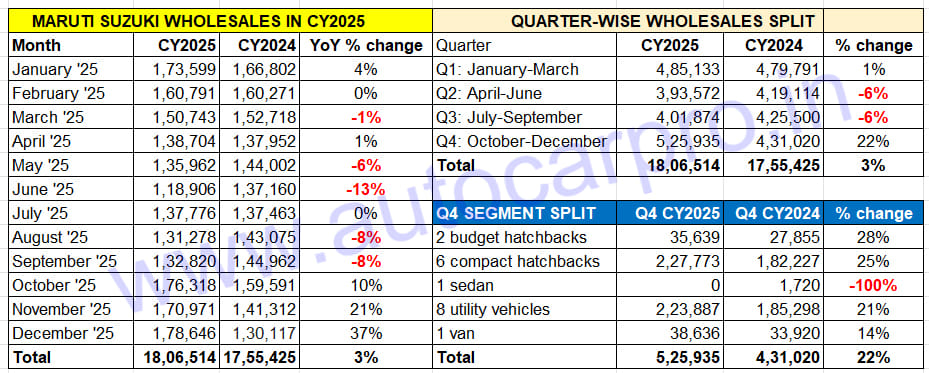

Passenger vehicle market leader has entered CY2026 on a buoyant note, having wrapped up CY2025 with total wholesales of 1.80 million units (18,06,514 PVs) in the domestic market. This constitutes a 3% YoY increase, which makes for similar growth (CY2024: 1.75 million units, up 3% YoY).

However, unlike CY2024, when UV sales, which comprised 40% of the wholesales in CY2024 and helped buffer the 10% fall in passenger car and sedan demand, CY2025 saw sales of the eight hatchbacks and the now-discontinued Ciaz sedan rise 3% YoY. And that is solely due to the accelerated demand this sub-segment saw in the fourth quarter (October-December 2025), which was driven by the substantial price cuts facilitated by GST.20 which kicked in end-September.

Q4 CY2025 clearly saved the blushes for the bellwether of the Indian PV industry. GST 2.0 lowered the taxes for a wide range of vehicles, resulting in a drop in their ex-showroom prices. Petrol, diesel and hybrid cars which was previously levied 28% percent GST would attract 18% GST, provided they were within the current small car definition: those up to 4,000mm in length and equipped with up to 1,200cc petrol engines or up to 1,500cc diesel engines. This clearly gave Maruti Suzuki, with its arsenal of hatchbacks and utility vehicles, new ammo in the domestic market.

GST 2.0-fueled sales in October-December have saved the blushes in the domestic market for Maruti Suzuki India in CY2025.

GST 2.0-fueled sales in October-December have saved the blushes in the domestic market for Maruti Suzuki India in CY2025.

As the detailed 12-month wholesales table (above) reveals, between January and September 2025, Maruti Suzuki witnessed five months of sales decline (March, May, June, August and September), two months of flat sales (February and July) and only one month of YoY growth (August). As a result, combined sales of the first three quarters at 12,80,579 units were down 3% YoY (January-September 2024: 13,24,405 units).

Then, thanks to GST 2.0-powered sales of cars and UVs with lowered sticker prices, demand in October-December (Q4 CY2025) jumped by 22% to 525,935 units. This marked an additional 94,915 units (Q4 CY2024: 431,020 units), helping Maruti Suzuki enter positive territory for the entire calendar year.

This quarter saw three straight months of 170,000-plus sales – October (176,318 units), November (170,971 units) and December (178,646 units). Q4 CY2024 delivered average monthly sales of 17,531 units compared to 14,367 units in the year-ago period. That’s not all . . . in December, which is usually a month when vehicle buyers delay purchase decisions to the new year, saw Maruti Suzuki hit a new high: 178,646 units and handsome 37% YoY growth.

As the vehicle category-wise split for Q4 CY2025 shows (see main data table above), barring the Ciaz sedan, all categories have logged double-digit growth in October-December 2025. These comprise the Alto and S-Presso budget hatchbacks (35,639 units, up 28%), the six-pack of hatchbacks comprising the Baleno, Celerio, Dzire, Ignis, Swift, Wagon R (227,773 units, up 25%), the 8 UVs (223,887 units, up 21%) and the Eeco van (38,636 units, up 14%).

Sales of the eight hatchbacks and one sedan (935,971 units) as well as the 8 UVs have each risen by 3% YoY.

Sales of the eight hatchbacks and one sedan (935,971 units) as well as the 8 UVs have each risen by 3% YoY.

Passenger Car Sales Growth Matches Utility Vehicles: 3%

As a result of the late charge in Q4 CY2025, total passenger car sales (8 hatchbacks and the now-discontinued Ciaz) closed the year at 935,971 units, up 3% YoY (CY2024: 906,049 units). This is better than this category’s performance in CY2024, when it was down 10% YoY (CY2023: 10,05,113 units). This gives Maruti cars a 52% share of total PV sales in CY2025, similar to CY2024.

In comparison, Maruti Suzuki’s eight UVs (Brezza, Ertiga, Fronx, Grand Vitara, Invicto, Jimny, Victoris, XL6) displayed somewhat tepid 3% growth versus CY2024’s 25 percent albeit this is on a larger base in CY2025. Nevertheless, with 732,489 units, up 3% YoY (CY204: 710,671 UVs), the company has achieved its highest-ever calendar year sales in this vehicle category.

Since the model-wise sales statistics for December 2025 will only be released in mid-January 2026, a deep dive into 18 passenger vehicles for the January-November 2025 period, when a total of 16,27,868 PVs were sold, reveals their status on the ranking ladder-board. This trend should continue in the December 2025 wholesales and, resultantly, for entire CY2025.