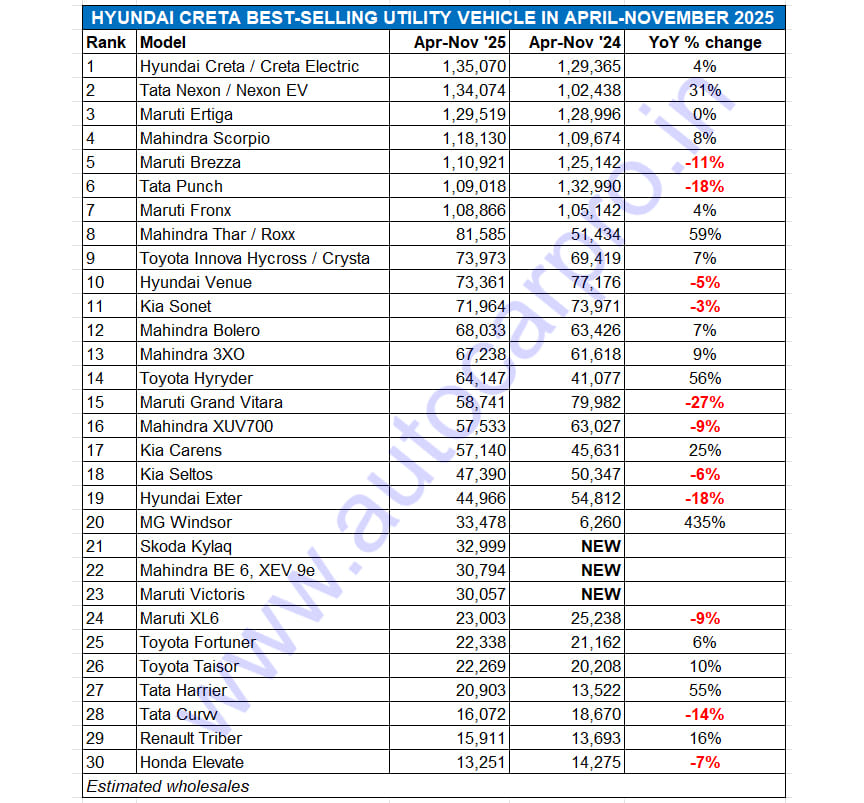

The utility vehicle segment, which comprises SUVs and MPVs, continues to fire on all cylinders with growth accelerated by the price-slashing GST 2.0 reform that kicked in from end-September. In the current fiscal year’s first eight months, 1.94 million UVs are estimated to have been sold (factory dispatches or wholesales).

This works out to 70% of FY2025’s record 2.79 million UVs (27,97,229 units), setting a strong base for UV manufacturers to surpass last fiscal’s sales over the next four months of FY2026. The compact SUV segment remains the biggest contributor with 921,560 units and a 47% share, with the balance 53% share accounted for by the midsize SUV and MPV sub-segments.

Over the past year, the midsize segment has benefited from growing demand driven by customers scouting for a blend of practicality and comfort in the form of a full-size SUV with a compact footprint. Furthermore, the advance of premium features once reserved for high-end models into most midsize SUVs gives this sub-segment the draw it needed to pull in the big numbers. The midsize SUV category is led by longstanding market leader, the Hyundai Creta which is also currently the best-selling UV in India, ahead of the Tata Nexon and Maruti Ertiga.

Here’s taking a closer look at the first 10 of the Top 30 utility vehicles sold in the first eight months of FY2026.

No. 1 – Hyundai Creta: 135,070 units, up 4% YoY

With 135,070 units, the Creta remains Hyundai Motor India’s best-selling model in the current fiscal. The IC engine Creta, which remains a popular buy, has earlier this year been joined by its zero-emission avatar, the Creta Electric. Hyundai’s strategy to remain bullish on diesel, compared to some of its rivals in India, continues to pay off.

With a 36% contribution, the Creta has provided the bulk of Hyundai Motor India’s 375,912 passenger vehicle dispatches and 51% of the 263,019 SUV sales in April-November 2025. September (18,861 units) saw the Creta achieve its highest monthly sales.

Eight months into the current fiscal, the Creta has a slender lead of 996 units over the Tata Nexon (134,074 units). Its reign at the top remains temporary because the Tata Nexon has strongly outsold the Creta in the September-November 2025 period.

No. 2 – Tata Nexon: 134,074 units, up 31% YoY

With 134,074 units, the Tata Nexon has witnessed strong YoY growth of 31% (April-November 2024: 102,438 units), with 50% of that coming in the last three months. In fact, the Nexon has been India’s best-selling UV in September (22,573 units), October (22,083 units) and November (22,434 units).

The Tata Nexon, which is sold with petrol, diesel, electric and CNG powertrains, is currently India’s No. 1 compact SUV and accounts for 35% of the 382,598 PVs Tata Motors has sold in the past eight months.

The strong sales – averaging 22,363 units a month in October-November – are a result of GST 2.0-driven price cuts which apply to compact SUVs (below 4000mm length) with petrol engines below 1200cc and diesel engines below 1500cc. And, with Tata Motors offering GST price reductions of up to Rs 155,000 – the highest on a Tata passenger vehicle – the Nexon is set to drive ahead of the Hyundai Creta and reclaim the No. 1 SUV crown it lost to sibling Punch in FY2025.

No. 3 – Maruti Ertiga: 129,519 units, 0% YoY

India’s No. 1 MPV for the past six fiscals, which is sold with petrol and CNG powertrains, has sold 129,519 units, which makes for flat sales (April-November 2024: 128,996 units). This is 523 additional Ertigas sold year on year, helped along by the new monthly high of 20,087 units in October.

The popular and city-friendly Ertiga is a sensible MPV for large families, with comfortable seating for seven passengers. While there’s no diesel option, the 1.5-litre mild hybrid petrol engine offered with manual and auto transmission gets the job done. The CNG-powered Ertiga remains a big draw.

No. 4 – Mahindra Scorpio: 118,130 units, up 8% YoY

Mahindra & Mahindra’s best-selling SUV continues to be the Scorpio in the form of the popular Scorpio N and the Scorpio Classic. The 118,130 units sold in the April-November 2025 period are an 8% YoY increase (April-November 2024: 109,674 units) and accounted for a 28% share of M&M’s 425,530 SUVs sold. In FY2025, the Scorpio twins sold a total of 164,842 units and were ranked sixth on the overall UV scale. In the current fiscal, they are up two ranks at No. 4 position.

No. 5 – Maruti Brezza: 110,921 units, down 11% YoY

This Maruti Arena model is ranked No. 5 with 110,921 units, down 11% YoY (April-November 2024: 125.142 units). In fact, the Brezza, which is currently Maruti’s second-best-selling UV after the Ertiga MPV (129,519 units) and ahead of the Fronx (108,866 units) had outsold the Tata Nexon till August – by 7,745 units – but lost out to the Tata rival from September onwards. The 1.5-litre Brezza, whose pricing now starts at Rs 825,900, received a GST price cut of up to Rs 112,700 (much lower than the 1.2-litre Nexon) and is available only in petrol and CNG versus the Nexon which has petrol, diesel, CNG and electric powertrains.

No. 6 – Tata Punch: 109,018 units, down 18% YoY

The Tata Punch, FY2025’s best-selling SUV, is currently ranked sixth with 109,018 units, down by 18% YoY (April-November 2024: 132,990 units) – a difference of 23,972 units YoY. A likely reason for the much-slowed-down sales could be that the new Punch is slated for launch soon. Nevertheless, the Tata Punch remains a top choice for first-time car buyers and nearly 70% of Punch ICE (petrol and CNG) owners are first-time car buyers. This compact SUV also has strong traction amongst women drivers.

No. 7: Maruti Fronx – 108,866 unts, up 4% YoY

The Maruti Fronx, a premium Nexa model, is ranked No. 7 in the UV scale with 108,866 units, up 4% YoY. The Fronx, which is available with petrol (1.0 and 1.2-litre engines) and CNG power (1.2-litre engine) accounts for 23% of the 467,448 UVs Maruti Suzuki has sold in the past eight months.

No. 8 – Mahindra Thar / Thar Roxx: 81,585 units, up 59% YoY

The Thar brand, which comprises the three-door Thar and five-door Thar Roxx, is a big success story for Mahindra. With combined sales of 81,585 units in the past eight months, the YoY growth is 59% (April-November 2024: 51,434 units), which is an additional 30,151 units. Model-wise, the Thar Roxx is estimated to account for 55-60% of total Thar brand sales, with the rest accruing to the three-door Thar. The five-door Thar Roxx, which won Autocar India’s Car of the Year 2025 award, appeals to a wider target audience as a more practical and more mainstream product than the already popular three-door Thar and has also taken the battle into many a rival’s camp.

No. 9 – Toyota Innova Hycross / Crysta: 73,973 units, up 7%

The Innova MPV – Toyota Kirloskar Motor’s best-selling product – has sold 73,973 units, up 7% YoY (April-November 2024: 69,419 units). This total is 69% of the Innova’s sales of 107,204 units in FY2025, comprising 62,794 Hycross and 44,410 Crysta units. The highest monthly sales this fiscal were in October (11,089 units) but the Innova was outsold for the first time by the Toyota Hyryder midsize SUV (11,555 units).

While the Innova Crysta is a diesel-only model which is a dependable and reliable workhorse, customer demand continues to rise rapidly for the front-wheel-drive, petrol-only Innova Hycross which is estimated to account for 63% of the Innova brand’s sales in the first eight months of FY2026. Compared to the mild hybrid variant, the strong hybrid variant shines with its high fuel efficiency of 13.1kpl in the city and 16.1kpl on the highway. The Hycross offers everything buyers with large families want and there’s a new level of luxury too in this people-mover.

No. 10 – Hyundai Venue: 73,361 units, down 5% YoY

The Hyundai Venue, Hyundai Motor India’s first-ever compact SUV and the company’s second best-selling SUV after the Creta midsize SUV, has sold 73,361 units, down 5% YoY (April-November 77,176 units). The decline was 12% in the first-half of FY2026 but the launch of the new Venue has brought the numbers back. Sales have risen from a monthly average of 7,698 units in April-August to 11,622 in September-November.

The Skoda Kylaq, Mahindra’s two new Born Electric SUVs, and the Maruti Victoris have sold over 30,000 units each and are ranked No. 21, 22 and 23 respectively in the Top 30 UV listing.

The Skoda Kylaq, Mahindra’s two new Born Electric SUVs, and the Maruti Victoris have sold over 30,000 units each and are ranked No. 21, 22 and 23 respectively in the Top 30 UV listing.

SKODA KYLAQ, MAHINDRA BE 6/XEV 9E & MARUTI VICTORIS AMONGST TOP 25 MODELS

Four new SUVs launched between January and November feature in this Top 30 UV listing, reflecting the growing demand for new models in the ultra-competitive market. The Skoda Kylaq, Mahindra BE 6 and XEV 9 and the Maruti Victoris are ranked Nos. 21, 22 and 23 respectively.

The Skoda Kylaq, Skoda India’s vehicle of entry into the booming compact SUV market, has received a strong customer response. So much so that from February 2025 onwards, it has become the company’s best-selling locally produced vehicle, ahead of the Slavia sedan and Kushaq SUV. With 32,999 units sold in April-November 2025, the Kylaq accounts for 66% of the company’s 49,960 units. This gives the Kylaq No. 21 rank. This model has helped double Skoda India’s overall passenger vehicle sales.

Meanwhile, Mahindra & Mahindra’s two Born Electric SUVs – BE 6 and XEV 9e – have sold 30,794 units in the April-November 2025 period, giving them a 7% share of the 425,30 SUVs that M&M has dispatched to its dealers.

Launched in September, the Maruti Victoris has sold 30,057 units. Maruti Suzuki’s latest midsize SUV will be sold through its Arena dealerships as the company’s flagship model. The Victoris debuts a segment-first underbody CNG tank for S-CNG technology with full boot space. Priced from Rs 10.50 lakh to Rs 19.99 lakh (ex-showroom), the 21-variant Victoris comes with Level 2 ADAS and a five-star Bharat NCAP safety rating.

ALSO READ: Utility Vehicle Industry Poised for Record Sales of 2.8 Million Units in CY2025