, now rebranded River EV, which has a single product – the River Indie – is now a regular fixture in the Top 10 e-2W listing. It gets eighth rank with 857 units.

Quantum Energy, which has recently partnered with battery swapping solutions provider Indofast Energy to power its new Bziness XS electric scooter, takes ninth position with 375 units, and electric motorcycle maker Revolt Motors wraps up the Top 10 list for the December 1-15 period with 298 units.