Tata Motors Passenger Vehicles Ltd. rose to become India’s second-largest passenger vehicle maker in the October–December quarter of fiscal 2026, overtaking Hyundai and Mahindra, as strong demand for its Nexon compact SUV and early traction from the new Sierra model lifted volumes, according to government vehicle registration data.

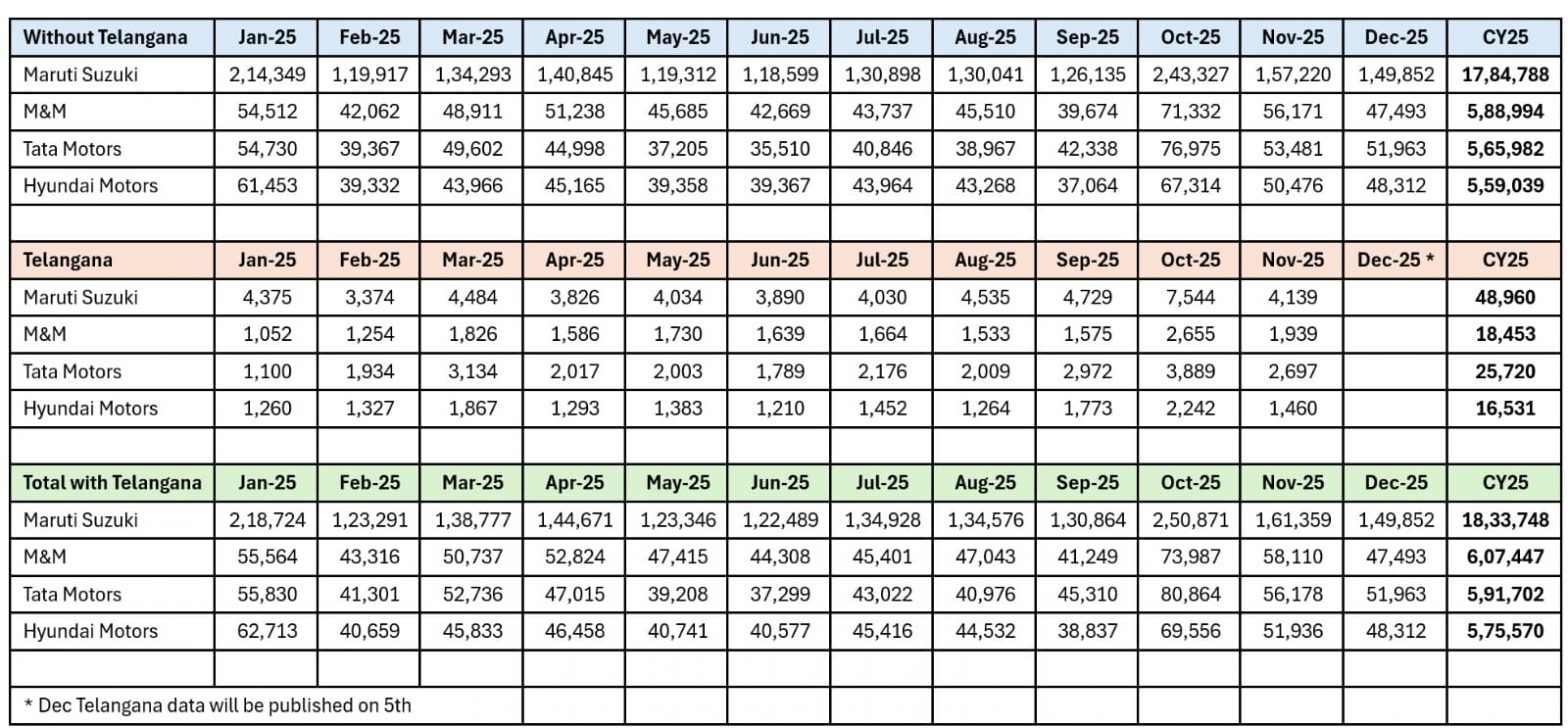

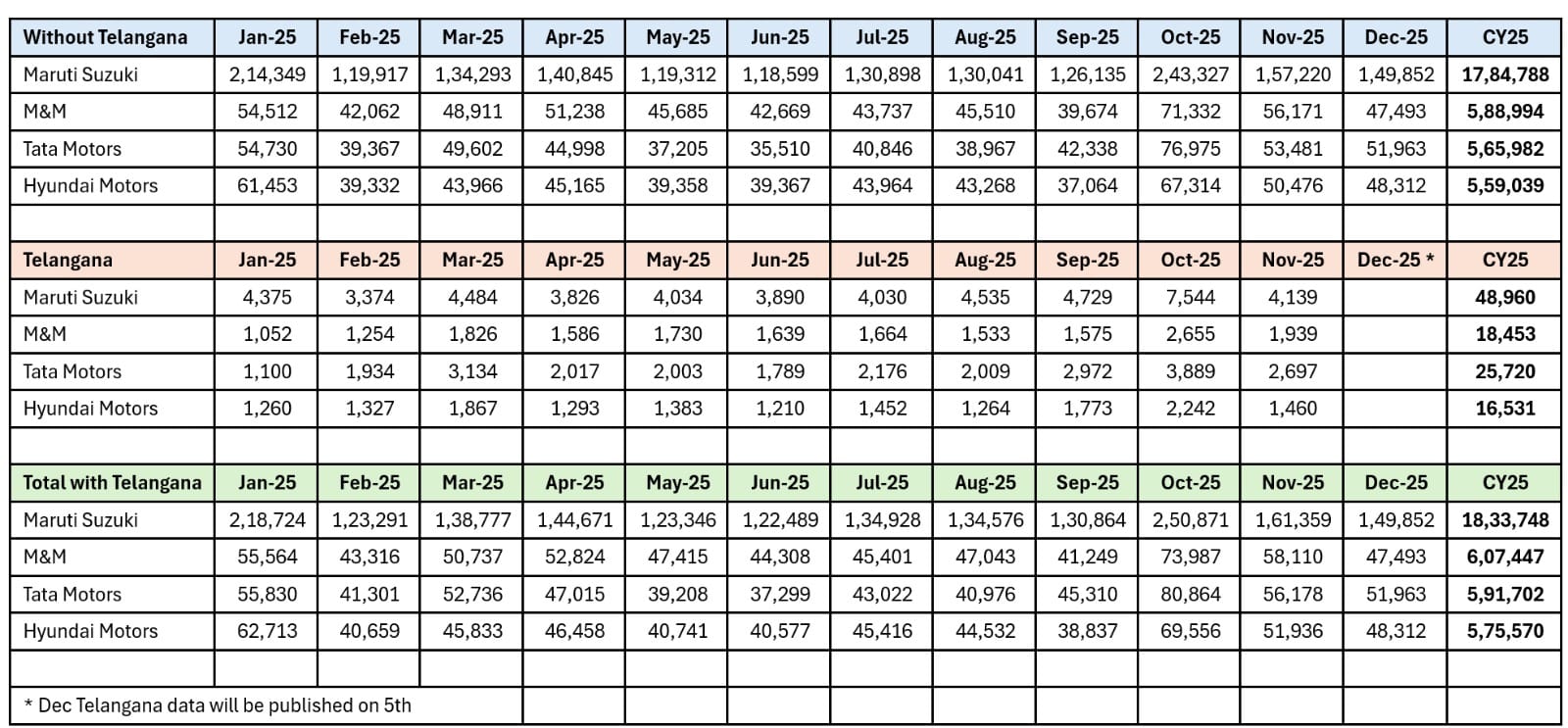

The automaker sold 1.89 lakh units in Q3 FY26, ahead of Mahindra & Mahindra’s 1.80 lakh units and Hyundai Motor India’s 1.70 lakh units, according to Vahan data. Tata also ranked second in December 2025, reinforcing the momentum seen in the latter half of the year.

For the full calendar year 2025, however, Tata Motors finished third, behind Maruti Suzuki and Mahindra, with total sales of 5.92 lakh units. Mahindra ended the year at 6.07 lakh units, while Maruti remained the market leader.

Tata’s improved performance in the second half was driven primarily by the Nexon, which emerged as India’s best-selling passenger vehicle in both October and November 2025. The model continued to deliver strong volumes across petrol, diesel and electric variants.

Tata’s improved performance in the second half was driven primarily by the Nexon, which emerged as India’s best-selling passenger vehicle in both October and November 2025. The model continued to deliver strong volumes across petrol, diesel and electric variants.

The company also began to see incremental contributions from the Sierra, which entered the market in the latter part of the year. While volumes remain limited, the model has started adding incremental demand, particularly in urban markets, and has contributed to Tata’s stronger Q3 showing.

In December 2025, Tata Motors reported 51,963 units, compared with 48,312 units for Hyundai and 47,493 units for Mahindra, according to Vahan data.

The performance marks a turnaround after a softer first half of the calendar year, when Tata faced pressure from rising competition and uneven demand. Improved supply execution, a broader SUV portfolio and steady electric vehicle sales helped the company regain momentum in the latter part of the year.

Despite finishing CY2025 behind Maruti Suzuki and Mahindra, Tata Motors’ Q3 showing signals a shift in competitive dynamics as the company enters the final quarter of FY26 with stronger volumes and a more balanced product mix.