A major link in Tesla’s 4680 battery supply chain has just snapped. South Korean battery material supplier L&F Co. announced today that the value of its massive supply deal with Tesla has been slashed by over 99%, signaling a catastrophic drop in demand for the automaker’s in-house battery cells.

This is arguably the strongest evidence yet that Tesla’s 4680 program, and the vehicle that relies on it, the Cybertruck, is in serious trouble.

In early 2023, L&F announced a $2.9 billion contract to supply high-nickel cathode materials directly to Tesla.

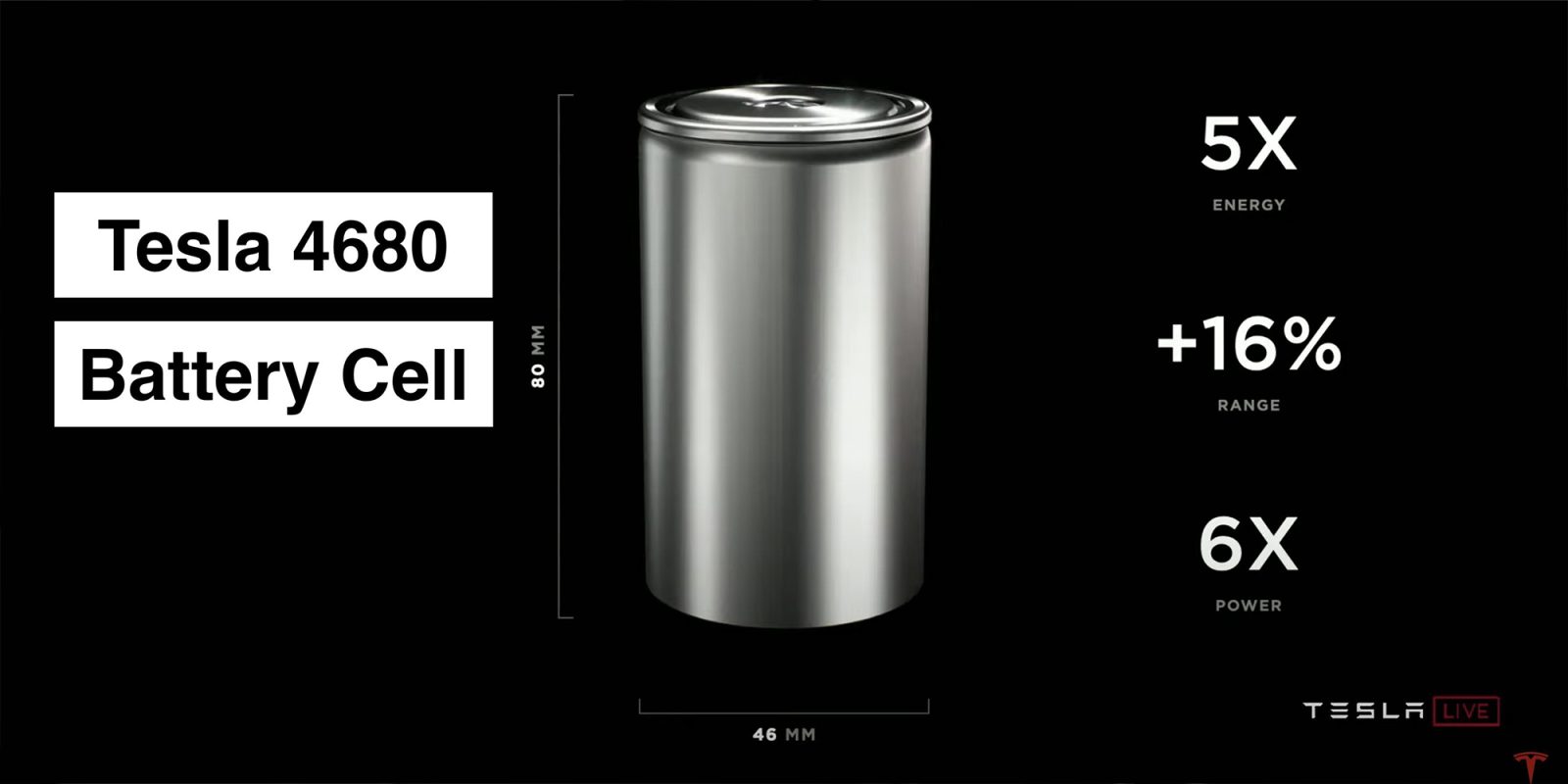

At the time, the industry saw this as a major move by Tesla to secure materials for its ramp-up of the 4680 battery cell, which Elon Musk had touted as the key to halving battery costs and enabling cheaper electric vehicles, a plan he later scrapped.

Right now, Tesla’s Cybertruck is the only vehicle using the automaker’s own 4680 cells.

In a regulatory filing today, L&F revealed that the contract’s value has been written down to just $7,386.

No, that is not a typo. $2.9 billion to roughly $7,400.

L&F did not explicitly state the reason for the cut, citing only a “change in supply quantity,” but the dots are easy to connect. The high-nickel cathode was destined for Tesla’s 4680 cells, and the primary consumer of those cells is the Cybertruck.

We have been reporting on the Cybertruck’s demand issues for the better part of this year. In March, we noted that the truck was turning out to be a flop as Tesla began offering discounted financing to move inventory. By June, Tesla became desperate, launching 0% APR incentives as inventory piled up in lots across the US.

Despite a production capacity of 250,000 units per year at Giga Texas, the Cybertruck is currently selling at a run rate of roughly 20,000 to 25,000 units annually. We even saw Tesla discontinue the cheapest Cybertruck in September because, frankly, no one wanted a gutted version of a truck that was already struggling to find buyers.

If Tesla isn’t building Cybertrucks, it doesn’t need 4680 cells. And if it doesn’t need 4680 cells, L&F has no one to sell its cathode material to.

Electrek’s Take

This is not a good look Tesla’s 4680 program.

For years, we’ve been told that the 4680 cell was the “holy grail” that would allow Tesla to produce a $25,000 electric car. But five years after Battery Day, the cells are still reportedly difficult to manufacture at scale due to the dry electrode process, and their only application is a low-volume pickup truck that has become a commercial failure.

The math here is brutal. A 99% reduction in a supply contract basically means the contract was cancelled. It means Tesla is not ramping 4680 production; if anything, they might be winding it down.

The ‘Cybercab’ is also supposed to be using the 4680 cells, but we will have to wait and see how that goes.

It’s also a vehicle program that could go the way of the Cybertruck. CEO Elon Musk is insisting that it will launch in early 2026 without a steering wheel, but Tesla has yet to solve level 4 autonomous driving.

If it does launch without a steering wheel, it will be a program even more limited in volume than the Cybertruck.

The battery supply situation and the critical minerals behind it are evolving fast, and China controls most of it. In a new Substack, I shared a full list of the years of reserve remaining for each mineral.

FTC: We use income earning auto affiliate links. More.