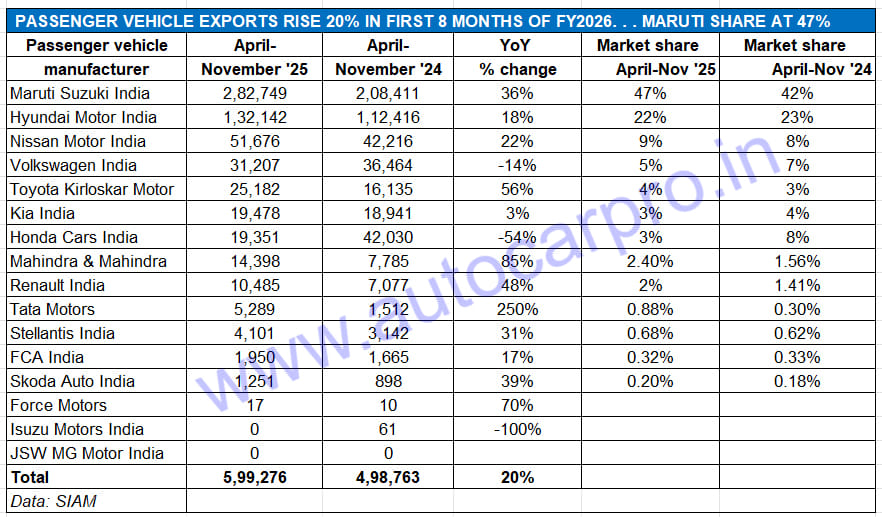

Led by Maruti Suzuki, overseas shipments of made-in-India cars, sedans, SUVs and MPVs have hit a new high of nearly 600,000 units in the first 8 months of FY2026. As per SIAM export sales data, 599,276 passenger vehicles were dispatched to key global markets, up by a strong 20% YoY (April-November 2024: 498,763 units), which translates into an additional 100,513 units.

With four months left to go in the current fiscal year, this performance puts the PV industry in close sight of the highest export total yet: 770,364 units in FY2025. In the first eight months of FY2026, monthly PV exports have crossed the 80,000-units mark thrice: September (87,762 units), November 84,646 units) and August (82,246 units).

However, the recent decision by Mexico, which is India’s third-largest PV export market after South Africa and Saudi Arabia, to substantially raise import tariff on made-in-India PVs to 50% from 20% starting January 1, 2026, will cast a shadow over the future rate of growth of made-in-India PV exports. Mexico, which imported around 194,000 cars and SUVs from India in FY2024, accounted for 25% of the record 770,364 PVs shipped overseas last fiscal. This represents business worth $1.9 billion (around Rs 15,800 crore).

Saharsh Damani, CEO, Federation of Automobile Dealers Associations (FADA), has called Mexico’s new 35-50% tariff on Indian automobiles a “serious challenge” as the Latin American country prepares to implement duties on imports from countries without free-trade agreements (FTAs) from January 1, 2026. “Industry and government’s task is cut out as they need to swiftly activate their diplomacy to set things right,” said Damani.

The stiff tariff increase will expectedly adversely impact major Indian automakers across both the PV and two-wheeler markets. According to Damani, Maruti Suzuki India exports 66,000-70,000 units annually to Mexico — representing 22-25% of its total exports — including popular models like the Baleno, Swift, Dzire, and Brezza. Hyundai Motor India ships 25,000-30,000 units including the Grand i10 Nios, Aura, Venue, and Creta, while the Volkswagen Group ships 55,000-60,000 units of the Virtus, Slavia, Taigun, and Kushaq. Nissan India also exports several thousand Magnite SUVs, sold as the Kicks in Mexico.

Let’s take a quick look at how India’s 16 PV exporters have fared in the April-November 2025 period.

With exports of 282,749 PVs in the past eight months, Maruti Suzuki has already achieved 86% of its record FY2025 shipments. The company is eyeing an 400,000 export milestone in FY2026.

With exports of 282,749 PVs in the past eight months, Maruti Suzuki has already achieved 86% of its record FY2025 shipments. The company is eyeing an 400,000 export milestone in FY2026.

Maruti Suzuki India, India’s No. 1 passenger vehicle exporter for the past four fiscals, has taken a strong lead in FY2026 with shipments of 282,749 units, up 36% YoY. The car, SUV and MPV manufacturer, which exported a record 330,081 vehicles in FY2025, has already achieved 86% of that in the first eight months of the current fiscal. Maruti Suzuki is targeting 400,000 vehicle exports in FY2026, but Mexico’s upcoming stiff hike in tariffs could prove to be a dampener since the country is a leading market in the key Latin American region. Mexico, along with Africa, Japan, Chile and Saudi Arabia are key growth markets for the company.

In April-November 2025, while Maruti’s car exports rose 32% YoY to 135,358 units, demand for its SUVs and MPVs jumped 39% YoY to 140,601 units. This strong performance is reflected in export market share which has risen to 47% from 42% a year ago.

Hyundai Motor India has exported 132,142 units, up 18% YoY. This total comprises 112,271 cars and sedans, up 22% YoY, and 19,871 SUVs, down 1.48% YoY. The Verna sedan, now in its sixth generation, continues to be its best export model – the 44,315 units exported are a 24% YoY increase. In FY2025, Hyundai had exported 52,615 Vernas.

Nissan Motor India, ranked No. 3 on the PV exporter scale, has shipped 51,676 vehicles in the past eight months, up 22% and sees a resultant increase in export market share to 9% from 8% a year ago. While demand for the Sunny sedan is down sharply by 46% YoY (April-November 2024: 34,556 units), that decline is more than made up by the 330% YoY increase in export sales of the Magnite SUV. Nissan India has shipped 32,991 Magnites, an additional 25,331 units (April-November 2024: 7,660 Magnites) catering to both left-hand-drive and right-hand-drive markets. Like Maruti and Hyundai, key export regions for Nissan India include Africa, the Middle East, Latin America. Southeast Asia is also a growing market for the Magnite. India is a global manufacturing hub for the Magnite, whose export sales (32,991 units) outstrip domestic market sales (13,379 units in April-November 2025, down 28% YoY)

Volkswagen India, with exports of 31,207 units, is down 14% YoY which sees its market share reduce to 5% from 7% a year ago. Demand is down 13% YoY (22,539 units) for its main model – the Virtus sedan as well as for the Taigun SUV at 8,668 units, down 17% YoY.

Toyota Kirloskar Motor has risen one rank to No. 5 with 25,182 vehicle exports, up 56% YoY. This mainly due to strong demand for the Hyryder midsize SUV whose sales are clubbed with the Rumion MPV (25,100 units, up 55% YoY). The company also shipped 77 Innova MPVs and five other SUVs.

Kia India has seen a 3% increase in exports to 19,478 units comprising 9,787 units of the Sonet and Syros compact SUVs, 5,095 Carens MPVs, and 4,596 Seltos midsize SUVs.

Honda Cars India, which was the No. 2 PV exporter a year ago, has slid to No. 7 with 19,351 units, down sharply by 54% YoY (April-November 2024: 42,030 units). This is mainly due to the 64% fall in export demand for the Elevate midsize SUV to 11,152 units from 30,813 units a year ago. Honda also exported 7,536 City and 663 Amaze sedans, whose sales are also down year on year.

Mahindra & Mahindra, which is on a roll in the domestic market and set to achieve 600,000 sales in both CY2025 and FY2026v, has also witnessed strong export sales. At 14,398 units, exports are up 85% YoY. Shipments of its compact SUVs led by the 3XO rose 160% YoY to 10,614 units. Exports of midsize SUVs (Scorpio, Thar Roxx, XUV700 and Bolero Neo) were down 3% to 3,484 units. M&M also exported 262 units of the BE 6 and XEV 9e electric SUVs.

Renault India has exported 10,485 vehicles in the past eight months, up 48% YoY. This comprises 5,965 units of the Kiger and Triber SUVs, and 4,520 Kwid hatchbacks.

Will Mexico, which itself is a target of American president Donald Trump’s high tariffs, reduce the proposed 50% tariff on Indian-made goods and vehicles? That’s difficult to say but it is understood that a number of Indian business and trade bodies including apex auto industry association SIAM have urged the Indian government to call upon Mexico to maintain the status quo on vehicle tariffs.

ALSO READ: SUV and Car Makers Sell 388,000 Units in November, Mahindra Regains No. 2 Position From Tata