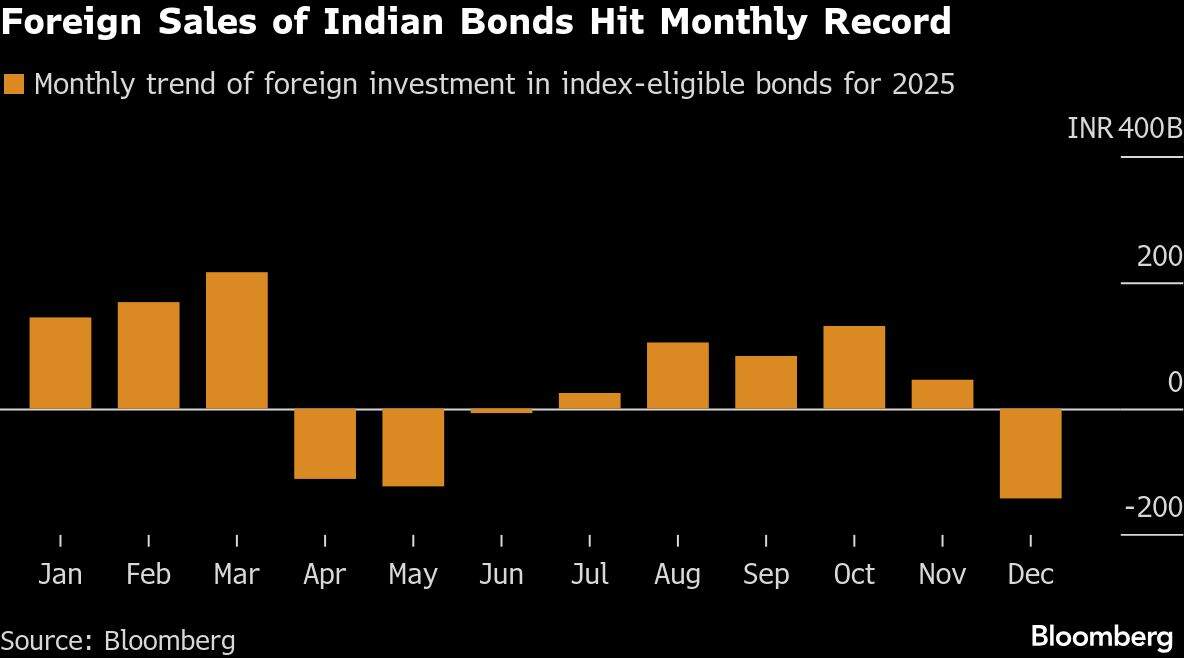

Indian sovereign bonds eligible for inclusion in global indexes are on track for a record monthly outflow, as a weaker rupee and signs the central bank is nearing the end of its interest-rate cut cycle weigh on sentiment.

Global funds have sold 143 billion rupees ($1.6 billion) of bonds so far in December, according to Clearing Corporation of India data. That marks the biggest outflow since the so-called Fully Accessible Route — a framework under which select government bonds have no foreign investment restrictions – was created in 2020. Outflows may continue in the coming months, Standard Chartered Plc said.

The selling comes as the rupee tested a series of record lows against the dollar this month, eroding returns for foreigners. For a euro-based investor, the rupee’s total return has been “a whopping negative 10%” this year, while Hungary’s forint and the Mexican peso have posted double-digit returns, according to Gama Asset Management SA.

“Foreign investors have been reallocating their emerging-market local bond investments to countries with higher yields and greater potential for currency appreciation,” said Rajeev De Mello, global macro portfolio manager at Gama Asset. Including carry, the rupee is the worst-performing major EM currency in 2025, he added.

The outflows are pressuring Indian bonds, which are on track for their biggest monthly decline in four months in December, weighed by heavy debt issuance from states. The selloff has pushed up government borrowing costs even as India faces the harshest US tariffs in Asia. Expectations for deeper interest-rate cuts are also fading after the central bank signaled higher inflation next year.

The rupee, Asia’s worst performer this year, weakened past the closely watched 91-per-dollar mark to an all-time low in December before recovering on central bank interventions.

Year-end profit-taking also drove some foreign selling as investors trimmed bond holdings and entered interest-rate derivative trades after a jump in swap rates, said Vikas Jain, head of India fixed income, currencies and commodities trading at Bank of America Corp.

Still, developments next year have the potential to shift momentum back in favor of the Indian securities. Should a long-awaited US trade deal come together, it may revive foreign interest in local bonds, as lower tariffs would ease pressure on the rupee. Analysts at Australia and New Zealand Banking Group see scope for the currency to strengthen as much as 1.5% to 88.5 per dollar if an accord is reached.

The prospect of more global bond-index compilers including the securities next year may spur foreign demand for Indian debt, traders said. “India may also get included in the Bloomberg global index next year, which should help bring in more real-money flows,” Jain said. India’s index-eligible bonds are already part of JPMorgan Chase & Co.’s widely followed emerging market gauge.

Bloomberg LP is the parent company of Bloomberg Index Services Limited (BISL), which administers indexes that compete with those from other providers. In September, BISL said it had solicited client feedback on whether India should be included in its Global Aggregate Index.