With just four days left for CY2025 to end, the Indian passenger vehicle industry is set to record annual wholesales of over 4.60 million vehicles, beating CY2024’s 4.27 million (42,74,793 units). The PV industry will also most likely see a new No. 2 player – Mahindra & Mahindra – taking the podium position behind the unsurmountable PV market leader, Maruti Suzuki, which is also the utility vehicle market leader.

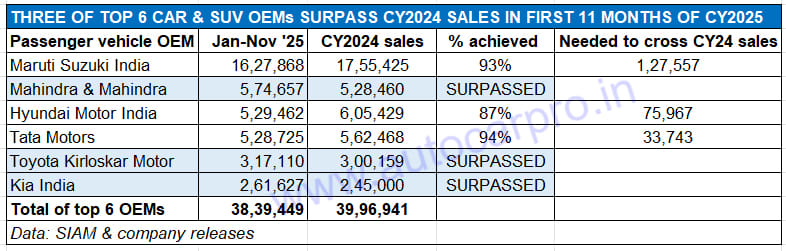

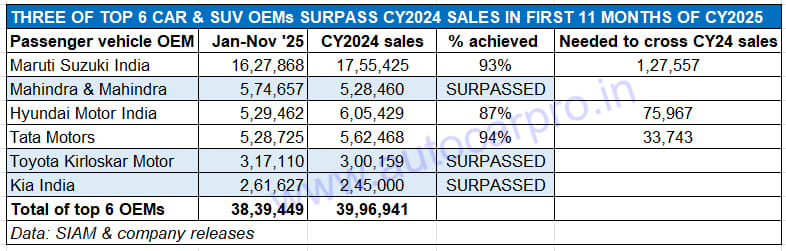

Of the top six PV manufacturers, three – M&M, Toyota Kirloskar Motor and Kia India – have already surpassed their CY2024 sales and their December numbers will enable them to set a new benchmark. The other three – Maruti Suzuki, Hyundai Motor India and Tata Motors – have achieved 93%, 87% and 94%, respectively, of their CY2024 sales.

CY2024’s top six PV OEMs were Maruti Suzuki (1.75 million units), Hyundai Motor India (605,429 units), Tata Motors (562,468 units), Mahindra & Mahindra (528,460 units), Toyota Kirloskar Motor (300,159 units) and Kia India (245,000 units).

M&M (574,657 SUVs, up 18% YoY) is expected to end this year with estimated wholesales of 625,000 units which will make it the new No. 2 PV OEM ahead of Tata Motors and Hyundai Motor India.

M&M (574,657 SUVs, up 18% YoY) is expected to end this year with estimated wholesales of 625,000 units which will make it the new No. 2 PV OEM ahead of Tata Motors and Hyundai Motor India.

MAHINDRA: THE OUTLIER MANUFACTURER OF CY2025

While Maruti Suzuki (1.62 million PVs) remains head and shoulders above its rivals in the January–November 2025 period, CY2025 will see two OEMs make an upward movement, while one is expected to see a downward re-ranking. Maruti Suzuki also leads the UV pack with 658,671 SUVs and MPVs sold in the past 11 months.

However, of all the 16 PV manufacturers, Mahindra & Mahindra has been the outlier OEM in the first 11 months of this year, and has risen two ranks from No. 4 in CY2024 to being the current No. 2 in CY2025 YTD. The SUV maker, which sold over half-a-million SUVs (528,460 units) for the first time in a calendar year in CY2024, has already raced past that total. Its January–November 2025 wholesales, at 574,657 units, are a robust 18% YoY increase (January–November 2024: 487,036 units). This translates into an additional 87,621 SUVs sold YoY.

Tata Motors, which has sold 528,725 PVs in the January–November 2025 period, needs to sell another 33,744 units to go past its record CY2024 sales of 562,468 units. If the company maintains the same strong momentum of September–October–November, when it averaged monthly sales of 59,412 units, one can expect Tata to wrap up CY2025 with total PV wholesales of around 580,000–590,000 units. However, that would still fall short of M&M’s likely 625,000 units. Nevertheless, Tata Motors is set to be the new No. 3 PV manufacturer, ahead of Hyundai Motor India.

Hyundai Motor India, which was the longstanding No. 2 PV OEM till CY2024, is currently ranked No. 3 among the top six players but just 737 vehicles ahead of Tata Motors. The 529,462 cars and SUVs sold in January–November 2025 are down 6% YoY (January–November 2024: 563,221 units). The company, whose best-seller is also India’s No. 1 midsize SUV (Creta), needs to sell 75,967 PVs in December to be level with its record CY2024 wholesales of 605,429 units. That seems difficult, considering its best month this year was October (53,792 units, down 3% YoY) and that the company saw a YoY decline in nine of the past 11 months, barring September and November. This means Hyundai will drop two ranks to No. 4 this year from No. 2 in CY2024.

While the Scorpio remains the No. 1 model for M&M, the Thar brand with 55% YoY growth and a 19% model-wise share has risen to the No. 2 rank from fourth position in CY2024.

THAR THE NEW NO. 2 MAHINDRA MODEL AFTER SCORPIO

M&M’s stellar market performance this year is the result of surging demand for some of its models, particularly the Thar Roxx, Scorpio twins, 3XO and the two Born Electric SUVs. In terms of model-wise share, the Scorpio N and Classic, with 161,103 units (up 4% YoY) and a 28% share, remain the best-selling SUV. The two Thars (the five-door Thar Roxx and three-door Thar) have jumped to No. 2 from No. 4 in the model ranking for the company. Combined Thar sales, at 107,326 units, are up 55% YoY (January–November 2024: 69,354 units) and account for a 19% share. The Thar Roxx is estimated to account for the bulk of the sales, at around 65%.

The Bolero brand, which comprises the Bolero and Bolero Neo, has a 16% model-wise share with 93,436 units in the past 11 months, but has recorded flat sales (January–November 2024: 93,850 units). The 3XO compact SUV, with an estimated 90,608 units and 12% YoY growth, is ranked No. 4 in the M&M SUV stable and has a nearly 16% share. Sales of the flagship XUV700 (80,251 units) are down 4% YoY (January–November 2024: 83,390 units), which gives it a 14% share.

M&M has received a boost from the introduction of the two new BEVs – the BE 6 and the XEV 9e. The 38,841 units give the two zero-emission SUVs a 7% share of M&M’s total wholesales year-to-date, which is a notable achievement. The two remaining models are the XUV400 e-SUV (2,764 units, 0.48% share) and the Marazzo MPV (328 units, 0.05% share).

ALSO READ: Utility Vehicle Industry Poised for Record Sales of 2.8 Million Units in CY2025

India’s Electric Car and SUV Makers Set for Record Sales of 175,000 Units in CY2025