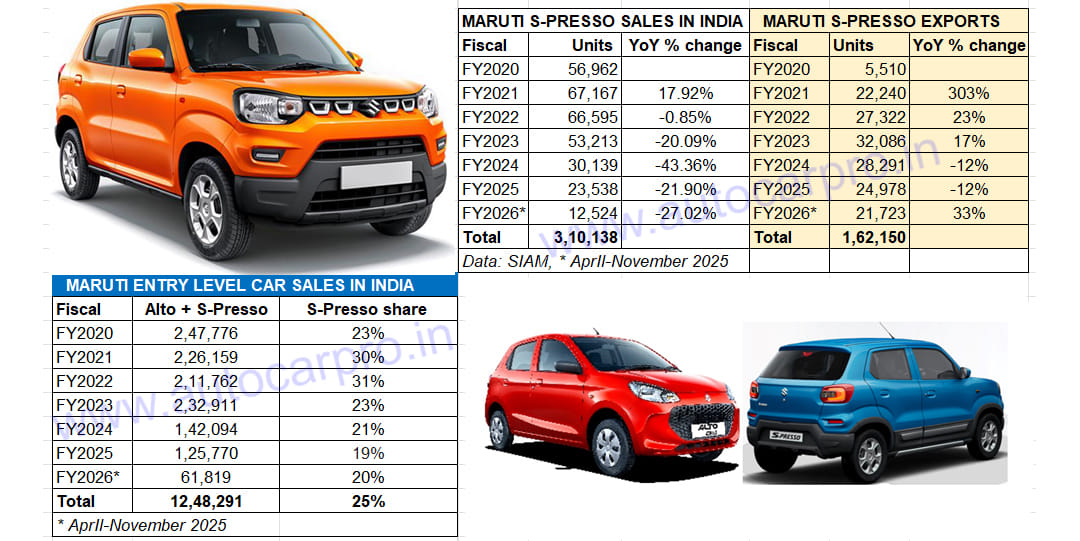

Launched on September 30, 2019, the Maruti S-Presso entry level hatchback has driven past cumulative sales of 300,000 units in the domestic market. While the milestone was surpassed in May 2025, five years and six months after its launch, the S-Presso has clocked total wholesales of 310,138 units till end-November 2025. Add export sales of 162,150 units and the S-Presso’s combined domestic-export total is 472,288 units.

At launch, the SUV-inspired hatchback was priced in the Rs 369,000-491,000 bracket and had received over 10,000 bookings within just 10 days. At the time, the S-Presso’s main rivals were the Renault Kwid along with the lower-end variant of its sibling, the Maruti Alto. The Datsun Redigo entered the budget hatchback market in June 2020 but is now history with Datsun having exited the India market in April 2022. The S-Presso with 310,138 units has fared much better than the Renault Kwid (145,216 units since September 2019) and accounts for 25% of Maruti Suzuki’s combined Alto-S-Presso sales of 1.24 million units, with the Alto being the more popular model with 938,153 units (September 2019-November 2025).

S-Presso’s best fiscal year was FY2021 with 67,167 units, 18% growth and a 30% share of Maruti Suzuki’s budget car sales. Since then, demand has fallen in tandem with the rest of the segment.

S-Presso’s best fiscal year was FY2021 with 67,167 units, 18% growth and a 30% share of Maruti Suzuki’s budget car sales. Since then, demand has fallen in tandem with the rest of the segment.

The S-Presso opened its account with a flourish, selling 5,006 units in its very first month to be ranked No. 8 in the Top 10 Passenger Car Models listing for September 2019. Total sales in the last seven months of FY2020 were 56,962 units which saw the S-Presso become the 10th best-selling passenger car that fiscal. The ranking improved to No. 8 in FY2021 (67,167 units, up 18% YoY), which remains this model’s best fiscal year yet. In FY2022, the S-Presso (66,595 units) was ranked seventh but since then has not figured in the Top 10 passenger car listing.

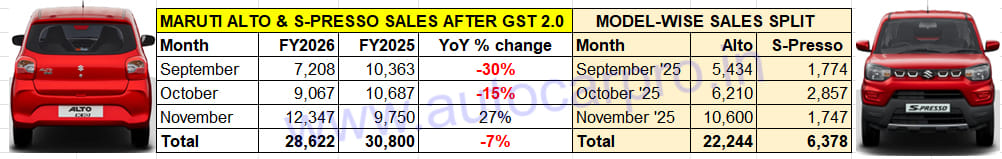

Combined Alto and S-Presso sales have returned to positive territory in November but the Alto’s past three months’ sales are down 10% YoY and the S-Presso’s are up just 4 percent.

Combined Alto and S-Presso sales have returned to positive territory in November but the Alto’s past three months’ sales are down 10% YoY and the S-Presso’s are up just 4 percent.

With GST 2.0 kicking in end-September 2025, the S-Presso benefited from a sharp price cut of Rs 120,000 which made it cheaper than its sibling Alto K10, India’s previous cheapest – read affordable – car. In comparison, the base price for the Alto is Rs 370,000. Prices for the S-Presso start at Rs 350,000 (ex-showroom) for the base Std (O) MT trim, with the on-road pricing starting from Rs 395,000. The top-end VXi+(O) AMT is priced at Rs 585,000.

Available in 8 variants – Std (O) MT, LXi (O) MT, VXi (O) MT, VXi (O) AMT, VXi+ (O) MT, LXi (O) CNG MT, VXi+ (O) AMT, VXi (O) CNG MT – the S-Presso is powered by a 1.0-litre naturally aspirated petrol engine that produces 68hp and 91Nm equipped with a manual or an AMT option. This engine can also be had with a CNG setup, which develops 56hp and 82Nm while being mated with a manual transmission. Mileage-wise, this small petrol-engined Maruti delivers up to 25.30kpl while the S-Presso CNG has a claimed fuel efficiency of 32.73km/kg.

The moot question is will the sizeable GST 2.0-driven price cuts revive the budget car market? The latest SIAM wholesales data for the three budget cars in the market (Alto, S-Presso and Renault Kwd) shows April-November 2025 sales at 65,416 units, down 25% YoY (April-November 2024: 87,689 units). Of this, the two Maruti cars account for 61,819 units and the Kwid 3,597 units.

Sales data for the Alto and S-Presso in the past three months reveals that monthly sales are in positive territory after a long time in November (see data table above). The 12,347 units sold this November are up 27% YoY (November 2024: 9,750 units)

A look at the two Maruti budget car sales for the past three months’ sales shows that demand remains tepid despite the sizeable price cut. While the Alto, which has sold 22,244 units, is down 10% YoY (September-November 2024: 24,670 units), the S-Presso has clocked dispatches of 6,378 units, up 4% YoY (September-November 2024: 6,130 units).

Though Maruti Suzuki remains upbeat that GST 2.0 will revive demand for these two entry-level cars, the real-world market scenario could prove to be rather different. The easy availability of finance, reduced interest rates, growing buyer aspirations even in Tier 2 and 3 towns, and the ongoing consumer shift to SUVs, particularly compact SUVs, will ensure that the fizz will not return to the budget car market in India.

ALSO READ: Utility Vehicle Industry Poised for Record Sales of 2.8 Million Units in CY2025

Mahindra, Toyota and Kia surpass their CY2024 sales in first 11 months of CY2025