Founded in 1995, ORIX Corporation India Ltd. (formerly ORIX Auto Infrastructure Services Ltd.) is a subsidiary of Japan’s ORIX Corporation. Over the years, it has evolved into a comprehensive mobility and financial services provider with offerings that include vehicle operating leases, car rentals, self-drive cars under the MyChoize brand, employee transportation, and fleet management solutions.

Its wholly owned subsidiary, ORIX Leasing & Financial Services India Ltd. (OLFS), strengthens this ecosystem by providing finance lease and lending solutions to corporates and SMEs. Together, the two entities employ over 1,000 professionals across 20+ locations, serving businesses with innovative and technology-led solutions.

In March 2025, ORIX India celebrated its 30th anniversary, coinciding with a Rs 300 crore strategic equity infusion from its parent, ORIX Corporation, Japan. This investment underscores the group’s long-term commitment to expanding its footprint in India’s rapidly growing leasing, mobility, and financial sectors.

Recognized for financial stability, ORIX India and its NBFC subsidiary OLFS has consistently maintained a AAA rating from India Ratings & Research (a Fitch Group company) since 2016 and continue to hold this rating. Equally committed to people and performance, ORIX India has been certified a Great Place to Work® since 2021 and was listed among India’s Top 75 Great Mid-size Workplaces 2025.

With innovation, trust, and customer focus at its core, ORIX India continues to shape the future of smart mobility and financial solutions. Mr. Vivek Wadhera, MD & CEO at ORIX India shares some important insights and trends of the automotive leasing business in India.

How does auto leasing differ from traditional car loans in India, both in terms of cost and ownership?

Auto leasing offers a modern, flexible alternative to traditional car loans. When you finance a car through a loan, you become the owner and take on full responsibility for everything such as maintenance, insurance, servicing, and eventually, resale. This can be time-consuming and costly, especially as the vehicle ages. Leasing, on the other hand, works like a long-term rental.

You pay a fixed monthly amount, typically lower than a loan EMI and the leasing company, like ORIX India, takes care of all the operational aspects. From procurement to renewal of insurance and periodic servicing to documentation and even resale, everything is managed for you. At the end of the lease term, you simply return the car or choose to upgrade to a newer model. It’s a hassle-free, cost-effective solution that gives customers the freedom to drive the car they want, without the long-term financial and maintenance commitments of ownership.

What are the key benefits for individuals choosing leasing over outright purchase?

Leasing is essentially outsourcing car ownership tailored to individual preferences. It gives individuals the freedom to select the car they want, choose the colour, decide the lease duration, and even tailor the monthly rental based on their usage. One of the most attractive aspects is that the cost is directly linked to how much you drive, lower usage means lower cost. Beyond flexibility, leasing removes the burden of ownership.

You don’t have to worry about maintenance schedules, insurance renewals, or the hassle of reselling the car. At ORIX India, we take care of all of that. Customers enjoy the convenience of driving a car that suits their lifestyle, while we handle the backend – making it a stress-free, cost-efficient, and modern mobility solution. Should you wish to extend your lease, ORIX India would extend your tenure as per your requirement.

How is corporate auto leasing structured in India, and why is it gaining popularity among companies?

Corporate auto leasing is fast becoming the preferred choice for companies with employees spread across multiple regions. Managing a fleet in-house involves high costs, logistical challenges, tie-ups with multiple vendors and the need for expertise. ORIX India simplifies this by offering a fully outsourced solution, handling everything from vehicle procurement and delivery to maintenance, insurance, and replacements on a pan India basis. This ensures consistent service quality across locations while helping companies reduce operational overhead and focus on their core business.

Which segments of the Indian automotive market (passenger cars, luxury cars, EVs, commercial vehicles) are most actively adopting leasing?

Leasing is gaining traction across all vehicle categories, but the passenger car (PC) segment stands out due to its typical usage cycle of around 3 to 5 years. This duration provides flexibility for customers who want to keep upgrading, they can pay only for usage without bearing the full cost of ownership. This makes leasing ideal for those who prefer convenience and adaptability over long-term commitments.

However, the benefits of leasing become even more pronounced in the luxury car segment. High purchase costs, expensive maintenance, and rapid depreciation make ownership challenging. Leasing solves this by offering lower monthly rentals, owing to strong residual values (RV), and by outsourcing all management responsibilities such as insurance, servicing, and resale. The same logic applies to electric vehicles (EVs). With technology evolving rapidly, especially in battery performance and features, leasing allows customers to stay ahead of the curve without worrying about long-term risks.

How does the residual value of a car impact lease rentals?

The secondary car market in India is vibrant and growing, with a strong demand for genuine, well-maintained pre-owned vehicles. Many customers today are looking for transparency. They want to know the car’s history, service records, mileage, and overall condition before making a purchase. At ORIX India, we see this as a key strength.

Since we manage our leased vehicles throughout their lifecycle, we maintain detailed and verified records for each car. When these vehicles enter the resale market, we can share their complete service history, kilometres driven, and maintenance logs with prospective buyers. These builds trust and enhances the resale value.

What role do OEMs and financial institutions play in shaping the leasing ecosystem?

OEMs (Original Equipment Manufacturers) are central to the growth of auto leasing in India. Traditionally, their sales strategies have revolved around vehicle loans, but there’s now a growing market segment that prefers leasing for its flexibility and lower financial commitment. To tap into this opportunity, OEMs need to actively promote leasing as a viable alternative to ownership.

This means creating awareness at the dealer level, training sales teams to explain leasing benefits, and launching targeted marketing campaigns that highlight the convenience and affordability of leasing. Additionally, leasing still has limited reach in Tier 2 and Tier 3 cities, where customers may not be familiar with the concept. OEMs can play a key role in expanding their footprint by leveraging their dealer networks and customer relationships.

How does leasing support the adoption of EVs in India?

Leasing plays a crucial role in accelerating the adoption of electric vehicles, especially in a market where long-term ownership still carries uncertainty. One of the biggest concerns for EV buyers is the residual value (RV), how much the vehicle will be worth after a few years. Since EV technology, particularly battery systems, is evolving rapidly, predicting future value becomes difficult.

Leasing eliminates this risk for the customer. Instead of committing to ownership, users can enjoy the benefits of driving an EV without worrying about depreciation, battery replacement costs, or outdated features. As manufacturers continue to introduce newer models with enhanced performance and premium features, leasing allows customers to upgrade easily and stay current with technological advancements.

What’s blocking wider adoption of auto leasing in India— policy gaps, consumer mindset, or financial barriers?

India’s auto-leasing model is held back by outdated registration norms and inconsistent RTO procedures. Although leasing companies legally own the vehicles, current rules still require registration in the user’s name, creating confusion and compliance challenges. Heavy reliance on physical documents and non-uniform RTO systems further slows processing and raises costs. A modern, leasing-friendly policy framework would streamline operations, increase adoption, and make mobility more efficient for individuals and businesses.

What trends can we expect in the Indian auto leasing industry over the next five years, given the shift towards shared mobility and subscription-based ownership?

The auto leasing landscape in India is poised for a major transformation. We’re going to see a wave of new and innovative products tailored to evolving customer needs. Leasing will no longer be one-size-fits-all, there will be flexible tenure options, allowing users to choose short-term or long-term plans based on their lifestyle and usage. Additionally, offerings will span across segments, from economy vehicles to premium and luxury models, making leasing accessible to a wider audience. We also anticipate the introduction of value-added features such as bundled insurance, maintenance packages, tech upgrades, and subscription-based services. These enhancements will redefine convenience and make leasing a more personalized and future-ready mobility solution. There will be a market for both new and used passenger car and leasing companies will offer enhanced products to tap this market demand.

Why should companies with extensive fleets across India consider leasing as a strategic alternative to ownership?

Many industries in India such as pharma, agriculture, logistics, media, and healthcare depend on large fleets as a prerequisite for their sales and operational performance. These vehicles are essential for routine activities like field visits, deliveries, and client servicing.

However, managing such fleets involves complex tasks:

• Tracking, monitoring vehicles & managing service schedules

• Insurance and claims management

• Turnaround time (TAT) optimization

• Fuel expense control

• Driver training for safe driving

• Fleet and driving reports

• Fine management

OLFS streamlines fleet operations through an end-to-end fixed-rental model that covers procurement, maintenance, compliance, and vehicle returns. Businesses can refresh fleets seamlessly while ORIX India manages OEM sourcing, statewise registrations, RTO compliance, vehicle movement, and re-registration. As a single-source solution with decades of expertise, ORIX India ensures nationwide efficiency, seamless operations, and cost optimisation—making fleet management simpler and more predictable for large enterprises.

How new and how old is the fleet?

Our leasing portfolio is built for flexibility and consistently high vehicle quality. We offer lease terms starting at 1 year or 10,000 km, for both new and used cars, to meet even shortterm mobility needs. The fleet maintains a young profile with an average age of 1.5 years, supported by an average lease tenure of 42 months, ensuring regular rotation and upgrades. The youngest vehicles in the fleet are brand-new units leased for short durations, while the oldest typically reach around 3.5 years, depending on usage and lifecycle.

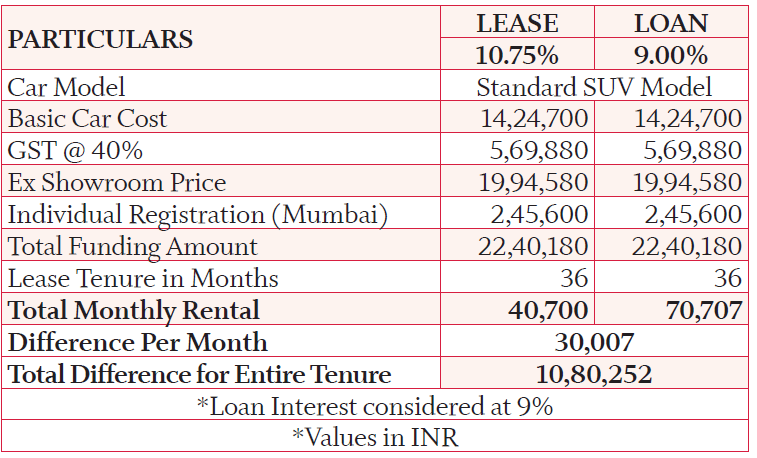

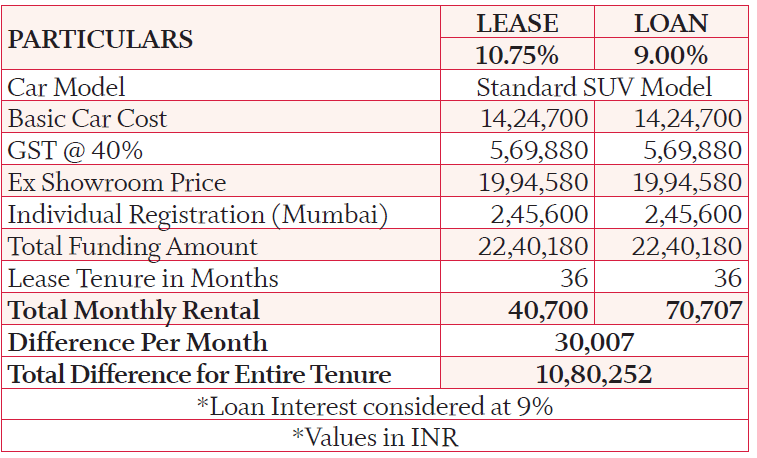

Can you give an example in numbers of a same car leased vs purchase vs residual value say for a period of 3 years.