India’s energy future is increasingly reliant on advanced battery technologies, which are indispensable for powering electric vehicles (EVs) and facilitating the storage of renewable energy from burgeoning solar and wind sources. This national drive is fuelled by rapidly rising energy demand and a decisive governmental shift towards clean technologies.

India has set ambitious targets, including achieving 30% EV sales penetration and reducing projected carbon emissions by 1 billion tonnes by 2030; and committing to net-zero emissions by 2070. These objectives underscore a profound strategic commitment to sustainable mobility and energy independence.

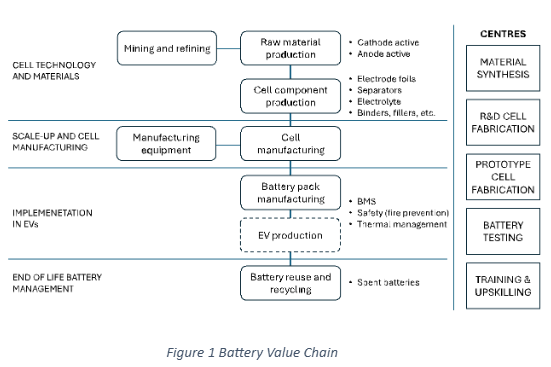

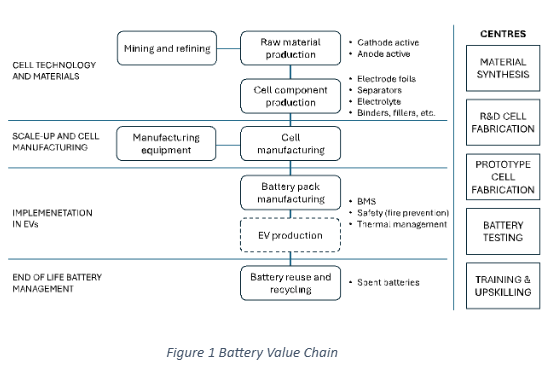

The article covers current challenges associated with indigenous development of raw materials, battery cell manufacturing, equipment/ machinery development so to meet the growing demand for energy storage systems both for the electric mobility and stationary storage applications.

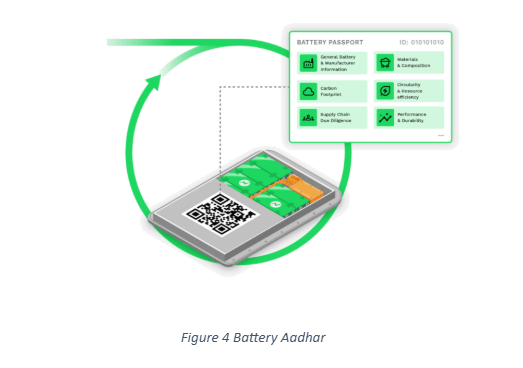

It briefly highlights the issues allied with circularity of critical battery materials, to ensure raw material security in the country. Creation of Battery Aadhar, a digital tool is crucial to improve traceability, safety performance over its lifecycle, and accountability in the battery ecosystem in the entire lifecycle right from mining, usage till recycling.

Growth of Electric Vehicles & Battery Energy Stoarge Systems

India’s electrical vehicle industry is growing at rapid pace driven by encouraging policies and programs by the Government, increasing consumer awareness, and new model launches, particularly, for two and three wheelers segment. Electric bus segment also made significant progress in various states across the country. The passenger car segment is yet to take off as per expectations.

Further, the demand for stationary energy storage is driven by the target to achieve 500 GW of installed electricity capacity from renewable energy by 2030. This ambitious target necessitates the massive deployment of Battery Energy Storage Systems (BESS) to manage the inherent intermittency of solar and wind resources, thereby ensuring grid stability and reliable power dispatch.

The demand for advanced chemistry cells is projected to rise sharply, driven primarily by EV adoption and stationary storage applications. As per NITI Aayog report, battery demand is expected to rise to 260 GWh by 2030. Multiple gigafactory projects have been announced across key states, positioning India as an emerging hub for battery production. Over the last 5 years, close to 15 Nos of Indian companies including Amara Raja, Exide Energy, Nash Energy, Agratas (Tata Group), JSW, and Lucas TVS have made announcements in setting up of battery cell manufacturing facilities within the country.

The Government of India also introduced Advanced Chemistry Cells (ACC) PLI Scheme with a budgetary outlay of ₹18,100 crore to achieve a 50 GWh manufacturing capacity, both for mobility and stationary battery applications. The ACC PLI Scheme launched by Ministry of Heavy Industries (MHI) is instrumental in promoting indigenous development of batteries and establishing robust supply chain within the country.

The government has also taken initiative to address the market gap through robust fiscal support, through the Viability Gap Funding (VGF) scheme, which financially de-risks large-scale BESS projects (such as the commitment to support 30 GWh of storage announced by Ministry of Power). At present, Lithium Iron Phosphate (LFP) batteries are widely being used for BESS applications.

The sodium ion batteries, flow batteries are emerging and have greater potential for BESS applications. These technologies need to be matured for its commercial exploitation. In addition, the incentive schemes, especially, FAME, PM e-Drive, PM e-SEWA focused mainly in promoting public transportation so as to reduce air pollution in the cities. National Critical Mineral Mission announced by Ministry of Mines aims to establish effective framework for India’s self-reliance in critical mineral sector covering entire value chain right for mining till recycling through various funding programs.

In order to bridge the gap in Research & Development, Department of Science and Technology (DST), GoI launched various initiatives such as MAHA EV Mission under the aegis of Anusandhan National Research Foundation (ANRF), which focusses on development of key electric vehicle technologies to reduce dependency on imports, promote domestic innovation. DST also launched another program known as ‘EVolutionS’, Electric Vehicle solutions led by Startups for component manufacturing, which is aimed to support electric vehicle startups in translation of their proof of concept/prototypes into commercially viable products.

Battery Ecosystem in India

Battery requirements for an EV include high energy density and power density with a trade-off between the two as demanded by the application; fast charge capability; safety, especially with fire incidents; and durability. These are to be achieved for manufacturing and use cases, at affordable lifecycle costs for India. Moreover, the solutions must be environmentally acceptable and nationally sustainable.

The critical gap in the India ecosystem is the capability to scale up technology from lab scale to commercial production. The scale up capability can be achieved by establishing cell fabrication and testing centres for demonstrating battery cell technology from basic research to proof of concept and manufacturability.

Currently, two battery chemistries that are predominantly used in Electric Vehicle industry in the country i.e. (a) Nickel Manganese Cobalt (NMC) and (b) Lithium Iron Phosphate (LFP). NMC is a dense battery with higher energy density and power density and is compact in nature. However, this battery requires thermal management to prevent them catching fire in the tropical weather conditions.

The other chemistry, LFP has got higher thermal stability and lower in cost and well suitable for Indian weather conditions. Though the energy density of this battery is relatively low, the Indian industries have adopted widely LFP batteries including international giant companies such as TESLA.

In case of LFP batteries, apart from lithium, all other component materials such as iron oxide, phosphate and graphite can be developed and sourced domestically. It has a price advantage as raw materials for NMC such as Nickel and Cobalt are expensive, imported and experience significant price volatility. The anode material is predominantly graphite although graphite-silicon blends are gaining acceptance. These cell technologies are mature, and the cells are manufactured in giga factories in other countries.

The new chemistry that is emerging is Sodium-ion battery (SIB) and many startups in India have made significant progress in developing functional prototype of these batteries. These companies include KPIT, INDI Energy, IIT Roorkee, Reliance in collaboration Faradion. SIB, where sodium replaces lithium, offers a potential cost benefit but suffers from lower energy density.

SSB has superior thermal stability but lower cycle life and manufacturability hinder development for commercial EVs. Metal- air batteries may be explored, especially for large vehicle applications. They are non-rechargeable but recyclable; zinc-air and aluminium-air technologies do not rely on imported materials, which addresses the raw material scarcity and cost associated with LIB.

A short-term strategy may focus on adapting already mature cell technologies, facilitating rapid cell production, and subsequent implementation in EV, thus allowing India to quickly catch up with global trends. The candidate cell chemistries are NMC, LFP and LMFP as cathode materials and graphite and its blends with silicon as anode materials.

Sodium ion chemistry may also be considered. For the long term, beyond lithium-ion chemistries, Sodium Ion Batteries (SIB) and Solid-State Batteries (SSB) are emerging as promising options, and Lithium-Sulphur and Lithium Metal chemistries are still in contention. The long-term focus will drive innovation across the entire battery value chain, with battery technologies tailored to India market and conditions, using indigenous materials, equipment, and manufacturing.

Solid state, metal-air, and lithium-sulfur are potential cell chemistries, as well as novel cathode materials. Innovations in electrode coating technology, cell/pack design, and pack thermal management are areas of opportunity.

Critical Minerals and Raw Material Supply Chain

India faces significant systemic challenges as it strives to build a robust and self-sustaining battery and energy storage ecosystem. India remains heavily dependent on imports of key battery raw materials such as lithium, cobalt, and nickel, sourced primarily from Australia, Bolivia, Chile, the Democratic Republic of Congo, and South Africa. These materials are essential for lithium-ion and other advanced battery chemistries, making India’s battery ambitions vulnerable to global price volatility, trade restrictions, and geopolitical tensions.

In the current global context, marked by increasing protectionism and the tightening of high-tech exports, countries are prioritizing their strategic interests. As a result, access to critical know-how, Intellectual Property (IP), and high-performance materials is becoming more restricted. This underscores the urgency for India to develop indigenous technologies and reduce dependence on external sources for core components and technical know-how.

The need of the hour is to develop raw materials within the country. India is endowed with significant Bauxite resources, which is the primary ore for aluminium production, used for current collectors. India’s major domestic lithium sources include the 5.9 million tonnes of inferred resources discovered in Jammu & Kashmir, and smaller inferred reserves of approximately 1,600 tonnes in Karnataka.

Further exploration is underway in potential pegmatite and mica belts across states like Rajasthan, Chhattisgarh, and Jharkhand to secure the vital mineral for its electric vehicle and energy storage applications. India needs to move towards indigenisation of raw materials production and cell manufacturing to cater to the requirements of the automotive and energy sectors.

Battery Prototype Cell Fabrication and Testing Centre

India has a growing demand for battery energy storage and industrial appetite for multi-giga-scale manufacturing. Many new battery chemistries and products are emerging or at R&D stage, but advancing them from lab-scale prototypes to industrial-scale manufacturability requires dedicated RD&D infrastructure and collaboration among R&D institutions and industry.

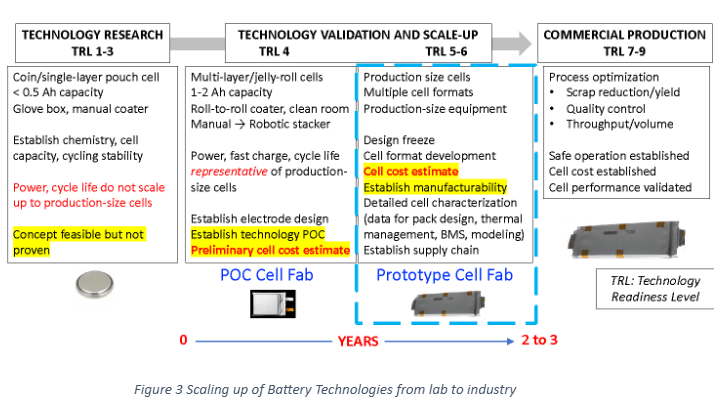

This can be accomplished through a “Rapid Prototyping Centre” or a “Common Facilities Centre”. Figure below shows the steps necessary to take a cell technology concept from research level (Technology Readiness Level, TRL 1-3) to full-scale manufacturing (TRL 7-9).

The scale up capability can be achieved by establishing cell fabrication and testing centres for demonstrating battery cell technology proof of concept (TRL 4) and PROTO-FAB Centres (TRL 5-6) for battery cell manufacturing. The purpose of this centre is to demonstrate techno-commercial viability of a candidate cell technology for full-scale cell manufacturing and subsequent implementation in EVs. Thus, promising battery cell technologies can move from research to full scale manufacturing, rapidly and cost effectively.

Large format, production size cells can be fabricated, and the fabrication process would mimic a commercial manufacturing operation but at a lower throughput. It should have the capability to build production size cells with multiple formats (cylindrical, prismatic, pouch) and include quality control measures. The data and knowledge derived will enable cell manufacturers to rapidly translate a cell technology into full-scale production.

They will also enable automakers to set vehicle specifications and pack design early, for safe and reliable vehicle operation. Such a scale up capability requires large investment costs and hence typically lies with large OEMs or established cell manufacturers, serving technologies of immediate commercial interest to them, exclusively.

Research institutions and start-ups cannot afford to invest in such a facility; often their innovations are not able to move past TRL 4 and promising technologies may not achieve commercial success. Therefore, there is a need to establish a PROTO-FAB Centre that is accessible to the entire battery ecosystem in India.

The proposed facility should produce large-format pouch/prismatic cells with about 50 Ah capacity or cylindrical cells with 10 Ah capacity. Within a campaign duration of weeks, the center should have the ability to produce A samples (100-150 cells) for extensive cell testing/characterization and B samples (~500 cells) for pack development.

The PROTO-FAB Centre should be equipped with cell fabrication lines of different chemistries, cycler lab, analytical lab, training and up skilling center. This would help researchers to carried out research from grams level to kg level and startups/ MSMEs can produce functional prototypes and can gain confidence in further investments for setting up their own factories. This facility can help skilling the manpower in this specialized domain to serve the purpose of the nation.

Machinery/Equipment for Battery Cell Manufacturing

India relies heavily on imported equipment, mainly from China and South Korea, for battery cell manufacturing and testing. This dependence presents several key challenges:

- Supply Chain Delays: Obtaining the necessary equipment involves long lead times, significantly impacting the crucial timelines for setting up battery cell production.

- Geopolitical Hurdles: Geopolitical issues pose challenges in securing travel for foreign technical experts needed for machine installation and maintenance.

- IP and Upgrades: Since the IP resides with the overseas manufacturers, domestic production is forced to rely on them for timely updates and modularized equipment to keep pace with evolving battery cell technology.

India possesses a significant advantage in skilled human capital, featuring strong capabilities in machinery design, IT, and established expertise in developing equipment for the textile and pharmaceutical industries.

It is crucial that India leverages this talent and expertise to focus on developing indigenous machinery and equipment, thereby fulfilling the goals of Atmanirbhar Bharat (Self-Reliant India). While a few companies are already engaged in this domain, a significant push is required to strengthen this sector. This will build the capabilities and capacities of this mission-critical industry. Since the equipment used for battery cell manufacturing is largely chemistry-agnostic, requiring only minor modifications across different battery chemistries, a holistic approach to indigenous development is warranted. This approach will help secure a robust domestic supply chain for this essential machinery, with built-in provisions for upgrades and improvements as required.

Circularity and Battery Aadhar

India faces a significant opportunity for second-life utilization of retired electric vehicle (EV) batteries, with a potential of over 200 gigawatt-hours (GWh) for second-life use and over 1.2 million tons for recycling by 2030, driven by the expected surge in EV adoption. This needs strategic planning and appropriate scientific methods to collect, dismantle and safely dispose of them.

Hence technology, standards and testing procedures are needed at different stages in entire ecosystem. There is a need for technology development in the entire value chain of critical minerals (right from mining to recycling). It is crucial for energy security and also establishing domestic supply chain within the country.

Environmentally friendly technologies that may reduce energy consumption and impact on human health may be promoted. In this context, academia, industry collaborations (startups and MSMEs) are crucial in nurturing innovative ideas/ translating them into viable products thereby addressing technology needs for upstream, mid-stream and downstream levels.

While Hydrometallurgy and Pyrometallurgy technologies are widely being used, there is a lot of scope for improvement of these technologies to make these processes energy efficient and environmentally friendly. Further, direct recycling technology is showing promising results. Since purification and toxicity issues continue to be a challenge, there is a need for R&D effort that incorporates aqueous methods and also improve cost and safety at an industrial level.

Establish Testing Centres is equally important that are spread across the country to cater to needs of researchers/ Startups to synthesis their materials and carry out testing at different stages of development of materials extracted from black mass to ensure security of these materials. These test centres are also enablers in setting guidelines for testing of Remaining Useful Life (RUL) of the battery to segregate batteries for secondary life or for recycling. These testing Centres may be established across the country.

Battery Aadhaar, a digital tool for tracing the batteries and ensuring a safety performance over its lifecycle. The purpose of the battery Aadhar is to improve safety, traceability, and accountability in the battery ecosystem. India must institutionalize a “Battery Aadhaar” system—a unique digital identity for each battery pack (it will be first-of-its-kind in the country).

This system can track the manufacturing origin, chemistry, safety certification, and lifecycle performance of batteries. Monitor thermal events, charge-discharge cycles, and end-of-life status, enabling predictive maintenance and recycling. Serve as a regulatory and consumer confidence tool, preventing counterfeit products and enabling circular economy interventions. Battery Aadhaar would be a powerful enabler of India’s battery intelligence ecosystem, integrating it with BMS, AI-enabled diagnostics, and national EV databases.

Looking Ahead

At present, the industry depends heavily on imported materials, cells due to lack of raw material supply chain, domestic manufacturing capabilities to address the needs of the industry. This calls for definitive strategy and intervention in developing indigenous R&D capabilities to strengthen the capability and capacity of Indian Industry for long term sustainability and end-to-end value creation across the value chain. Indigenisation through R&D will also bring down the cost/kWh and helps in evolving local supply chain that includes battery components, equipment/ machinery for component manufacturing & testing.

The country need to invest in advanced materials (e.g., silicon-graphite anodes, Lithium metal-based anodes, high nickel-based electrode materials, LFMP, NMC, solid-state, sodium-ion) and manufacturing equipment to boost both performance and safety, while reducing costs. Establishing decentralised testing facilities will help startups and MSMEs to have quick access for testing and validation of their products. This will enable mass-scale production of reliable and affordable batteries tailored to Indian conditions.

Setting up a prototype Battery Cell Fabrication and Testing Centre is the need of the hour to meet the needs of the industry. Such facilities are available abroad wherein industry, startups can avail the services from the Centre to improvise the existing Chemistries and also develop new Chemistries and also scale up their research from gram level to kgs.

These centers can also be utilized effectively for technical manpower development. The Centre can also work on new and emerging chemistries that may have promising applications both for mobility and stationary applications including BESS. These efforts will reduce dependency on imports, and build a resilient, self-reliant EV and battery value chain in India.

Suresh Babu Muttana & Dr. Anita Gupta, Climate, Energy and Sustainable Technology (CEST) Division, Department of Science and Technology, Government of India. Views expressed are the author’s personal.