After a sluggish start to the year, India’s passenger vehicle market regained momentum in the last quarter of 2025, driven by GST 2.0, falling interest rates, and new model launches at attractive prices, reviving demand.

While growth remained moderate rather than spectacular in the first 9 months due to a high base and a slowing economy, the industry clawed back lost ground and closed the year with volumes estimated at around 4.58 million units, making India the second-fastest-growing large car market globally after China.

The recovery came amid slowing global demand and persistent geopolitical uncertainty. Yet, unlike several mature markets that saw stagnation or contraction, India managed to sustain forward momentum, aided by a combination of price correction beyond the GST cut, portfolio expansion, and improving consumer sentiment around the festive season.

GST Reset Provides Timely Support

A key inflection point for the market came with the rationalisation of GST, which altered vehicle pricing across segments. While the move was widely perceived as a 10 percent tax cut, industry data suggest the weighted average reduction was closer to 6.5 percent, depending on the segment mix.

Importantly, automakers passed on more than the headline benefit. Effective price reductions averaged nearly 7 percent as manufacturers recalibrated pricing and reduced the intensity of discounting. The net benefit to consumers was estimated at around 5 percent, enough to revive showroom traction without triggering an unsustainable spike in demand.

The impact was particularly visible during the festive and year-end period, when deferred purchases began converting into bookings. While the recovery lacked the exuberance of earlier post-pandemic years, it marked an apparent stabilisation after a muted start to the calendar.

Growth holds, Shape Changes

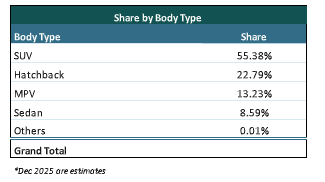

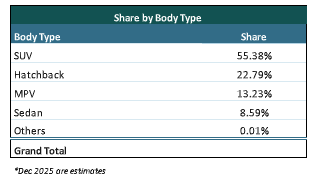

Even as volumes improved, growth remained uneven across segments. Hatchbacks continued to lose relevance, with their share slipping to around 21-22 percent, down a few hundred basis points from last year. To be sure, the GST cut did bring an improvement in volumes, containing the category’s free fall, with the market leader asserting that mojo in small hatchbacks is back. The sustenance of the same will, however, be a litmus test with a structural shift towards higher-priced sub-compact UVs.

The sub-4-metre SUVs and compact utility vehicles remained the engine of growth, supported by strong product pipelines and evolving consumer preferences. Sedans recorded healthy percentage growth on a low base, while MPVs continued to benefit from stable family demand and improved supply. (See table)

According to Jato Dynamics India, SUVs now account for 56% of the passenger vehicle sales, underscoring the structural shift in buyer preference toward higher-riding, feature-rich vehicles.

Powertrain Choices Reflect Pragmatism

Powertrain trends in 2025 reflected a distinctly pragmatic consumer mindset. CNG and diesel vehicles gained share, while petrol models ceded ground. Hybrids accounted for roughly 2.7 percent of the market, while electric cars remained below the 5 percent mark, with adoption softening toward the latter half of the year.

The data suggests that affordability, fuel economics, and usability continue to outweigh policy signalling in purchase decisions. While electrification remains on the agenda, it is progressing at a measured pace rather than through a disruptive leap.

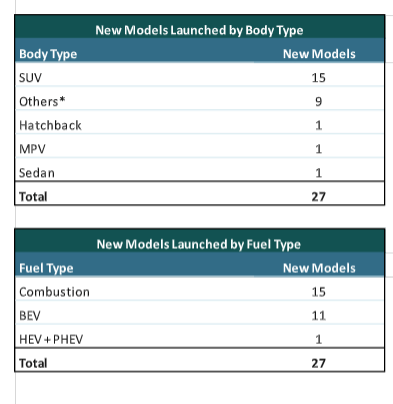

New Launches Drive Choice, not Volumes

New-model activity remained strong through 2025, reflecting an emphasis on portfolio refresh rather than on volume expansion. According to data shared by Jato Dynamics, 27 new passenger vehicles were launched during the year, of which 15 were ICE models, 11 were BEVs, and 1 was a hybrid. The skew toward ICE and SUV-led products highlighted OEMs continued focus on core revenue segments. At the same time, EV introductions remained selective, primarily confined to higher price bands rather than to mass-market volumes.

Discipline on Supply, Stability in Inventories

Manufacturers exercised tighter control over production as inventories and discounts remained high through the year, with GST 2.0 offering a much-needed reprieve. Unlike previous cycles, production was extended into late December as dealer stocks remained manageable and retail demand stayed resilient. Wholesale dispatches, however, have significant room to grow, with volumes in October and November hitting their highest ever. Even December is likely to see the highest dispatches and retail sales, riding the GST wave.

Exports add Ballast

Exports provided a vital cushion throughout the year, with shipments moving towards the 1-million-unit mark, helping India cross the 5-million mark twice – both domestically and through exports.

India’s growing role as a global manufacturing hub, particularly for emerging markets, helped offset domestic volatility and added resilience to overall industry performance, with Japan emerging as a new growth market. In contrast, South Africa and the continent as a whole continued to offer significant volume potential for India to serve.

A year of Revival, not Acceleration

Overall, 2025 marked a year of smart recovery led by policy initiatives. GST rationalisation helped arrest the slowdown and restore momentum, even as structural shifts, particularly in body styles and powertrains, continued to reshape demand.

While the recovery was not broad-based, it was sufficient to position India among the strongest global auto markets in a year marked by uneven growth elsewhere. Not surprisingly, all major car makers – Suzuki, Hyundai, Mahindra, Tata, Honda, Renault announced a significant long-term roadmap for the Indian market.

For the industry, the year reinforced a key lesson: sustainable growth will increasingly depend not on pricing levers alone, but on portfolio depth, cost discipline, and the ability to read a rapidly evolving consumer not only in India but also to serve global markets to achieve scale.