The global two-wheeler industry is undergoing a rare shake-up. TVS Motor has overtaken Yamaha and now ranks among the world’s top three two-wheeler makers by volume. Besides becoming the second Indian brand after Hero MotoCorp to break into the top three, the Chennai-based automaker has claimed the top spot in India’s electric two-wheeler market.

It also surpassed Hero MotoCorp in revenues in the first half of the ongoing financial year. TVS’ rise is the result of years of steady market-share gains under the leadership of its 36-year-old chairman and managing director—and Autocar Professional’s 2025 Person of the Year—Sudarshan Venu.

People who work with Sudarshan describe him as a man not easily categorised. He insists on structure and a clear emphasis on process, yet shows a willingness to test ideas that would once have been parked indefinitely. That tension between order and exploration mirrors where TVS itself sits today.

Under his leadership, the company has seemingly achieved the impossible: moving up steadily on the value curve while snapping up incremental market share points every year to fuel a growth engine that appears unstoppable in its momentum. TVS is no longer a volume-focused manufacturer but one of the industry’s most structurally robust players.

With Sudarshan at the helm, TVS has emerged as the big winner in the Indian two-wheeler market, mercilessly wresting away shares from much larger players such as Honda and Hero—adding nearly 1.8 percentage points in 2025 alone in one of the world’s most competitive markets. Over three years, it has added almost four percentage points to its overall share. No other player has come close.

More importantly, TVS has been gaining ground in the fastest-growing and most lucrative segments. In the four years to March 31, 2025, its share in scooters has risen from 15% to 25%, and in the electric two-wheeler market, it has surged from 2% to 23%. In entry-premium motorcycles, it now controls 27%.

Add to this a formidable export footprint. TVS has emerged as the second-largest Indian two-wheeler brand outside India, behind only Bajaj, generating nearly a quarter of its revenue from international markets. But unlike Bajaj, TVS has achieved this without ceding ground domestically.

The financial performance reflects this momentum: 21% average annual revenue growth between FY2021 and FY2025, coupled with 33% average annual growth in operating profits.

Industry observers credit TVS with having moved beyond competing aggressively for market share to setting the terms of engagement, quietly compelling rivals to take notice. Sanjay Tripathi, a two-wheeler industry veteran and automotive consultant, notes the shift in perception: “TVS has always known how to build good bikes. What’s changed is that they are now building the right bikes for the right customers.”

No Silver Bullet

It is difficult to pinpoint a single element in Sudarshan’s strategy that fuels this success. There is no singular winning product or cycle. Growth has come from multiple contributors – scooters, premium motorcycles, EVs and exports.

Sudarshan’s own language reveals this temperament: he speaks less about disruption and more about capabilities, values and the discipline of staying invested through cycles. Those who have worked with him say he has insisted on doing things the hard way when shortcuts were available—longer discussions upfront, cleaner decisions later, and relentless follow-through on execution.

His youth has also been an asset. As the reins shifted from his father, Venu Srinivasan, a new version of TVS emerged: one comfortable hiring world-class talent, partnering with global technology specialists and embracing multi-powertrain futures without ideological resistance.

Another hallmark of his leadership has been realism. The company has not sought to dominate every segment. Instead, it sidestepped areas where competition was too entrenched—avoiding Hero’s stronghold in commuters, steering clear of Royal Enfield’s 350cc-plus empire and declining to outmuscle Bajaj in three-wheelers. TVS picked open lanes and built capability until they stopped being open.

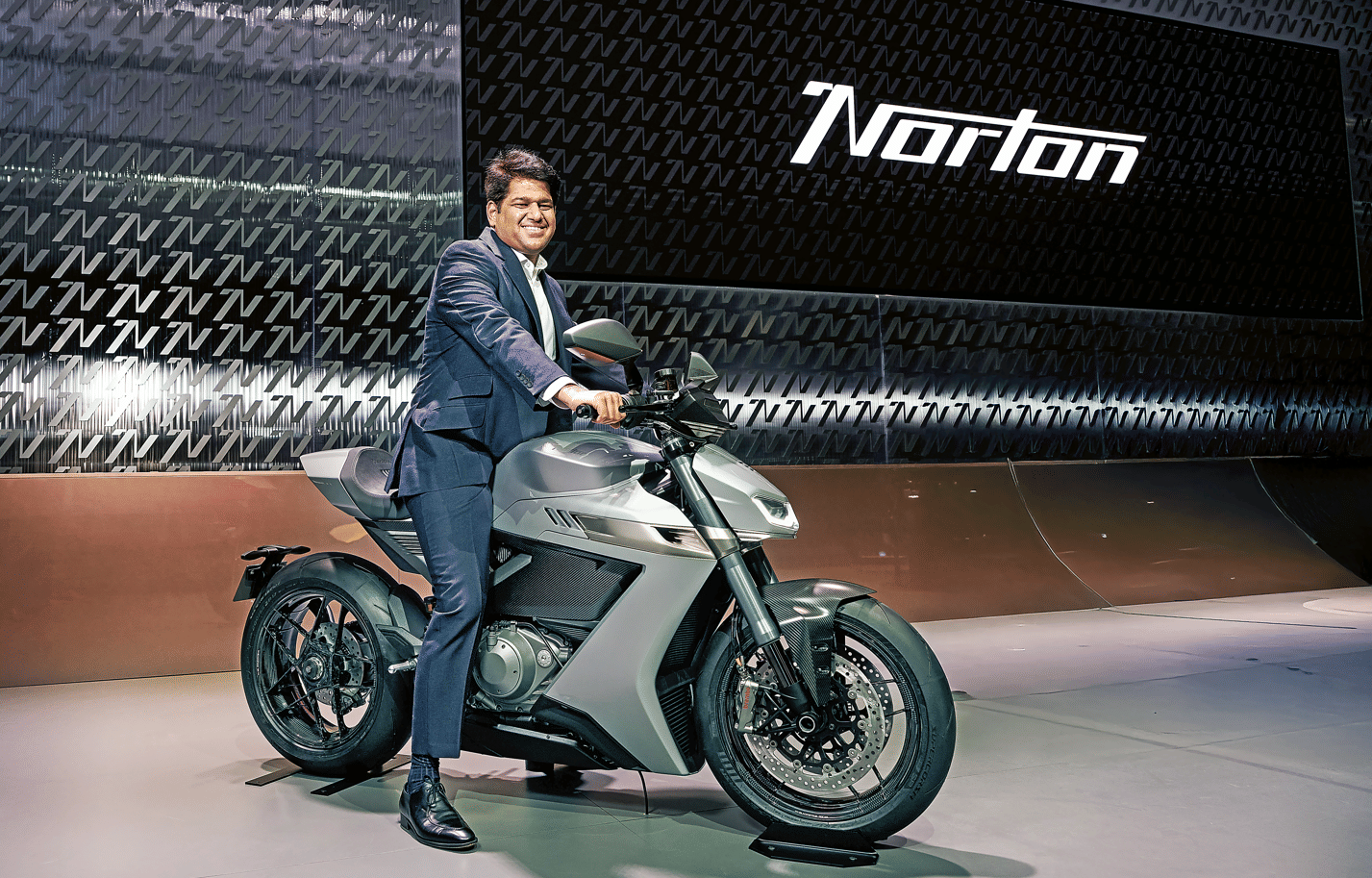

Yet Sudarshan has not been all about safe bets or steady incrementalism. Among the company’s boldest moves is the acquisition of vintage British brand Norton—a strategic signal that TVS is no longer content being a mid-market player and that it wants a seat at the global premium table, a space long dominated by European and Japanese brands. TVS is also launching a separate premium distribution channel, where it can cater to more affluent customers.

The importance of the Norton acquisition lies not just in volume potential. It represents capability uplift: engineering processes, quality systems and brand discipline that tend to elevate the entire group. The acquisition of Italian engineering consultancy Engines Engineering further strengthens this R&D muscle, with the experienced team working collaboratively with TVS engineers.

No other Indian two-wheeler manufacturer is attempting something this global, this premium, this brand-sensitive. That is why the moment of overtaking Yamaha matters. It is not merely about passing a number—it announces a new category of ambition.

A Blueprint for Indian Ambition

Sudarshan Venu’s leadership style may be understated and his strategy measured, but the results speak clearly. He has exhibited a rare combination of traits: discipline in choosing battles, knowing when to compete and when to step aside; ambition in picking global bets, as evidenced by the Norton acquisition; humility in learning from world-class talent brought in from across the industry; patience in building premium and EV capabilities over years rather than quarters; and an unwavering belief in engineering excellence as the foundation of lasting success.

Under his stewardship, TVS Motor has not merely grown—it has evolved into the most compelling two-wheeler story to emerge from India in recent times. His leadership offers a blueprint for Indian manufacturing ambition built not on spectacle but on substance.

It is for these reasons that Autocar Professional recognises Sudarshan Venu as its Person of the Year for 2025.

______________________________________________________________________________________________________________________________

INTERVIEW

‘We must stay true to the values my father built the company on, and adapt them to today’s context.’

Sudarshan, congratulations on being the youngest-ever automotive Person of the Year. What does this award mean to you?

Thank you, I really appreciate it. I think it’s really a recognition of the entire TVS organisation, which I am fortunate to lead. Everyone has rallied together to strengthen our growth based on our core values, and we continue to take it ahead.

Let’s start with EVs, the segment where TVS is now among the leaders. How has this journey shaped up?

EVs are a very important area of investment we have committed to over the last few years. We have launched new products that have been very well received, and we continue to grow. EVs have grown quickly, accounting for about 7% of the market, and I think there’s still a long runway ahead as penetration increases. We must develop our technology in-house, and I think, for India, the world’s largest two-wheeler market, we must create a local, resilient supply chain to sustain this momentum.

Supply chain localisation has been challenging, especially with rare-earth magnets. How do you see this playing out?

There is a big opportunity for EVs in India – the products we look towards for the next 5 to 10 years. Penetration will increase, more products will be launched, [and so will] more segments, more categories. There’s a definite opportunity.

At the same time, I still think internal combustion engine (ICE) segments will continue to grow, particularly on the premium side, and we are launching exciting products there as well.

Given India’s large economy and the geopolitical conditions on magnets, I think it’s important that we further strengthen the local supply chain. The government has taken many steps to incentivise production, technology and the entire EV ecosystem, and now we have to build on it.

On the ICE side, you’ve explored CNG and ethanol. How do these alternatives fit into TVS’ plans?

Definitely, CNG is there in three-wheelers, and there are some CNG two-wheelers also now. We have also shown Jupiter CNG. I think biofuels, such as ethanol, have also done very well in Brazil, and we have an ethanol three-wheeler, an ethanol Apache, and some more ethanol vehicles in the works. These are options for the future that we are investing in. Some countries may do more of one, and therefore, we believe that all of these are very important for a sustainable future economy.

TVS operates from mopeds all the way up to 1,200cc superbikes. How do you avoid spreading yourself too thin?

We have strengthened the teams in each of the segments so that each segment has its own unique focus: the India business, the commuter segment, the premium business, the super-premium segment, the commercial business and the international business. That is at the front end. On the back end, we have strengthened the teams to build capabilities and maintain a sharp focus on each segment.

For Norton, we offer all the resources, support and capabilities from TVS. At the same time, it has people who are very experienced in making big bikes, in understanding and delivering on the DNA of Norton, in marketing and retailing, and in building the brand in its own unique way.

Norton sits at the pinnacle of your technology stack. How will its learnings flow down to mainstream TVS products?

Hopefully, [it will be] at the pinnacle of technology for the entire world. We are trying to build globally competitive bikes with class-leading performance figures. All vehicles are true to Norton’s values of design, dynamism and detail.

The Manx stands for the fastest road bike, and that’s what we are recreating. Atlas is a bike with very good off-road capabilities and on-road capabilities – a great all-rounder. These platforms have been created specifically for Norton, but they also offer our team an excellent opportunity to work with experts from other countries. Some of the technology, knowledge and ideas will come to other vehicles.

You’ve also strengthened R&D with the acquisition of Engines Engineering. Why was this a priority?

That is another major area where we are strengthening the team further. Engines Engineering already has a very talented and experienced in-house team for two-wheelers, and they work collaboratively with our team.

TVS has always been strong in engineering but conservative in branding. With the emergence of Gen Z customers, does the brand need to evolve?

We are definitely focused on quality, technology and innovation. For Gen Z, we are launching cooler designs, more software, and also communicating the brand in a differentiated way through apps.

We will offer a sophisticated retail experience dedicated to premium vehicles, both offline and digitally. Millennials have different aspirations, and our teams and designers are passionate about adapting to and catering to them in an exciting, aspirational way.

What has your father’s mentorship meant to you?

Tremendous, really. TVS is what it is because of him, his values, his focus on quality and the customer, his passion for products and technology, and his commitment to maintaining trust. I’m fortunate to have learnt from him and continue to have his guidance, counsel and ideas to do better.

What does TVS look like in 2030 in your mind?

TVS must remain true to its values and continuously delight the customer. We are trying to bring greater speed and agility, strengthen talent, groom in-house talent for the future and become more global.

We are looking at more exciting and premium products, strengthening brand experience and entering new markets. We want a truly global talent pool and a global product range. That is what we are excited to do.