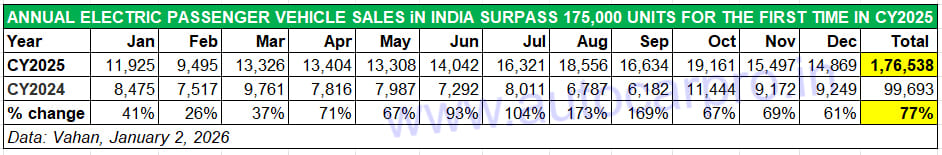

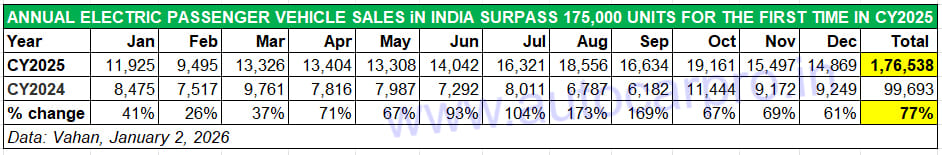

The Indian electric passenger vehicle segment, in tandem with the electric two- and three-wheeler segments, has registered its best-ever calendar year retails in CY2025. At 176,538 units, the year-on-year increase is a massive 77% (CY2024: 99,693 units).

Proof of the growing demand for zero-emission cars, SUVs and MPVs in India is seen on Indian roads as PV buyers prefer to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren. Between 2015 and 2024, over 425,000 electric PVs have been sold in India.

Right from January itself, CY2025 turned out to be a stellar year for India e-PV Inc (see 12-month data table below). Compared to CY2024, which saw only one month of five-figure sales, CY2025 had 11 months of over 11,000-unit sales and hit a best-ever monthly high of 19,161 units in the festive month of October. The advent of GST 2.0, which reduced taxes substantially on ICE passenger vehicles and thereby increased the price differential of EVs to ICE, impacted e-PV demand in November and December. Nevertheless, that doesn’t singe the strong performance of this sub-segment of the Indian EV industry.

Though festive October (19,161 units) saw best-ever monthly sales, Q3 (July-Sep) with 51,511 units was the best quarter. Electric PV retails were impacted in Nov-Dec due to reduced GST on ICE PVs.

Though festive October (19,161 units) saw best-ever monthly sales, Q3 (July-Sep) with 51,511 units was the best quarter. Electric PV retails were impacted in Nov-Dec due to reduced GST on ICE PVs.

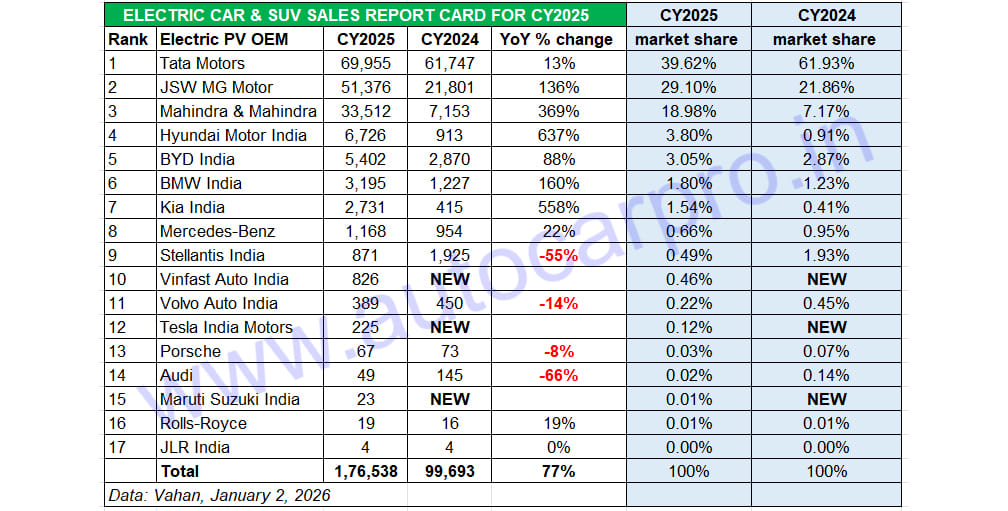

The robust YoY growth is reflected in the additional 76,845 e-PVs sold in CY2025 over CY2024 in a market which witnessed intense competition and has two new players in Vinfast and Tesla. Importantly, the rapid advance of JSW MG Motor India and Mahindra & Mahindra has seen market leader Tata Motors’ e-PV market share whittle down to 40% from 62% in CY2024, which is its lowest in the past four years. Let’s take a detailed look at the movers and shakers in the year that was.

No. 1 – TATA MOTORS

CY2025: 69,955 units, up 13%. Market share: 40%

CY2024: 61,747 units, up 3% YoY. Market share: 62%

CY2023: 60,007 units. Market share: 73%

A competitive marketplace is always healthy for businesses as well as consumers. CY2025, more than CY2024, saw the impact of this economic dynamic for market leader Tata Motors. While the electric car and SUV OEM registered its best-ever annual retail sales of 69,955 units, up 13% YoY (CY2024: 61,747 units), the expanding market with aggressive competition has eaten into its once seemingly unassailable market share. In CY2025, Tata Motors had an e-PV share of 40%, down from the 62% in CY2024 and the 73% it commanded in CY2023.

While the recently launched Harrier EV has helped revive demand for the company, the Nexon EV, Tiago EV and Punch EV continue to have their share of buyers. The Curvv coupe-SUV, however, is yet to achieve proper sales traction for Tata Motors, whose EV portfolio also has the Tigor (XPres-T). Tata has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of whom have launched new EVs in the past year and with much success.

No. 2 – JSW MG MOTOR INDIA

CY2025: 51,376 units, up 136%. Market share: 29%

CY2024: 21,801 units, up 129%. Market share: 22%

CY2023: 9,523 units. Market share: 11%

Maintaining the same strong momentum of CY2024, JSW MG Motor India has delivered another sterling performance in CY2025. Retail sales of 51,376 units translate into handsome 136% growth (CY2024: 21,801 units) and a resultant increase in e-PV market share to 29% from 22% a year ago. In August, the company hit its highest monthly sales – 5,353 units – for a market share of 33 percent.

In October, JSW MG Motor registered cumulative EV sales of 100,000 units, with the game-changing Windsor EV being the growth accelerator. The company, which has made inroads into Tata Motors’ market share with the Windsor EV and its BaaS option, has expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster . Both models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

No. 3 – MAHINDRA & MAHINDRA

CY2025: 33,512 units, up 369%. Market share: 19%

CY2024: 7,153 units, up 67% YoY. Market share: 7%

CY2023: 4,269 units. Market share: 5%

Taking the third position on the e-PV podium is Mahindra & Mahindra with customer deliveries of 33,512 electric SUVs in CY2025. This is a handsome 369% YoY increase (CY2024: 7,153 units), which makes for an additional 26,359 units YoY and helped nearly triple its market share to 19% from 7% a year ago.

The two new Born Electric SUVs – BE 6 and XEV 9e – launched in early 2025 have been the instruments of the rapid growth. End-November saw M&M launch the XEV 9S, its first three-row, born-electric SUV based on the modular INGLO skateboard platform. The XEV 9S slots above the stylish XEV 9e and the radical BE 6 SUVs, both of which are two-row EVs. With battery options spanning 59 kWh, 70 kWh, and 79 kWh, the XEV 9S introduces technology and comfort features that the company typically associates with vehicles positioned much higher in the market.

No. 4 – HYUNDAI MOTOR INDIA

CY2025: 6,726 units, up 637%. Market share: 4%

CY2024: 913 units, down 43% YoY. Market share: 0.91%

CY2023: 1,608 units. Market share: 2%

Hyundai Motor India has risen three ranks from CY2024 to be the new No. 4 e-PV OEM in CY2025. The 6,726 units sold last year are a 637% YoY increase on a low year-ago base of just 913 Ioniq 5s and Kona EVs.

January 2025 saw the company launch the Creta EV, the zero-emission avatar of India’s best-selling midsize SUV with two battery options and up to 473km range. In fact, the company expected the Creta EV to replicate the success of the ICE Creta but its hopes have been belied. Following the launch of the Creta Electric, monthly sales had risen from 775 units in February to 905 units in March but since then demand has tapered down sharply. Nevertheless, the increased sales volume has resulted in a market share increase for Hyundai to 4% from 1% in CY2024.

No. 5 – BYD INDIA

CY2025: 5,402 units, up 88%. Market share: 3%

CY2024: 2,870 units, up 43% YoY. Market share: 2.84%

CY2023: 2,012 units. Market share: 2.43%

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer, sold 5,402 e-PVs in CY2025, up 88% YoY (CY2024: 2,870 units). While this marks strong growth pe se, Hyundai’s move to fourth rank sees BMY slip to fifth rank on the e-PV OEM sales table.

BYD’s Indian arm, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, has increased prices of the Sealion 7 from January 1. Following its launch at the Bharat Mobility Global Expo 2025 in January, the Sealion 7 has sold over 2,000 units in India, indicating strong market acceptance in the premium EV segment.

No. 7 – KIA INDIA

CY2025: 2,731 units, up 558%. Market share: 1.54%

CY2024: 415 units, down 5%. Market share: 0.41%

CY2023: 438 units. Market share: 0.53%

Kia India, which was ranked 10th in CY2025, has risen three positions to become the No. 7 e-PV OEM after No. 6 (BMW India: 3,195 units, up 160% YoY) and above No. 8 (Mercedes-Benz: 1,168 units, up 22% YoY – details on BMW and Mercedes-Benz in the luxury EV OEM section below).

Kia has delivered a total of 2,731 e-PVs last year, up 558% on a low year-ago base of just 415 units. The company clocked three-figure monthly sales for the first time in August (465 units), with month-on-month increases in September (530 units) and October (630 units), followed by 477 units in November and 314 units in December. This sudden jump in volumes can be attributed to growing demand for the mass-market Carens Clavis EV MPV. Kia’s EV portfolio also contains the EV6 and EV9, which are imported as CBUs into the country and, as a result, are far more expensive than the mass-market Carens Clavis EV-MPV.

No. 9 – STELLANTIS INDIA (CITROEN)

CY2025: 871 units, down 55%. Market share: 0.49%

CY2024: 1,925 units, down 4% YoY. Market share: 1.93%

CY2023: 1,949 units. Market share: 2.36%

Stellantis India (Citroen India) has witnessed a sales decline in CY2025. The company sold 871 units, down 55% on year-ago retails (CY2024: 1,925 units), which results in its market share falling to 0.49% from 1.93% in CY2024. The company, which markets the eC3 hatchback, opened the year with 274 units but barring 125 units in May, sales fell to double-digits in the other 10 months of CY2025. In CY2024 and CY2023, the eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, has witnessed demand for EV fleet operators, a dynamic which seems to have dried down in CY2025.

No. 10 – VINFAST INDIA

CY2025: 826 units. Market share: 0.46%

Vietnamese EV OEM Vinfast, which has plugged into the Indian market with locally assembled VF6 and VF7 e-SUVs, takes 10th rank with 826 units in three-odd months of sales. Following September (6 units), rose month on month: October (136 units), November (308 units) and December (376 units). The company, which has partnered with the State Bank of India and ICICI Bank for EV customer financing, has opened 24 dealerships in major Indian cities with plans to have added another 11 by end-2025.

Recognising the potential of the growing market for electric MPVs and the demand for the Kia Carens Clavis EV and the BYD eMax 7, Vinfast India has confirmed plans to launch its third premium EV – the seven-seater Limo Green electric MPV – in February-March 2026.

Interestingly, Maruti Suzuki India makes its appearance for the first time in the EV section of the Vahan statistics. The portal has listed 23 units to the company, which could mean that the company has sold these many units of the soon-to-be-introduced-in-the-market e-Vitara midsize SUV to its dealers.

Over 275,000 electric passenger vehicles have been sold in India in the past two years.

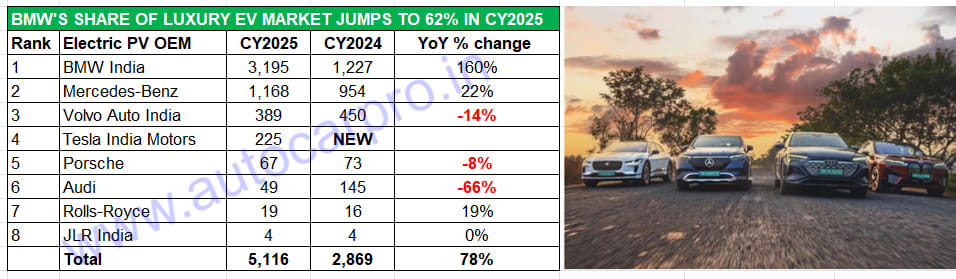

Luxury Ev Manufacturers Sell 5,116 Units in CY2025, Up 78%

In tandem with the overall e-PV market trend, CY2025 turned out to be the best year to date for luxury e-PV manufacturers. Demand for luxury electric cars, sedans and SUVs jumped by 78% YoY to 5,116 units (CY2024: 2,869 units). This translates into an additional 2,247 units year on year with the bulk of the sales going to market leader BMW India (ranked overall No. 6 EV OEM). As per Vahan data, of the eight luxury carmakers, three OEMs saw a sales decline.

BMW India, with 3,195 zero-emission cars and SUVs, captured a 62% share of the luxury EV market.

Reversing its CY2024 performance when its sales were down 7%, BMW India has entered CY2026 on a very strong note. In CY2025, the German carmaker sold 3,195 units, which is a handsome 160% YoY increase (CY2024: 1,227 units). This gives it a commanding luxury e-PV market share of 62% versus 43% in CY2024.

Mercedes-Benz India, with 1,168 units (ranked overall No. 8 EV OEM), registered 22% YoY growth (CY2024: 954 units) to maintain its No. 2 luxury EV OEM rank. This sees its market share at 23%, down from the 33% it had in CY2024.

Volvo India, the consistent No. 3 in the luxury EV makers list, sold 389 zero-emission cars and SUVs, down 14% on the 450 units in CY2024 – this sees its market share halve to 8% from 16% a year ago and 21% in CY2024.

Tesla, which is the newest entry in the Indian luxury market, is ranked fourth with 225 units of the Model Y e-SUV and a 4% market share. The Model Y, imported as a CBU for the India market, is currently available in India starting at Rs 59,89,000, with home charging support included for customers.

German sportscar maker Porsche, sold 67 units of its EVs last year, down 8% (CY2024: 73 EVs). In CY2023, Porsche had sold 96 zero-emission cars and SUVs in India.

While Audi India, with retails of 49 units, saw demand slide 66% YoY (CY2024: 145 units), Rolls-Royce saw demand rise 19% for its first all-electric model – the Spectre – which is literally the Rolls-Royce of EVs. Priced from Rs 7.50 crore through to Rs 9.50 crore for the Spectre Black Badge, 19 such uber-luxurious sedans (with 530km range) which rival high-end luxury EVs such as the Mercedes-Benz EQS, Porsche Taycan Turbo, and BMW i7 M70, albeit it sits in a higher luxury bracket. And JLR India, which sold exactly the same number of EVs – 4 – as it did in CY2024, wraps up the luxury EV OEM list.

Despite its 78% YoY growth, the hugely expanded overall EV market in CY2025 sees the luxury EV OEMs’ share increase marginally to 2.89% from 2.87% in CY2024.